Every day, crypto markets churn with volatility, and smart traders know that where there’s chaos, there’s opportunity. One of the most effective tools in a day trader’s arsenal is the liquidity sweep strategy. It’s simple, actionable, and laser-focused on exploiting those sharp price moves that shake out weak hands and reward patient, tactical entries. Let’s break down exactly how this works with a step-by-step approach tailored for today’s fast-moving crypto landscape.

Spotting High-Probability Zones: Identify Key Liquidity Zones and Fair Value Gaps

The first step to mastering this crypto day trading strategy is learning to see what most traders miss: where liquidity pools are hiding. Large clusters of stop-loss orders often accumulate just above recent swing highs or below swing lows. These are your key liquidity zones, areas where price is likely to make a sudden move as big players hunt stops.

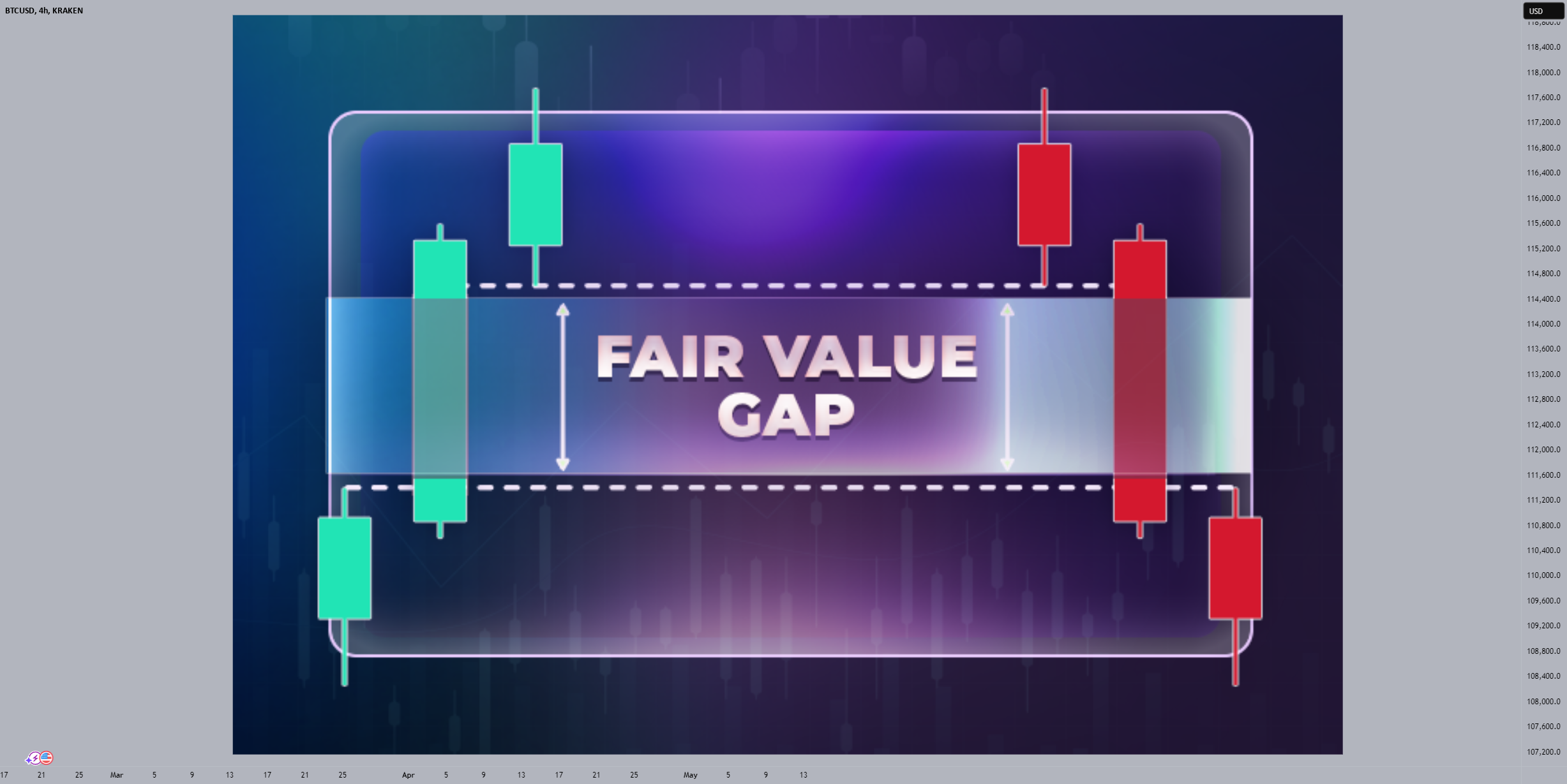

But don’t stop there. On higher time frames (think 1-hour or 4-hour charts), look for fair value gaps – price imbalances where candles move rapidly without much trading in between. These gaps often act like magnets, drawing price back for a retest. Mark these zones on your chart; they’re prime real estate for liquidity sweeps.

If Bitcoin just printed a swing high at $60,000 and left a fair value gap nearby, you’d highlight that level as a potential sweep target. This isn’t guesswork, it’s about stacking probabilities in your favor by focusing only on high-traffic areas where smart money lurks.

The Waiting Game: Wait for a Confirmed Liquidity Sweep and Price Reaction

This step separates disciplined traders from impulsive ones. Once you’ve mapped out your zones, resist the urge to jump in early. Instead, wait for the market to tip its hand with an actual liquidity sweep.

A classic sweep looks like this: Price surges into your marked zone (above $60,000 in our example), triggering stop-losses. You’ll often see a dramatic wick or spike as orders are filled en masse. But here’s the key, don’t enter yet! Watch for the immediate price reaction after the sweep.

You want to see rejection, maybe an engulfing candle or pin bar forming right at your level. That’s your signal that the sweep has run its course and momentum may reverse quickly. This patience pays off by filtering out false breakouts and keeping you aligned with institutional order flow.

Tactical Execution: Enter Trade with Tight Stop-Loss and Set Realistic Risk-Reward Targets

Once you spot confirmation of rejection after the sweep, it’s go time! Enter your trade in the opposite direction of the initial move (short if it swept above resistance and got slammed back down; long if it swept below support then bounced hard).

3 Essential Steps for a Simple Liquidity Sweep Strategy

-

Identify Key Liquidity Zones and Fair Value Gaps on Higher Time FramesStart by marking significant swing highs and lows on your chart—these are hotspots where stop-loss orders cluster, creating potential liquidity pools. Also, look for fair value gaps, which are price imbalances that often attract market moves. For example, if Bitcoin recently hit a high at $60,000, this level becomes a prime candidate for a liquidity sweep. Use higher time frames (like 4H or daily) to spot these zones for greater accuracy.

-

Wait for a Confirmed Liquidity Sweep and Price Reaction at Marked LevelsMonitor the market for a sharp move that breaches your marked levels—this is the liquidity sweep. Look for a quick spike with a long wick, signaling stop-losses being triggered. Confirmation comes when price quickly rejects the level, often with a strong engulfing candle or pin bar. Patience is key: don’t jump in until you see clear evidence of the sweep and reaction.

-

Enter Trade with Tight Stop-Loss and Set Realistic Risk-Reward TargetsOnce you spot a confirmed rejection, enter your trade in the opposite direction of the sweep. Place your stop-loss just beyond the extreme of the sweep to minimize risk, and set your take-profit at the next key support or resistance. Aim for a risk-reward ratio of at least 1:2 for consistent results, and always align your entry with the broader market trend for higher probability trades.

Your stop-loss should be placed just beyond the extreme point of the wick, tight enough to limit risk but wide enough to avoid getting picked off by noise. For take-profit targets, aim for logical levels like the next support/resistance or midpoint of the previous range. Aiming for at least a 1: 2 risk-to-reward ratio keeps your edge intact over time.

This disciplined approach not only protects capital but also positions you to ride those sharp reversals that leave less-prepared traders scratching their heads.

Remember, the real magic of the simple liquidity sweep strategy comes from combining sharp technical execution with robust crypto risk management. It’s not about catching every move, but about catching the right moves with discipline and confidence.

If you’re new to this approach, don’t hesitate to backtest it across different pairs and timeframes. Notice how liquidity sweeps often precede explosive reversals, especially at zones marked by fair value gaps or obvious stop clusters. The more you see these patterns play out, the more conviction you’ll have when it’s time to pull the trigger live.

Sharpen Your Edge: Why This Strategy Works in Crypto

The beauty of this method is its adaptability. Crypto markets are notorious for their volatility and frequent stop hunts. By focusing on identifying key liquidity zones and fair value gaps on higher time frames, then waiting for a confirmed sweep and price reaction, you’re essentially shadowing the smart money, those who move markets, not just follow them.

This isn’t just theory; it’s rooted in real order flow dynamics. When large players trigger a sweep, they create temporary imbalances that can be exploited by nimble day traders who know what to look for. By entering trades with a tight stop-loss and realistic targets, you keep your downside small while letting winners run when those sharp reversals unfold.

Checklist: Executing the Liquidity Sweep Strategy

Pro tip: Use volume spikes as extra confirmation during sweeps, if volume surges as price pierces your level and then sharply rejects, that’s usually institutional activity at work. And always keep an eye on overall trend direction from higher time frames; fighting momentum rarely ends well.

If you want to see this strategy in action or share your own setups, join our community discussions! There’s no substitute for real-time feedback and learning from others’ experiences in fast-moving markets.

Final Thoughts: Mastering Simplicity in Volatile Markets

At its core, the liquidity sweep trading strategy is about stacking probabilities, not chasing every candle but waiting for those high-probability setups where smart money leaves its mark. By rigorously following these steps:

- Identify key liquidity zones and fair value gaps on higher time frames

- Wait for a confirmed liquidity sweep and price reaction at marked levels

- Enter trade with tight stop-loss and set realistic risk-reward targets

You’ll find yourself trading with more confidence, less stress, and greater consistency, even as crypto prices whip around like wild stallions.

This approach isn’t just for pros; it’s accessible to anyone willing to slow down, plan ahead, and let the market come to them. So next time Bitcoin makes a dramatic move around $60,000 or another coin rips through a key level, don’t panic. Watch for that telltale sweep-and-reject pattern… then strike decisively!