Trading around major crypto news events, especially token unlocks and airdrops, demands a systematic approach rooted in timing, risk management, and understanding market psychology. As we continue to see projects utilize these mechanisms to incentivize participation and liquidity, traders must adapt their strategies to remain competitive and protect capital. Let’s delve into the actionable tactics that can help you navigate these volatile periods with confidence.

Monitor Token Unlock Schedules and Pre-Position Trades

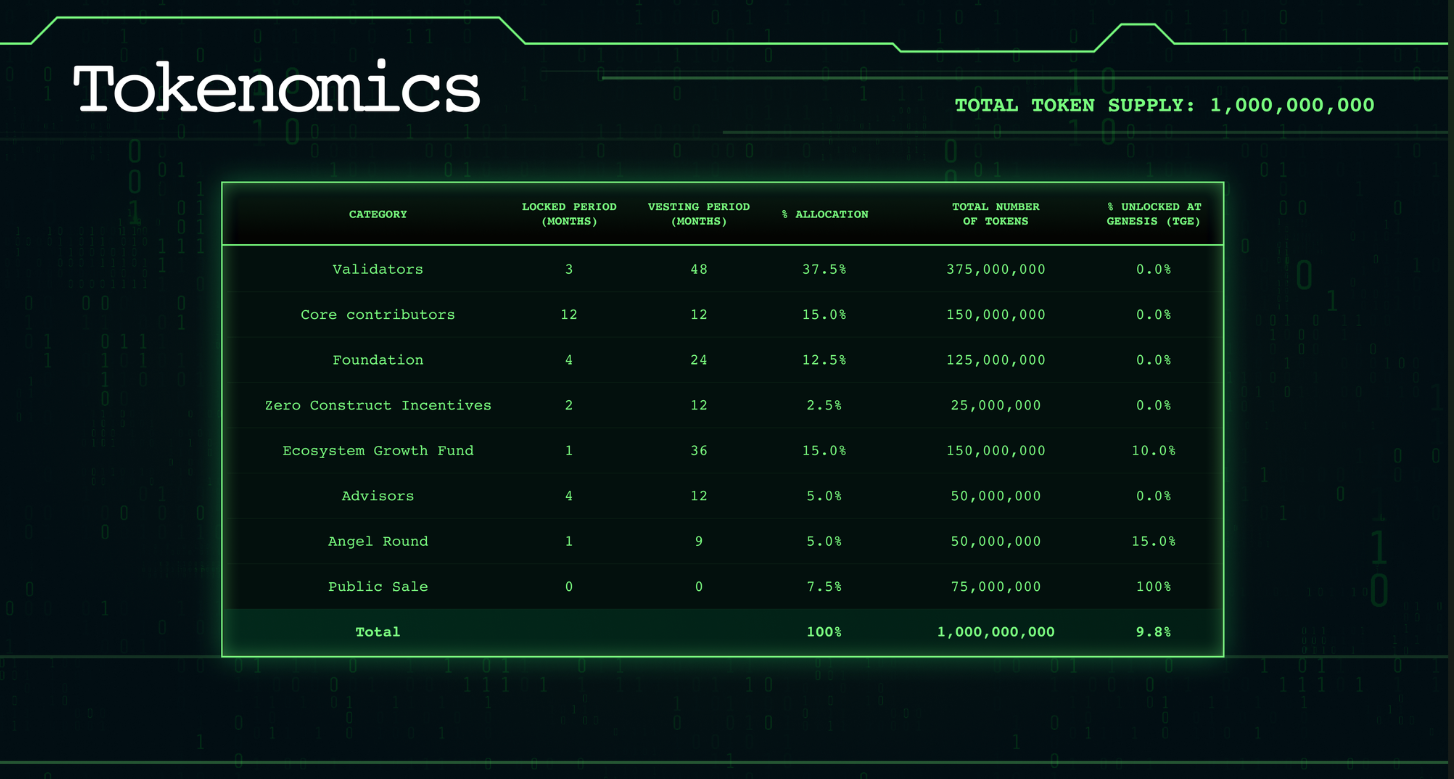

Token unlocks represent a pivotal moment for any project. When previously locked tokens become available for trading, the sudden increase in circulating supply can trigger significant price swings. According to data from Cointelegraph, top crypto VCs actively track unlock schedules to anticipate volatility and adjust their portfolios accordingly.

To stay ahead, use reliable aggregators like TokenUnlocks or follow official project announcements. Analyze historical price action around similar unlock events – most notably, 90% of large unlocks tend to create negative price pressure as per ChainCatcher research. If you notice an impending unlock for a token you hold, consider reducing your exposure or setting stop-loss orders before the event. This is especially prudent if the increase in circulating supply is substantial compared to average daily trading volumes.

Top Platforms for Tracking Token Unlock Schedules

-

TokenUnlocks: A leading, dedicated platform for real-time tracking of upcoming token unlock events across major blockchains. TokenUnlocks provides detailed schedules, circulating supply breakdowns, and historical unlock data, making it essential for traders monitoring supply changes.

-

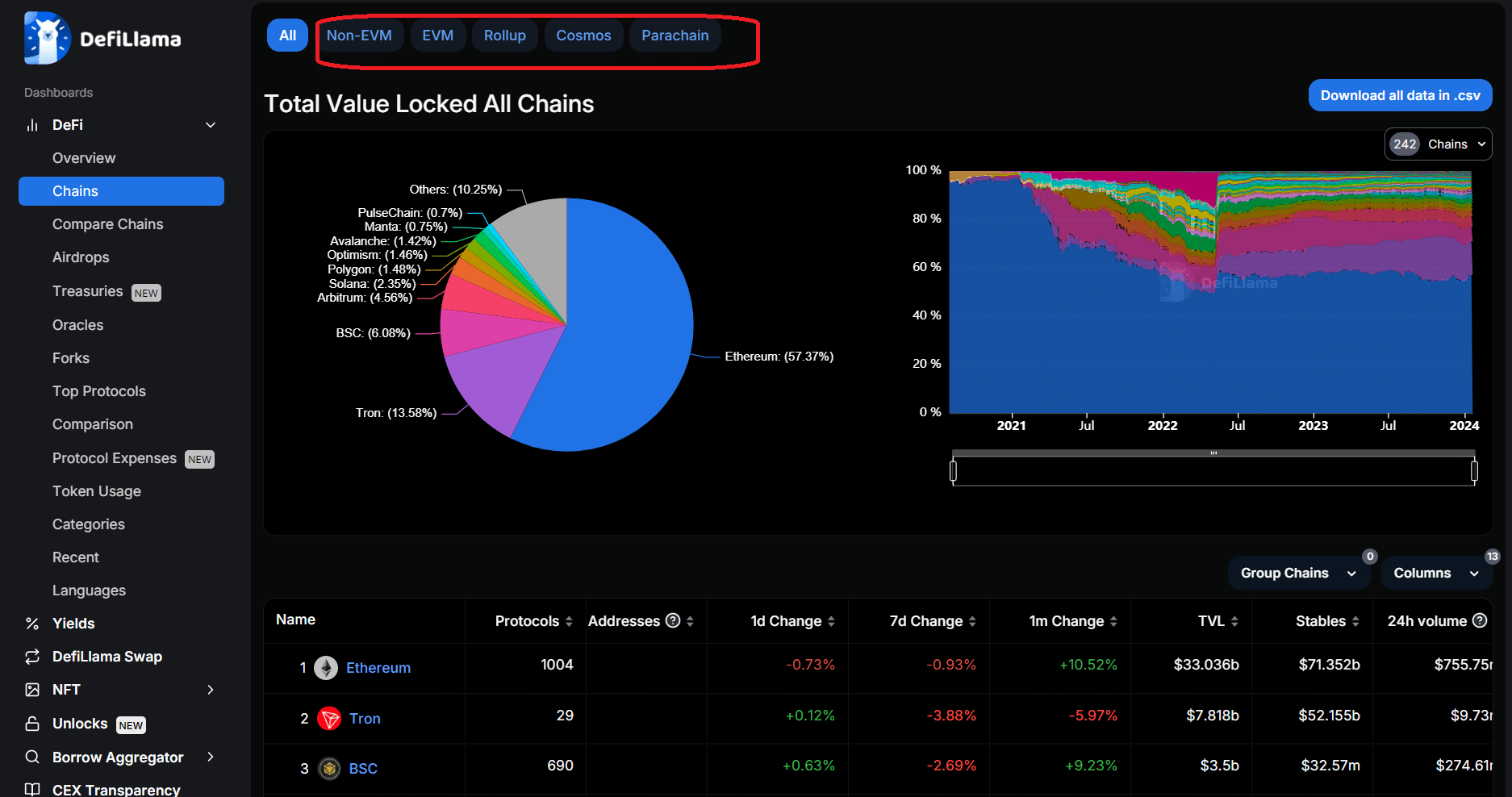

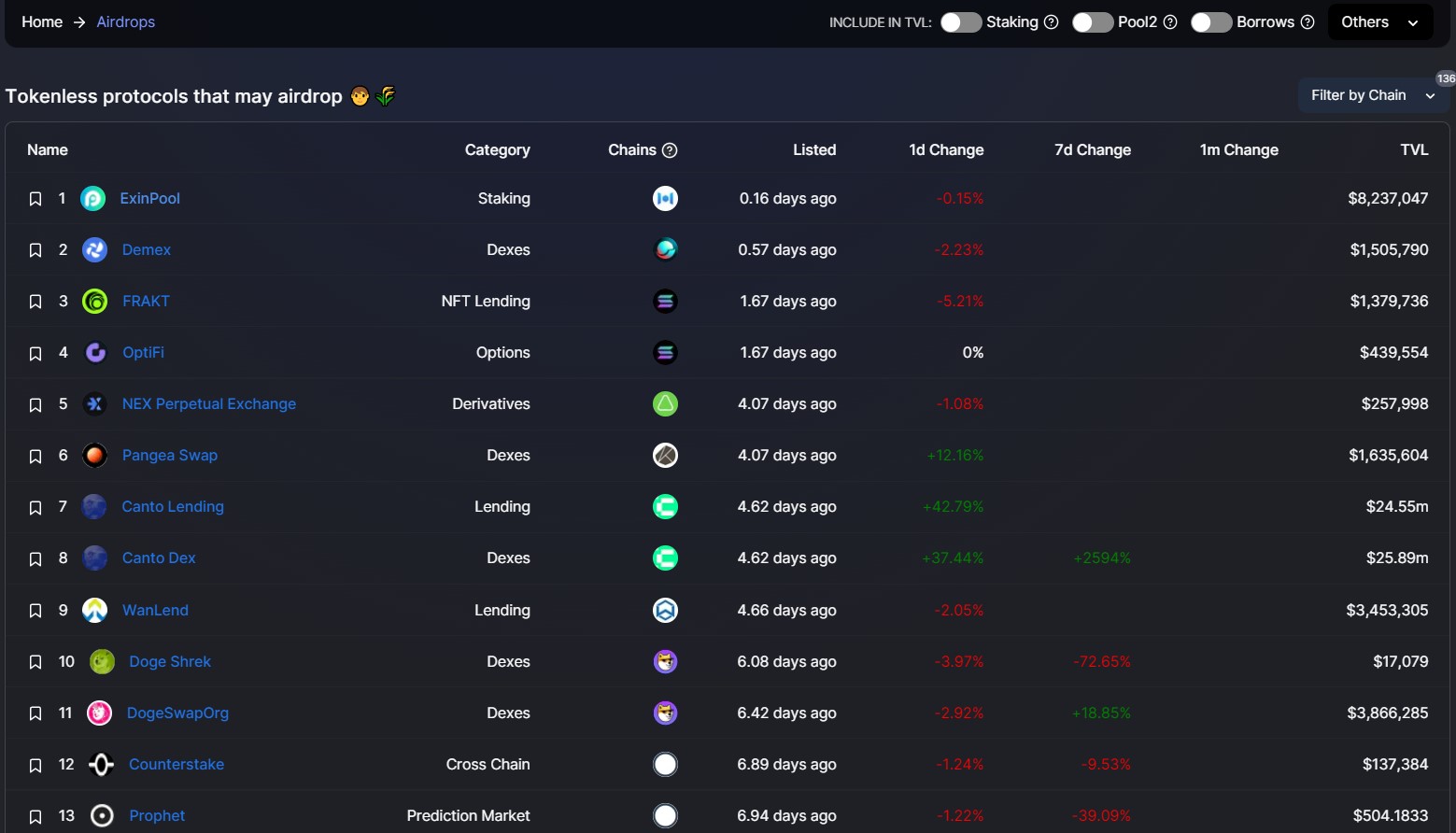

DeFiLlama: Known for its comprehensive DeFi analytics, DeFiLlama also features a robust unlocks tracker, aggregating token unlock schedules, vesting timelines, and airdrop events for hundreds of projects.

-

CryptoRank: CryptoRank offers a detailed token unlock calendar, including vesting schedules, project overviews, and analytics to help users anticipate potential market impacts from unlock events.

-

CoinGecko: While primarily a price aggregator, CoinGecko provides updates on newly unlocked tokens and airdrop distributions, allowing users to track circulating supply changes and related market data.

-

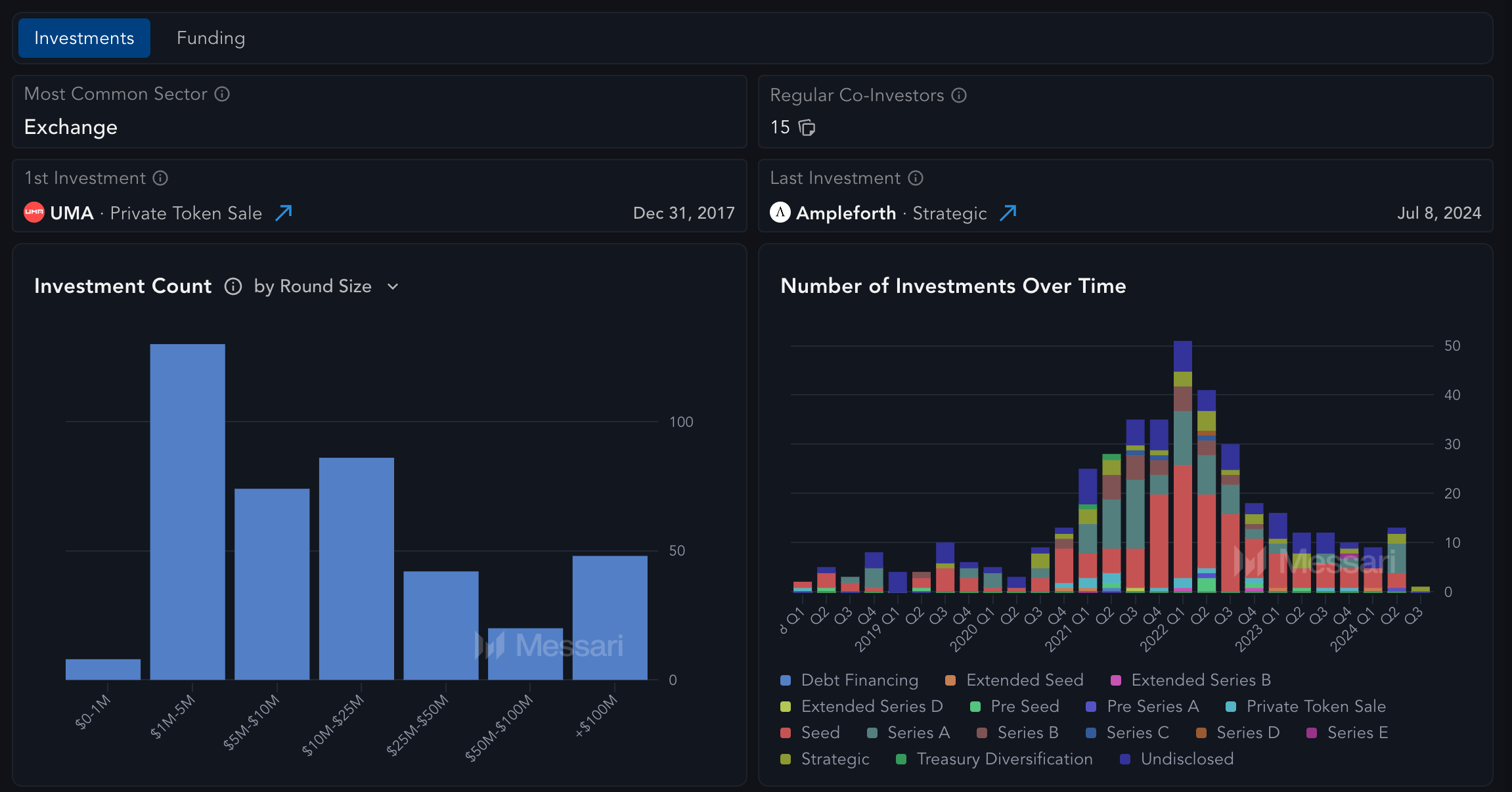

Messari: Messari delivers institutional-grade research and analytics, including token unlock schedules, vesting breakdowns, and impact assessments for major crypto assets.

Pre-positioning trades before major unlocks can help mitigate drawdowns and even present short-term opportunities if sentiment remains positive due to concurrent milestones or partnerships.

Leverage Airdrop Announcements for Short-Term Momentum Trades

Airdrop news consistently acts as a catalyst for rapid price movements. Projects often distribute free tokens to reward early adopters or boost awareness – but this influx of liquidity is usually met with swift profit-taking once tokens hit wallets. By tracking official airdrop announcements via project channels, Twitter feeds, and aggregators like DeFiLlama, traders can position themselves early on tokens likely to benefit from pre-airdrop hype.

The optimal window often lies between the announcement and the actual distribution date. Prices may spike as eligibility criteria are revealed and speculators rush in; however, history shows that rapid retracements are common post-airdrop as recipients sell their free tokens en masse (source). The key is agility: enter positions early based on credible news flow, set clear profit targets, and be prepared to exit quickly once distribution commences.

Implement Dynamic Risk Management During News Events

The heightened volatility surrounding token unlocks and airdrops requires disciplined risk management above all else. Adjust your position sizing based on expected volatility – smaller allocations can limit downside during uncertain periods. Trailing stop-losses are particularly effective here; they allow profits to run during momentum surges while providing protection if sentiment suddenly reverses.

Avoid overexposure by diversifying across multiple projects rather than concentrating capital in one high-risk event. Where possible, hedge with stablecoins or derivatives contracts that move inversely relative to your main holdings (source). This layered approach cushions your portfolio against sharp drawdowns caused by unexpected sell-offs or negative news surprises.

Proven Strategies for Trading Crypto News Events

-

Monitor Token Unlock Schedules and Pre-Position Trades: Use reliable sources like TokenUnlocks and official project announcements to track upcoming major unlock events. Analyze historical price action around similar unlocks to anticipate volatility, and consider reducing exposure or setting stop-loss orders before the event if the circulating supply is set to increase significantly.

-

Leverage Airdrop Announcements for Short-Term Momentum Trades: Track official airdrop news and eligibility criteria through project channels, Twitter, and aggregators like DeFiLlama. Enter positions early on tokens likely to benefit from airdrop hype, but be prepared to exit quickly as prices often spike pre-airdrop and retrace sharply after distribution.

-

Implement Dynamic Risk Management During News Events: Adjust position sizing and use trailing stop-losses during periods of heightened volatility around unlocks or airdrops. Avoid overexposure to single tokens, hedge with stablecoins or derivatives if available, and diversify across projects to mitigate downside risk from unexpected market reactions.

By integrating these strategies into your trading playbook – monitoring unlock schedules, leveraging short-term momentum from airdrop announcements, and dynamically managing risk – you’ll be better equipped to navigate one of crypto’s most unpredictable landscapes.

Remaining adaptable is essential as the market environment around crypto token unlocks and airdrop events continues to evolve. The most successful traders are those who treat these occurrences not as isolated risks, but as repeating cycles with identifiable patterns. With careful observation and a methodical approach, you can turn volatility into opportunity while maintaining strict capital preservation.

Checklist: Execute Your Token Unlock and Airdrop Strategy

Let’s recap the three core strategies for navigating trading news events in crypto:

- Monitor Token Unlock Schedules and Pre-Position Trades: Consistently track upcoming unlocks using trusted sources. Analyze historical data to anticipate potential price pressure, and adjust your positions proactively, reducing exposure or setting stop-losses before increased supply hits the market.

- Leverage Airdrop Announcements for Short-Term Momentum Trades: Use timely information from project channels and aggregators to identify tokens likely to experience hype. Enter early, set defined exit points, and avoid holding through the distribution unless you have strong conviction in the project’s fundamentals.

- Implement Dynamic Risk Management During News Events: Adapt your trade size based on expected volatility. Employ trailing stop-losses, diversify across projects, and hedge when possible to protect against sharp reversals or unforeseen negative sentiment.

The intersection of news-driven events like unlocks and airdrops with broader market momentum can provide significant edge, but only if approached with discipline. Remember that liquidity can dry up quickly after a major unlock or airdrop, amplifying volatility both ways. Always use real-time data feeds to inform your decisions, especially when managing open positions during these periods.

If you’re new to this space or wish to refine your process further, consider joining community forums or following experienced traders who share their playbooks around such events. Peer insights can help you spot nuances in timing or execution that aren’t obvious from charts alone.

Capital preservation remains paramount, let profits run only when risk is clearly defined.

As you integrate these approaches into your trading routine, you’ll find that measured preparation often outperforms reactive decision-making. By consistently applying these strategies before, during, and after major token unlocks or airdrops, you position yourself not just to survive crypto’s news-driven volatility, but to thrive within it.