Crypto markets are famous for their volatility and sudden price surges, but seasoned traders know that the real edge comes from mastering disciplined entry strategies. The pullback after breakout strategy in crypto trading is a proven approach to catch high-probability moves while sidestepping the common pitfall of chasing false breakouts. With Bitcoin (BTC) currently trading at $119,440 and Ethereum (ETH) at $4,397.37, both up over 2% intraday, opportunities for breakout and pullback setups abound across the market.

Understanding the Pullback After Breakout Play

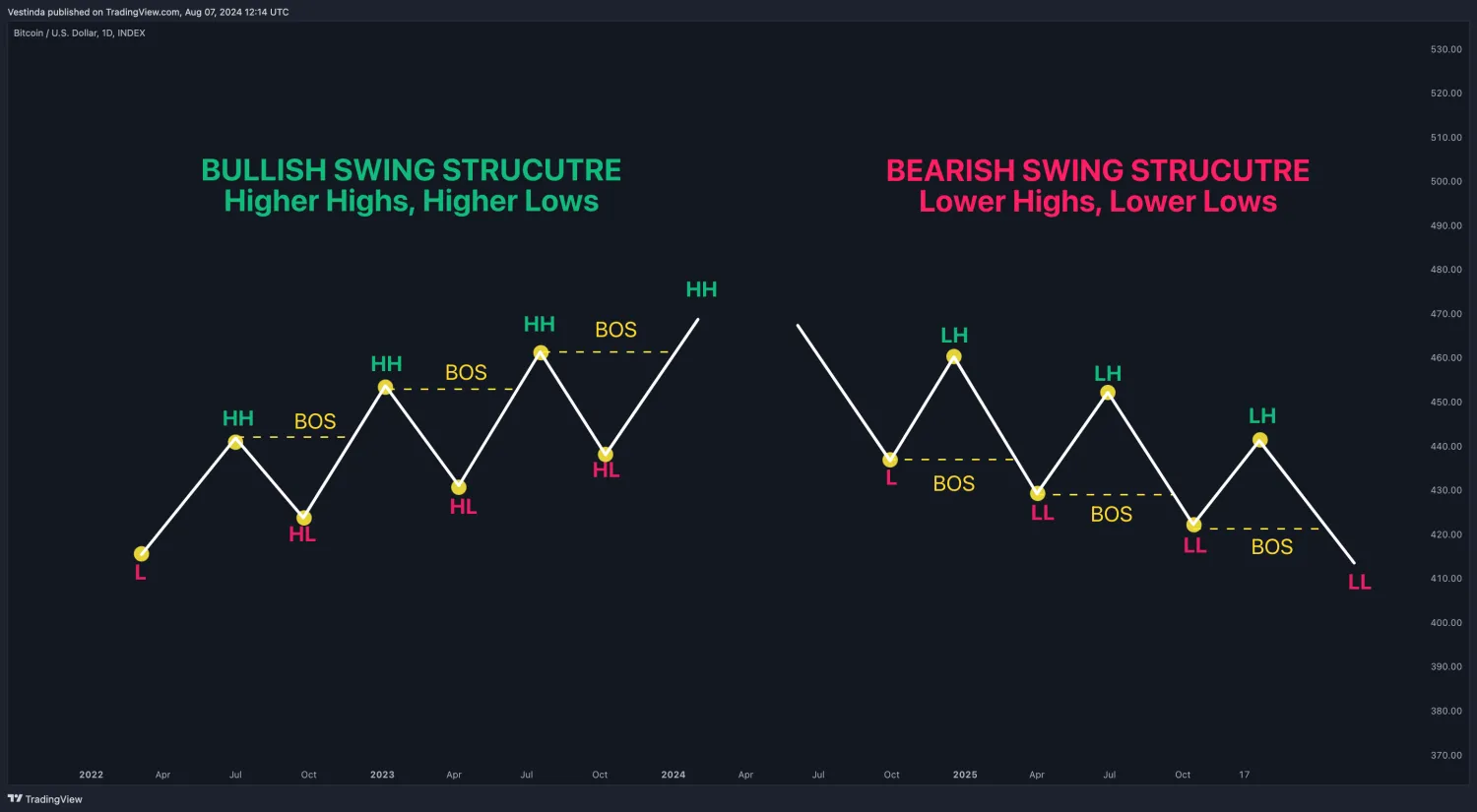

A breakout occurs when price forcefully moves above a well-defined resistance level or below a support level, often accompanied by a surge in volume. However, not every breakout sustains – many reverse quickly, trapping late entrants. The pullback after breakout strategy waits for price to return (or ‘pull back’) to the former resistance (now acting as support), offering a more reliable entry point. This technique is especially powerful in crypto markets where whipsaws and fakeouts are frequent.

Breakout trading strategies consistently highlight that this “second chance” entry reduces risk and improves reward-to-risk ratios versus buying into initial euphoria. As noted by Binance, this method is particularly accessible for new traders seeking structure in chaotic markets.

Step-by-Step Guide: Spotting Quality Pullback Setups

Key Steps to Trade Pullbacks After Breakouts in Crypto

-

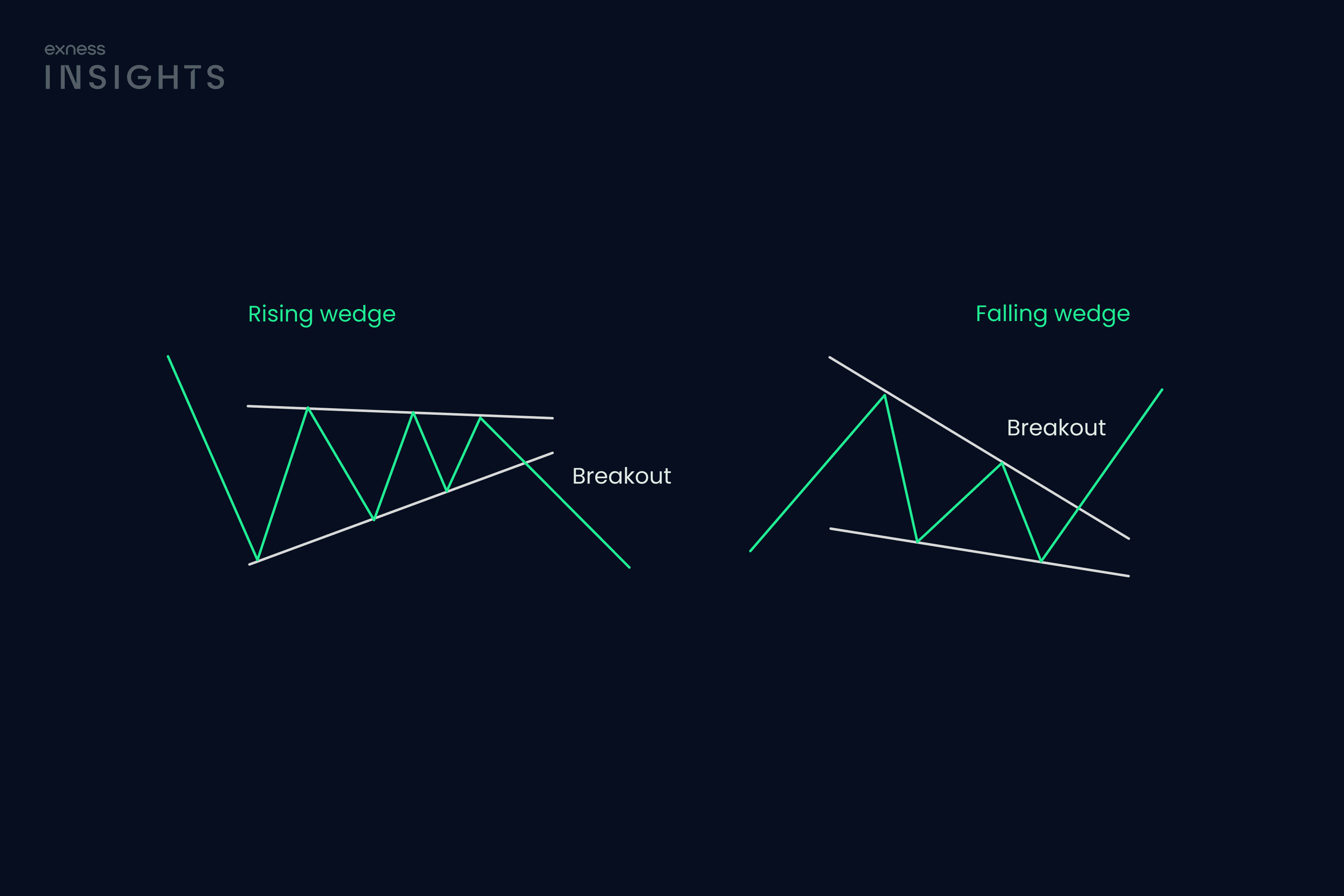

Identify Consolidation Patterns: Spot periods where the price moves within a defined range, forming chart patterns like triangles or rectangles. These structures often precede significant breakouts and help pinpoint potential entry zones.

-

Wait for a Breakout with Volume: Monitor for a decisive price move above a key resistance level, ideally accompanied by increased trading volume. This combination signals a higher probability of a valid breakout.

-

Observe the Pullback to New Support: After the breakout, wait for the price to retrace back to the previous resistance, now acting as support. This pullback offers a safer entry point and helps avoid chasing the price.

-

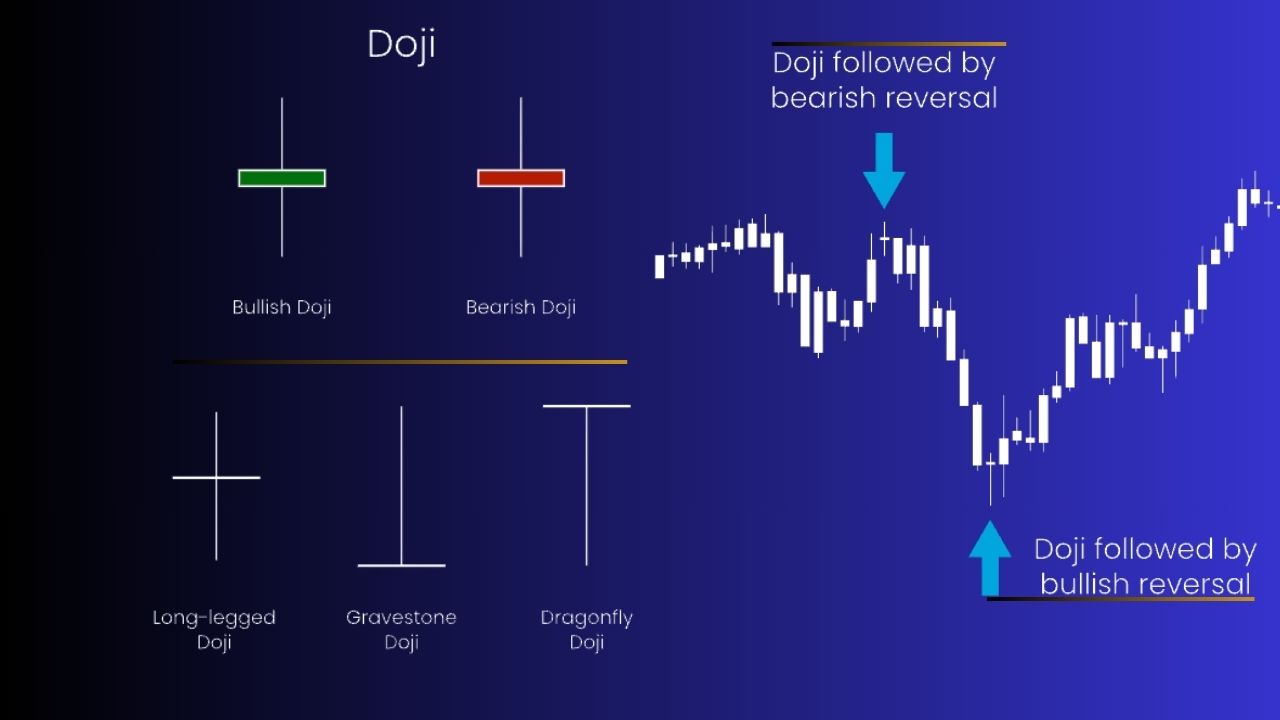

Confirm Entry with Bullish Signals: Look for bullish candlestick patterns (such as hammers or engulfing candles) and other indicators at the new support level to validate the potential for upward momentum.

-

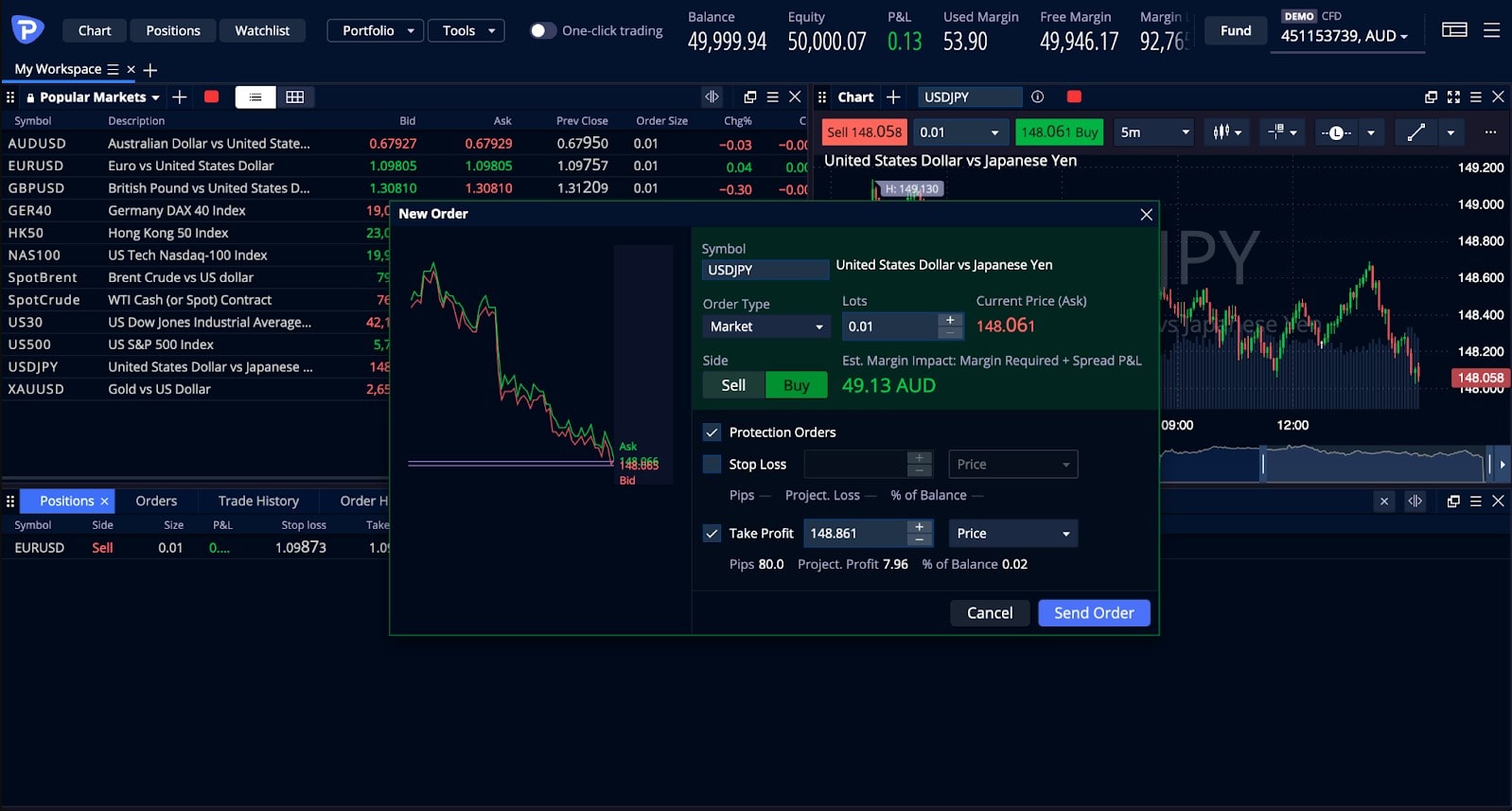

Set Stop-Loss and Take-Profit Levels: Place a stop-loss just below the new support to limit downside risk, and define take-profit targets using upcoming resistance levels or a favorable risk-reward ratio.

-

Apply Risk Management and Avoid Chasing: Use limit orders or alerts to enter near key levels, and avoid buying after the price has moved too far from the breakout point. Focus on setups from well-defined chart patterns and watch for false breakouts (fakeouts) by confirming with volume or candle closes.

The first step is to identify consolidation patterns. Look for price ranges forming triangles or rectangles – these are zones where buyers and sellers reach temporary equilibrium before an explosive move. When price finally breaks out with conviction (ideally on elevated volume), it signals potential trend continuation.

But rather than jumping in immediately, patience pays off. Wait for a pullback – a retracement toward the original breakout zone. This area often transforms into new support as market participants reassess value. Confirmation comes from bullish reversal candlestick patterns such as hammers or engulfing formations near this level.

Why Pullbacks Matter: Risk Management and Entry Precision

The allure of “buying the dip” isn’t just psychological; it’s rooted in sound risk management principles. By entering on a pullback after confirmation, you can set tighter stop-loss levels just below new support rather than far below a stretched price move. This means smaller losses if the trade fails and better profit margins if it runs your way.

The most successful crypto traders aren’t those who chase every green candle – they’re those who wait for high-probability setups with clear invalidation points.

This approach also helps filter out fakeouts – situations where price briefly breaks out only to snap back into its previous range. As highlighted by Flipster. io, using volume analysis and waiting for candle closes beyond key levels can further increase your win rate (source).

Essential Tools: Candlesticks, Volume and Fibonacci Retracements

Candlestick patterns provide visual cues of buyer strength during pullbacks; look for signs like bullish engulfing candles or pin bars near the retest zone. Volume spikes confirm institutional interest behind moves – weak volume on the pullback can signal lackluster demand and raise caution flags.

Some traders add Fibonacci retracement levels to sharpen entries further. For instance, if Bitcoin breaks above $119,440 then pulls back toward its 38.2% or 50% retracement of that move with strong candlestick support, confidence in continuation increases dramatically.

Beyond chart patterns, blending multiple indicators can provide a statistical edge. The Enhanced Dual EMA Pullback Breakout Trading Strategy, for example, leverages two exponential moving averages to filter out noise and pinpoint robust pullbacks. When price retests the breakout zone while remaining above both EMAs, probability of trend continuation rises, an approach especially useful in high-volatility environments like crypto day trading.

Real-World Example: Bitcoin at $119,440 and Ethereum at $4,397.37

Let’s apply these concepts to current market leaders. With Bitcoin (BTC) trading at $119,440, suppose it broke out above this level after consolidating between $116,435 and $119,440. If price pulls back to retest $119,440 with a bullish engulfing candle and strong volume, that’s your actionable entry point, stop-loss just below support and targets set near the next resistance or a risk-reward ratio of 2: 1 or better.

Similarly, Ethereum (ETH) at $4,397.37 presents a textbook scenario for the pullback entry strategy if it reclaims this level after a breakout and subsequent retracement. These setups are not only technically sound but also psychologically advantageous: you’re buying when fear of missing out subsides and weak hands exit.

Checklist: Mastering Pullback After Breakout Strategy in Crypto

Risk management remains paramount. Always size your positions based on volatility and never risk more than a small percentage of your capital per trade. The aim is consistency over home runs, protect your downside so you can stay in the game long enough to capitalize on high-probability crypto trading breakouts.

Common Pitfalls and How to Avoid Them

- Chasing extended moves: Entering after price has already run far from the breakout increases risk of reversals.

- Ignoring volume: Breakouts without strong volume are prone to fail; always look for confirmation.

- Poor stop placement: Stops too close get triggered by noise; too wide exposes you to unnecessary loss.

- Lack of patience: Most setups require waiting through consolidation and pullbacks before an optimal entry appears.

The beauty of mastering the pullback after breakout strategy in crypto is its adaptability across timeframes, from intraday scalps on altcoins to swing trades on majors like Bitcoin and Ethereum. As with any method, keep refining your edge by journaling trades and analyzing both winners and losers.

If you’re ready to elevate your approach beyond guesswork or FOMO-driven buys, this disciplined method offers structure amid chaos, and potentially outsized returns when executed with precision. Remember: success in volatile markets favors those who combine technical skill with emotional control. Happy trading!