Ready to dominate the crypto markets in 2025? Building a profitable crypto trading system isn’t about luck or guesswork. It’s about speed, structure, and relentless execution. The digital asset landscape is evolving at breakneck pace, with Bitcoin (BTC) now sitting at $87,417.00, Ethereum (ETH) at $2,856.21, and Cardano (ADA) at $0.416384. Market volatility is your opportunity, if you have a system that’s built to capture it.

Step 1: Define Clear Investment Goals and Risk Parameters

Your first move? Get laser-focused on your objectives and risk appetite. Are you chasing aggressive short-term gains or aiming for steady long-term growth? The answer will drive every other decision in your system. In 2025’s climate, with regulatory winds shifting (the SEC is easing up on registration requirements for some crypto firms), opportunity is everywhere, but so is risk.

Set specific targets: annual IRR, drawdown limits, position sizes. Only trade what you can afford to lose; this isn’t just a catchphrase, it’s survival. Establish stop-loss rules and stick to them with ruthless discipline.

Step 2: Select a Diversified Portfolio Using Narrative-Driven Analysis

Forget the old “just buy Bitcoin” mantra. In today’s market, diversification isn’t optional, it’s mission-critical. But don’t just scatter capital across random coins; use narrative-driven analysis. That means targeting assets aligned with powerful market stories: AI-powered DeFi platforms, regulatory breakthroughs (like Nasdaq’s push for tokenized securities), or projects leading the charge in compliance and transparency.

Diversification smooths out volatility shocks and positions you for asymmetric upside as narratives shift throughout the year. Review sector correlations regularly, what worked last quarter might be dead weight tomorrow.

Step 3: Integrate AI-Powered Trading Tools for Market Insights and Automation

If you’re not leveraging AI in 2025, you’re trading blindfolded while everyone else has night vision goggles. From Nansen AI’s new trading chatbot to proprietary algorithmic systems that scan order books and social sentiment in milliseconds, AI tools are now table stakes for any serious trader.

Deploy bots to handle routine trades based on pre-set signals; use advanced analytics platforms to spot emerging trends before they hit mainstream news feeds. Automation slashes emotional bias out of your process and lets you act on data at machine speed, not human hesitation.

Bitcoin (BTC) Price Prediction 2026-2031

Professional forecast based on current market data as of November 24, 2025. All prices in USD.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg vs. Prev Year) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $68,000 | $92,500 | $120,000 | +5.8% | Continued institutional adoption, moderate bull trend |

| 2027 | $75,000 | $105,000 | $145,000 | +13.5% | ETF expansion, further regulatory clarity, tech upgrades |

| 2028 | $82,000 | $119,000 | $170,000 | +13.3% | Increased integration with traditional finance, global macro tailwinds |

| 2029 | $90,000 | $135,000 | $200,000 | +13.4% | Potential supply squeeze post-halving, mainstream investment vehicles |

| 2030 | $98,000 | $150,000 | $230,000 | +11.1% | Broad retail adoption, tokenized assets boom |

| 2031 | $105,000 | $162,000 | $260,000 | +8.0% | Mature market, strong competition, BTC as digital reserve asset |

Price Prediction Summary

Bitcoin is projected to maintain a bullish trend over the next six years, driven by expanding institutional interest, regulatory clarity, and technological advancements. While volatility will remain, the average BTC price could rise from $92,500 in 2026 to $162,000 by 2031, with potential spikes to $260,000 in highly bullish scenarios. Minimum price predictions account for possible market corrections and macroeconomic headwinds.

Key Factors Affecting Bitcoin Price

- Evolving global regulatory landscape (e.g., SEC & CFTC policy shifts)

- Institutional adoption and spot ETF growth

- Integration of AI and advanced trading systems

- Macro-economic factors (inflation, global liquidity, fiat currency trends)

- Bitcoin halving cycles and supply constraints

- Competition from other digital assets and tokenized securities

- Adoption as a reserve and settlement asset by corporations and governments

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Playbook So Far: Aggressive Structure Meets Adaptive Execution

This is just the start of your long-term crypto trading playbook. With clear goals set and a diversified portfolio built on narrative conviction, not hype, you’re already ahead of most retail traders chasing pumps on social media. Next up: perfecting your entry/exit strategy with rigorous backtesting and ongoing optimization as markets morph around you.

Step 4: Develop and Backtest a Robust Entry/Exit and Risk Management Strategy

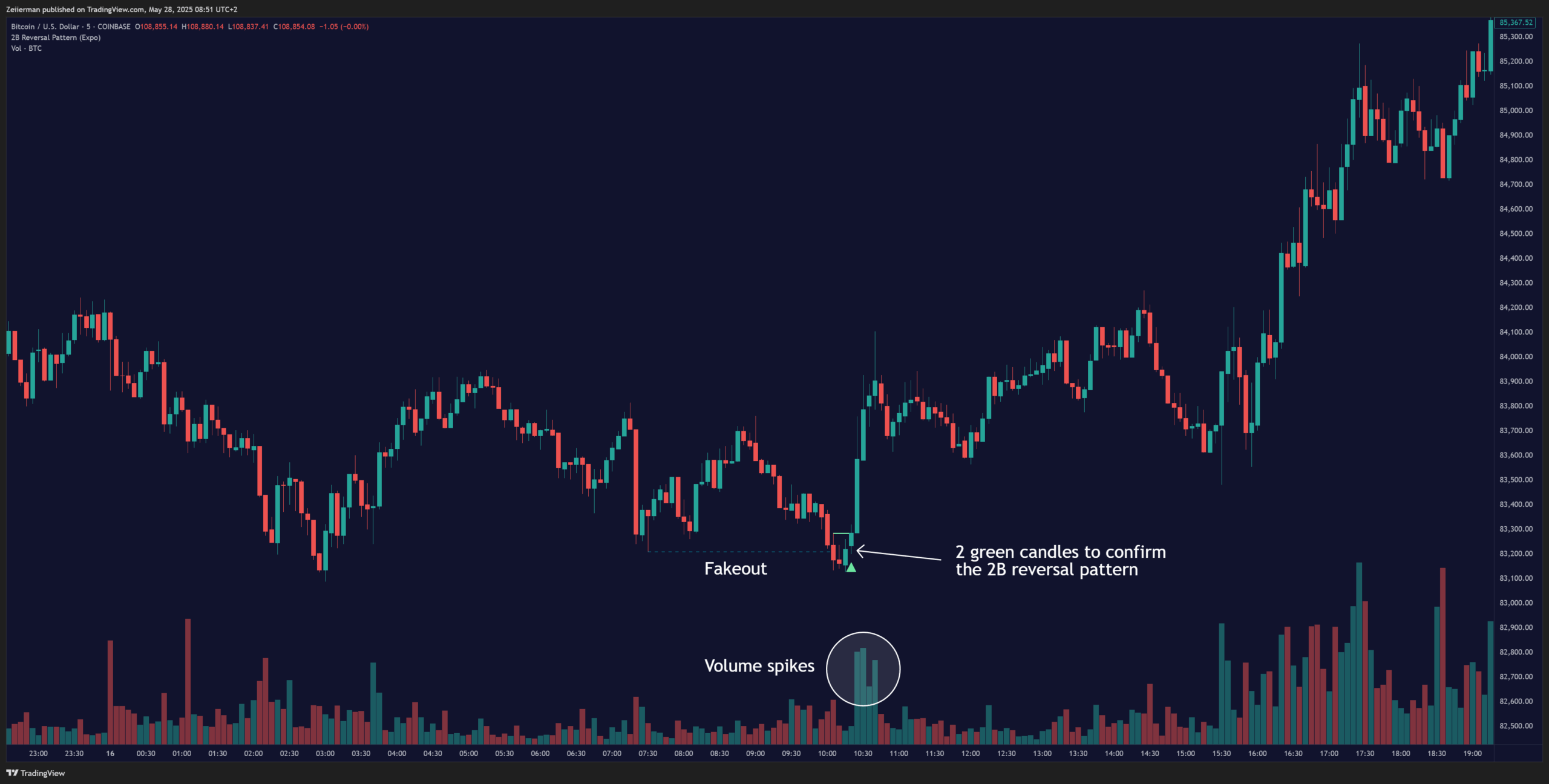

This is where your system goes from theory to real-world performance. Every profitable crypto trading system in 2025 is built on a foundation of rules: when to enter, when to exit, and how much to risk on every single trade. The market doesn’t care about your opinions or emotions, it rewards discipline, data, and speed.

Start by defining technical triggers for entries and exits. Maybe you’re using a blend of momentum indicators (like RSI or MACD), volume surges, or order book imbalances. Then backtest these signals against historical data, if your setup can’t survive 2023-2025’s wild swings, it won’t last another six months. Backtesting exposes hidden weaknesses before they drain your capital in live markets.

But don’t stop at the technicals. Layer in position sizing rules, trailing stops, and maximum daily loss limits. These are your guardrails when volatility spikes, like we’ve seen with Bitcoin holding at $87,417.00 and Ethereum’s steady climb to $2,856.21. Smart risk management keeps you in the game long enough for your edge to pay off.

Step 5: Continuously Monitor, Optimize, and Adapt Your System to Evolving Market Conditions

The only constant in crypto is change. Regulatory shifts (like the CFTC allowing spot crypto asset contracts on futures exchanges), new AI-powered tools, and macroeconomic shocks can all flip the script overnight. That’s why ongoing optimization isn’t optional, it’s mission critical.

Review your performance weekly: Are you hitting your IRR targets? Did a new narrative emerge that should change your portfolio allocation? Are your AI bots still outperforming manual trades? Use detailed trade journals and analytics dashboards to spot patterns fast.

If something isn’t working, tweak it without mercy. Rotate out underperforming assets; test fresh strategies as new opportunities arise (think tokenized securities or sectors benefiting from regulatory clarity). The best traders adapt faster than the market itself.

What is your biggest challenge when optimizing your crypto trading system for 2025?

As the crypto market evolves—with Bitcoin at $87,417 and new AI-powered tools emerging—traders face unique hurdles. Which step in building a profitable trading system do you find most challenging?

The Roadmap Recap: Build Your Edge for Profitable Crypto Trading in 2025

- Define Clear Investment Goals and Risk Parameters: Set targets, know your max risk per trade.

- Select a Diversified Portfolio Using Narrative-Driven Analysis: Ride emerging stories, not just price charts.

- Integrate AI-Powered Trading Tools: Automate insights and execution for speed that humans can’t match.

- Develop and Backtest Entry/Exit and Risk Strategies: Test until you break it; only deploy what survives real volatility.

- Continuously Monitor and Optimize: Evolve with the market or get left behind.

This is how you maximize IRR with a crypto trading system built for 2025: structure plus relentless adaptation equals profit potential most traders only dream about. Remember, speed wins, but precision keeps you alive long enough to cash out big when opportunity strikes!