The crypto market in late 2025 is buzzing with anticipation. Altcoins have surged over 50% since July, and Bitcoin sits near record highs at $122,946.00. But for traders and investors seeking outsized returns, the real question is: how do you spot the next true altcoin season before it becomes front-page news? The answer lies in a blend of macro indicators, behavioral data, and technical metrics, three of which have proven especially reliable for timing these cycles.

Altcoin Season Index Surpassing 75: The Historical Trigger

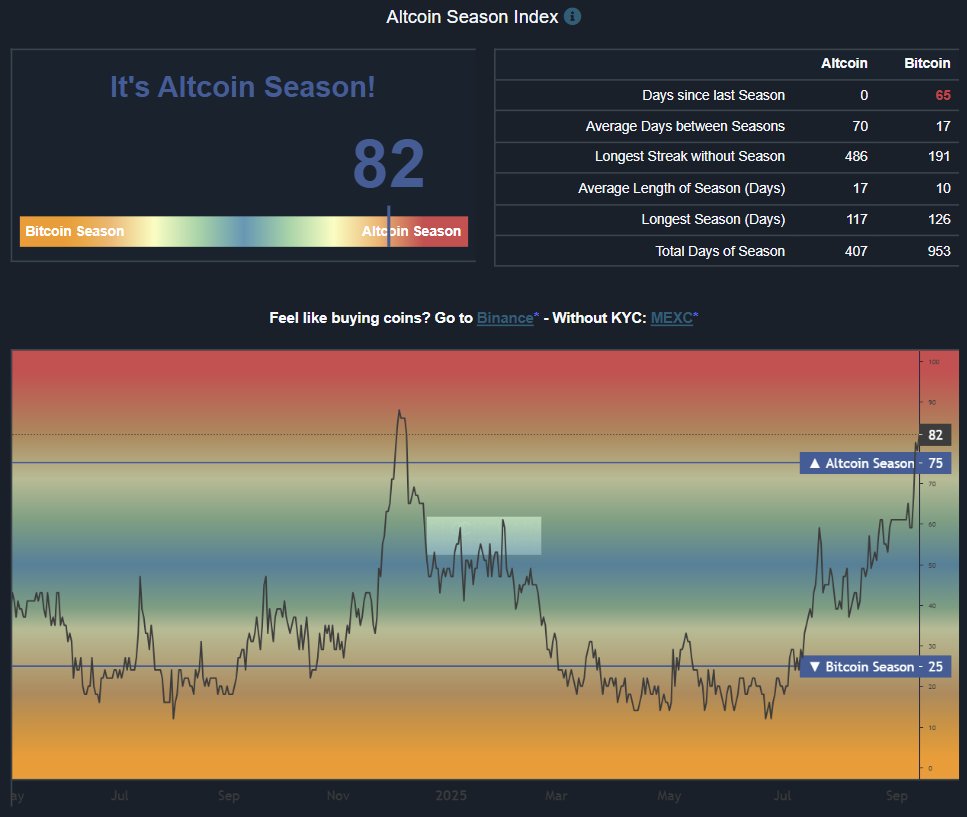

One of the most robust signals is the Altcoin Season Index moving above 75. This metric aggregates performance across dozens of major altcoins versus Bitcoin over a rolling period. Historically, when the index crosses this threshold, it has marked a decisive shift in market sentiment away from Bitcoin maximalism and toward high-beta altcoins. In previous cycles, 2017’s mania and the DeFi boom of 2021, this level consistently preceded explosive rallies in Layer-1s, DeFi tokens, and speculative microcaps.

As of mid-November 2025, the Altcoin Season Index is hovering in the low 40s, a neutral-to-bullish zone. Analysts are watching closely: if macro conditions remain favorable and trading volumes stay elevated (currently up to 60% higher for alts than BTC), this index could break above 75 by late Q3. That would be your textbook signal to rotate capital into carefully selected altcoins before retail FOMO takes hold.

Google Trends Crypto Search Spike: Measuring Retail FOMO

The second critical tool is behavioral rather than technical: a sustained surge in Google Trends search volume for terms like “altcoin”, “crypto”, and specific trending coins. Google Trends is a real-time proxy for retail curiosity, and historically, spikes here have presaged major inflows into altcoins. In fact, Forbes recently highlighted that Google searches for “altcoin” hit a five-year high just as institutional rotations into Ethereum intensified and Bitcoin dominance dipped below 60%.

The logic is simple: when retail investors start searching en masse for new opportunities beyond Bitcoin, they typically follow with capital flows. This creates self-reinforcing momentum that can drive rapid price appreciation across even obscure tokens. For those monitoring Google Trends dashboards or setting up alerts on key phrases, this behavioral data often provides an early heads-up, sometimes days or weeks before price action confirms the move.

Bitcoin Dominance Drop Below 50%: The Rotation Signal

The third pillar of any serious altseason strategy is keeping an eye on Bitcoin’s dominance metric, especially when it falls below the pivotal 50% threshold. This figure tracks what percentage of total crypto market capitalization belongs to BTC versus all other coins. A drop below half signals that capital is rotating out of Bitcoin (and sometimes Ethereum) into smaller-cap assets.

Currently, BTC dominance sits at about 58%, not yet at the critical level but well off its highs earlier this year. If dominance continues to decline, driven by surging volumes in DeFi tokens, Layer-2s like Solana or Arbitrum, and AI-themed coins, it could mark the optimal timing to diversify away from BTC-heavy portfolios into higher-risk/higher-reward plays.

This trifecta provides retail search data, index breakouts above 75, and sharp drops in Bitcoin dominance, forms the core playbook for anticipating crypto rotation in 2025. In upcoming sections we’ll dive deeper into actionable trading strategies built around these signals, and how disciplined risk management can help you survive (and thrive) amid extreme volatility.

Traders who want to maximize returns during altcoin season 2025 should treat these three signals as an interconnected system, not isolated events. When all three align, an Altcoin Season Index above 75, a Google Trends search spike, and Bitcoin dominance under 50%: the probability of outsized altcoin gains rises sharply. But the window can close fast: as capital floods into smaller tokens, volatility and risk escalate just as quickly.

Let’s break down how to operationalize these signals into a disciplined trading approach.

Top Strategies to Trade Altcoin Season 2025

-

Altcoin Season Index Surpassing 75: When the Altcoin Season Index moves above 75, it’s a historically reliable signal that market sentiment is shifting from Bitcoin to altcoins. This metric often marks the start of explosive altcoin cycles, as seen in previous bull runs. Traders should closely monitor this index to time their entry into high-potential altcoins.

-

Google Trends Crypto Search Spike: A sustained surge in Google Trends search volume for terms like “altcoin”, “crypto”, and specific trending coins signals growing retail interest. Historically, these spikes in search activity precede major altcoin rallies, offering a valuable early indicator for traders looking to front-run market momentum.

-

Bitcoin Dominance Drop Below 50%: Monitoring Bitcoin dominance is crucial. When this metric falls below the 50% threshold, it often indicates significant capital rotation into altcoins, marking the optimal timing to diversify away from BTC and capture outsized gains in the broader crypto market.

From Signal to Execution: Trading Strategies for Crypto Rotation 2025

1. Dollar-Cost Averaging (DCA) Into Strength: Once the Altcoin Season Index pushes past 75 and Google Trends confirms surging retail interest, consider deploying capital gradually using DCA. This reduces the risk of buying local tops and helps smooth entries during volatile upswings. Focus on sectors showing real momentum, DeFi, Layer-2s, and AI coins have led so far in 2025.

2. Monitor On-Chain Activity and Volume: Look beyond price charts. Spikes in on-chain transfers, wallet activity, or exchange inflows for trending altcoins often precede parabolic moves. Combine this with search data for early confirmation that new money is entering, not just traders recycling liquidity.

3. Dynamic Portfolio Rotation: As Bitcoin dominance approaches or drops below 50%, rebalance away from BTC-centric allocations toward a basket of high-conviction altcoins. Use stop losses and position sizing to manage downside risk; even in bull phases, sharp corrections are common.

Avoiding Pitfalls: Risk Management During Altseason

The promise of triple-digit gains is alluring, but remember that altcoin seasons are notoriously volatile. Sudden reversals happen when profit-taking accelerates or macro conditions shift unexpectedly. To protect capital:

- Set clear exit targets: Don’t let greed override your plan; scale out as your targets are hit.

- Avoid excessive leverage: Liquidations spike during altseason whipsaws.

- Diversify across narratives: Don’t put all your capital into one sector or meme coin trend.

- Stay updated daily: News flow can trigger abrupt sentiment shifts, especially regulatory headlines or major exchange hacks.

If you’re looking for more advanced playbooks built around these metrics, including trend-following setups and risk management frameworks, see our guide on crypto trading strategies for altseason 2025.

The Macro View: Why Timing Still Matters Most

The bottom line? Cycles matter, timing is everything. The best gains come not from chasing hype but from recognizing when the stars align across metrics like the Altcoin Season Index, Google Trends crypto search volume, and Bitcoin dominance drops. By combining data-driven signals with disciplined execution, you can navigate the chaos, and potentially front-run the next wave of crypto wealth creation before it becomes obvious to everyone else.