Crypto-backed stocks are redefining how investors approach the intersection of traditional equities and digital assets. As of October 23,2025, this market segment is gaining momentum, driven by regulatory advancements and innovative platforms like Coinbase Global Inc. , which is currently trading at $320.33. For newcomers eager to learn how to trade crypto-backed stocks, a clear, methodical approach is essential. This guide breaks down the process into four actionable steps, each tailored for beginners looking to build confidence and competence in this evolving space.

1. Select a Reputable Trading Platform Offering Crypto-Backed Stocks

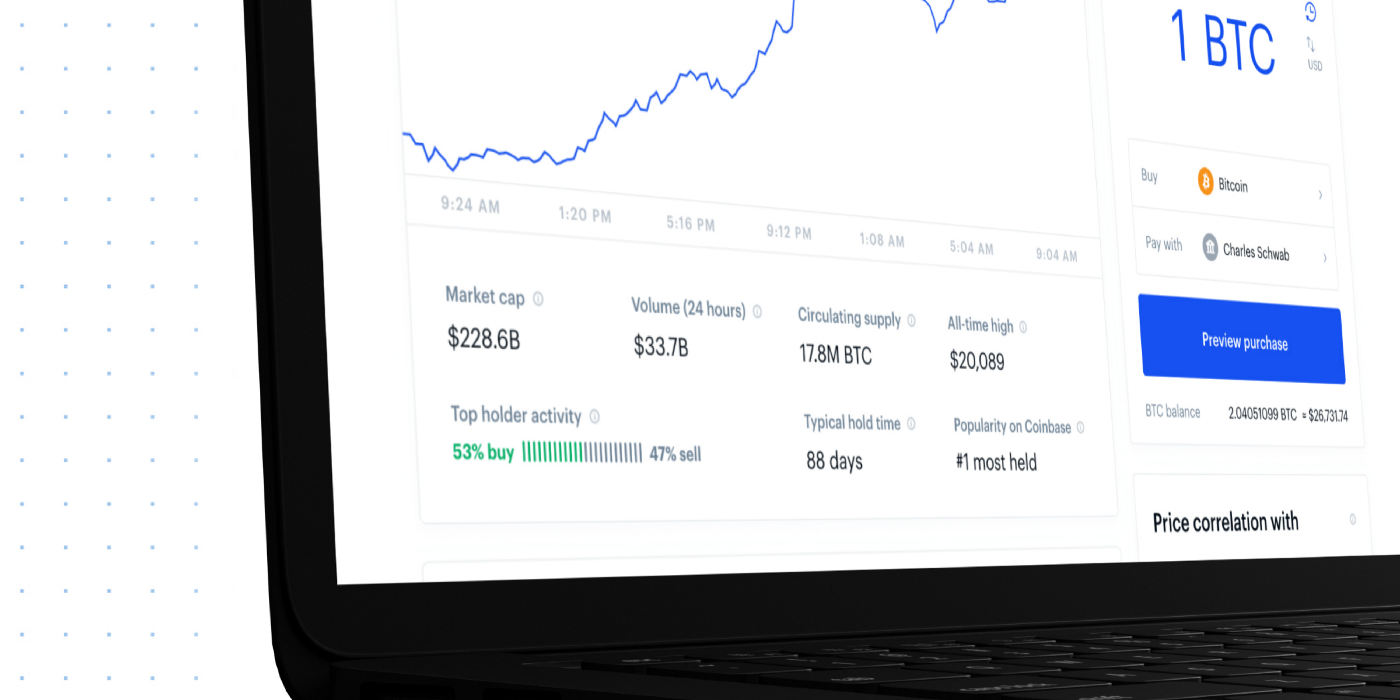

Your first decision as a beginner is choosing where to trade. Not all platforms are created equal, especially when it comes to crypto-backed equities or ETFs. Look for exchanges that are regulated, transparent about their fees and security protocols, and have a track record of reliability. With Coinbase actively seeking SEC approval to offer tokenized stocks on the blockchain, the potential for 24/7 trading and reduced settlement times is becoming a reality. Always verify that your chosen platform lists legitimate crypto-backed assets and complies with your local regulations.

For context, here are the current prices of key players in this sector:

- Coinbase Global Inc (COIN): $320.33

- Strategy Inc (MSTR): $280.81

- Grayscale Bitcoin Trust (GBTC): $84.50

Selecting a reputable platform provides access not only to these stocks but also to real-time data feeds and robust order execution tools, critical features for any trader.

2. Research and Choose Crypto-Backed Stocks or ETFs Aligned with Your Goals

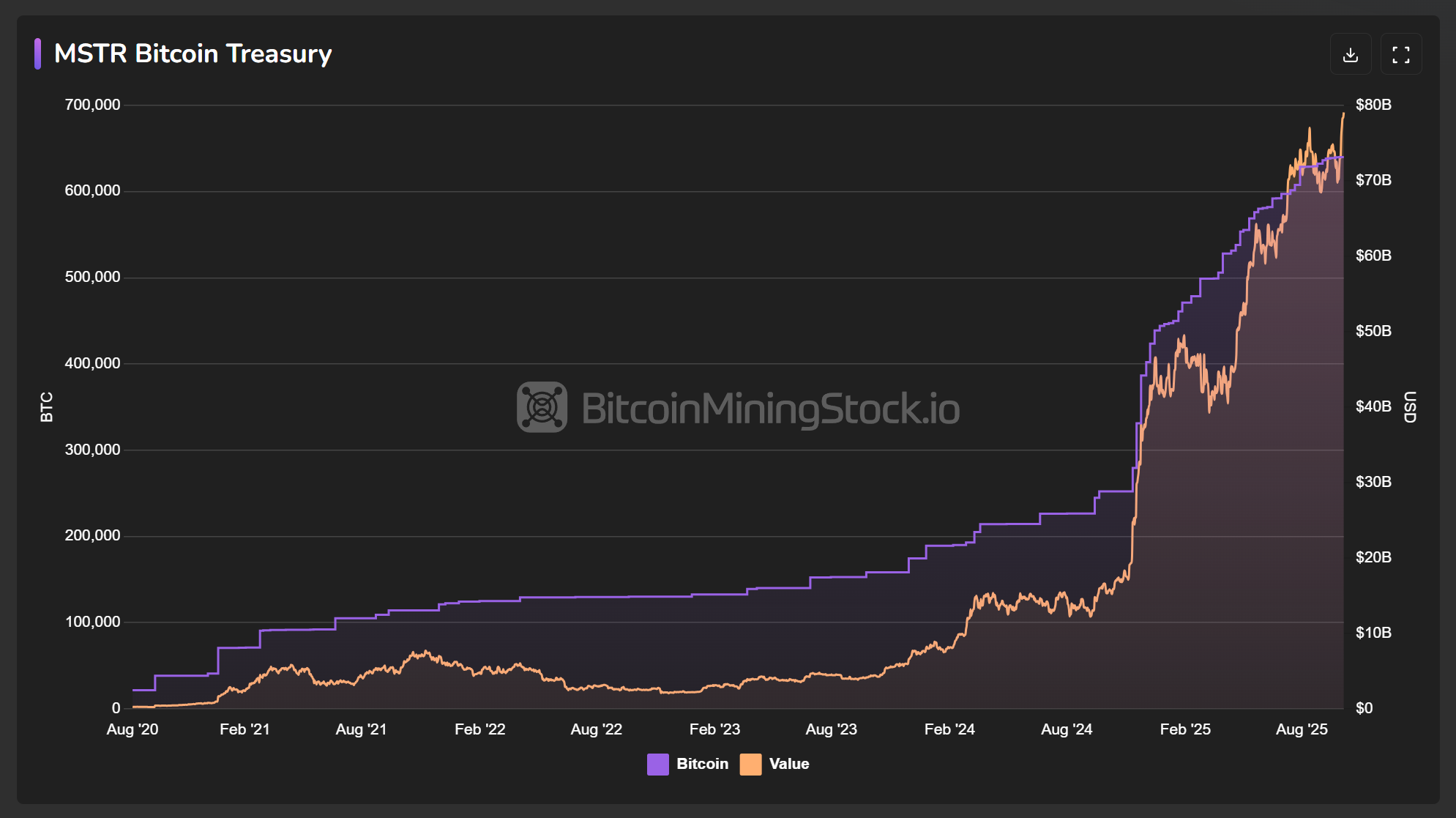

The next step is asset selection. Crypto-backed stocks can include companies directly involved in blockchain infrastructure (like Coinbase), those with significant digital asset holdings (such as Strategy Inc. ), or funds like GBTC that offer exposure through traditional investment vehicles.

Steps to Evaluate Crypto-Backed Stocks or ETFs

-

Select a Reputable Trading Platform Offering Crypto-Backed StocksBegin by choosing a well-established platform that supports crypto-backed equities or ETFs. Leading platforms such as Coinbase (currently priced at $320.33) are at the forefront of integrating traditional stocks with blockchain technology. Ensure the platform is regulated and offers secure trading features.

-

Research and Choose Crypto-Backed Stocks or ETFs Aligned with Your GoalsInvestigate available assets such as Coinbase Global Inc. (COIN), Strategy Inc. (MSTR) (formerly MicroStrategy), and Grayscale Bitcoin Trust (GBTC). Consider each asset’s market performance, such as COIN at $320.33, MSTR at $280.81, and GBTC at $84.5, to ensure alignment with your investment objectives.

-

Develop a Risk-Managed Trading Strategy Using Real-Time Market DataCreate a trading plan that incorporates the latest price movements and volatility. For example, note that COIN changed by -$18.24 (-0.05%) and MSTR by -$21.11 (-0.07%) in the most recent session. Set clear entry, exit, and stop-loss levels to protect your capital.

-

Execute Trades and Monitor Portfolio Performance RegularlyPlace your trades through your chosen platform and actively track your portfolio. Use real-time tools to monitor price changes, such as GBTC’s latest price of $84.5 (down $3.14 or -0.04%). Adjust your holdings based on market developments and your investment strategy.

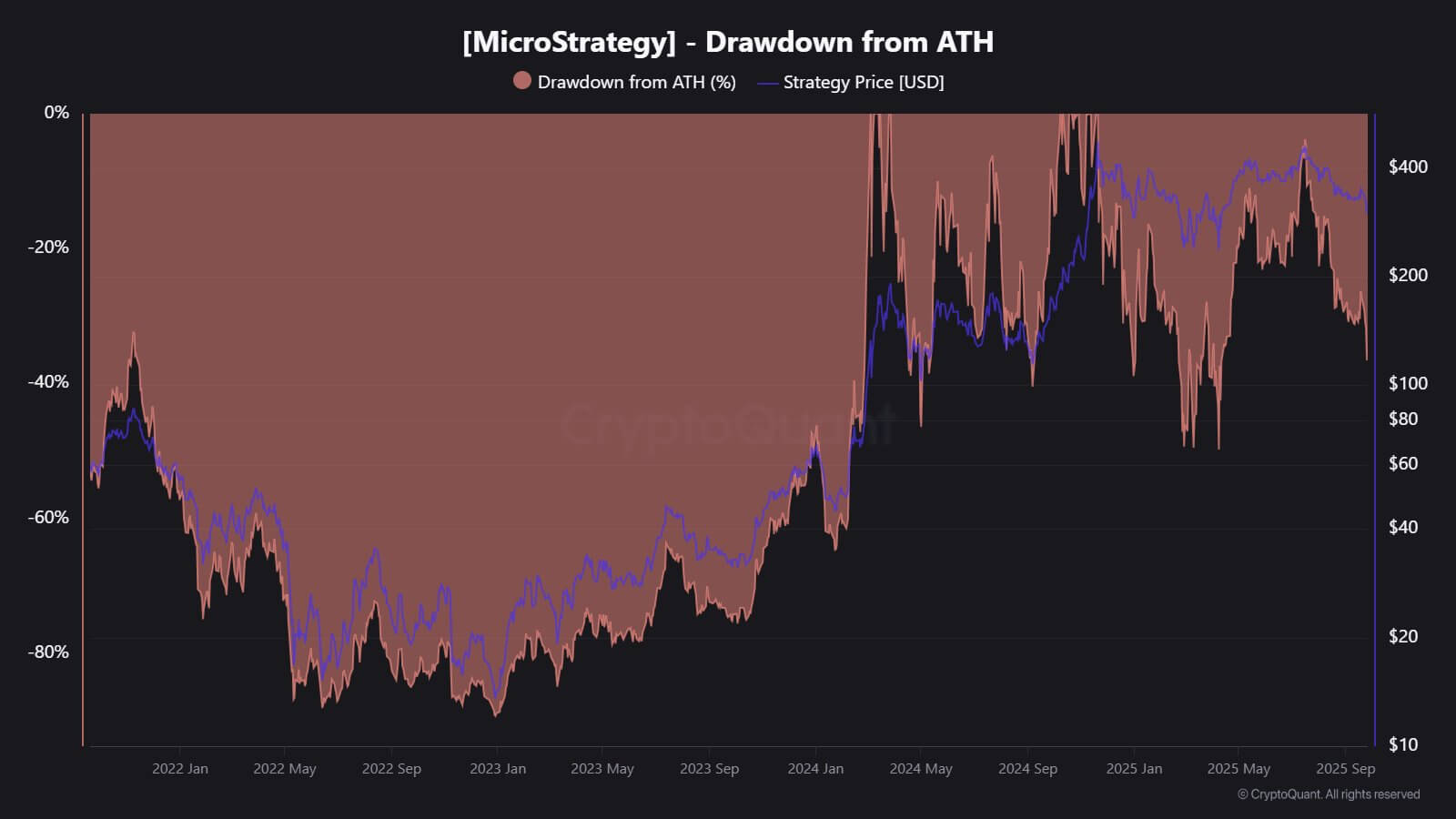

Begin by clarifying your investment objectives, are you seeking growth through volatility, or do you prefer more stable exposure via ETFs? Scrutinize each asset’s fundamentals: examine their balance sheets, exposure to cryptocurrencies, regulatory posture, and recent performance trends. For example, Strategy Inc. ’s price at $280.81 reflects its aggressive accumulation of Bitcoin on its balance sheet, a factor that may align with bullish long-term views on crypto adoption.

The key here is alignment: only choose assets that fit your risk tolerance and financial goals.

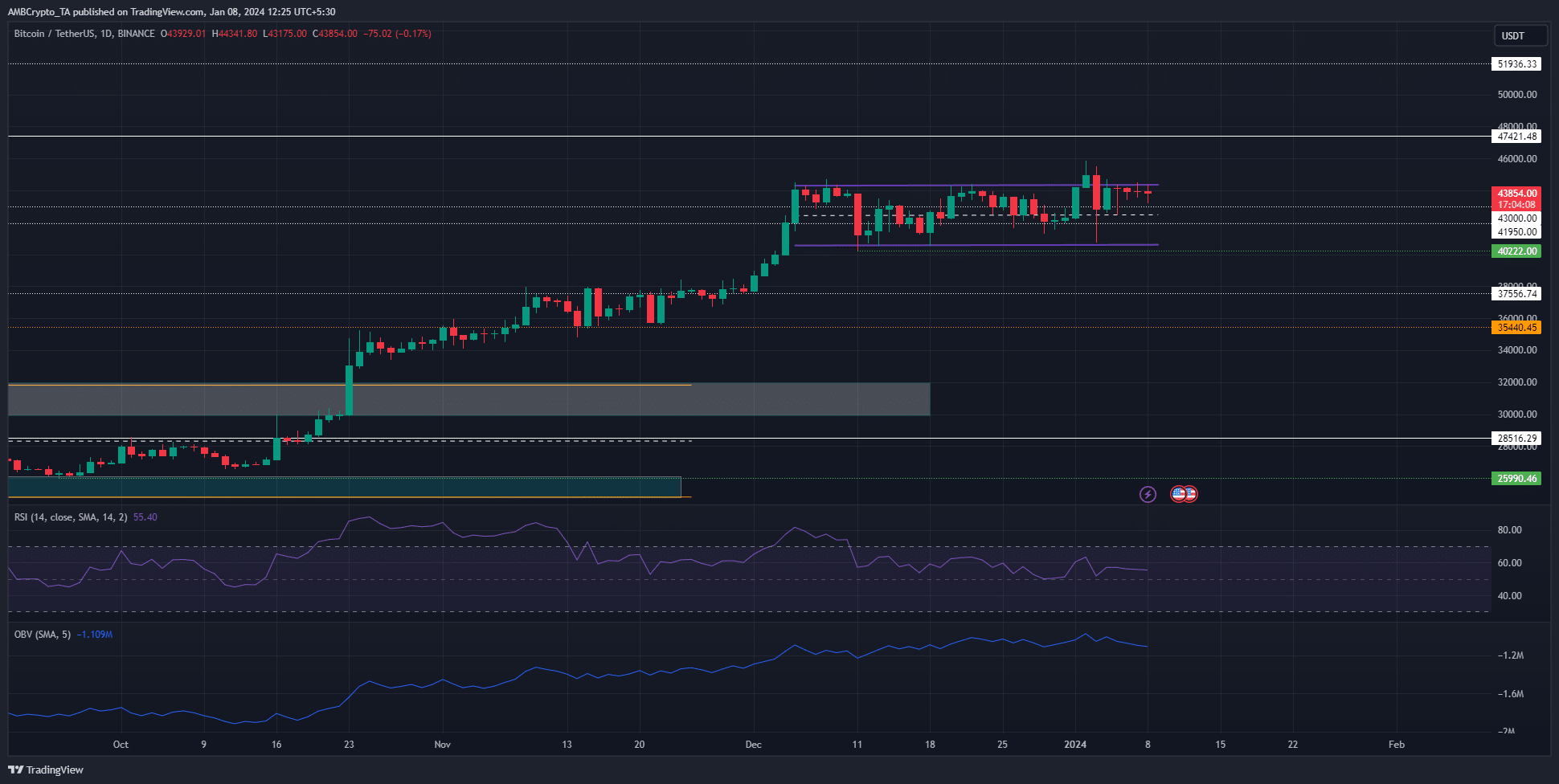

3. Develop a Risk-Managed Trading Strategy Using Real-Time Market Data

No matter how promising an asset appears, success in crypto-backed stocks trading hinges on disciplined strategy development. Start small, never risk more than you can afford to lose, and use real-time data as your compass for decision making.

A sound beginner strategy might involve setting stop-loss orders below key support levels or using dollar-cost averaging to smooth out entry points over time. Leverage technical analysis tools offered by most major platforms, these can help identify trends in assets like COIN or GBTC as they fluctuate around their current prices of $320.33 and $84.50, respectively.

Coinbase (COIN), Strategy Inc. (MSTR), and Grayscale Bitcoin Trust (GBTC) Price Predictions: 2026-2031

Professional Forecast Table Based on Current Market Data and Crypto-Equity Industry Trends (as of October 2025)

| Year | COIN Min Price | COIN Avg Price | COIN Max Price | MSTR Min Price | MSTR Avg Price | MSTR Max Price | GBTC Min Price | GBTC Avg Price | GBTC Max Price | Market Scenario Insights |

|---|---|---|---|---|---|---|---|---|---|---|

| 2026 | $260.00 | $345.00 | $410.00 | $220.00 | $310.00 | $390.00 | $62.00 | $93.00 | $128.00 | Crypto regulation uncertainty, moderate BTC growth, early adoption of tokenized stocks |

| 2027 | $290.00 | $385.00 | $470.00 | $245.00 | $350.00 | $440.00 | $70.00 | $106.00 | $143.00 | Increased institutional adoption, SEC approval for tokenized stocks, BTC halving tailwinds |

| 2028 | $320.00 | $425.00 | $535.00 | $265.00 | $395.00 | $510.00 | $77.00 | $120.00 | $163.00 | Broader blockchain integration, higher earnings growth, bullish crypto sentiment |

| 2029 | $340.00 | $470.00 | $590.00 | $285.00 | $440.00 | $570.00 | $82.00 | $133.00 | $185.00 | Peak adoption of tokenized equities, global expansion, potential for volatility |

| 2030 | $370.00 | $520.00 | $660.00 | $310.00 | $495.00 | $635.00 | $88.00 | $148.00 | $210.00 | Mature market, stable regulatory environment, BTC at new highs |

| 2031 | $400.00 | $570.00 | $730.00 | $340.00 | $550.00 | $710.00 | $95.00 | $165.00 | $240.00 | Continued innovation, stable crypto integration, potential for new financial products |

Price Prediction Summary

COIN, MSTR, and GBTC are expected to show steady growth through 2031, driven by increasing crypto adoption, potential SEC approval for tokenized stocks, and institutional capital inflows. While price volatility will remain due to macroeconomic and regulatory factors, the long-term outlook is bullish, with average annual growth rates of 8-12% for these crypto-backed stocks. Min/max ranges reflect both bullish (rapid adoption, higher Bitcoin prices) and bearish (regulatory setbacks, tech disruptions) scenarios.

Key Factors Affecting Coinbase Global, Inc. Stock Price

- Approval and mainstream adoption of tokenized equities on blockchain platforms

- Bitcoin price trends and network developments (e.g., halvings, ETF adoption)

- SEC and global regulatory frameworks for crypto-backed stocks

- Company fundamentals: earnings growth, innovation, and market share expansion

- Institutional capital inflows and broader investor adoption

- Macroeconomic conditions affecting tech and financial markets

- Potential for new crypto-linked financial products and expanded global reach

Disclaimer: Stock price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, economic conditions, and other factors.

Always do your own research before making investment decisions.

Remember: the goal isn’t just to chase returns but also to preserve capital during downturns, a principle at the heart of all successful trading strategies.

The Importance of Ongoing Education and Community Insights

The landscape of crypto stock trading evolves rapidly; staying informed is crucial for long-term success. Engage with reputable sources, follow expert commentary on social media platforms like Twitter, and participate in community discussions where traders share insights about emerging opportunities or regulatory changes impacting tokens such as those offered by Coinbase.

Once your strategy is in place, it’s time to take action. Executing trades in the crypto-backed stock market requires a calm, methodical approach. Most reputable platforms provide user-friendly interfaces for placing buy and sell orders. Start with small position sizes and consider using limit orders to control your entry price, especially given the volatility that often accompanies assets like Coinbase Global Inc (COIN) at $320.33, Strategy Inc (MSTR) at $280.81, and Grayscale Bitcoin Trust (GBTC) at $84.50.

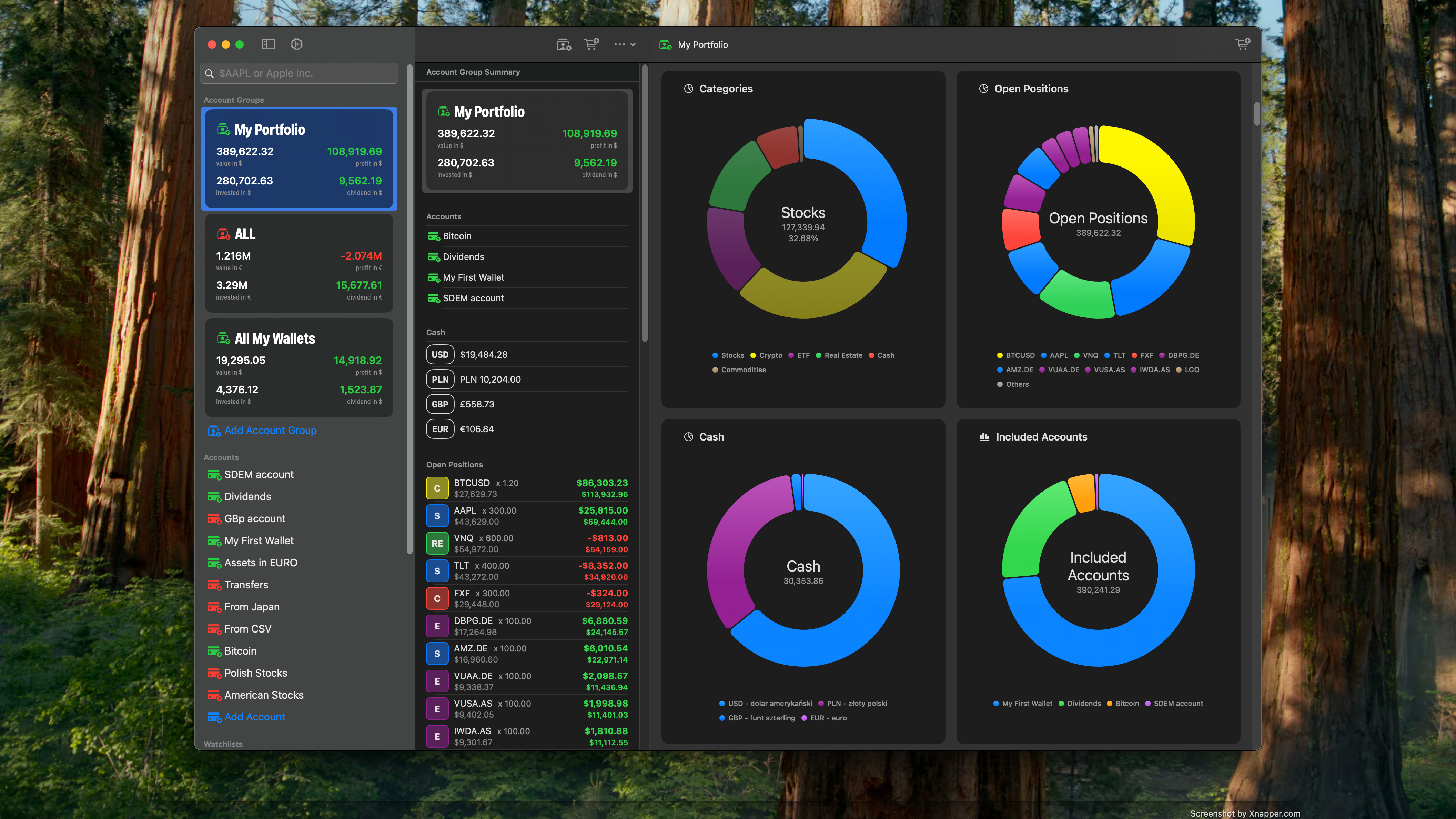

4. Execute Trades and Monitor Portfolio Performance Regularly

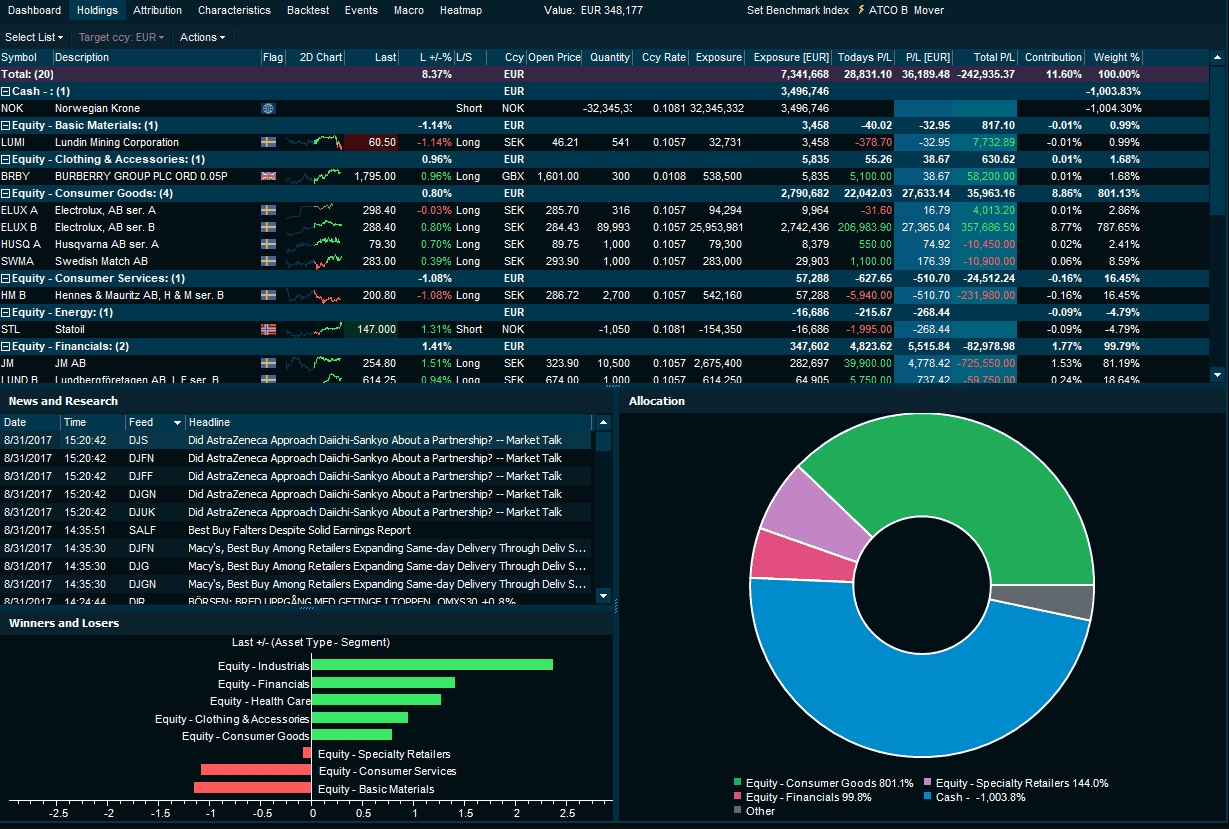

Active portfolio management is essential in the world of crypto-backed stocks trading. Once your trades are live, monitor them regularly using the real-time data feeds and portfolio tracking tools available on your chosen platform. Pay close attention to both price movements and news events that could impact your holdings, regulatory developments, earnings reports, or shifts in crypto market sentiment can all trigger significant volatility.

Set aside time each week to review your positions and rebalance if necessary. Are your assets performing as expected? Have your risk parameters changed? Don’t hesitate to adjust stop-loss levels or take profits when targets are met; disciplined execution is key to long-term success.

“Preserve capital, let profits run. “ This mantra is especially relevant when navigating assets that bridge the traditional and digital finance worlds.

Essential Steps to Monitor & Manage Crypto-Backed Stocks

-

Select a Reputable Trading Platform Offering Crypto-Backed StocksBegin by choosing a secure, regulated platform that supports crypto-backed stocks. Leading exchanges like Coinbase are actively working to offer tokenized equities, bringing traditional stocks onto the blockchain for 24/7 trading and enhanced transparency.

-

Research and Choose Crypto-Backed Stocks or ETFs Aligned with Your GoalsInvestigate established crypto-centric stocks and funds such as Coinbase Global Inc. (COIN) ($320.33), Strategy Inc. (MSTR) ($280.81), or Grayscale Bitcoin Trust (GBTC) ($84.5). Review each asset’s fundamentals, recent performance, and how their crypto exposure fits your investment objectives.

-

Develop a Risk-Managed Trading Strategy Using Real-Time Market DataCreate a trading plan that includes position sizing, stop-loss orders, and diversification. Utilize up-to-date price data—such as COIN at $320.33 or MSTR at $280.81—to inform your decisions and adapt to market volatility.

-

Execute Trades and Monitor Portfolio Performance RegularlyPlace trades through your chosen platform and track your holdings using portfolio management tools. Monitor price movements, such as the recent -0.05% change in COIN, and adjust your positions as needed to stay aligned with your strategy and risk tolerance.

Beginner traders often underestimate the value of routine portfolio reviews and emotional discipline. By setting clear rules and sticking to them, even during periods of heightened volatility, you build resilience and improve your chances of compounding gains over time.

Next Steps: Deepen Your Knowledge and Stay Agile

The intersection of blockchain technology and traditional equities is still unfolding. As regulatory frameworks evolve and new products come online, such as tokenized equities pending SEC approval, opportunities will expand for those who stay informed and adaptable.

To continue building your skills, explore our comprehensive step-by-step guide for beginners, which delves deeper into platform features, risk controls, and advanced trading tactics.

What’s your top priority when trading crypto-backed stocks?

As crypto-backed stocks become more accessible and integrated with traditional markets, investors have several key steps to consider. Which aspect matters most to you when getting started?

Remember: success in crypto stock trading strategies 2024 comes from a blend of preparation, ongoing learning, and calm execution. With these four steps, platform selection, asset research, strategy development, and diligent portfolio management, you’re well equipped to participate confidently in this dynamic market.