Crypto-backed stocks are rapidly transforming how investors gain exposure to the digital asset ecosystem without directly holding cryptocurrencies. In 2025, the market is more accessible than ever, with major equities like Coinbase Global Inc (COIN) trading at $375.78 and a growing array of ETFs and traditional stocks linked to crypto performance. For beginners, understanding how to trade these assets is essential for capitalizing on the sector’s volatility while leveraging the familiar structure of traditional stock markets.

What Are Crypto-Backed Stocks?

Crypto-backed stocks, sometimes referred to as crypto stocks or crypto-linked equities, are shares of companies whose business models are closely tied to the cryptocurrency sector. These include exchanges like Coinbase, mining companies, blockchain technology firms, and asset managers offering Bitcoin or Ethereum ETFs. Unlike direct crypto trading, purchasing these stocks allows you to gain exposure via regulated exchanges and brokerage accounts.

For those new to this space, it’s crucial to recognize that the price movements of these equities often mirror sentiment and trends in the underlying crypto markets – but with their own unique risk profiles. For example, COIN is sensitive both to overall crypto adoption and transaction volumes on its platform. As of October 8,2025, COIN trades at $375.78 after a 24-hour decline of -2.68%.

Why Trade Crypto-Backed Stocks Instead of Direct Crypto?

There are several compelling reasons why beginners might start with crypto-backed stocks rather than buying Bitcoin or Ethereum directly:

- Regulation and Security: Stocks trade on established exchanges with investor protections and regulatory oversight.

- Ease of Access: Most major brokerages allow you to buy and sell these equities in your existing account – no need for a separate crypto wallet.

- Diversification: Crypto stocks often provide indirect exposure to multiple digital assets or blockchain applications.

- Tax Simplicity: Taxation of equities is generally more straightforward than dealing with crypto capital gains rules.

For a practical overview of starting out in this market, see How to Trade Cryptocurrency: A Practical Guide.

Step-by-Step Guide: Getting Started with Crypto Stock Trading

Before placing your first trade, ensure you understand both the broader market context and your own risk tolerance. The following steps will help you navigate your entry into crypto-backed stock trading:

- Choose a Reputable Brokerage: Select a platform that offers access to US-listed crypto stocks and ETFs. Many major brokers now support these products alongside traditional equities.

- Research Key Stocks: Focus on leading players such as Coinbase (COIN), mining firms, or blockchain innovators. Track their financials and correlation with major cryptocurrencies.

- Monitor Real-Time Prices: Stay updated on current prices – for example, COIN at $375.78 – and watch for significant moves that could signal trading opportunities.

- Develop a Trading Plan: Set your entry/exit points, position sizes, and stop-loss levels. Avoid emotional trading by sticking to your plan.

- Execute Your First Trade: Place your buy or sell order through your brokerage account. Start small as you learn market dynamics.

You can also explore a more detailed beginner’s guide at How to Trade Cryptocurrency: Beginner’s Guide.

As the market matures, analysts expect further integration between traditional finance and digital assets. For a forward-looking view on where major crypto stocks like COIN could be headed next, see the table below:

Coinbase Global Inc. (COIN) Price Prediction 2026-2031

Comprehensive annual price outlook for COIN, the leading crypto-backed stock, based on current trends, company fundamentals, and evolving crypto market integration.

| Year | Minimum Price (Bearish Scenario) | Average Price (Base Case) | Maximum Price (Bullish Scenario) | Potential % Change (Avg) |

|---|---|---|---|---|

| 2026 | $295.00 | $410.00 | $520.00 | +9.1% |

| 2027 | $315.00 | $445.00 | $575.00 | +8.5% |

| 2028 | $335.00 | $485.00 | $635.00 | +9.0% |

| 2029 | $355.00 | $525.00 | $700.00 | +8.2% |

| 2030 | $375.00 | $570.00 | $770.00 | +8.6% |

| 2031 | $400.00 | $620.00 | $850.00 | +8.8% |

Price Prediction Summary

Coinbase (COIN) is projected to experience steady growth over the next several years, driven by the ongoing adoption of cryptocurrency, expansion of digital asset offerings, and increasing institutional involvement. While crypto market volatility and regulatory risks could introduce significant short-term price swings, the overall trend suggests a moderate upward trajectory. The price could range from a bearish scenario of $295.00 in 2026 to a bullish high of $850.00 by 2031, with average annual growth rates between 8-9%.

Key Factors Affecting Coinbase Global Inc. Stock Price

- Continued mainstream adoption of cryptocurrencies and blockchain technology.

- Expansion of Coinbase’s product suite, including institutional services and new asset listings.

- Regulatory clarity and potential approval of additional crypto ETFs.

- Volatility and overall health of the broader cryptocurrency market.

- Company financial performance, profitability, and revenue diversification.

- Potential competitive pressures from traditional financial institutions and fintech entrants.

- Global macroeconomic conditions and interest rate environment.

Disclaimer: Stock price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, economic conditions, and other factors.

Always do your own research before making investment decisions.

Effective trading in crypto-backed stocks requires more than just following price charts. You need a disciplined approach, robust risk management, and a willingness to adapt as both regulatory and technological landscapes evolve. With volatility remaining a hallmark of the sector, especially as seen in COIN’s recent 24-hour drop to $375.78, beginners should prioritize education and incremental exposure.

Essential Strategies for Crypto Stock Trading

Essential Crypto Stock Trading Strategies for Beginners

-

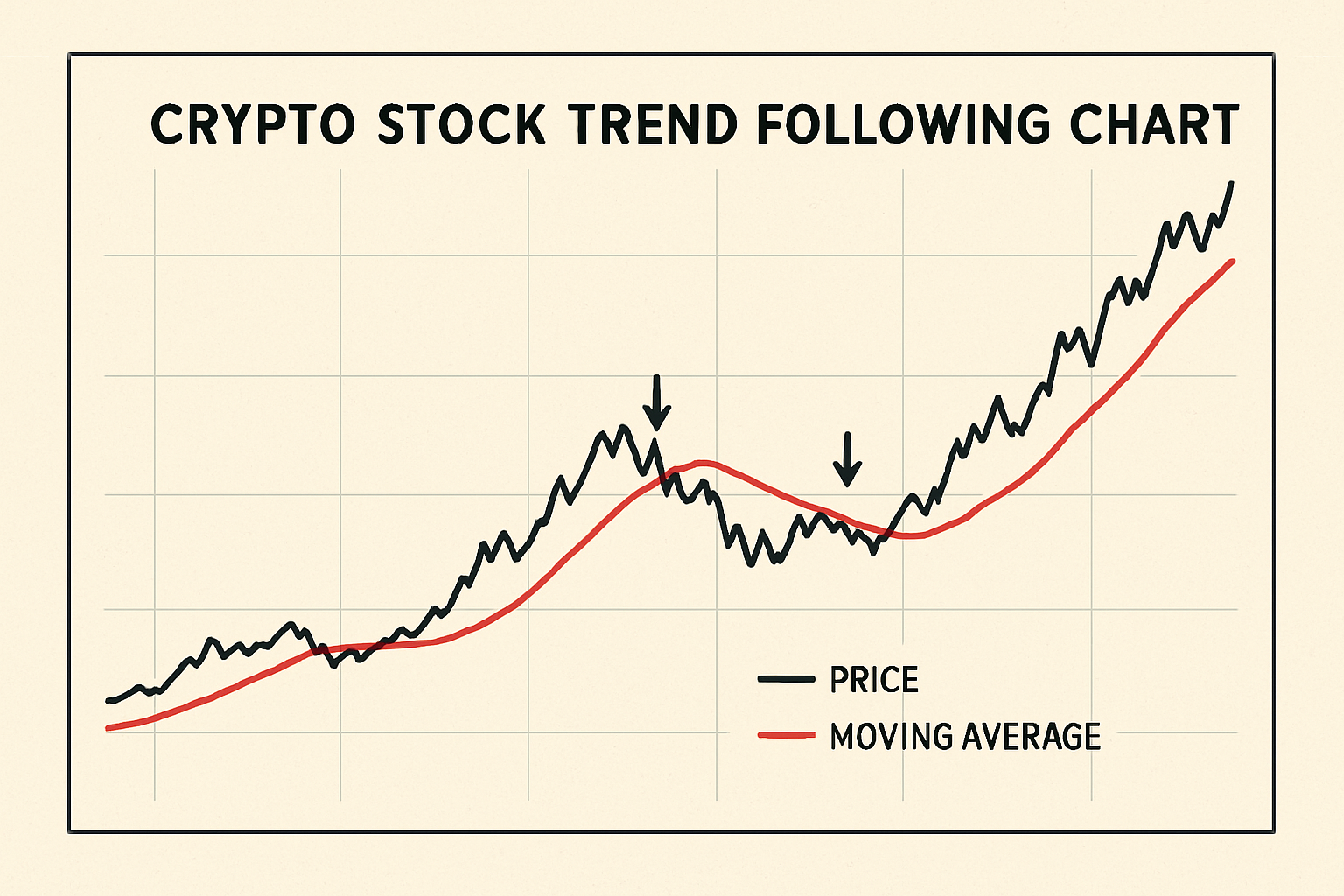

Trend Following: Identify and trade in the direction of prevailing market trends using tools like moving averages and relative strength index (RSI). This approach is popular on platforms such as TradingView for chart analysis.

-

Diversification: Reduce risk by spreading investments across multiple crypto-related stocks and ETFs, such as Coinbase Global Inc (COIN) (currently priced at $375.78) and ProShares Bitcoin Strategy ETF (BITO).

-

Risk Management: Set clear stop-loss and take-profit orders to limit potential losses and lock in gains. Most major brokerages like Fidelity and Charles Schwab offer these risk controls for crypto-linked stocks.

-

Position Sizing: Decide how much capital to allocate to each trade based on your risk tolerance. Beginners often use the 1-2% rule—risking no more than 1-2% of total capital on a single trade.

While some traditional equity strategies translate well to crypto stocks, it’s important to account for sector-specific drivers. For instance, news around Bitcoin ETF approvals, regulatory crackdowns, or blockchain adoption can move prices swiftly. Here are some actionable tips:

- Stay Informed: Track both crypto and equity news. For example, significant Bitcoin price shifts often impact COIN and similar stocks.

- Use Stop-Losses: Given the volatility, always set stop-loss orders to protect your capital from sharp downturns.

- Diversify: Don’t put all your funds in one stock. Mix crypto-backed equities with broader tech or financial stocks to balance risk.

- Review Correlations: Understand how your chosen stocks move in relation to underlying crypto assets. High correlation can amplify gains and losses.

- Start Small: Begin with modest positions. As you gain confidence and experience, consider scaling up your trades.

For a deeper dive into best practices, you may find value in IG’s guide on trading cryptocurrency stocks.

Risk Factors and Market Volatility

Crypto-backed stocks are inherently volatile. For example, Coinbase (COIN) fluctuated between $387.60 and $363.48 in the last 24 hours alone. This kind of movement is not unusual and can present both opportunities and risks. Factors such as regulatory news, exchange hacks, or shifts in crypto adoption rates can all trigger rapid price changes. Always invest with money you can afford to lose and avoid over-leveraging your account.

Many investors find it helpful to use technical analysis tools, such as moving averages and RSI, to identify entry and exit points. However, never rely solely on chart patterns, fundamental analysis remains critical, especially in a sector where sentiment can turn on a dime.

Community Insights and Learning Resources

The crypto stock trading community is active and eager to share insights. Following reputable analysts and engaging in discussion forums can keep you ahead of market trends. Social sentiment, especially on platforms like Twitter, often precedes sharp market moves.

If you’re looking for hands-on guidance, there are interactive courses and detailed guides available. For example, Coursera’s practical guide covers foundational skills for navigating both crypto and crypto-backed equities.

Checklist: Before You Trade

By following a structured approach and leveraging the latest market data, like COIN’s current price of $375.78: you can participate in one of the most dynamic corners of today’s financial markets. Stay curious, manage your risk, and remember: sound analysis builds wealth over time.