In the rapidly evolving landscape of crypto trading, understanding market sentiment is crucial to gaining an edge. The Crypto Fear and Greed Index has become a go-to tool for traders seeking to decode the emotional drivers behind Bitcoin and altcoin price movements. As of November 2025, with Bitcoin trading at $101,725.00 and the index reading a stark 21 (“Extreme Fear”), the stage is set for strategic decision-making based on crowd psychology. But how can you translate this data-driven indicator into actionable trading strategies for 2025?

How the Crypto Fear and Greed Index Works in Today’s Market

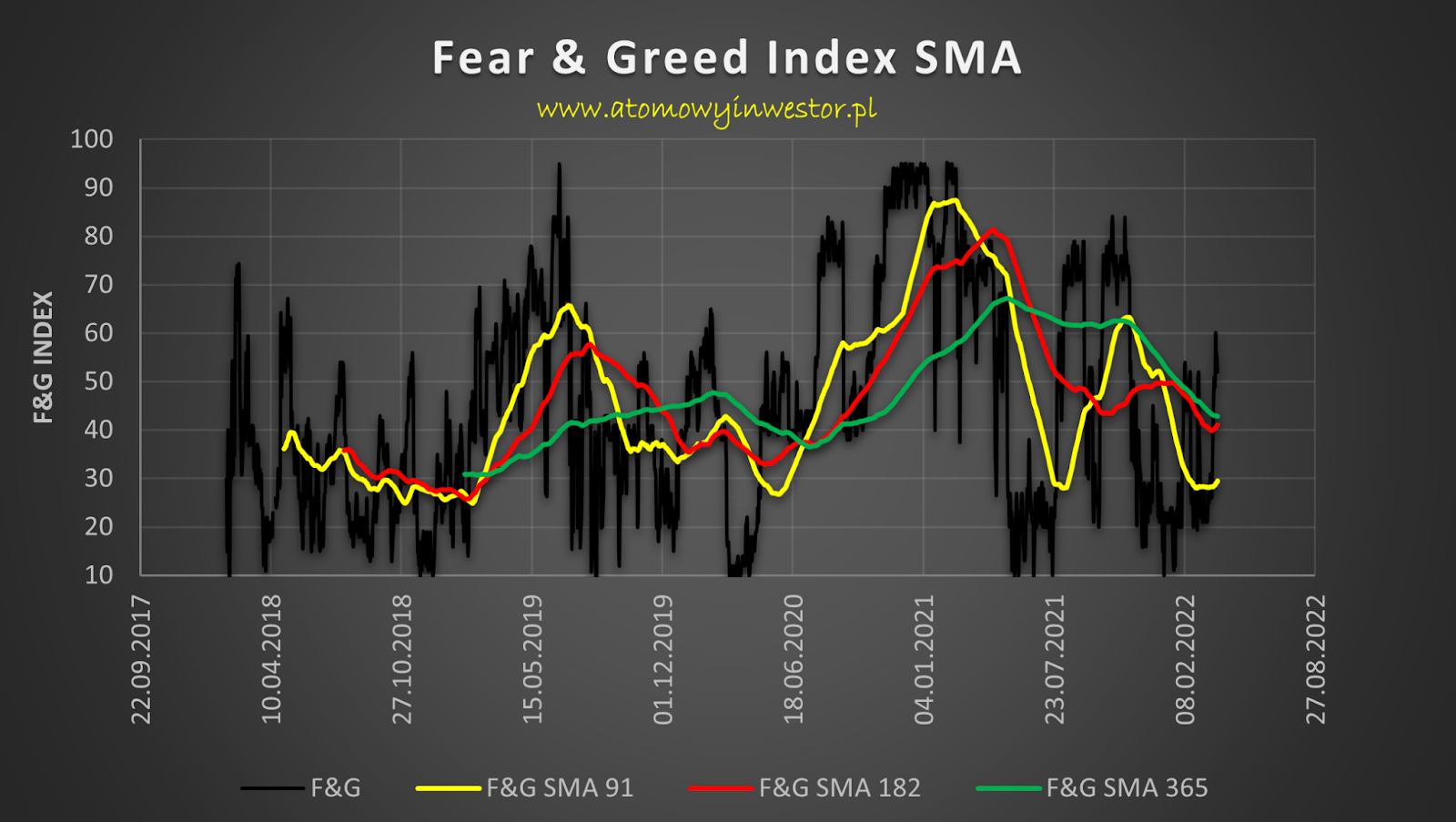

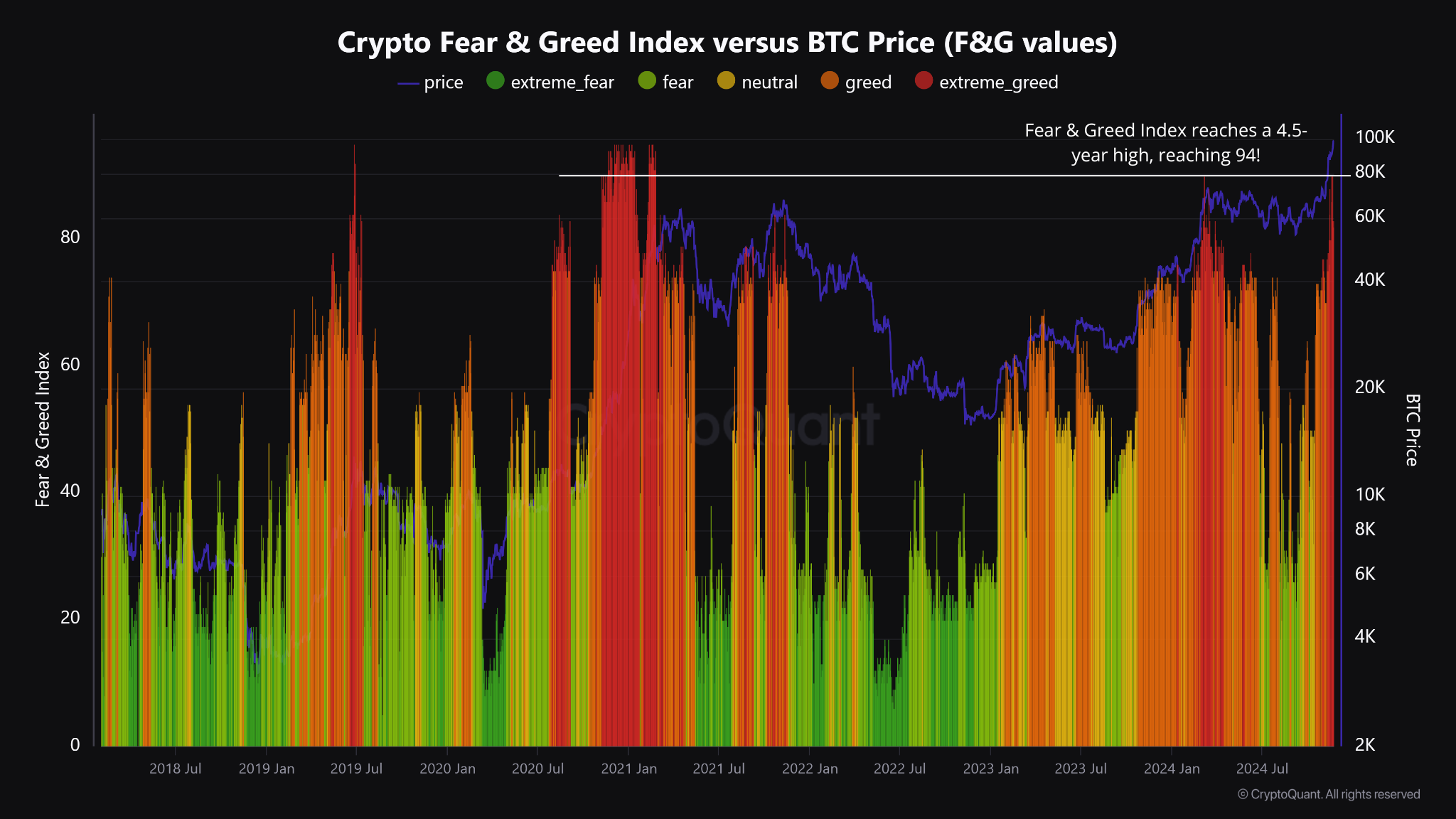

The index distills a range of metrics, including volatility, trading volume, social media trends, and momentum, into a single score from 0 (Extreme Fear) to 100 (Extreme Greed). When the index drops toward its lower bound, as it has recently, it signals that fear is dominating market psychology. Historically, these moments have coincided with undervalued conditions and panic selling, potentially lucrative opportunities for disciplined investors.

However, the index shouldn’t be used in isolation. Pairing it with technical indicators like RSI or MACD, on-chain analytics such as wallet flows or miner activity, and keeping abreast of macroeconomic news is essential for robust risk management.

Three Actionable Strategies for Profitable Trading Using the Crypto Fear and Greed Index in 2025

The following strategies are designed to help you harness sentiment extremes for smarter entries and exits in both Bitcoin and altcoins:

Top 3 Actionable Strategies Using the Crypto Fear & Greed Index

-

Buy During Extreme Fear Readings to Capitalize on Market Panic: When the Crypto Fear & Greed Index drops to ‘Extreme Fear’ levels (like the recent score of 21), it often signals that assets such as Bitcoin (BTC)—currently trading at $101,725—may be undervalued due to widespread panic. Historically, buying during these phases has led to significant gains when sentiment recovers. Always combine this approach with technical analysis and risk management.

-

Monitor Divergences Between Index Sentiment and Price Movements for Early Trend Reversals: Watch for situations where the Fear & Greed Index and price action disagree. For example, if Bitcoin’s price stabilizes or rises while the index remains low, it may indicate a potential reversal or accumulation phase. Use this divergence alongside indicators like RSI or MACD for confirmation before making a move.

-

Scale Out or Take Profits When the Index Signals Extreme Greed, Especially After Sharp Rallies: When the index reaches ‘Extreme Greed’ territory (typically above 75), it suggests that the market may be overbought and due for a correction. Consider gradually selling or taking profits on Bitcoin and major altcoins after strong rallies, using the index as a sentiment-based timing tool.

1. Buy During Extreme Fear Readings to Capitalize on Market Panic

When the index plunges into “Extreme Fear” territory, such as its current reading of 21, it often signals that widespread panic has led to oversold conditions. This is when patient traders can accumulate positions at discounted prices. For instance, after similar fear-driven selloffs in previous cycles (like May 2022), those who bought during these windows saw outsized returns when sentiment normalized.

This approach isn’t about catching falling knives blindly; rather, it’s about identifying when capitulation has likely peaked by combining fear readings with other supporting data such as volume spikes or positive divergences on RSI.

2. Monitor Divergences Between Index Sentiment and Price Movements for Early Trend Reversals

Divergences between price action and sentiment are powerful clues for anticipating reversals before they become obvious to the broader market. For example: if Bitcoin’s price continues falling but the index stops declining, or even starts rising, it may indicate that bearish momentum is waning despite persistent negativity in headlines.

This strategy requires vigilance and nuance; not every divergence marks a bottom or top. Cross-reference with technical patterns (such as double bottoms or bullish engulfing candles) to increase your probability of success.

Bitcoin (BTC) Price Prediction Table: 2026-2031

Forecast Based on Current Extreme Fear Sentiment and Market Analysis (2025 Baseline: $101,725)

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $78,000 | $105,000 | $130,000 | +3.2% | Potential for accumulation phase; regulatory clarity may spark mild recovery. |

| 2027 | $92,000 | $120,000 | $155,000 | +14.3% | Adoption rebounds; halving impact and institutional entry drive gradual uptrend. |

| 2028 | $110,000 | $145,000 | $190,000 | +20.8% | Bullish breakout possible post-halving; tech upgrades increase scalability and demand. |

| 2029 | $125,000 | $172,000 | $225,000 | +18.6% | Continued global adoption, ETF inflows, and digital asset integration boost sentiment. |

| 2030 | $145,000 | $200,000 | $260,000 | +16.3% | Mainstream recognition; regulatory frameworks settled; possible ‘supercycle’ speculation. |

| 2031 | $170,000 | $235,000 | $310,000 | +17.5% | Mature market phase or new cycle peak; global macro and altcoin competition key factors. |

Price Prediction Summary

Bitcoin is forecast to experience a gradual recovery and new growth cycle following the current extreme fear phase. While short-term downside risk remains, historical patterns suggest accumulation during fear periods leads to significant long-term gains. By 2031, BTC could see average prices over double current levels, with min/max ranges reflecting both bearish and bullish scenarios.

Key Factors Affecting Bitcoin Price

- Market sentiment reversals following extreme fear phases and accumulation periods.

- Bitcoin halving events (2028) reducing new supply and historically triggering bull runs.

- Adoption by institutions, ETFs, and integration with traditional finance.

- Regulatory developments in major markets (US, EU, Asia) affecting investor confidence.

- Technological advancements (scalability, security, Layer 2 solutions) boosting utility.

- Macroeconomic trends (inflation, currency devaluation, global liquidity).

- Competition from major altcoins and emergence of new blockchain use cases.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Why Extreme Sentiment Matters More Than Ever at $101,725 BTC

The psychological dynamics driving crypto markets have only intensified as adoption grows and institutional capital enters the space. With Bitcoin holding above $100,000, swings between euphoria and despair are amplified by leverage and global liquidity flows.

This makes tools like the Crypto Fear and Greed Index more relevant than ever, not just for timing entries but also for managing risk during sharp rallies or sudden corrections.

Seasoned traders know that while panic creates opportunity, unchecked greed can be just as hazardous to your portfolio. The final core strategy is to use the Crypto Fear and Greed Index as a disciplined signal for scaling out of positions or locking in profits when the market tips into euphoria.

3. Scale Out or Take Profits When the Index Signals Extreme Greed, Especially After Sharp Rallies

When sentiment flips to “Extreme Greed”: typically readings above 75, the risk of overheated markets and potential pullbacks rises sharply. This is especially true after rapid price surges, where FOMO (fear of missing out) can drive unsustainable buying sprees. By using the index as a contrarian indicator, you can avoid getting caught at the tail end of a parabolic move.

For example, if Bitcoin climbs rapidly from $101,725.00 to new highs and the index spikes into greed territory, it’s prudent to consider trimming exposure or setting stop losses. This approach doesn’t require selling your entire position but encourages prudent risk management, protecting gains while leaving room for further upside if momentum persists.

Combining this tactic with technical resistance levels and volume analysis can help you identify likely inflection points. For altcoin traders, this is doubly important: smaller coins often experience even more exaggerated sentiment swings than Bitcoin, making disciplined exits essential for capital preservation.

Integrating Sentiment With Broader Trading Plans

No single tool guarantees success in volatile crypto markets. The real edge comes from integrating sentiment data like the Crypto Fear and Greed Index with a broader trading framework, one that incorporates technical analysis, on-chain signals, macroeconomic context, and strict risk controls.

For those new to these concepts or looking for deeper dives into how retail FOMO impacts altcoin rallies and market cycles in 2025, check out our detailed guide: How Retail FOMO Impacts Altcoin Rallies: Analyzing Google Trends and Crypto Market Cycles 2025.

Key Takeaway: The most profitable traders in 2025 will be those who remain data-driven yet flexible, using tools like the Crypto Fear and Greed Index not as crystal balls but as part of a disciplined decision-making process that accounts for both human psychology and hard numbers.

Whether you’re accumulating during panic-driven dips or protecting gains amid exuberant rallies at $101,725 BTC, remember that sentiment extremes are opportunities, but only when paired with robust analysis and unemotional execution.