The world of crypto stock trading in 2024 is more dynamic than ever, blending the volatility and innovation of digital assets with the structure and familiarity of traditional equities. For beginners, this hybrid market offers both unique opportunities and new risks. Whether you’re looking to diversify your portfolio or capitalize on emerging trends, understanding how to trade crypto stocks is essential for navigating today’s financial landscape.

1. Educate Yourself on Crypto Stocks and Market Fundamentals

Before you make your first trade, it’s crucial to understand what crypto stocks are and how they operate within the broader financial system. Crypto stocks typically refer to shares in companies deeply involved in blockchain technology or digital assets – think exchanges, mining firms, or fintech innovators bridging traditional finance with decentralized platforms.

Unlike direct cryptocurrency trading, investing in crypto stocks exposes you to both the performance of the underlying company and the volatility of the digital asset sector. Spend time learning about:

- The basics of blockchain technology

- How crypto markets differ from traditional equity markets

- Key drivers behind price movements in both sectors

Reliable sources such as Coursera’s beginner guides or IG’s step-by-step walkthroughs can provide foundational knowledge before you risk any capital.

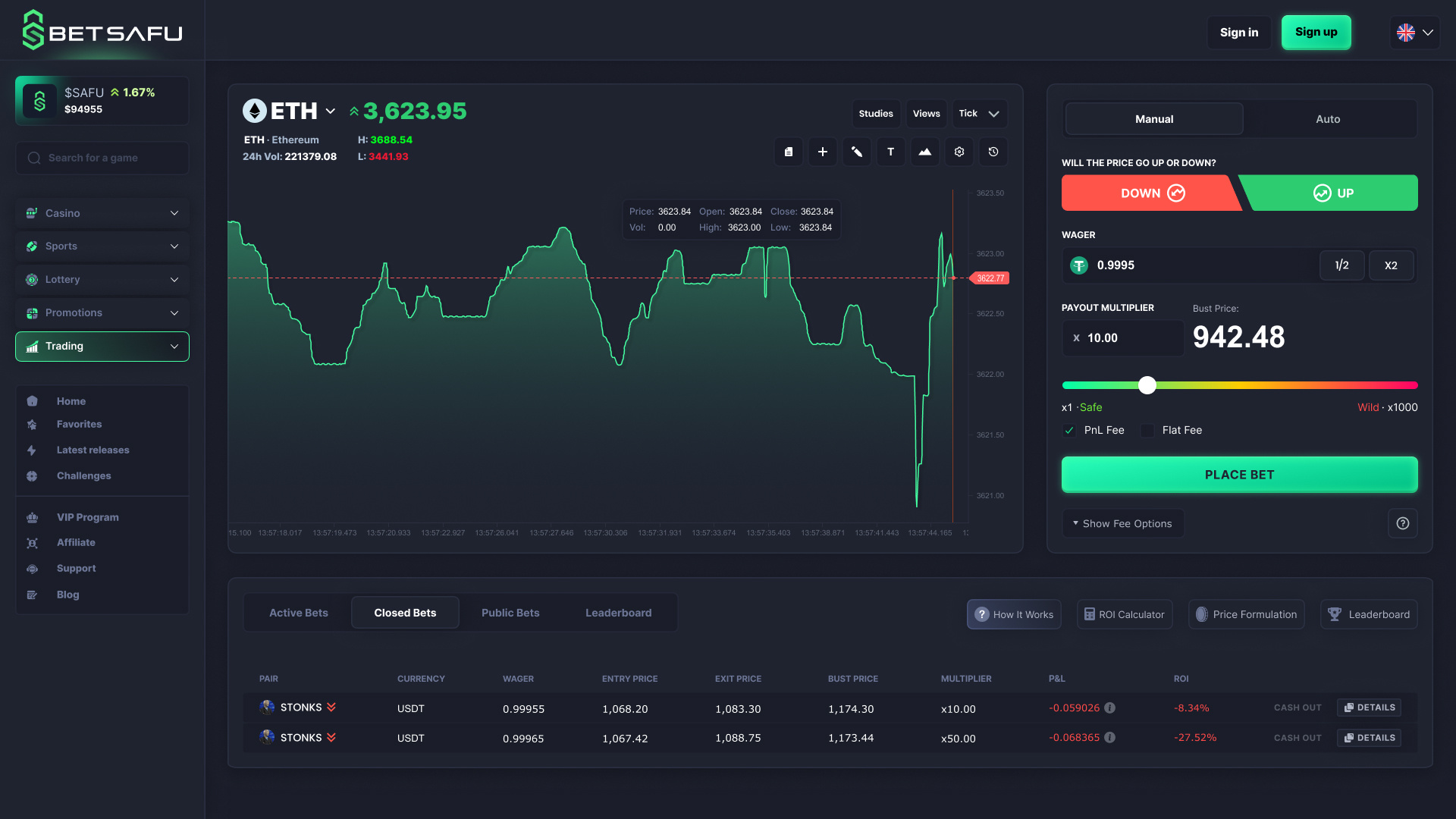

2. Choose a Reputable Crypto-Friendly Brokerage or Exchange

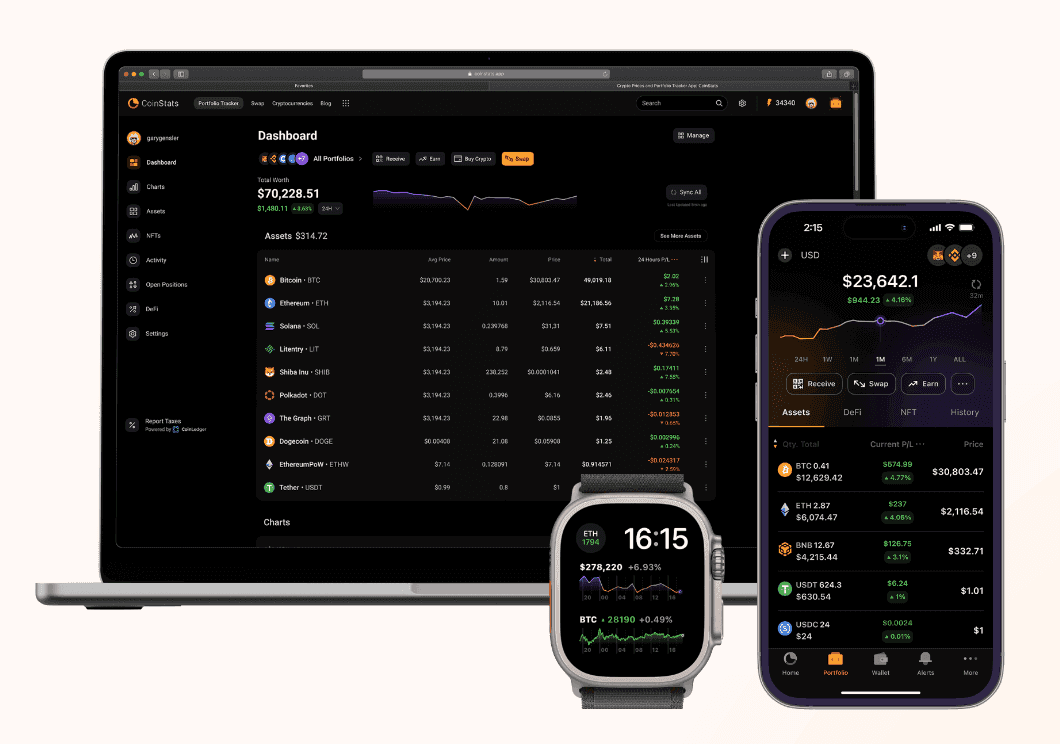

Your choice of platform will directly impact your trading experience, access to markets, fees, and even security. Not all brokerages offer exposure to both equities and cryptocurrencies; some specialize in one or the other. In 2024, look for hybrid platforms that allow seamless trading between traditional stocks and digital assets under one roof.

Key factors when evaluating a brokerage or exchange include:

- Regulatory compliance: Ensure your platform is licensed in your jurisdiction.

- User experience and support: Intuitive interfaces are invaluable for beginners.

- Diversity of offerings: Access to major crypto stocks as well as blue-chip cryptocurrencies is ideal.

- Security features: Two-factor authentication (2FA), cold storage options, insurance policies.

You can find more detailed comparisons on reputable financial education sites such as Bankrate’s guide for beginners.

Top Features to Seek in a Crypto-Friendly Brokerage

-

Educate Yourself on Crypto Stocks and Market FundamentalsBefore investing, build a solid foundation by learning about crypto stocks, blockchain technology, and how the crypto market operates. Explore resources from platforms like Coursera, IG, and Gemini Cryptopedia to understand key concepts and risks.

-

Choose a Reputable Crypto-Friendly Brokerage or ExchangeSelect a platform known for its security, regulatory compliance, and user-friendly interface. Leading options in 2024 include Coinbase, Kraken, and Binance. Ensure your chosen brokerage offers robust account protections and a transparent fee structure.

-

Develop a Trading Plan with Risk Management StrategiesCraft a clear trading plan outlining your investment goals, risk tolerance, and preferred assets. Utilize features like stop-loss orders and portfolio diversification to manage risk. Many brokerages offer demo accounts for practice—take advantage of these to refine your approach.

-

Start Trading with Small Positions and Monitor Market TrendsBegin with small trades to minimize risk as you gain experience. Use real-time data and charting tools available on platforms like TradingView to track market trends and price movements. Stay updated with news from reputable sources such as CoinDesk.

-

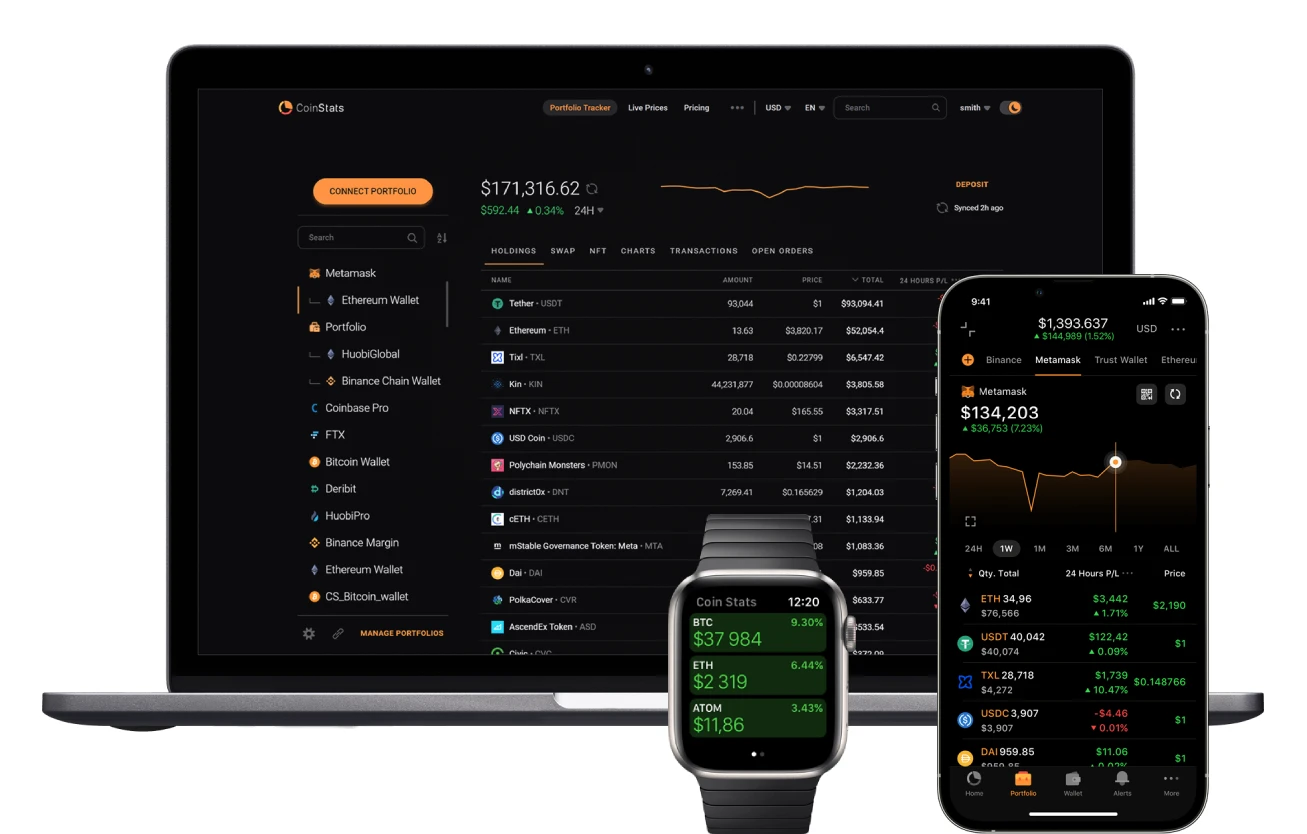

Review and Adjust Your Portfolio Based on Performance and NewsRegularly analyze your portfolio to assess performance and rebalance as needed. Stay informed about market news, regulatory updates, and emerging trends to make data-driven decisions. Use portfolio tracking tools like CoinTracker for ongoing optimization.

3. Develop a Trading Plan with Risk Management Strategies

No matter how bullish you feel about a particular asset or sector, entering trades without a plan is a recipe for losses. A solid trading plan should outline your investment goals (growth vs income), preferred timeframes (day trading vs long-term holding), entry/exit criteria, and – most importantly – risk management protocols.

Risk management strategies are non-negotiable in volatile markets like crypto stocks:

- Diversification: Don’t put all your capital into one stock or coin.

- Position sizing: Start small – especially when testing new strategies or assets.

- Stop-loss orders: Set clear thresholds where you’ll exit losing trades automatically.

- Capping leverage: Use leverage sparingly until you gain more experience; high leverage magnifies both gains and losses.

Your plan should be documented clearly so that emotions don’t dictate your decisions during periods of high market volatility – something that remains common even as institutional adoption grows in late 2025.

4. Start Trading with Small Positions and Monitor Market Trends

With your foundational knowledge in place and a solid trading plan ready, it’s time to take your first steps into live markets. The best approach for beginners is to start small. Allocate only a modest portion of your capital to initial trades, this not only limits potential losses but also allows you to learn from real-time market behavior without risking your overall financial health.

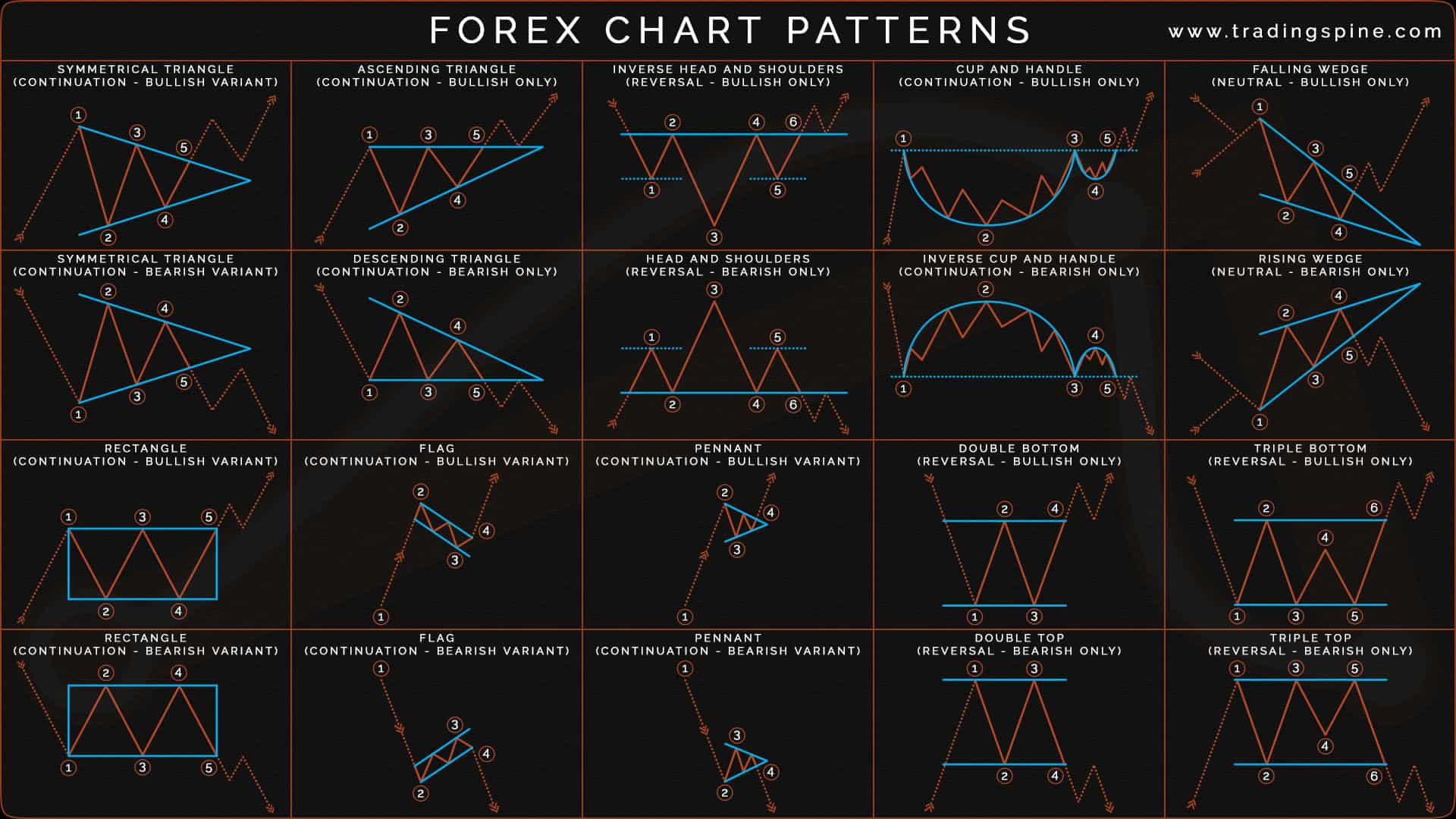

As you execute your first trades, pay close attention to:

- Order types: Practice using limit orders, market orders, and stop-losses so you can act decisively when volatility spikes.

- Market sentiment: Track news cycles, regulatory developments, and major company announcements. Crypto stock prices can swing dramatically on headlines alone.

- Technical indicators: Even basic tools like moving averages or RSI (Relative Strength Index) can help you spot trends or reversals.

This phase is about observation and adaptation. Don’t be afraid to stay on the sidelines if conditions are unclear, sometimes the best trade is no trade at all. Remember: the goal isn’t to get rich quick, but to build experience and confidence as a disciplined trader.

5. Review and Adjust Your Portfolio Based on Performance and News

The final step in mastering how to trade crypto stocks is ongoing: regularly review your portfolio. Successful traders treat their holdings as dynamic, not static, assets that must evolve with new information. Set aside time weekly or monthly to assess performance against your goals. Are certain crypto stocks consistently outperforming others? Has breaking news altered the outlook for a sector or company?

Your review process should include:

- Performance analysis: Compare each position’s returns against benchmarks like the S and P 500 or leading cryptocurrencies.

- Rebalancing: Trim winners if they’ve grown outsized; cut losers if fundamentals have shifted.

- Staying informed: Subscribe to reputable news sources and follow regulatory updates that could impact both stocks and digital assets.

This discipline helps you avoid emotional decision-making while keeping your strategy aligned with real-world developments, a crucial edge in today’s fast-moving markets.

Steps to Review & Optimize Your Crypto Stock Portfolio

-

Educate Yourself on Crypto Stocks and Market Fundamentals: Stay informed by following reputable sources like CoinDesk and Cointelegraph. Understanding key concepts such as blockchain technology, market volatility, and the influence of global news is crucial for making informed decisions.

-

Develop a Trading Plan with Risk Management Strategies: Set clear goals, determine your risk tolerance, and use tools like stop-loss orders to limit potential losses. Consider diversifying your portfolio across different crypto stocks and assets to manage risk effectively.

-

Start Trading with Small Positions and Monitor Market Trends: Begin with modest investments and gradually increase exposure as you gain confidence. Use real-time analytics from platforms like TradingView to track price movements and identify emerging trends.

-

Review and Adjust Your Portfolio Based on Performance and News: Regularly assess your holdings using tools like CoinTracker or Delta. Stay updated with the latest market news and regulatory changes to make timely adjustments for optimal performance.

Real-Time Price Monitoring Matters

Crypto stock trading thrives on up-to-the-minute data. Use real-time price widgets and alerts so you’re never caught off guard by sudden market moves. This is especially important during periods of high volatility or when major economic events are unfolding globally.

Community Insights: What Do New Traders Worry About Most?

What is your biggest concern when starting to trade crypto stocks in 2024?

As a beginner, there are several important steps to consider before trading crypto stocks. Which part of the process do you find most challenging or concerning?

Pro tip: Don’t just react, plan ahead. Set alerts for price levels that matter most to you, whether it’s securing profits or limiting losses. Automation is your friend as a new trader navigating an always-on market.