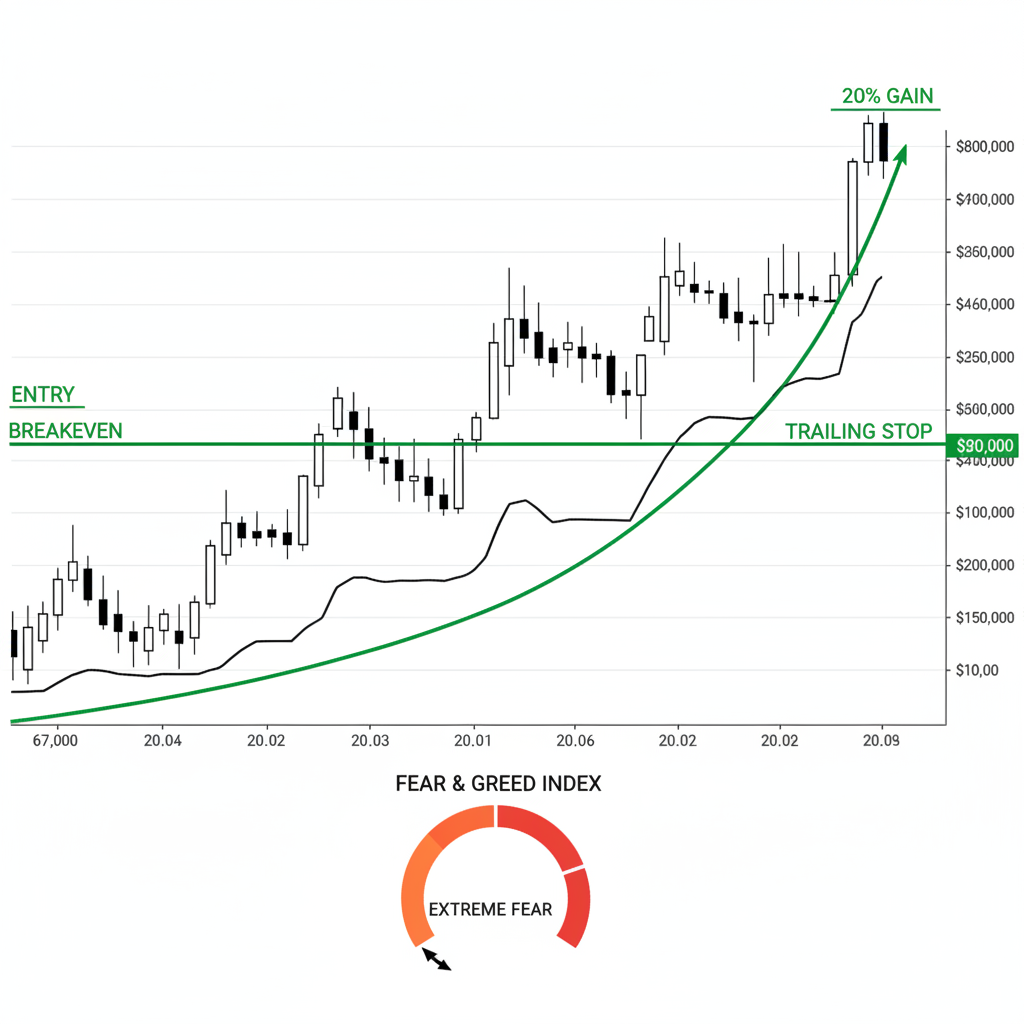

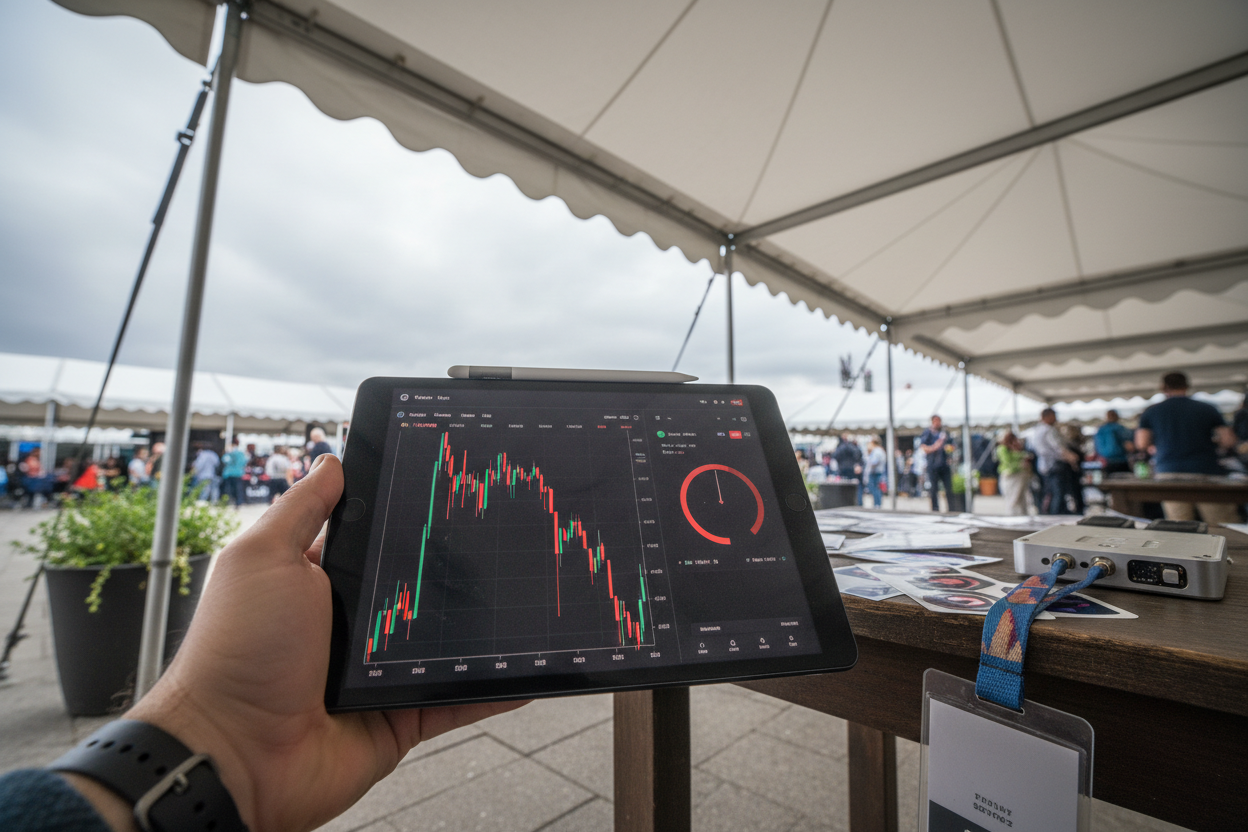

As Bitcoin hovers at $67,576 amid whispers of a ‘winter phase, ‘ the Crypto Fear and amp; Greed Index plunges to FTX-era lows, signaling extreme fear across the market. This isn’t panic selling from retail; it’s a leveraged unwind with futures open interest down 20%, clearing the way for savvy dip buyers. Big players are accumulating for SAFU rebalancing and long-term holds, echoing Tom Lee’s call to stop timing the bottom and just buy. With BTC off its $125,000 peak from October 2025, and supports aligning at $67K Fibonacci retracement, turning $1K into $10K becomes feasible through disciplined bitcoin dip buying 2026 strategies. We’re talking cross-market liquidity plays, institutional mimicry, and fear-fueled entries that connect crypto volatility to broader equity trends.

BlackRock highlights U. S. liquidity as the 2026 driver, while Elliott Wave analysis points to an A-B-C correction post-cycle peak. Bitcoin’s sideways range post-$125K offers a textbook setup for crypto extreme fear trading. Sentiment mirrors past crashes, yet institutional inflows via ETFs and Trump’s Bitcoin reserve executive order underpin resilience. Dip buyers stepped in at 2026 lows, but shaky follow-through demands precision. Here’s how to deploy $1K across six proven tactics tailored to this environment.

Seizing $67K Supports in the Winter Phase

Current price action at $67,576 tests a critical Fibonacci retracement, historically a magnet for buyers during corrections. Reports confirm no widespread panic; it’s deleveraging creating value. For btc support levels 67k, align entries where big players rebalance. This sets the stage for scaling to $100K-$150K targets, potentially 10x-ing modest capital amid rebound liquidity.

Bitcoin drops below $69,000 as the Crypto Fear and amp; Greed Index hits Extreme Fear. Is this a key BTC buy signal ahead of a 2026 rebound? (Source: CCN. com)

1. Buy at Key Support Levels: Enter at $67K Fibonacci Retracement with $1K Allocation

Start simple yet powerful: deploy your full $1K at $67K, the confluence of 0.618 Fib from the $125K high and multi-year supports. Why here? Post-cycle Elliott Waves target this zone for A-B-C basing. Avoid chasing; wait for $67,576 stabilization or a 24h low retest like today’s $66,702. This positions you for the winter phase bottom, with historical data showing 300% and rebounds from similar fear troughs. Cross-disciplinary lens: pair with equity market liquidity signals, as BlackRock notes, for confirmation.

2. Extreme Fear Timing: Use CNN Fear and amp; Greed Index and lt;20 for Scaled Entries During Winter Phase

Precision timing trumps guessing. When the index dips below 20 – as now amid FTX-level sentiment – scale in thirds: $333 at and lt;20, another at and lt;15, final at and lt;10. This captures crypto extreme fear trading without catching falling knives. Yahoo Finance flags the winter phase transition; use it to average into $67,576 dips. Tom Lee backs this: fear is your edge. Track alongside RSI divergences for health, ensuring corrections aren’t structural breakdowns.

Bitcoin (BTC) Price Prediction 2027-2032

Forecasts from 2026 Dip Recovery at $67K Support: Base $100K-$150K Rebound, Next Cycle Post-2028 Halving

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $90,000 | $130,000 | $200,000 |

| 2028 | $140,000 | $220,000 | $350,000 |

| 2029 | $250,000 | $400,000 | $650,000 |

| 2030 | $300,000 | $500,000 | $800,000 |

| 2031 | $450,000 | $700,000 | $1,000,000 |

| 2032 | $600,000 | $900,000 | $1,400,000 |

Price Prediction Summary

Bitcoin is set for a strong rebound from 2026’s extreme fear dip at $67K, targeting $100K-$150K base in 2026. Predictions project steady growth through the 2028 halving cycle, with average prices rising from $130K in 2027 to $900K by 2032 amid institutional adoption and bullish macro trends. Min/max ranges account for bearish corrections and euphoric peaks.

Key Factors Affecting Bitcoin Price

- 2028 Bitcoin halving reducing supply and sparking bull run

- U.S. government Bitcoin reserve and ETF inflows boosting institutional demand

- Regulatory clarity and global adoption trends

- Macro liquidity from major economies driving risk assets

- Technological scaling via Layer 2 solutions enhancing utility

- Market cycles showing historical post-correction 4-10x gains from lows

- Competition from altcoins but sustained BTC dominance in extreme fear rebounds

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Post-$125K peak, BTC grinds sideways, ideal for DCA. Commit $200 weekly, regardless of intra-week swings from $66,702 lows to $69,111 highs. This smooths volatility, building to $1K exposure over five weeks while dollar-costing below $67,576 average. Beth Kindig’s cycle analysis supports this for A-B-C corrections; it’s mechanical bitcoin sideways trading strategies that turned past winters into bull setups. Link to macro: U. S. equities and ETF flows amplify upside as sentiment flips.

Discipline here separates winners from sidelined watchers; past data shows DCA outperforms lump-sum in 68% of sideways crypto winters.

4. Scale-In with Risk Management: Add Positions at 5% Increments Below $70K, Limiting Risk to 1% of Capital

Volatility demands guardrails. With Bitcoin at $67,576 testing btc support levels 67k, scale in at 5% drops: $70K start with $250 (25% of $1K), $66.5K another $250, down to $63.2K for the rest. Cap each entry’s risk at 1% total capital via tight stops 3% below. This mirrors BingX’s ‘avoid falling knives’ ethos, blending technicals with position sizing. Cross-market tie-in: watch U. S. liquidity per BlackRock; if equities dip, BTC follows but rebounds sharper on ETF inflows. Platinum Academy notes shaky follow-through at lows, so this methodical layering builds conviction without overexposure, priming for turn 1000 to 10000 bitcoin.

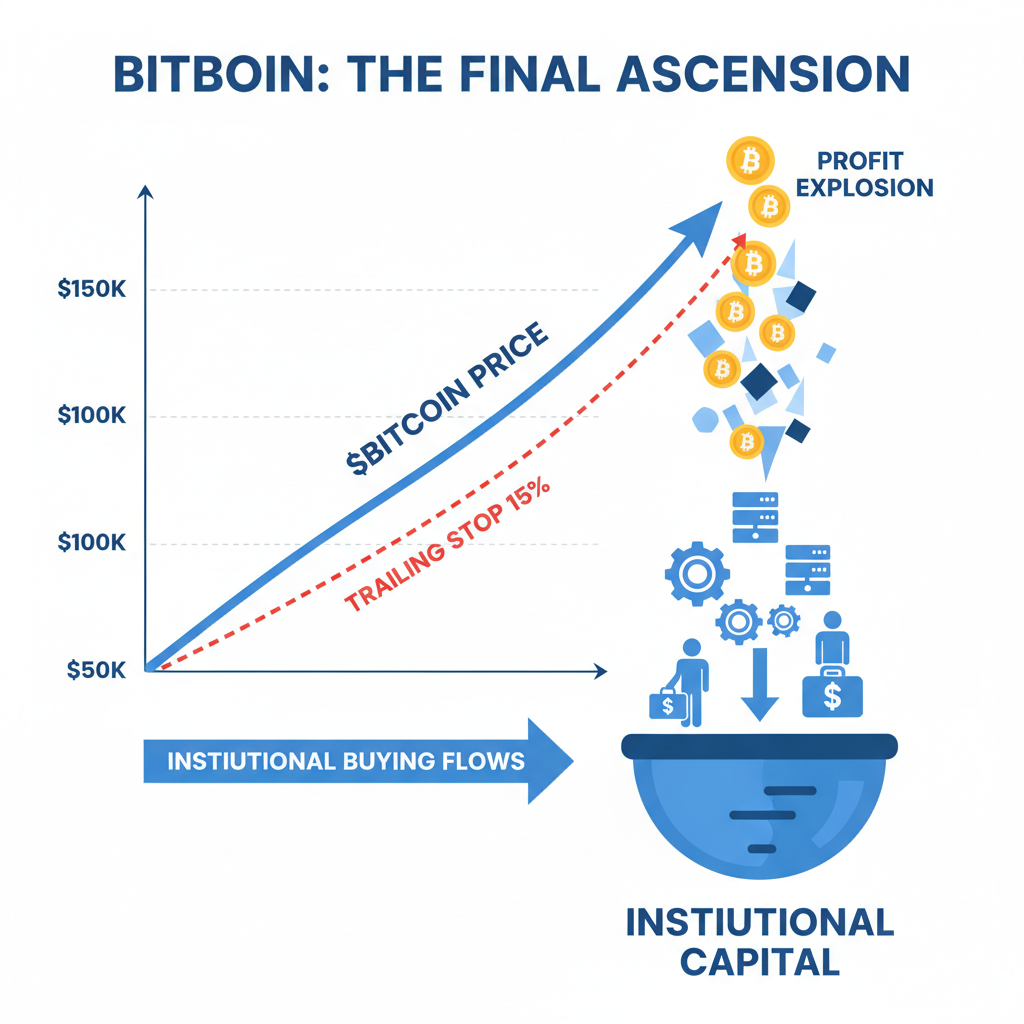

5. Big Player Mimicry: Accumulate Like Institutions During SAFU Rebalancing Dips for Long-Term Holds

Institutions aren’t flinching; CoinDCX reports SAFU rebalancing and accumulation fueling buys amid deleveraging. Emulate them: allocate $500 of your $1K on $67,576 dips when open interest drops further, holding through winter phase noise. Trump’s reserve order and ETF approvals cement this as asymmetric; unlike retail panic, whales view $67K as cheap insurance against inflation. Beth Kindig’s post-peak chart aligns with multi-year holds targeting cycle lows before 2027 lifts. Opinion: this cross-disciplinary play links crypto to sovereign adoption trends, turning fear into portfolio anchors that equities can’t match.

Layer these with macro vigilance; Four factors from BlackRock underscore liquidity’s role, so pair BTC buys with bond yield watches for reversal cues. AInvest’s flow data confirms unwinds are orderly, not capitulation, setting dip buyers up for outperformance.

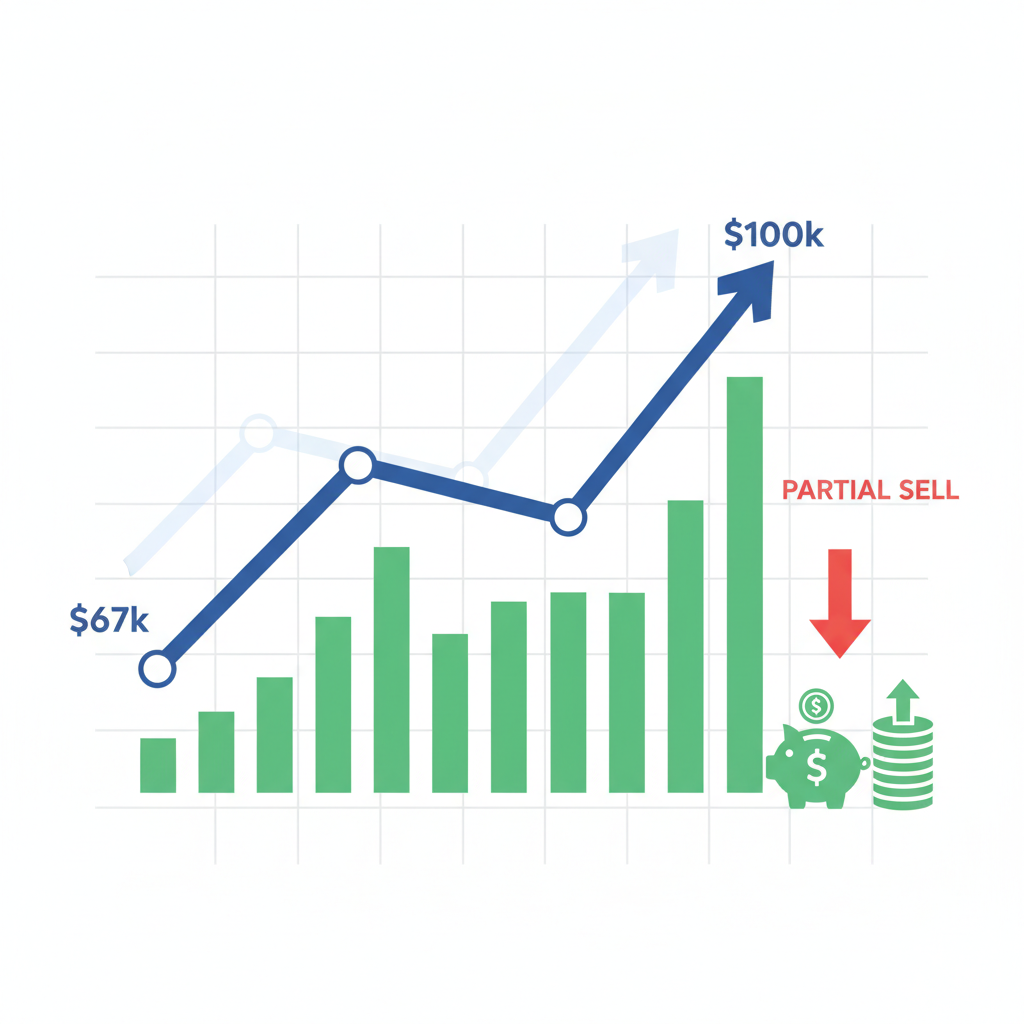

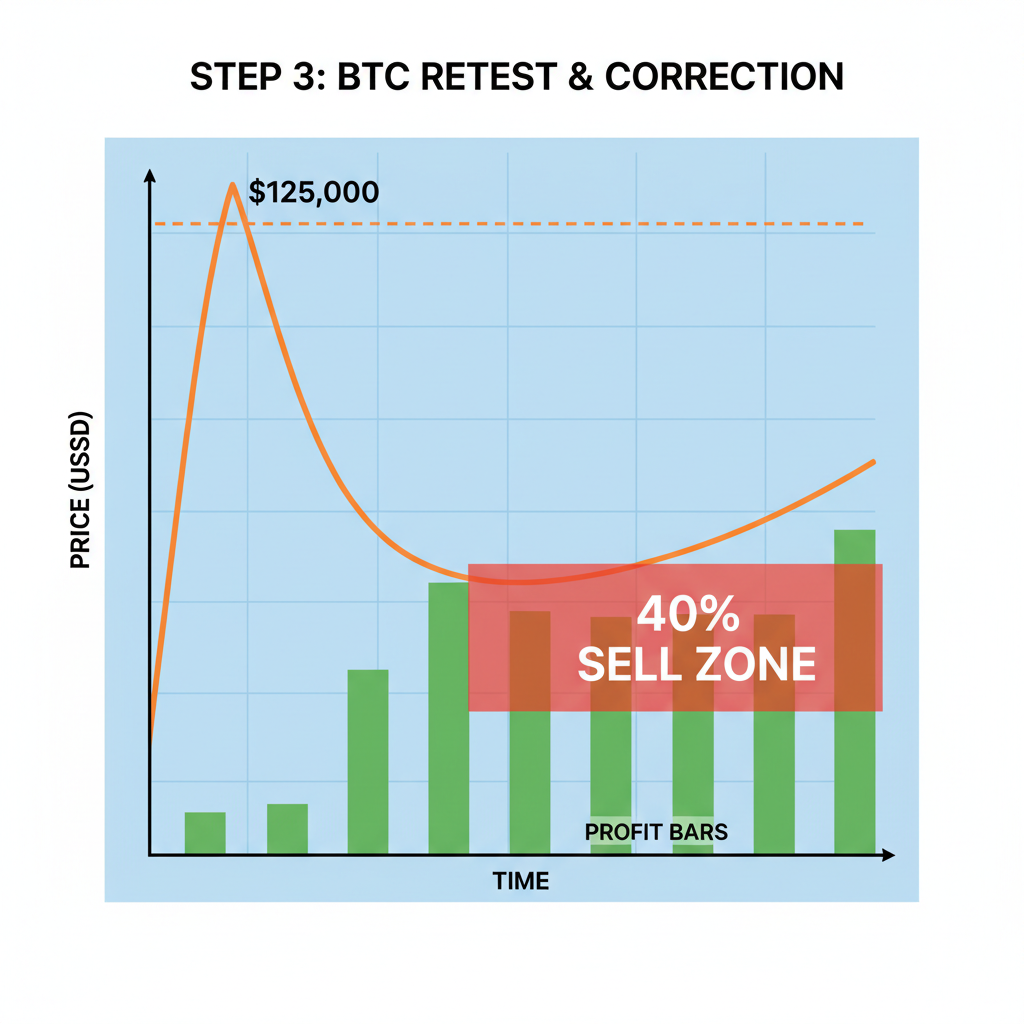

6. Profit Scaling to 10x: Trail Stops at 20% Gains, Partial Exits at $100K/$150K Targets for $1K to $10K

Entry is half the battle; exits seal the 10x. From $67,576 base, trail stops locking 20% gains first, then ladder sells: 30% at $100K (realistic base case per predictions), 40% at $125K (prior peak retest), ride the rest to $150K on sentiment flip. This nets $10K on $1K via compounded sizing across strategies. Why viable? Historical fear troughs birthed 5-15x runs; Warren Buffett-style crashes like now scream value, per CCN. Avoid greed traps; partial profits fund reinvestments, connecting short-term wins to long-term compounding in diversified setups.

Blending these six tactics deploys $1K surgically: supports for anchors, fear timing for edges, DCA for averaging, scaling for safety, mimicry for conviction, scaling out for realization. Amid 2026’s extreme fear, $67K holds as the pivot; big players agree, stepping in despite shaky bounces. Cross-market flows from equities and policy tailwinds position patient traders for liquidity-driven snaps higher. Track the Fear and Greed daily, respect $66,702 lows, and let volatility work for you. Disciplined execution turns winter phases into springboards, bridging crypto’s chaos to tangible gains.

Bitcoin vs. Cryptocurrencies and Major Equity Indices: 6-Month Performance

Highlighting BTC dip opportunity at $67,565 amid extreme fear and equity outperformance (as of 2026-02-17)

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Bitcoin | $67,565.00 | $112,419.03 | -39.9% |

| Ethereum | $1,993.78 | $4,223.21 | -52.8% |

| Solana | $84.81 | $180.28 | -53.0% |

| BNB | $618.86 | $839.04 | -26.2% |

| XRP | $1.48 | $2.85 | -48.1% |

| SPY | $683.63 | $447.95 | +52.6% |

| QQQ | $602.06 | $563.28 | +6.9% |

| DIA | $496.27 | $447.95 | +10.8% |

Analysis Summary

Over the past six months, Bitcoin and other major cryptocurrencies have declined sharply (26.2% to 53.0%), while equity ETFs like SPY (+52.6%), DIA (+10.8%), and QQQ (+6.9%) have posted gains, revealing a stark divergence and positioning BTC as a potential dip-buying opportunity during extreme fear.

Key Insights

- Cryptocurrencies down significantly: Solana (-53.0%) and Ethereum (-52.8%) worst performers, BNB mildest at -26.2%

- Bitcoin’s -39.9% drop from $112,419 to $67,565 amid ‘winter phase’ and extreme fear sentiment

- Equity indices outperform: SPY leads with +52.6% gain, contrasting crypto weakness

- Market divergence underscores BTC dip strategies for 2026 rebound potential per analysts

Data from CoinMarketCap historical snapshots (2025-08-21) for cryptocurrencies and Yahoo Finance historical data for equity ETFs (SPY, QQQ, DIA), reflecting prices as of 2026-02-17T19:59:42Z. Changes are 6-month percentage variations as provided.

Data Sources:

- Main Asset: https://coinmarketcap.com/historical/20250821/

- Ethereum: https://coinmarketcap.com/historical/20250821/

- Solana: https://coinmarketcap.com/historical/20250821/

- BNB: https://coinmarketcap.com/historical/20250821/

- XRP: https://coinmarketcap.com/historical/20250821/

- SPDR S&P 500 ETF Trust: https://uk.finance.yahoo.com/quote/DIA/history/

- Invesco QQQ Trust: https://de.finance.yahoo.com/quote/QQQ/history/

- SPDR Dow Jones Industrial Average ETF Trust: https://uk.finance.yahoo.com/quote/DIA/history/

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.