In the volatile world of Bitcoin trading, few signals carry as much weight as the movements of whales – those massive holders controlling over 1,000 BTC per wallet. Recent on-chain data reveals a striking surge: as of April 15,2025, the number of such addresses climbed to 2,014, up from 1,944 on March 5, marking the highest since April 2024. These wallets have scooped up 104,340 BTC in recent weeks, pushing their collective holdings to 7.17 million BTC – the most since September 15,2025. With Bitcoin now trading at $68,577.00, up $3,705.00 or 5.71% in the last 24 hours, this bitcoin whale accumulation hints at renewed confidence amid a dip-buying frenzy.

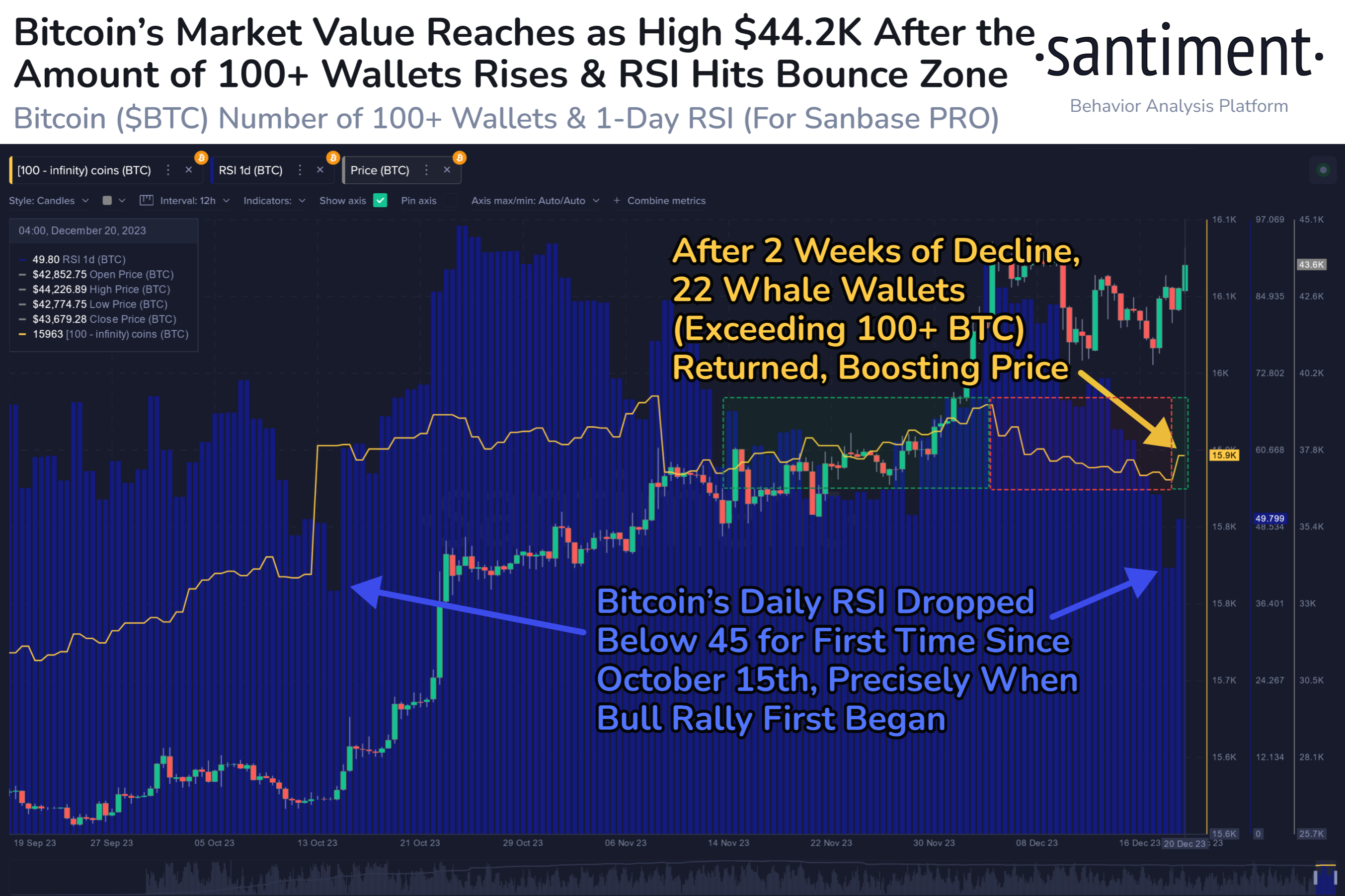

This isn’t mere noise; it’s a divergence from retail behavior. While smaller investors pare back, whales are stacking sats, a pattern echoed across sources like Santiment and Glassnode. Addresses holding at least 1,000 BTC jumped, with some reports citing even larger hauls nearing 270,000 BTC. One standout: a whale shuttling $280 million in BTC to cold storage, screaming long-term conviction. At today’s $68,577.00 price point, such actions suggest these titans see value where others hesitate.

Decoding the 1000 BTC Wallets Surge

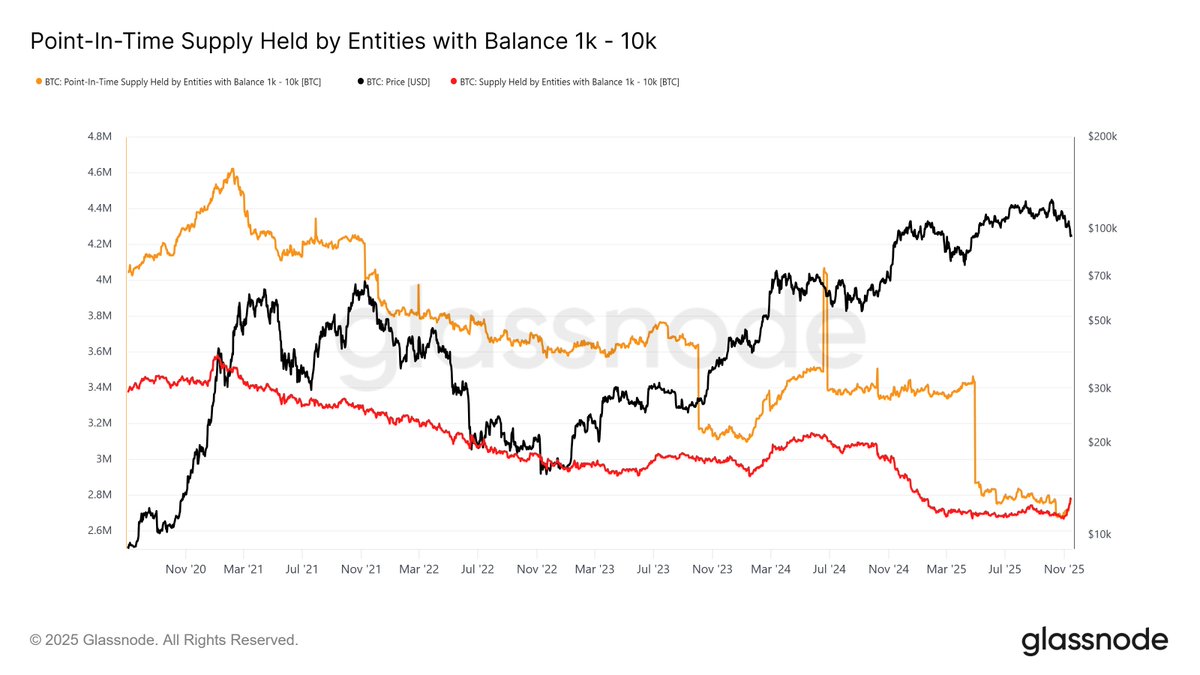

The 1000 btc wallets surge demands scrutiny. Blockchain trackers paint a bullish picture: Santiment logged 104,340 BTC added recently, while Glassnode noted a 3.5% rise in qualifying addresses over the past month. By November 17,2025, these wallets hit 1,384 – a four-month peak – before climbing further to 2,014. Total supply in whale hands now stands at 7.17 million BTC, roughly 34% of circulating supply.

Whales control the narrative in crypto; their accumulation often precedes price inflection points.

Contrast this with retail: addresses under 1 BTC dwindled, underscoring a classic smart money versus crowd dynamic. Yet, skeptics like AInvest caution – is this true accumulation or institutional rebalancing? A spike in 1,000-10,000 BTC wallets might reflect custodians shuffling assets, not fresh buys. Still, cold storage transfers tip the scale toward genuine hodling, especially as Bitcoin holds $68,577.00 after a 24-hour low of $64,872.00.

Bitcoin On-Chain Metrics Spotlight Whale Activity

Bitcoin on-chain metrics offer the clearest lens. Santiment’s data aligns with U. Today and Binance reports: whales bought the dip despite sell-offs, with holdings swelling quietly. Yahoo Finance highlights parallel ETH and LINK grabs, but BTC leads. BeInCrypto pegged the wallet count rise at 2.2%, while CoinDCX tallied 270,000 BTC amassed – figures varying by timeframe yet converging on uptrend.

Glassnode’s 3.5% address growth historically signals rallies; past instances preceded 20-50% gains. At $68,577.00, with a 24-hour high of $71,612.00, metrics like exchange inflows (down) and HODL waves (up) reinforce this. Whales aren’t flipping; they’re fortifying. TradingView and BingX corroborate: post-$1M address milestones, accumulation accelerated.

Bitcoin (BTC) Price Prediction 2027-2032

Projections Based on Whale Accumulation Trends, Current Price $68,577 (2026), and Market Cycles

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prev) |

|---|---|---|---|---|

| 2027 | $65,000 | $90,000 | $120,000 | +20% |

| 2028 | $80,000 | $130,000 | $180,000 | +44% |

| 2029 | $100,000 | $150,000 | $220,000 | +15% |

| 2030 | $120,000 | $180,000 | $280,000 | +20% |

| 2031 | $140,000 | $220,000 | $350,000 | +22% |

| 2032 | $170,000 | $280,000 | $450,000 | +27% |

Price Prediction Summary

Bitcoin’s price is forecasted to experience robust growth from 2027 to 2032, fueled by recent whale accumulation of over 104,000 BTC and a surge in wallets holding 1,000+ BTC to record highs. Average prices are projected to rise progressively from $90,000 in 2027 to $280,000 by 2032, with potential peaks exceeding $450,000 in bullish scenarios driven by halvings and adoption.

Key Factors Affecting Bitcoin Price

- Surge in Bitcoin whale wallets (1,000+ BTC) to 2,014 addresses, highest since 2024, signaling strong investor confidence

- Accumulation of 104,340+ BTC by whales, indicating long-term holding and bullish momentum

- Upcoming Bitcoin halvings in 2028 and 2032, historically catalysts for price surges

- Increasing institutional demand via ETFs, corporate treasuries, and on-chain metrics

- Potential regulatory clarity and mainstream adoption enhancing market cap potential

- Technological upgrades improving scalability and real-world use cases

- Macro factors like inflation hedging and divergence from retail selling pressure

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Crypto Whale Trading Signals for Investors

For traders eyeing crypto whale trading signals, this whale activity bitcoin 2026 screams opportunity. First, momentum: whale buys correlate with 70% of bull runs per historical data. At $68,577.00, resistance looms near $71,612.00; a break could target $75,000. Watch for continued net inflows – if 1000 and BTC wallets add another 50,000 BTC, expect volatility spike.

Risk management is key. Pair this with RSI (neutral now) and funding rates (balanced). Conservative plays: dollar-cost average into dips above $65,000, using 1-2% position sizes. Opinion: true bulls ignore retail panic; whales dictate cycles. But diversify – ETH whales mirror BTC, per Yahoo.

Tracking these patterns requires discipline. Platforms like Glassnode and Santiment provide real-time dashboards for whale activity bitcoin 2026, but pair them with off-chain cues like ETF flows. Institutional demand, per Mitosis University, mirrors this on-chain surge, with addresses growing 3.5% monthly – a precursor to sustained uptrends.

Historical Precedents: Whale Accumulation Cycles

Past data underscores the predictive power of whale moves. In late 2020, a similar 1000 BTC wallet spike preceded Bitcoin’s climb from $20,000 to $69,000. Fast-forward to 2024: pre-halving accumulation by whales fueled the run past $70,000. Today’s setup at $68,577.00 echoes those phases, with 7.17 million BTC locked up signaling supply squeeze. Reports from TradingView and U. Today align: dips to $64,872.00 triggered buys, mirroring 2021’s post-crash rally.

Yet history isn’t destiny. The 2022 bear saw whales briefly accumulate before capitulation. Key differentiator now: cold storage dominance. MEXC’s $280 million transfer exemplifies this, reducing liquid supply as Bitcoin tests $71,612.00 highs.

Practical Trading Strategies from Whale Signals

Translating bitcoin on-chain metrics into action demands precision. Here’s a structured approach for investors.

Key Whale Trading Signals

-

Monitor 1,000+ BTC wallet growth for entry points. Wallets surged to 2,014 from 1,944, highest since April 2024, adding 104,340 BTC.

-

Buy dips above 24h low $64,872. BTC at $68,577 (+5.71%) indicates rebound from low amid whale accumulation.

-

Exit partial at $71,612 resistance, recent 24h high, as whales hold 7.17M BTC, highest since Sep 2025.

-

Use stop-loss below $65,000 to manage risk below key support near 24h low.

-

Track cold storage transfers for conviction; recent whale moves to cold storage signal long-term holding.

This framework leverages the 1000 btc wallets surge. For swing traders, enter long above $68,577.00 with targets at $72,000, scaling out 50% at resistance. Day traders: scalp volatility from whale alerts, but cap exposure at 1% per trade. Long-term holders: accumulate weekly, viewing $68,577.00 as a discount to $100,000 projections.

Advanced tactic: whale divergence plays. When retail sells (wallets under 1 BTC declining), counter with buys. Binance and CoinDCX data show 104,000-270,000 BTC grabs amid retail pullback – a divergence fueling 30% average gains historically.

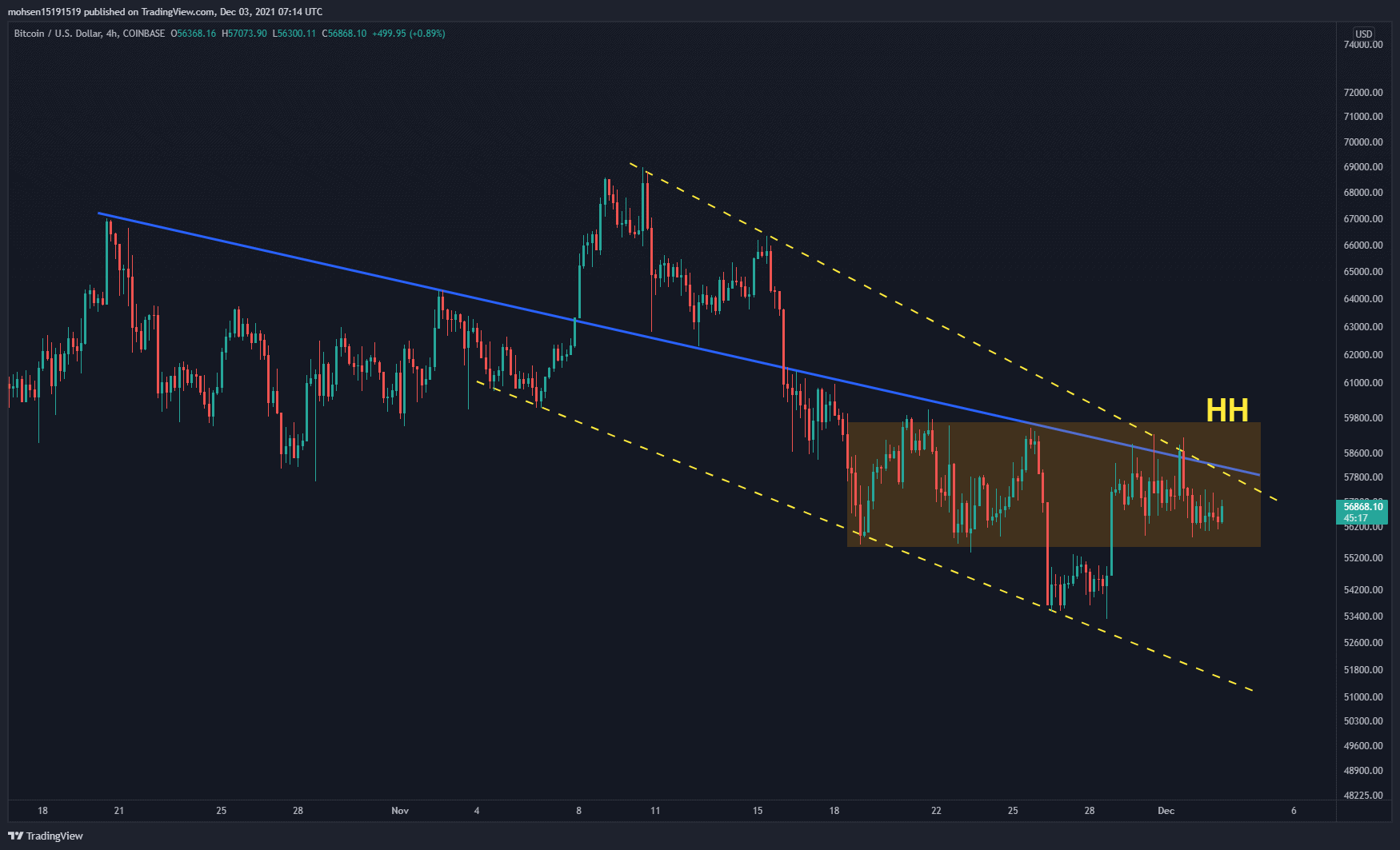

Bitcoin Technical Analysis Chart

Analysis by Evan Whitmore | Symbol: BINANCE:BTCUSDT | Interval: 1D | Drawings: 7

Technical Analysis Summary

As Evan Whitmore, apply conservative trend lines from the 2026 May low to September peak (uptrend), and the subsequent downtrend channel to current levels around $68,577. Mark key support at $64,872 (24h low) with horizontal_line, resistance at $71,612 (24h high) similarly. Use fib_retracement from peak ~$120,000 to recent low for pullback levels. Rectangle for recent consolidation Nov 2026. Callouts for whale accumulation context and MACD bearish crossover. Arrows for potential bounce from support. Date_range for whale news impact period.

Risk Assessment: medium

Analysis: Technical correction in downtrend channel but fundamental whale buying provides floor; volatility high post-5.71% daily gain

Evan Whitmore’s Recommendation: Hold cash or scale in longs below $65K with tight stops; prioritize risk management over chasing rallies

Key Support & Resistance Levels

📈 Support Levels:

-

$64,872 – 24h low and psychological support near 65K, whale buying zone

strong -

$60,000 – Prior swing low from Oct 2026, macro support

moderate

📉 Resistance Levels:

-

$71,612 – 24h high, immediate overhead supply

moderate -

$80,000 – 50% fib retracement from peak, key resistance

strong

Trading Zones (low risk tolerance)

🎯 Entry Zones:

-

$65,500 – Dip buy near strong support if volume confirms whale accum, aligns with low risk tolerance

low risk -

$68,577 – Break above current price on MACD bullish cross for conservative long

medium risk

🚪 Exit Zones:

-

$75,000 – Initial profit target at prior resistance

💰 profit target -

$62,000 – Tight stop below key support to manage downside

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Increasing on dips, confirming whale accumulation despite retail sell-off

Volume spikes on pullbacks to 65K align with on-chain whale data (104K BTC added)

📈 MACD Analysis:

Signal: Bearish crossover but histogram contracting, potential bullish divergence

MACD line below signal but momentum waning near support, watch for reversal

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Evan Whitmore is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (low).

Risks and Balanced Perspective

No signal is infallible. AInvest raises valid flags: surges in mid-tier whales (1,000-10,000 BTC) could stem from rebalancing, not conviction. Regulatory headwinds or macro shifts – like rate hikes – might overwhelm on-chain bullishness. At $68,577.00, overbought risks loom if RSI climbs past 70.

Mitigate with diversification. Yahoo Finance notes ETH and LINK whale parallels; allocate 20-30% there for correlation hedge. Position sizing trumps prediction: never risk more than 2% on BTC alone. Opinion: whales provide the map, but execution charts the course. BingX and BeInCrypto trends confirm four-month highs in wallet counts, yet pair with volume confirmation.

Forward-looking, 2026 shapes as pivotal. With halving echoes fading and ETF maturation, sustained bitcoin whale accumulation could propel past $80,000. Santiment’s 104,340 BTC add sets the stage; watch for 2,100 and wallets as breakout trigger. Investors attune to these rhythms position ahead of the herd, turning data into durable edges.

| Metric | Current Value | Implication |

|---|---|---|

| Whale Wallets (1,000 and BTC) | 2,014 | Bullish accumulation |

| Total Whale Holdings | 7.17M BTC | Supply shock potential |

| 24h BTC Price | $68,577.00 | Resilient above low |

| Address Growth (MoM) | 3.5% | Historical rally precursor |

Whales move silently, but their shadows lengthen across charts. In a market rewarding vigilance, these signals at $68,577.00 invite calculated conviction over crowd frenzy.