Trading crypto stocks on Robinhood has become increasingly accessible, especially as the platform continues to innovate with features like commission-free trading and tokenized U. S. stocks for EU users. If you’re new to crypto stock trading, Robinhood offers a streamlined entry point, but it’s vital to approach the process methodically and understand both the mechanics and risks involved.

Understanding Crypto Stock Trading on Robinhood

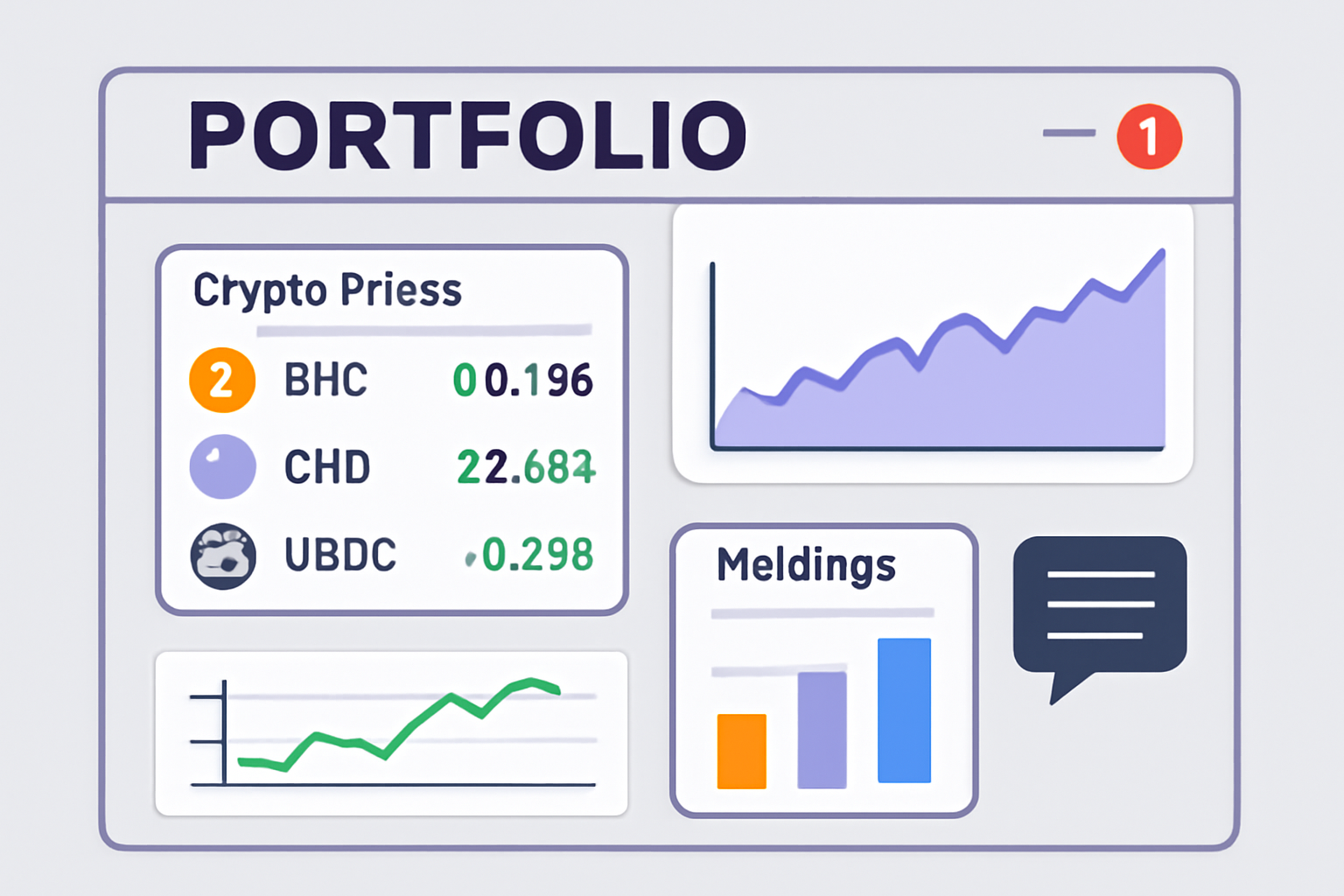

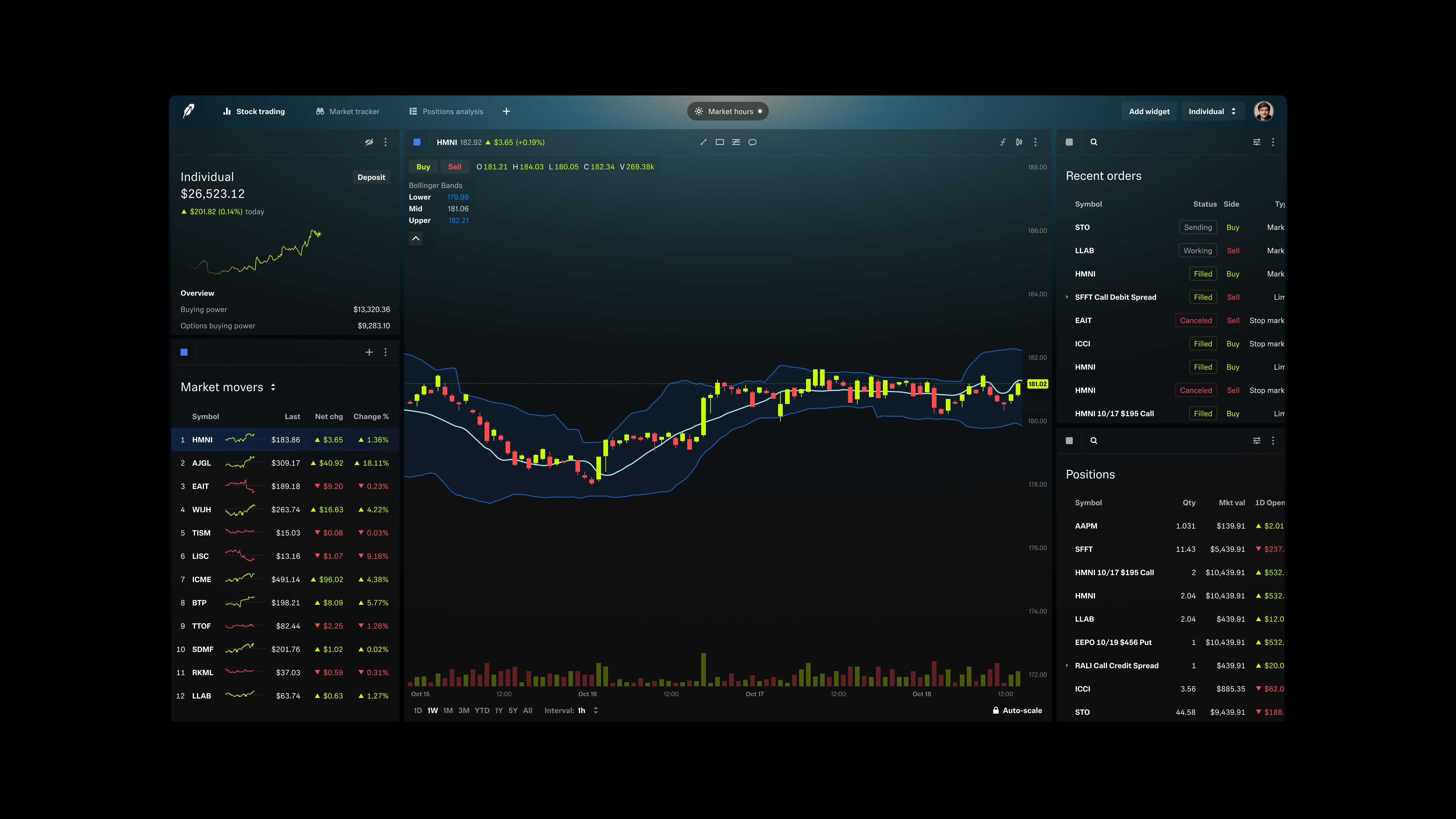

Robinhood stands out in 2025 for its user-friendly approach to both traditional stocks and cryptocurrencies. As of September 30,2025, Robinhood Markets Inc (HOOD) is trading at $136.72, reflecting a daily increase of and $14.96 ( and 0.1228%). The platform now supports not only major cryptocurrencies like Bitcoin and Ethereum but also tokenized versions of over 200 U. S. stocks for European users, allowing 24/5 access via blockchain-based tokens.

Crypto assets on Robinhood are managed separately from your main investing account. This separation is important for regulatory reasons and affects how you access and transfer your assets. For a detailed breakdown of available coins, visit CoinMarketCap Academy.

Step-by-Step: Getting Started With Your First Crypto Stock Trade

1. Set Up Your Account:

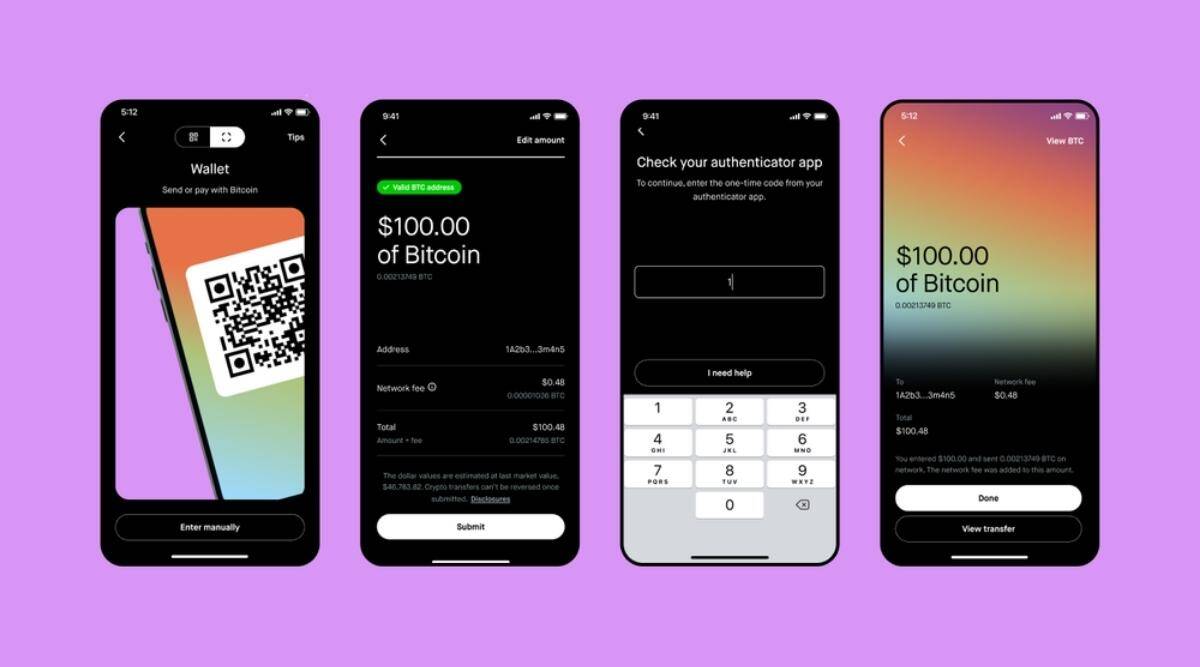

Begin by downloading the Robinhood app or visiting their website. You’ll be prompted to create an account using personal information such as your Social Security Number and a valid U. S. address. Identity verification is mandatory, have your documents ready.

2. Fund Your Account:

Link your bank account to initiate a funds transfer into Robinhood. While transfers may take 4-5 days to fully settle, you’ll get instant access to up to $1,000 for immediate trading, ideal for seizing timely opportunities in fast-moving markets.

3. Enable Crypto Trading:

Access to crypto isn’t automatic in every state; ensure that “Robinhood Crypto” is enabled in your profile settings before proceeding.

4. Place Your Trade:

Use the search function in-app or online to find your preferred cryptocurrency or tokenized stock (such as Bitcoin or Ethereum). Tap into its detail page and select ‘Buy’ or ‘Sell’ as needed. Enter either the dollar amount or crypto units you wish to trade, review all order details carefully before confirming.

If you’re wondering about day-trading rules: Unlike stocks, PDT (Pattern Day Trading) regulations do not apply to crypto assets on Robinhood. This means you can execute unlimited day trades regardless of account size (source).

Navigating Market Hours and Fees: What Every Beginner Needs To Know

The cryptocurrency market never sleeps, it operates 24/7 globally, so you can place trades at any time via Robinhood’s platform. However, periodic maintenance windows may temporarily restrict transactions; always check the app’s status if you encounter issues.

While Robinhood advertises commission-free crypto trading, don’t overlook network fees (also known as gas fees) when transferring assets between external wallets and your account (details here). These costs are set by blockchain networks themselves rather than by Robinhood.

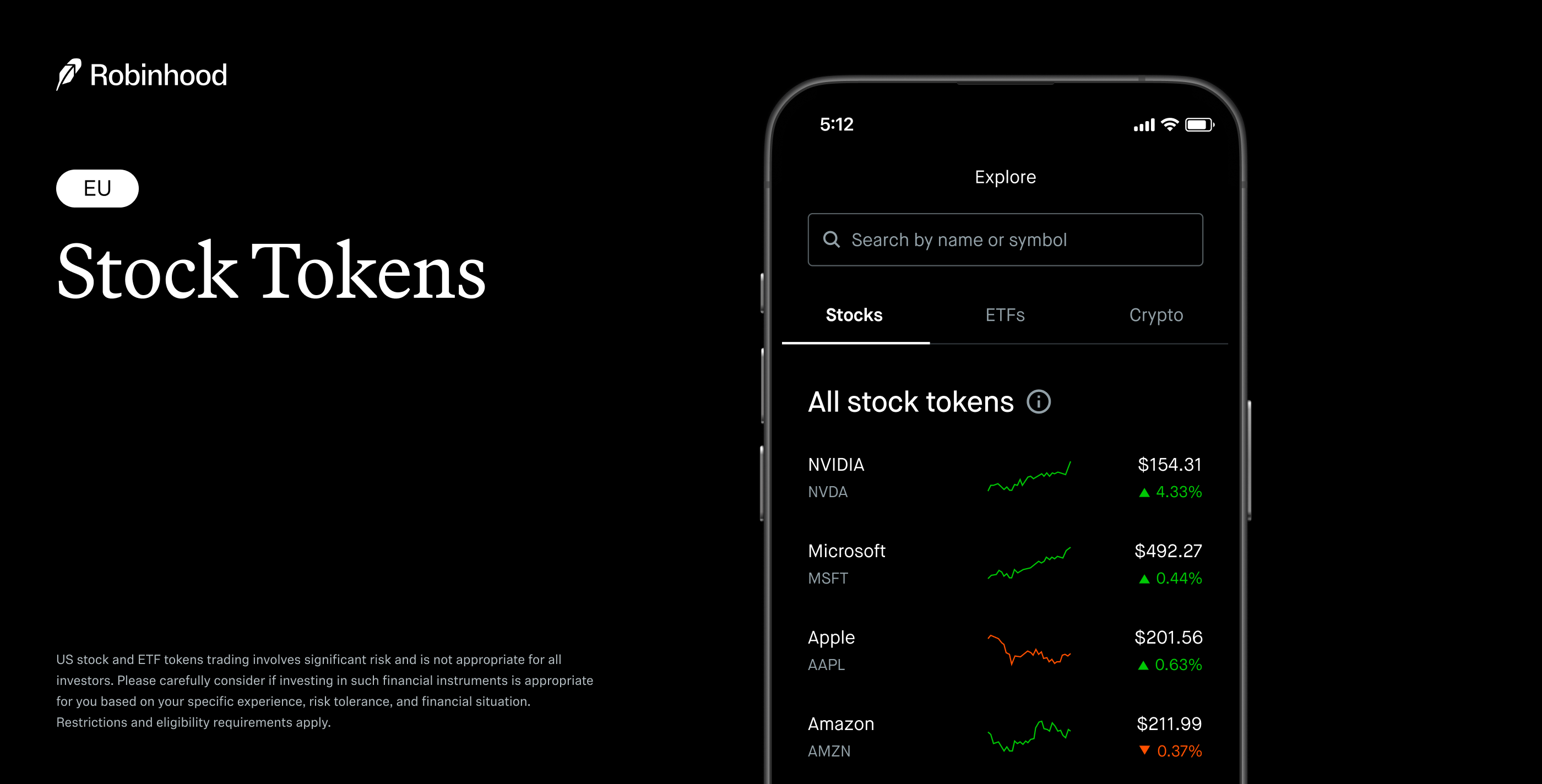

The Rise of Tokenized Stocks for EU Users

A significant recent development is Robinhood’s launch of tokenized U. S. stocks for European Union users (full story here). This allows EU investors nearly round-the-clock access (24/5) to more than 200 popular U. S. -listed equities through blockchain-based tokens, an innovation that blurs the lines between traditional equities and digital assets.

For those trading from the EU, this means you can now diversify your portfolio with tokenized shares of major U. S. companies alongside crypto, all within a single interface. The flexibility to buy fractional shares or tokens and trade outside of standard stock market hours is a game-changer for active traders and long-term investors alike.

Advantages & Risks of Trading Crypto Stocks on Robinhood

-

Commission-Free Trading: Robinhood allows users to buy and sell cryptocurrencies and tokenized stocks without charging commissions, making it cost-effective for frequent traders.

-

24/7 Crypto Market Access: Crypto trading on Robinhood is available 24/7, enabling users to react instantly to market movements at any time.

-

Unlimited Day Trading for Crypto: The Pattern Day Trading (PDT) rule does not apply to cryptocurrencies on Robinhood, allowing unlimited day trades regardless of account size.

-

Tokenized U.S. Stocks for EU Users: As of September 2025, Robinhood offers tokenized versions of over 200 U.S. stocks and ETFs for European Union users, enabling 24/5 trading via blockchain-based tokens.

-

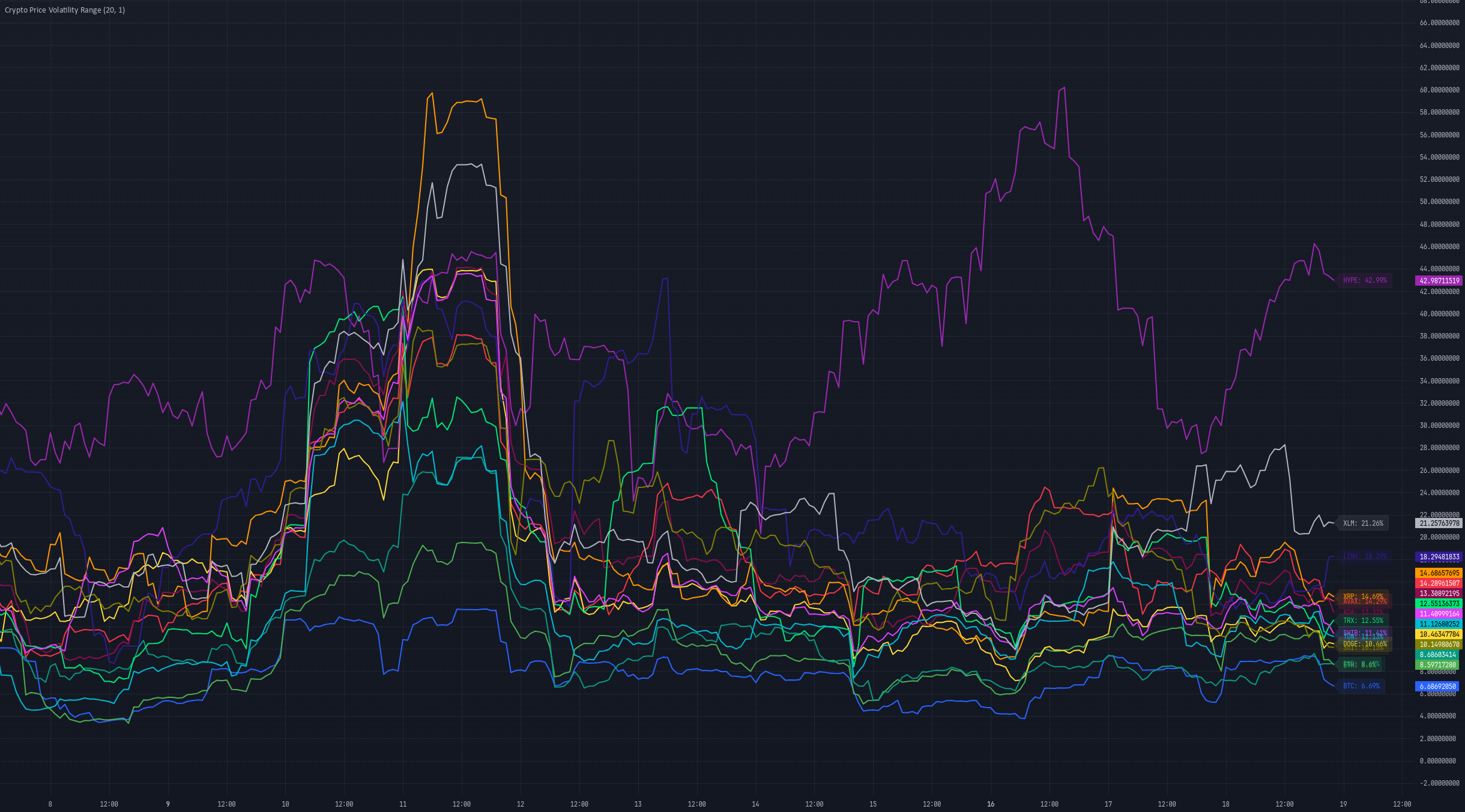

High Market Volatility Risk: Crypto assets on Robinhood are highly volatile, with prices subject to rapid and unpredictable swings, which can lead to significant losses.

-

Limited Crypto Selection: Robinhood offers a narrower range of cryptocurrencies compared to specialized exchanges, potentially restricting investment choices.

-

No Direct Crypto Ownership: When trading crypto on Robinhood, users do not hold the private keys to their assets, limiting control compared to external wallets.

-

Potential Network Fees: While trading is commission-free, network (gas) fees may apply when transferring crypto to or from external wallets, impacting overall costs.

-

Regulatory and Geographic Restrictions: Crypto trading on Robinhood is not available in all regions (e.g., Hawaii residents are excluded), and tokenized stocks are currently limited to EU users.

It’s important to remember that while Robinhood simplifies access, crypto stocks remain highly volatile assets. Price swings can be dramatic within minutes, so always use caution, especially when using advanced order types like limit orders or stop orders. To place a limit order on Robinhood, simply select ‘Limit Order’ during the trade process, enter your trade amount, and set your limit price before confirming.

Essential Tips for Beginner Crypto Stock Traders

As you start your journey in crypto stock trading on Robinhood, here are several practical tips to help you manage risk and build confidence:

- Start Small: Begin with modest trades until you’re comfortable navigating price volatility.

- Diversify: Don’t put all your capital into one asset. Spread investments across different cryptocurrencies or tokenized stocks.

- Stay Informed: Follow market news and updates directly within the app or through reputable financial news sources.

- Use Limit Orders: These allow you to control the exact price at which you buy or sell, offering protection against rapid market swings.

- Monitor Fees: While trading is commission-free, always account for potential network fees when transferring assets externally.

If you’re planning to day trade, take advantage of the unlimited trades allowed for crypto on Robinhood, just remember that more trades mean higher exposure to short-term risk. Practice patience and discipline; not every spike is an opportunity worth chasing.

The current price of Robinhood Markets Inc (HOOD) stands at $136.72, reflecting its ongoing relevance in both traditional and digital asset markets. Monitoring this price can offer insights into broader trends impacting crypto accessibility and fintech innovation in 2025.

If you’re ready to take the next step beyond basic buying and selling, explore technical analysis tools or join communities where experienced traders share insights. Learning from others’ wins, and mistakes, can accelerate your growth as a trader.

The future of investing is increasingly digital. With features like instant funding, unlimited day trades for crypto assets, and now tokenized stock offerings for EU users, Robinhood continues to lower barriers for retail investors worldwide. Approach each trade methodically: preserve capital first, let profits run second, a mindset that will serve you well as markets evolve.