Trading low cap altcoins in 2025 is not for the faint of heart. The volatility is relentless, liquidity can dry up in seconds, and narratives shift with every new protocol upgrade or regulatory headline. Yet, for those who approach this space with disciplined risk management, the upside remains unmatched. As institutional capital continues to flow into digital assets and retail traders hunt for the next breakout, understanding how to safeguard your capital is more critical than ever. Here are the top five risk management strategies tailored for low cap altcoin trading in this dynamic market.

1. Diversify Across Multiple Low Cap Altcoins and Narratives

Putting all your chips on a single microcap is a recipe for disaster. In 2025, diversification is your first line of defense. Spread your exposure across a basket of low cap altcoins that represent different narratives, think AI tokens, DePIN, RWA, and privacy coins. This approach reduces the impact of any single project failure or sector-wide downturn. For example, if a regulatory crackdown hits privacy coins, your allocation to DePIN or AI tokens can help buffer portfolio losses. A diversified allocation not only smooths your risk curve but also positions you to capture asymmetric upside from multiple emerging trends. For more on effective diversification in crypto, see this guide.

Top 5 Risk Management Strategies for Low Cap Altcoins 2025

-

Diversify Across Multiple Low Cap Altcoins and NarrativesReduce risk by spreading investments across several low cap altcoins and different market narratives (e.g., DeFi, AI, gaming). This limits exposure to any single project’s volatility and increases the chance of capturing sector-wide gains.

-

Implement Layered Stop-Loss Orders Based on Market StructureProtect your capital by setting multiple stop-loss levels (e.g., at −5%, −10%, −15%) according to support zones and market structure. This staged approach helps manage sudden downturns and avoids full liquidation on minor dips.

-

Set Strict Position Size Limits Relative to Portfolio ValueLimit each trade to a small percentage (typically 1–2%) of your total portfolio. This ensures that even a major loss on a single altcoin will not significantly impact your overall capital.

-

Automate Profit-Taking with Tiered Sell TargetsUse automated sell orders to secure profits at predefined price levels (e.g., selling 30% at +20%, another 30% at +40%). This discipline locks in gains and reduces emotional decision-making.

-

Continuously Rebalance Portfolio in Response to Volatility and LiquidityRegularly review and adjust your portfolio to account for changing market conditions, volatility, and liquidity. Rebalancing helps maintain your desired risk profile and prevents overexposure to any single asset.

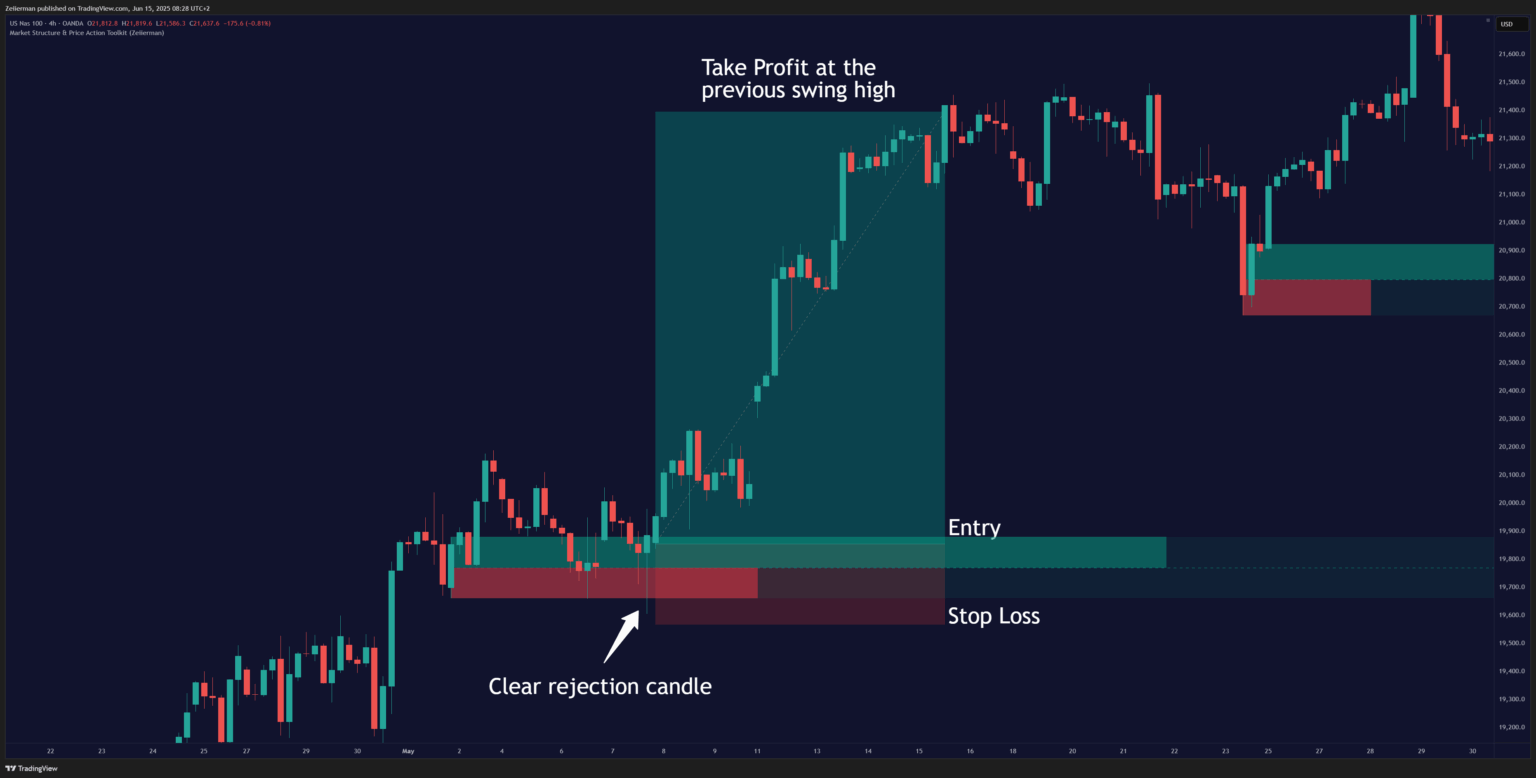

2. Implement Layered Stop-Loss Orders Based on Market Structure

Stop-losses are non-negotiable in the low cap universe, but a single static stop is rarely optimal. The best traders in 2025 are using layered stop-loss orders that align with key support levels and liquidity zones. For instance, you might exit 33% of your position if the price drops 5%, another 33% at a 10% drawdown, and the remainder at 15%. This staged approach helps you avoid getting wicked out by volatility while still protecting your downside. Layered stops also reduce emotional decision-making, allowing your plan, not panic, to dictate exits. For a practical breakdown on layered stop techniques, check out this resource.

3. Set Strict Position Size Limits Relative to Portfolio Value

Low cap altcoins can move 30% in an hour, sometimes in both directions. That’s why position sizing is the backbone of risk management in this sector. The rule of thumb for 2025: never risk more than 1-2% of your total portfolio value on any single trade. For a $10,000 portfolio, that means each low cap position should risk no more than $100-$200. This discipline ensures that a string of losses, inevitable in high-volatility markets, won’t decimate your capital. Smart traders also consider liquidity constraints: if an altcoin’s daily volume is thin, size down even further to avoid slippage and forced liquidation. Position sizing is not just about math; it’s about survival.

Why These Strategies Matter in Today’s Market

The current low cap landscape is shaped by rapid innovation and equally rapid cycles of hype and fear. With Bitcoin holding above $100,000 and top altcoins regularly making double-digit moves, low caps are more tempting, and dangerous, than ever. Each of these strategies serves a singular purpose: keep you in the game long enough to catch the next big move without blowing up your account.

4. Automate Profit-Taking with Tiered Sell Targets

In 2025’s altcoin market, letting profits run unchecked is just as risky as letting losses spiral. The solution is automated, tiered profit-taking. Set incremental sell targets, say, 25% at and 30%, 25% at and 60%, and the remainder at and 100%: to lock in gains as your chosen low cap coins rally. This approach removes emotion, helps you avoid round-tripping profits, and ensures you capitalize on sudden price spikes that often reverse in thinly traded markets. Automation is crucial: use exchange tools or trading bots to execute these sells, so you’re not caught second-guessing during market turbulence.

Tiered profit-taking is particularly effective in low liquidity environments, where large orders can move the market against you. By scaling out gradually, you reduce your footprint and minimize slippage. For more on structured profit-taking, refer to this in-depth strategy guide.

5. Continuously Rebalance Portfolio in Response to Volatility and Liquidity

Markets don’t stand still, and neither should your portfolio. Continuous rebalancing: adjusting your allocations in response to changing volatility and liquidity, is non-negotiable for low cap altcoin traders in 2025. When a coin pumps and becomes an outsized portion of your holdings, trim it back to your target allocation. If liquidity dries up or volatility spikes, reduce exposure to avoid being trapped. This dynamic approach ensures your risk profile stays aligned with your strategy and market conditions, not with yesterday’s winners.

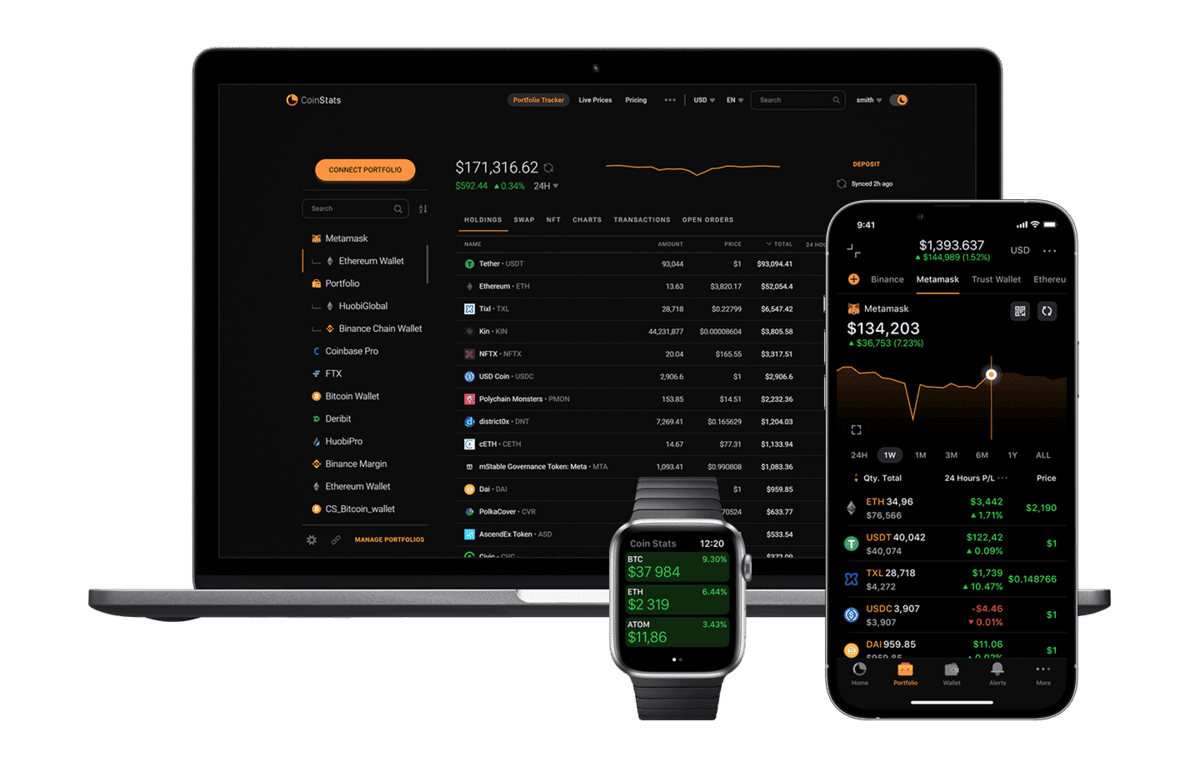

Smart rebalancing also means staying vigilant on new narratives and sector rotations. If a particular narrative, like AI or DePIN, starts to fade, reallocate into emerging sectors showing fresh momentum. Use portfolio management dashboards to track allocations in real time and set alerts for when positions drift outside your risk parameters.

Summary Table: Top 5 Risk Management Strategies for Low Cap Altcoins in 2025

Top 5 Risk Management Strategies for Trading Low Cap Altcoins in 2025

| Strategy (with Icon) | Core Benefit | Actionable Tip |

|---|---|---|

| 🧺 Diversify Across Multiple Low Cap Altcoins and Narratives | Reduces risk from any single asset’s volatility or failure. | Allocate your capital across several projects in different sectors to spread risk. |

| 🛑 Implement Layered Stop-Loss Orders Based on Market Structure | Limits losses by triggering automatic exits at predefined levels. | Set staggered stop-losses (e.g., exit 33% at -5%, 33% at -10%, rest at -15%) to manage downside risk. |

| 📏 Set Strict Position Size Limits Relative to Portfolio Value | Prevents overexposure to any single trade or asset. | Risk no more than 1-2% of your total portfolio on a single trade. |

| 🎯 Automate Profit-Taking with Tiered Sell Targets | Secures gains and removes emotion from selling decisions. | Predefine multiple take-profit levels and set sell orders accordingly. |

| 🔄 Continuously Rebalance Portfolio in Response to Volatility and Liquidity | Maintains optimal risk-reward by adapting to changing market conditions. | Review and adjust your allocations regularly based on market movements and liquidity. |

Trading low cap altcoins is a game of survival and asymmetric opportunity. By diversifying across narratives, layering your stops, sizing positions with discipline, automating profit-taking, and rebalancing in response to volatility, you put the odds back in your favor. Remember: risk management isn’t just about avoiding losses, it’s about staying solvent long enough to catch exponential wins. Adapt, overcome, and profit.