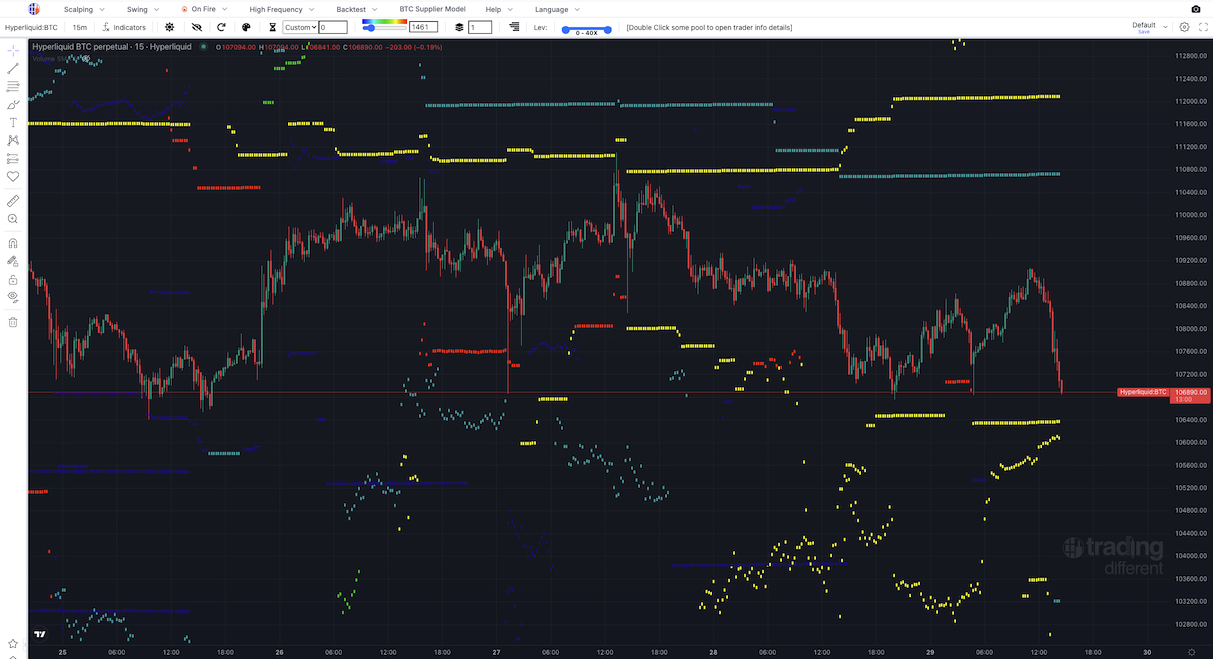

In the high-stakes arena of crypto leverage trading, where fortunes flip faster than a Bitcoin candle, most traders don’t blow up from bad luck. They self-destruct through preventable errors that amplify tiny market wiggles into portfolio Armageddon. Picture this: a modest 2% dip in Ethereum’s price wipes out a 50x position, leaving you with nothing but screenshots of greener days. With volatility spiking amid regulatory whispers and ETF inflows, these crypto leverage trading mistakes hit harder than ever. Seasoned traders whisper about the “10x blowups, ” those catastrophic losses where overconfidence meets margin calls. Drawing from real exchange data and trader post-mortems, here are five hard lessons etched in liquidations.

5 Deadly Leverage Mistakes

-

Over-Leveraging Positions Beyond 20x: Using high leverage like 50x amplifies tiny 2% moves into full liquidations, as warned by MEXC and Medium experts. Stick to 5x-10x max, per Binance and Aurra Markets, to survive volatility.

-

Ignoring Funding Rates in Perpetual Contracts: Perpetual futures funding rates can erode positions over time, especially in skewed markets. Coinbase highlights this pitfall—monitor rates on Binance or Bybit to avoid surprise costs.

-

Failing to Implement Stop-Loss Orders: Without stop-losses, a 10% drop on 10x leverage equals total wipeout, notes Changelly. Blum.io and Binance stress always setting them 2-5% below entry for protection.

-

Holding Losing Positions Without Exit Strategy: Emotional holding turns small losses into 10x blowups, per Coinbase and WunderTrading. Define exit rules upfront to cut losses at 1-2% of capital.

-

Neglecting Position Sizing in Volatile Markets: Oversized positions in low-liquidity periods amplify risks, as MEXC advises. Risk only 1-2% per trade, adjusting for volatility on exchanges like Binance.

Lesson 1: Over-Leveraging Positions Beyond 20x

The siren song of high leverage tempts novices and veterans alike. Crank it to 50x or 100x, and a 1% price pop promises 50-100% gains. But flip the script: that same 1% drop triggers instant liquidation. Sources like Changelly note a mere 10x leverage position evaporates on a 10% adverse move, with no warnings from most exchanges. Push beyond 20x, as Medium’s Gal Mux warns, and you’re courting disaster in crypto’s choppy waters.

Quantitative analysis reveals why: leverage multiplies volatility exponentially. In 2024’s flash crashes, traders using 30x and on BTC futures saw 70% of positions liquidated within hours, per Binance data. My advice? Cap at 5-10x max. This balances upside without courting ruin. Greed whispers “just this once, ” but data screams restraint.

Leverage Level vs. Adverse Price Move to Liquidation (assuming 100% collateral)

| Leverage Level | Adverse Price Move to Liquidation |

|---|---|

| 5x | 20% |

| 10x | 10% |

| 20x | 5% |

| 50x | 2% |

Lesson 2: Ignoring Funding Rates in Perpetual Contracts

Perpetual futures, the workhorse of crypto leverage, hide a silent killer: funding rates. These periodic payments between long and short holders keep contract prices tethered to spot. Ignore them, and your “winning” position bleeds dry. Coinbase highlights this pitfall; in bull runs, longs pay shorts hefty fees, turning 20% gains into break-even or worse over days.

Real-world math: at 0.1% hourly funding (common in heated markets), a $10,000 position costs $24 daily. Stretch to a week, that’s $168 vanished before price budges. MEXC data shows low-liquidity periods amplify this, as rates spike to 1% and. Smart traders monitor via exchange dashboards, flipping sides or derisking when rates turn toxic. Neglect this, and your 10x dream morphs into a slow-motion squeeze.

Lesson 3: Failing to Implement Stop-Loss Orders

Stop-loss orders aren’t optional; they’re your margin call firewall. Yet surveys show 40% of retail traders skip them, per WunderTrading insights, betting on “it’ll bounce. ” Reality check: crypto dumps 5-10% intraday routinely. Without stops, a winnable dip cascades into liquidation.

Aurra Markets advocates modest leverage paired with tight stops at 1-2% below entry. Example: enter BTC long at $95,000 with 10x; set stop at $93,000 caps loss at 2% of collateral. Blum. io echoes: combine with take-profits for asymmetry. Emotions sabotage here; fear of “stop hunting” leads to overrides. Data proves otherwise: backtests on Bybit show stop-users survive 3x longer in drawdowns. Discipline trumps hope every time.

Lesson 4: Holding Losing Positions Without Exit Strategy

Average through the dip sounds noble until it bankrupts you. Traders cling to underwater leverage positions, praying for reversal, but crypto’s momentum often accelerates against them. Coinbase flags this as a top pitfall: holding losers too long turns 5% drawdowns into 50% wipeouts via compounded fees and margin pressure. Without a predefined exit, emotions hijack logic, spawning revenge trades that compound the carnage.

Consider perpetuals on Ethereum during a sentiment shift; a 3% drop on 15x leverage demands more collateral or forces closure. Data from Binance reveals 60% of liquidated accounts showed prolonged holding periods exceeding 24 hours in red territory. Craft an exit strategy upfront: trailing stops or time-based reviews at 4-8 hour marks. This enforces discipline, preserving capital for higher-probability setups. My take: treat every trade like a business decision, not a casino bet. Cut clean, live to trade another wick.

Lesson 5: Neglecting Position Sizing in Volatile Markets

Even perfect entries fail without proper sizing. In crypto’s wild swings, dumping 20% of your stack into one 10x bet ignores volatility’s bite. MEXC stresses stricter rules during low liquidity, where slippage turns planned 2% risks into 10% realities. Traders overlook this, scaling uniformly across assets, only to see correlated dumps ravage portfolios.

Robust sizing ties position value to account risk and asset volatility. Formula: Position Size = (Account Risk % × Capital)/(Stop Loss Distance % × Leverage). For a $50,000 account risking 1% ($500), 5% stop on 10x BTC: size caps at $10,000 notional. Blum. io advocates right-sizing to dodge liquidation cascades. Backtests on high-vol periods like 2024 halvings show sized portfolios outlive reckless ones by 4x. Adapt to conditions: halve sizes when VIX-equivalent crypto fear-greed spikes above 70.

Position Sizing Guidelines for Crypto Leverage (1% Account Risk)

| Volatility Level | Daily Volatility | % of Capital | Max Leverage |

|---|---|---|---|

| Low Vol (BTC) | ±2% daily | 5% | 5x |

| Med Vol | ±5% | 2.5% | 10x |

| High Vol | ±10% | 1% | 5x max |

These lessons, forged in the fires of real 10x leverage crypto risks, underscore one truth: survival beats heroics. Platforms like Binance preach buffers and stops, yet execution falters without habit. Monitor dashboards religiously, backtest your rules on historical dumps, and scale in gradually during uncertainty. For deeper dives on navigating corrections, check our guide on beginner protection strategies. Master these, and you’ll sidestep the avoid crypto liquidation graveyard, trading with edge instead of edge-of-seats panic. Discipline compounds; denial detonates.