The Volume-Weighted Average Price (VWAP) has become a cornerstone in the toolkit of savvy crypto traders seeking to enhance their intraday performance. As digital assets continue to mature, the VWAP crypto trading strategy stands out for its ability to provide a real-time, volume-adjusted benchmark, helping traders identify fair value and capitalize on market inefficiencies. In 2025, with Bitcoin and major altcoins experiencing heightened volatility and liquidity, mastering VWAP pullback strategies can offer a significant edge for both day traders and swing traders.

Why VWAP Pullback Strategies Work in Crypto Markets

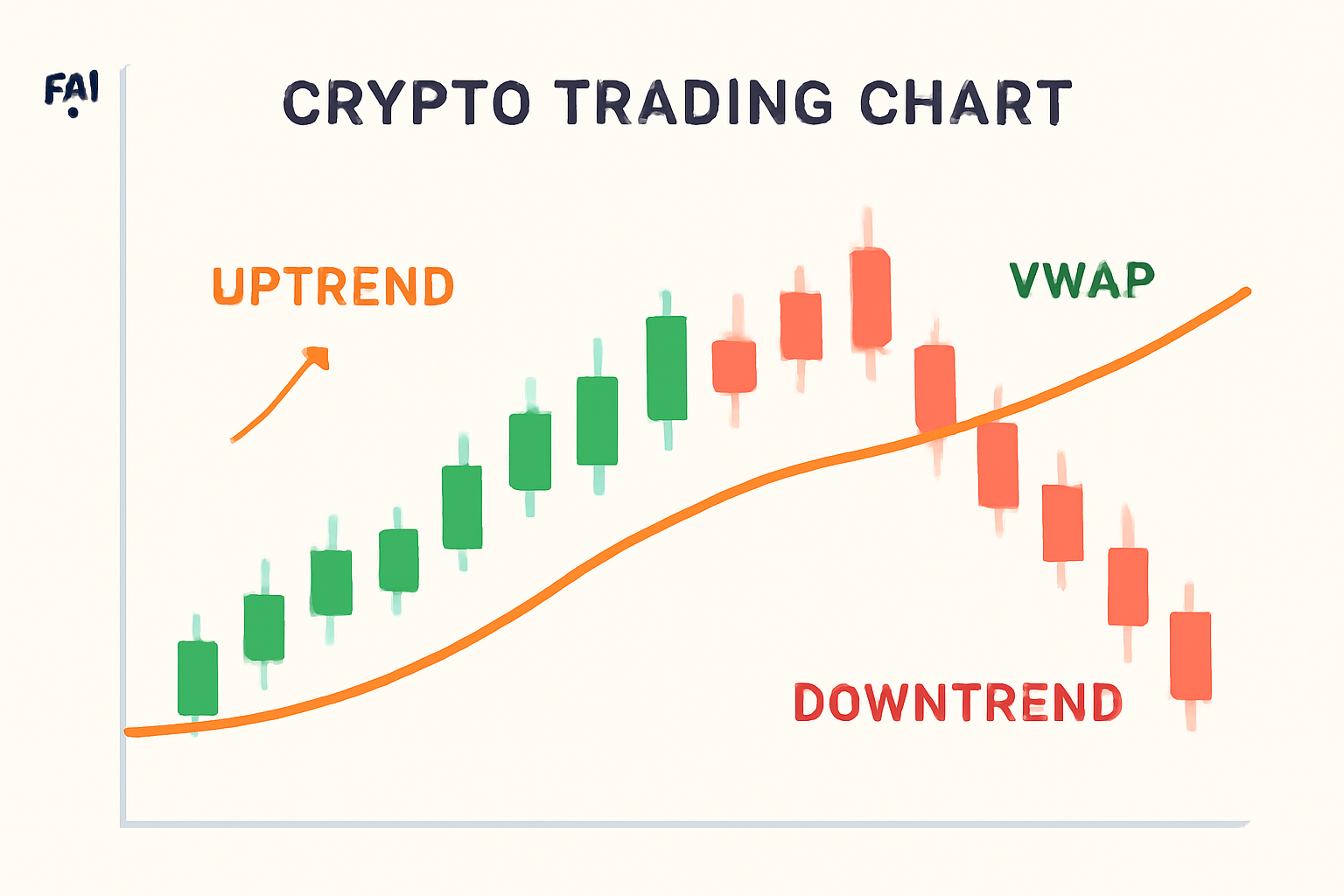

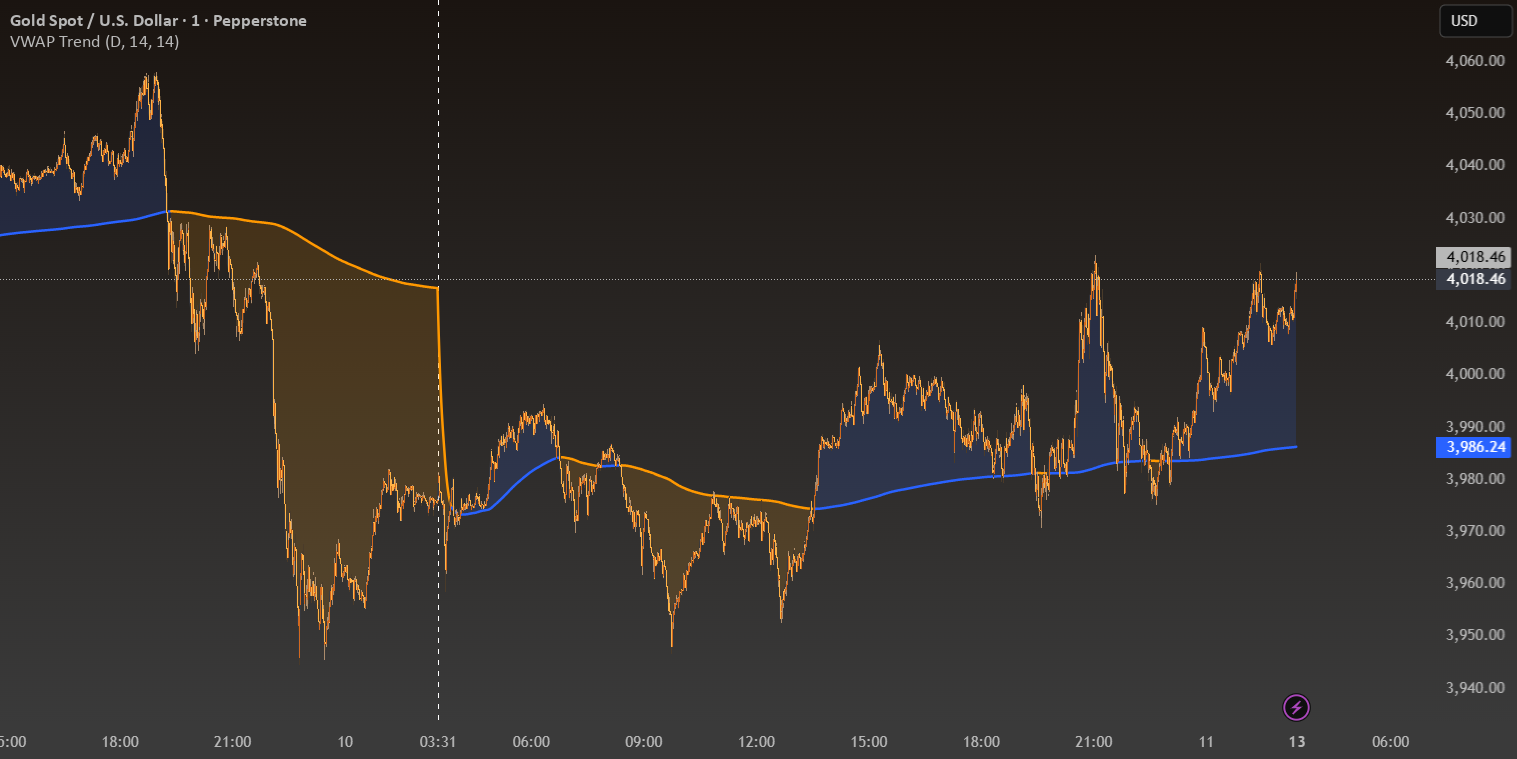

Unlike static moving averages, VWAP dynamically adjusts to both price and trading volume, reflecting where the majority of trading activity occurs during a session. In crypto, where order flow can shift rapidly due to global markets and 24/7 trading, this is invaluable. VWAP acts as a magnet for price action, often serving as a key support or resistance level. Pullbacks to VWAP are not random; they represent moments when the market is testing whether the prevailing trend remains intact or is about to reverse.

For example, during a bullish trend, when the price of Bitcoin or an altcoin retraces toward the VWAP but holds above it, this typically signals strong underlying demand. Savvy traders use this as a trigger for re-entry or adding to positions, aiming for a bounce back toward recent highs. Conversely, in a downtrend, rallies to VWAP can provide low-risk shorting opportunities.

Step-by-Step VWAP Pullback Trading Setup

Implementing a VWAP pullback strategy requires precision and discipline. Here’s a structured approach to maximize your odds of consistent profits:

- Identify the prevailing trend: Is the price consistently above or below the VWAP? Confirm with higher highs/lows (uptrend) or lower highs/lows (downtrend).

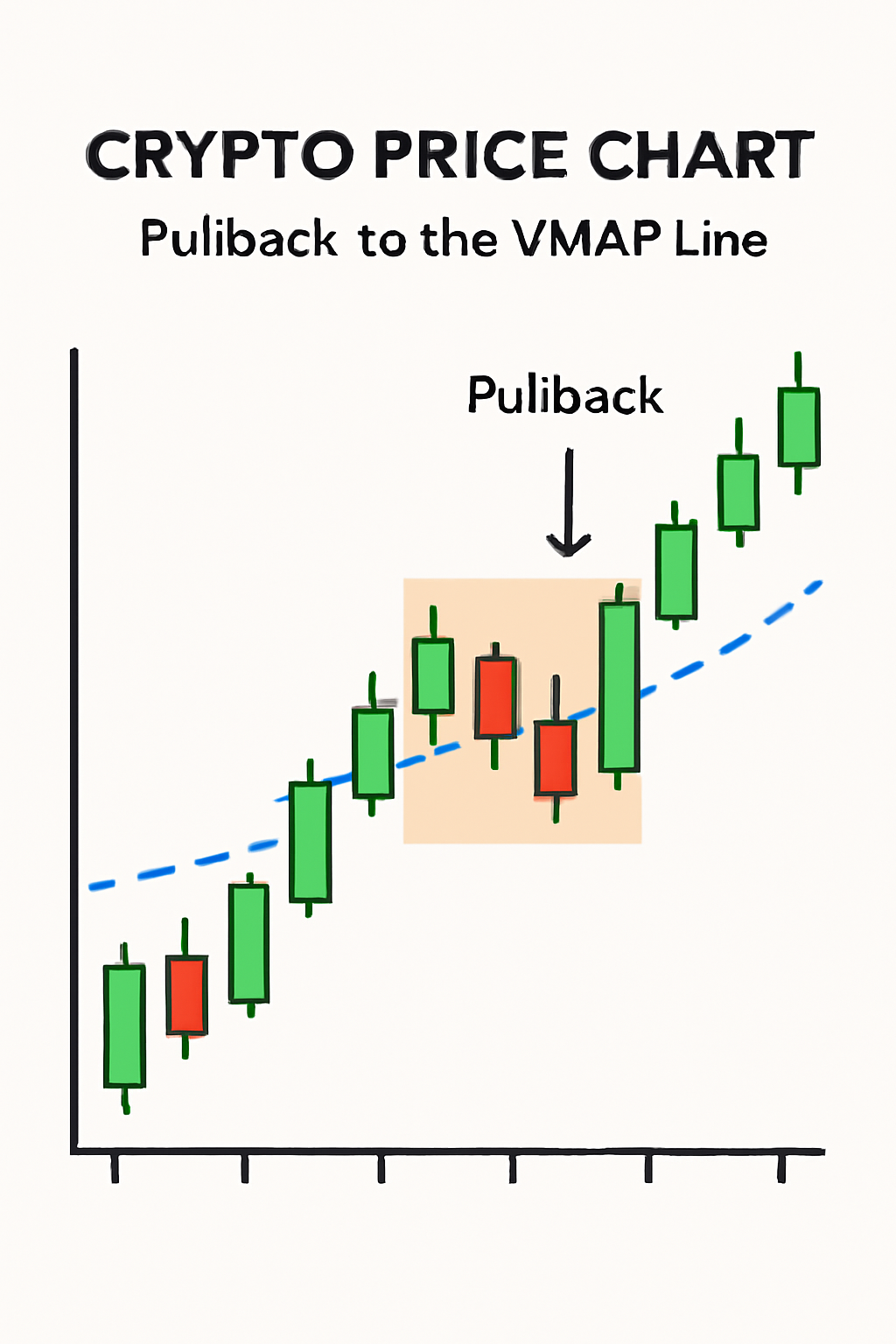

- Wait for a pullback: In an uptrend, watch for price retracing to or just below the VWAP. In a downtrend, look for rallies that approach the VWAP line.

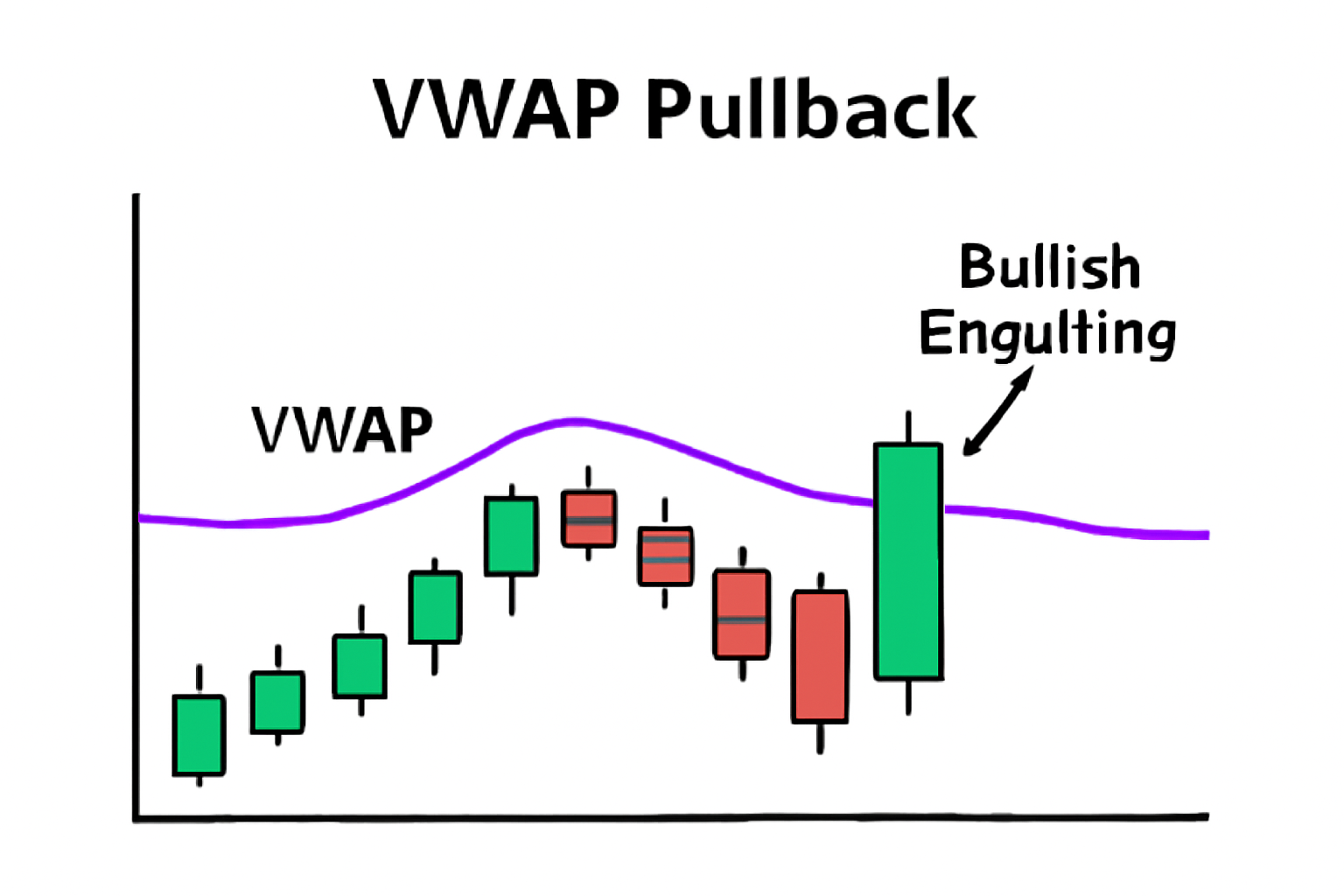

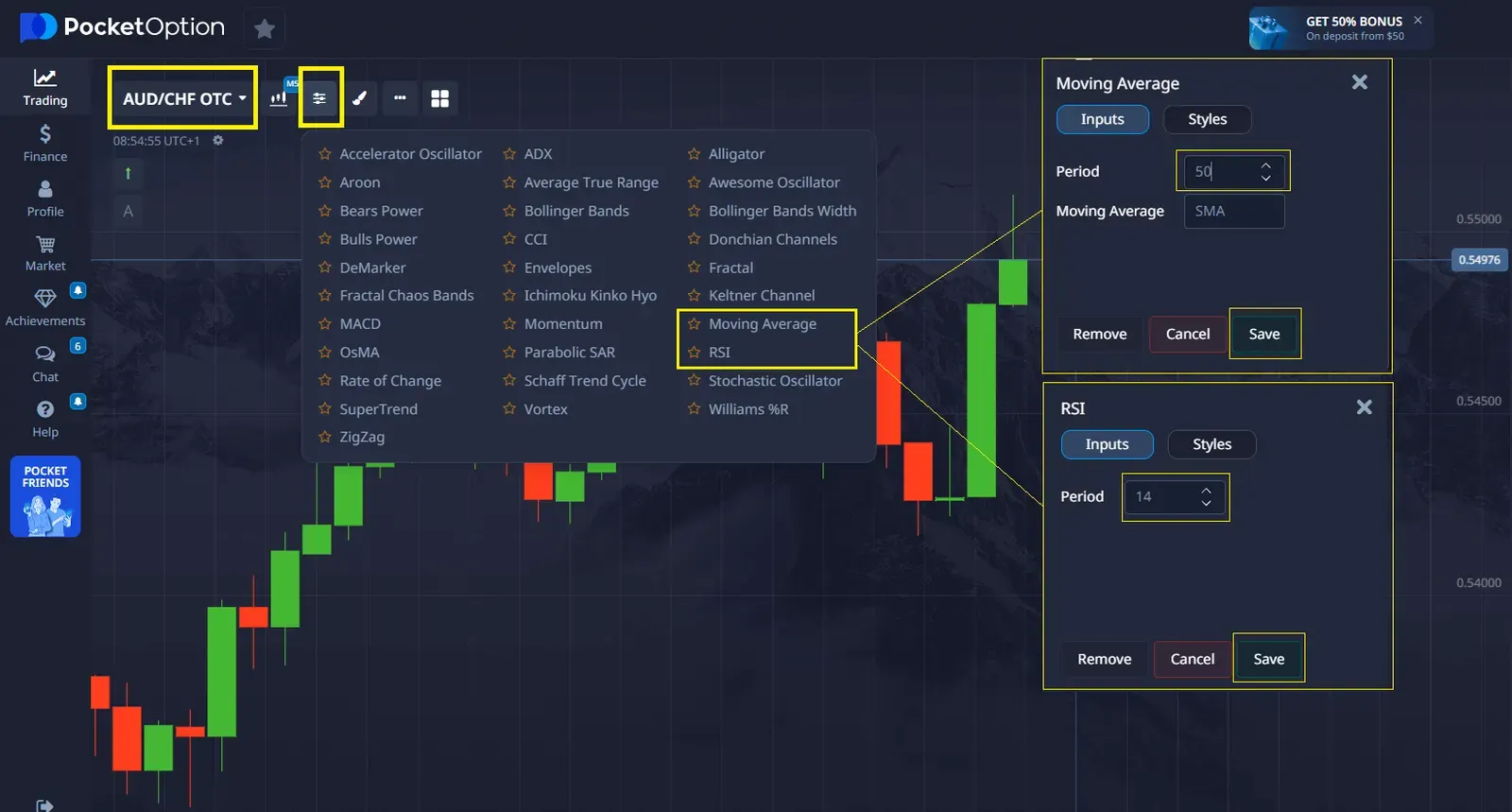

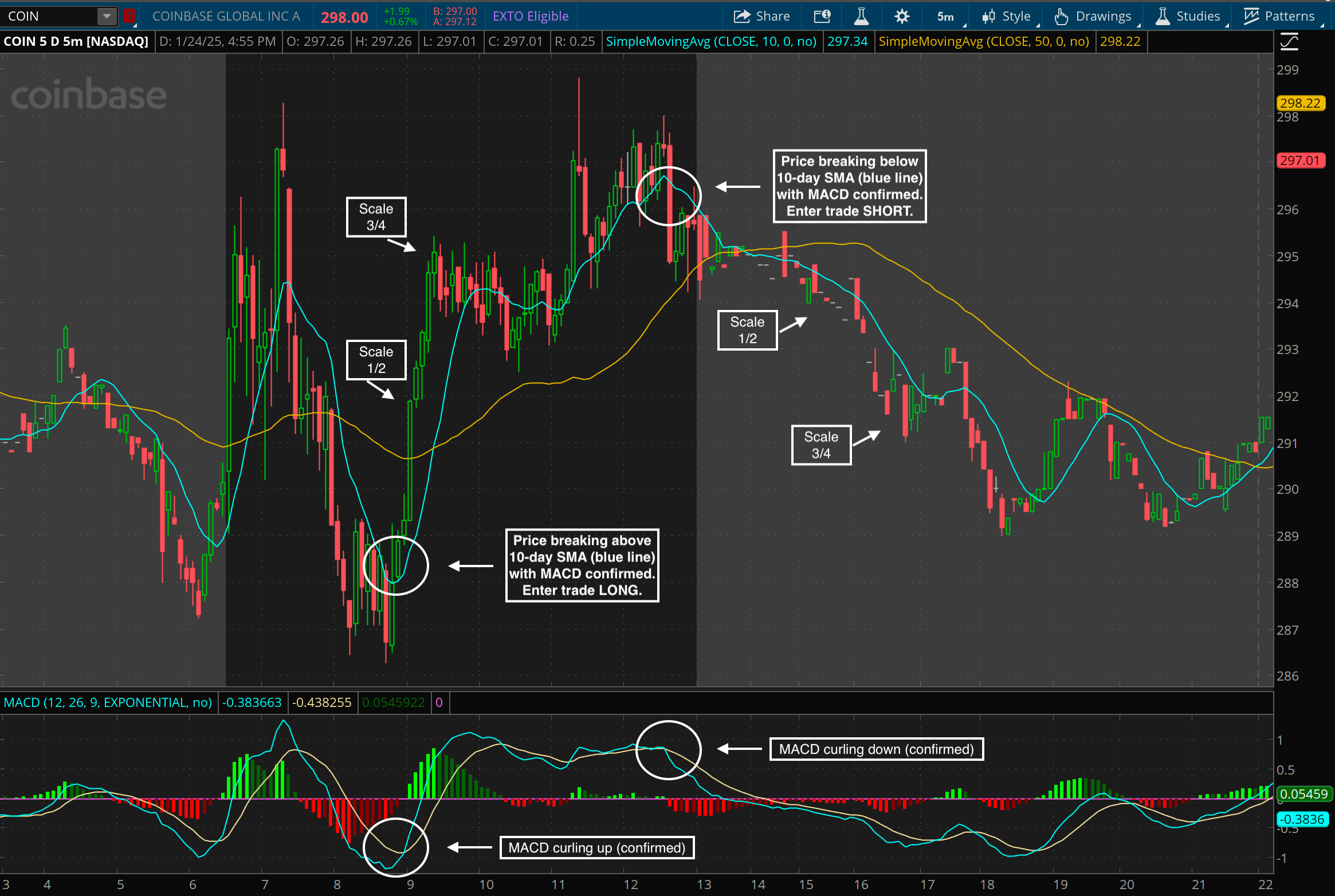

- Seek confirmation: Use candlestick reversal patterns (like bullish engulfing in uptrends) or secondary indicators such as RSI or EMA for added conviction (see comparison with EMA/RSI).

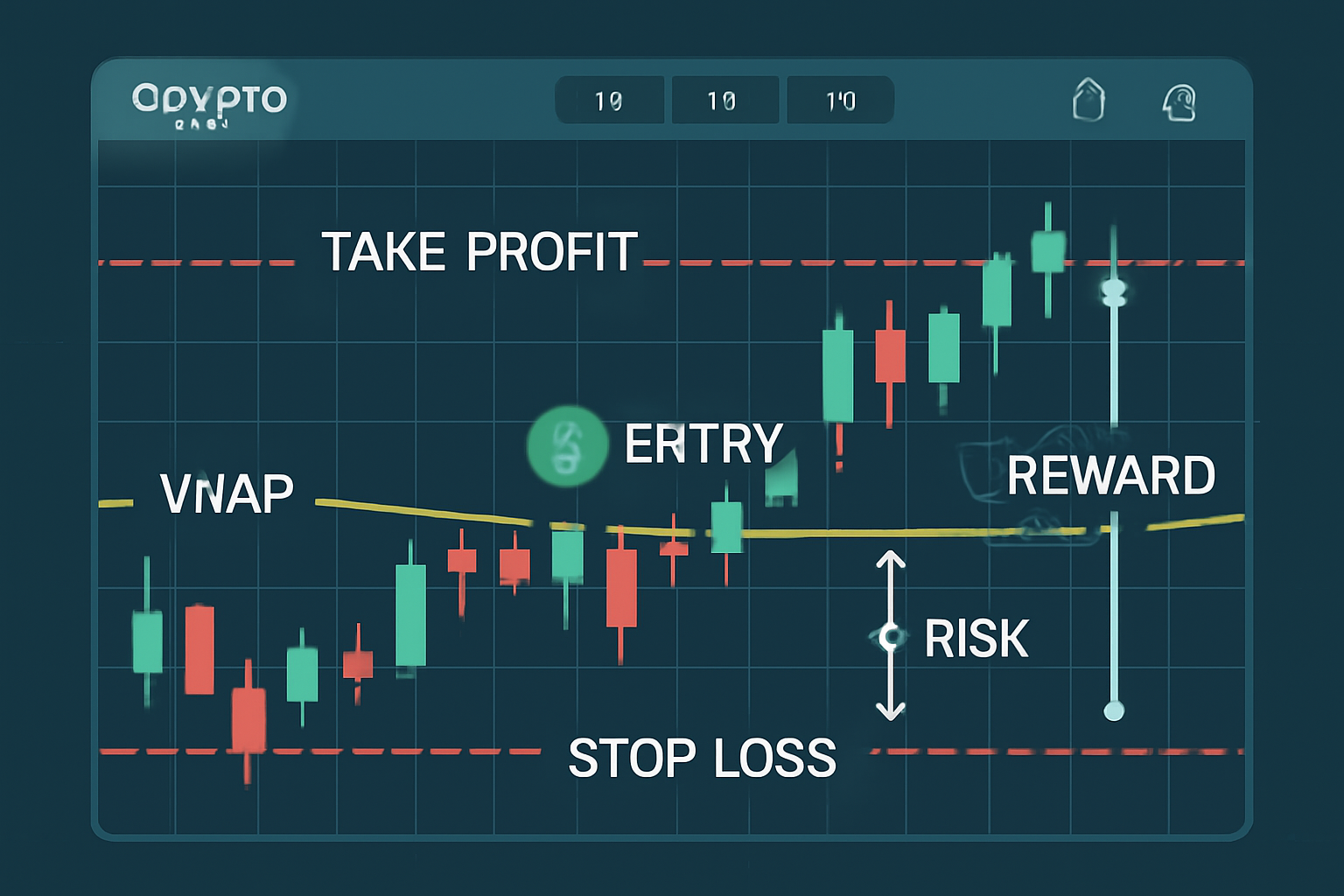

- Execute with risk controls: Enter only when all signals align, set stop-loss just beyond the recent swing low/high, and define profit targets based on prior support/resistance.

Enhancing VWAP Pullbacks with Volume Profile and Anchored VWAP

To further refine your VWAP pullback strategy, consider integrating complementary tools:

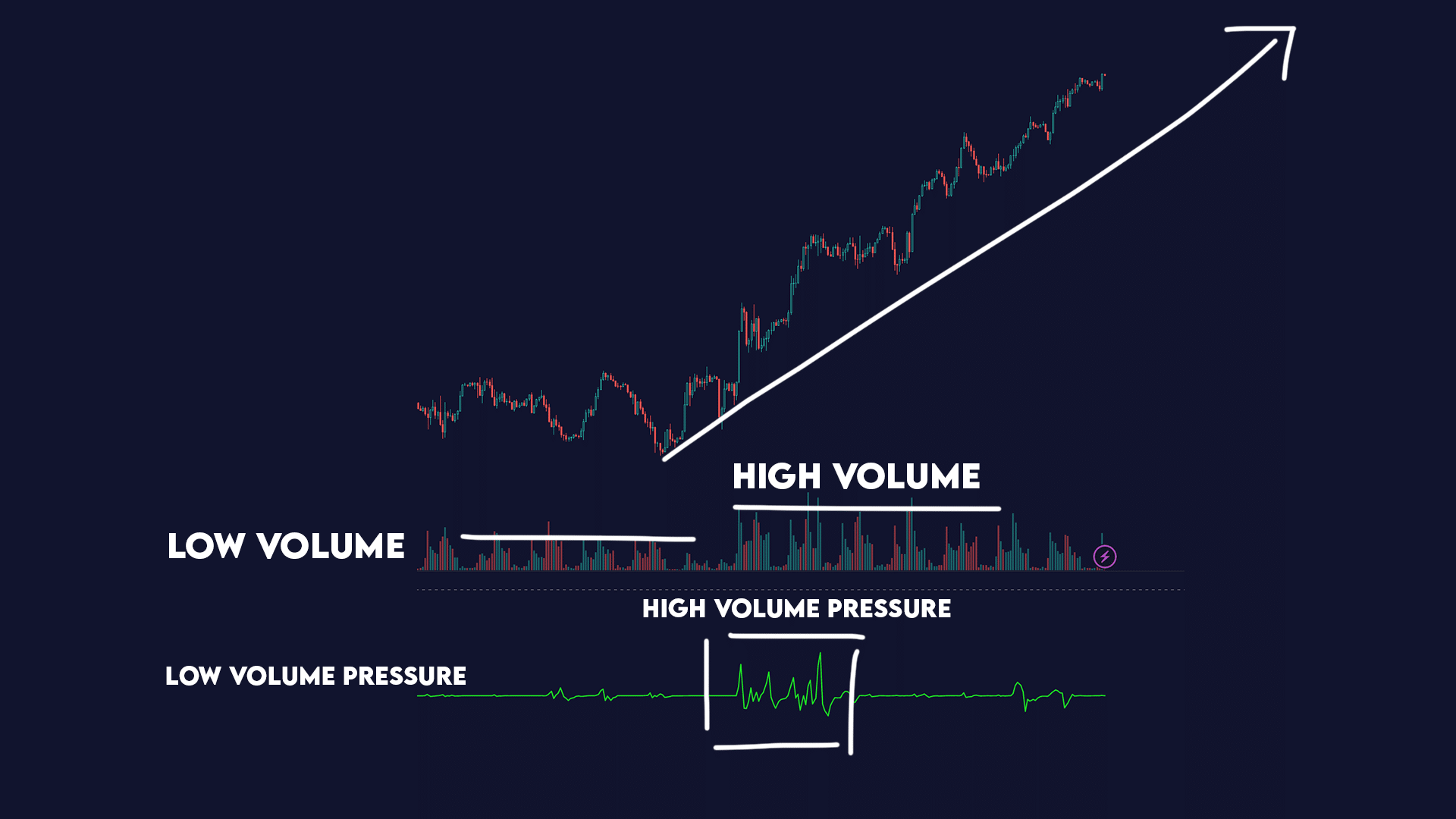

- Volume Profile: Overlaying Volume Profile can highlight high-volume nodes near VWAP, increasing the probability of a successful bounce. For detailed tactics, check out this VWAP and Volume Profile guide.

- Anchored VWAP: Anchoring the VWAP to significant events, such as the start of a major breakout or news release, enables more tailored trade setups. This is particularly useful in crypto, where news-driven volatility is common. For practical application, see using Anchored VWAP for day trading.

Key Benefits of VWAP Pullback Strategies in Crypto Trading

-

Improved Trade Entries: VWAP pullback strategies help traders identify optimal entry points by buying near dynamic support or selling near resistance, reducing the risk of chasing prices during volatile crypto sessions.

-

Objective Benchmarking: VWAP provides a volume-weighted average price, serving as an impartial reference for fair value and helping traders avoid emotional decisions based on short-term price swings.

-

Enhanced Trend Confirmation: By combining VWAP with price action, traders can confirm prevailing trends (bullish above VWAP, bearish below), increasing the probability of successful trades.

-

Effective Risk Management: VWAP pullback strategies facilitate precise stop-loss placement just beyond recent swing highs/lows, enabling disciplined risk control and position sizing.

-

Synergy with Other Indicators: VWAP works seamlessly with tools like Volume Profile and Anchored VWAP, allowing traders to refine entries and exits based on high-volume nodes and significant events.

-

Adaptability Across Market Conditions: VWAP pullback strategies remain effective in both trending and ranging markets, providing versatility for crypto traders on major platforms like Binance and Coinbase.

VWAP pullback strategies are not just about technical precision; they also demand rigorous risk management and psychological discipline. Overtrading or ignoring market context can erode gains quickly. In the next section, we’ll explore real-world examples, risk management frameworks, and advanced tactics for maximizing your edge with VWAP in the ever-evolving crypto landscape.

Real-World VWAP Pullback Examples in Crypto

Consider a scenario where Ethereum trades in a strong uptrend, consistently printing higher lows above the VWAP. The price retraces intraday, tapping the VWAP line as volume surges. Seasoned traders watch for a decisive bullish reversal candle at this level. If the price closes firmly above the VWAP, this confirmation can trigger a long entry, with stop-loss set just below the session’s swing low. The trade aims for a retest of the recent high, optimizing risk-reward by entering close to the volume-weighted average.

Conversely, during bearish phases, altcoins like Solana or Cardano may rally intraday toward the VWAP after a sharp sell-off. If the price stalls or prints a bearish engulfing candle at the VWAP, this can be a signal to initiate a short position, targeting a move back toward the session low. These setups allow traders to participate in the prevailing trend without chasing price extremes.

Risk Management: The Key to Longevity

Even the most robust VWAP pullback strategy requires disciplined risk management to weather crypto’s notorious volatility. Here are core principles:

Essential Risk Management Rules for VWAP Pullback Trading

-

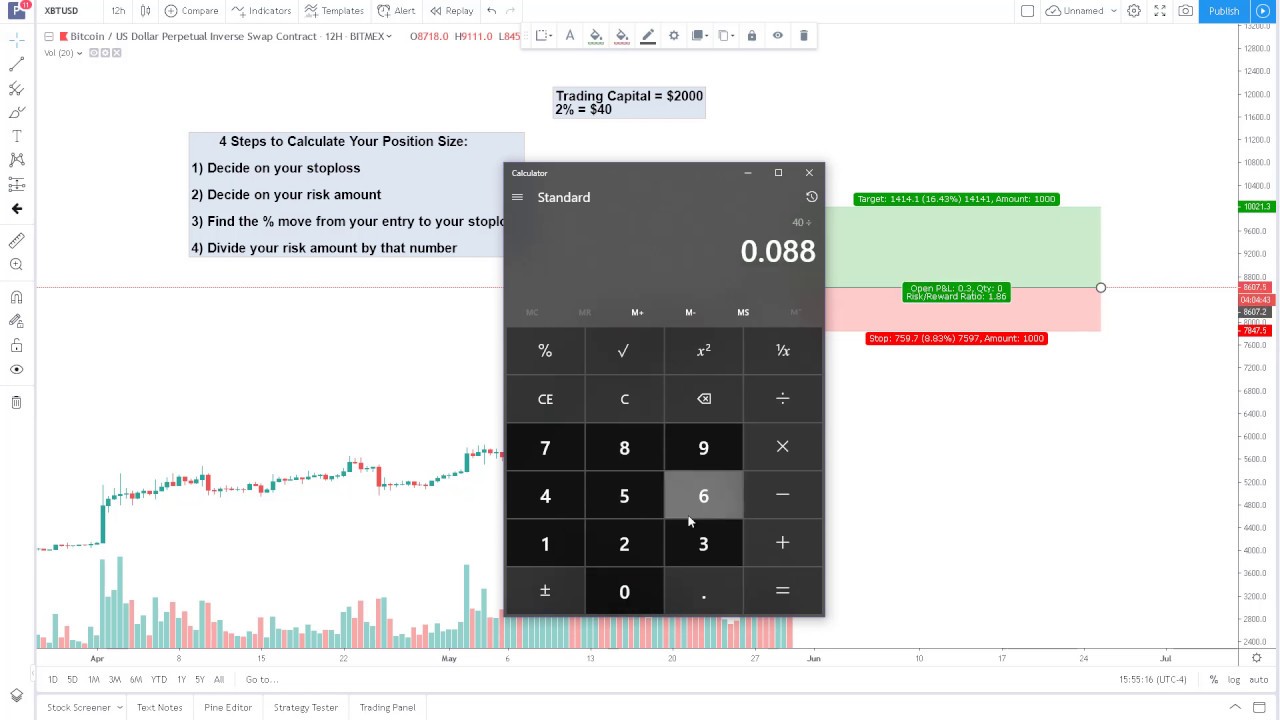

Use Strict Position Sizing: Limit each trade to a small percentage of your total capital (commonly 1-2%) to minimize losses from unexpected market moves.

-

Set Stop-Loss Orders: Always place stop-loss orders just beyond recent swing lows (for long trades) or swing highs (for shorts) to protect against large losses if the VWAP pullback fails.

-

Avoid Overtrading: Only take trades that meet all your VWAP pullback criteria. Overtrading increases exposure to market noise and can erode profits.

-

Monitor Market Conditions: Be cautious during low-volume or highly volatile periods, as VWAP signals may become unreliable. Confirm liquidity and market stability before entering trades.

-

Define Clear Take-Profit Targets: Set realistic profit targets based on prior support/resistance or a favorable risk-reward ratio to lock in gains and avoid emotional decision-making.

-

Review and Adjust Strategies Regularly: Analyze your trade outcomes and adapt your VWAP pullback approach as market conditions evolve to maintain consistent performance.

Always size positions so that a single loss does not exceed your predetermined risk threshold, commonly 1-2% of trading capital. Use trailing stops or adjust take-profit levels as the trade moves in your favor. Avoid trading during periods of erratic volume or when major economic data is due, as VWAP signals can become unreliable.

Advanced Tactics for Consistent VWAP Profits

To further stack the odds in your favor, consider layering in advanced tactics:

- Multiple Timeframe Analysis: Confirm VWAP setups on both intraday and higher timeframes. For example, a 15-minute VWAP pullback that aligns with a 1-hour uptrend increases conviction.

- Combining with Order Flow: Monitor real-time order book imbalances or large trades near VWAP to gauge institutional activity.

- Session Awareness: Recognize when VWAP resets (e. g. , at UTC midnight in crypto), as new sessions can bring fresh liquidity and invalidate previous levels.

Common Pitfalls and How to Avoid Them

Many traders stumble by treating every touch of the VWAP as a trade signal. Patience is critical, wait for confirmation from price action and supporting indicators. Overtrading, especially in choppy or low-volume environments, can quickly erode gains. Keep a trade journal to review setups, outcomes, and emotional responses, continuously refining your approach.

Is VWAP Pullback Strategy Right for You?

The VWAP pullback strategy crypto approach is particularly well-suited for active traders who thrive on intraday volatility and prefer clear, rule-based setups. It offers a systematic way to participate in trends without chasing breakouts or fading moves prematurely. However, like any strategy, it is not foolproof, success hinges on risk management, adaptability, and continuous learning.

As crypto markets evolve and liquidity deepens, VWAP-based tactics will remain a mainstay for professionals and serious retail traders alike. By mastering these techniques and maintaining discipline, you can position yourself for more consistent results, even in the face of crypto’s wild price swings.