In the current market environment, with Bitcoin hovering at $67,908.00 after a modest 24-hour dip from a high of $69,999.00, investors seeking indirect exposure to BTC’s movements are turning their attention to stocks like Metaplanet Inc. (3350. T). This Japanese firm has aggressively built a Bitcoin treasury, holding approximately 30,823 BTC as of November 2025, positioning it as the fourth-largest corporate holder worldwide. Trading Metaplanet stock during these 67K dips offers a leveraged play on Bitcoin’s recovery potential, but it demands a disciplined, data-driven approach amid the stock’s own volatility.

[price_widget: Real-time Bitcoin USD price and 24h change]

Metaplanet’s pivot from hospitality roots to a Bitcoin-centric entity mirrors the strategies of firms like MicroStrategy, yet its Tokyo Stock Exchange listing adds unique accessibility for Asian markets and yen-based investors. As BTC tests support near $67,908.00, Metaplanet’s shares, last trading at 405 JPY on December 30,2025, present an opportunity to capitalize on correlated upside without direct crypto custody risks.

Metaplanet’s BTC Accumulation: A Yield-Focused Powerhouse

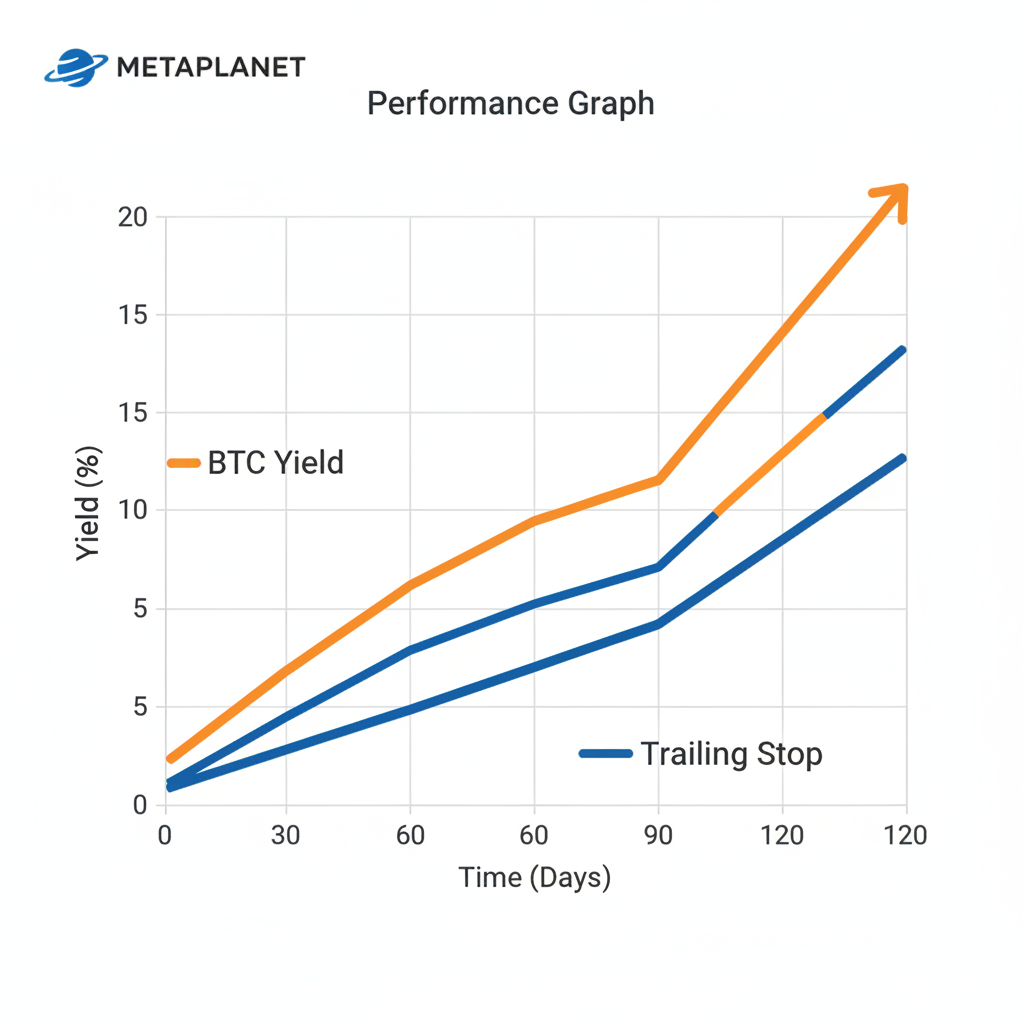

Metaplanet’s commitment to Bitcoin stands out through its innovative “BTC Yield” metric, which clocked in at an astonishing 487% year-to-date in 2025. This measures the growth in Bitcoin per share, underscoring the company’s relentless buying during dips. Even as Bitcoin slumped, prompting a stock slide to levels like 340 JPY, management reaffirmed its strategy, raising funds via preferred shares like MARS and MERCURY to fuel further accumulation. The MERCURY class, priced at 900 JPY each, targeted 21.25 billion yen ($150 million) with a 4.9% dividend yield and conversion options tied to common shares.

Metaplanet holds Bitcoin plan firm despite 50% crash and stock slide.

This resilience shines in contrast to miners like Riot Platforms, whom Metaplanet surpassed with 20K BTC holdings earlier. Now at 30,823 BTC, the treasury dwarfs many peers, offering pure exposure less diluted by operational costs. For 2026, fiscal forecasts project revenue of 16 billion yen and operating profit of 11.4 billion yen, banking on Bitcoin’s rebound from $67,908.00 levels.

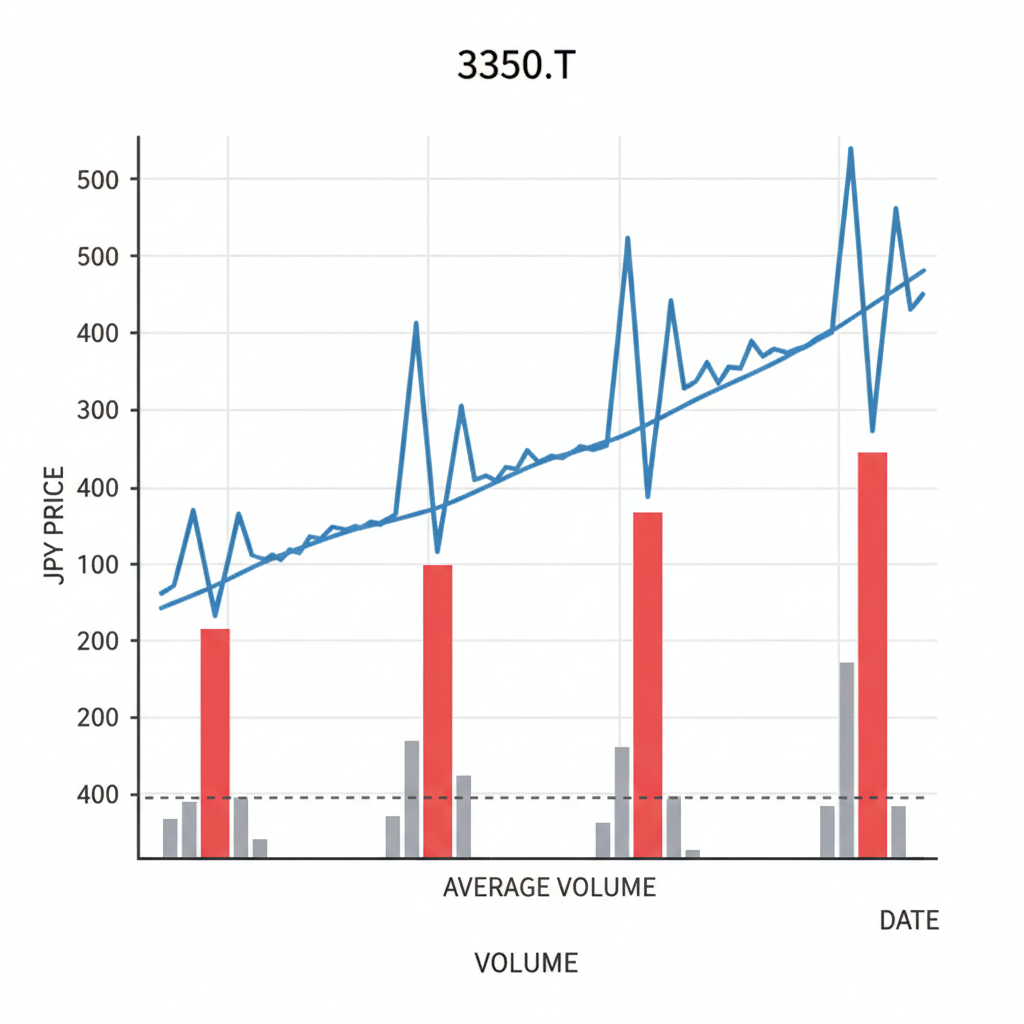

Navigating Stock Volatility as a Bitcoin Proxy

Metaplanet stock trading as a Bitcoin proxy in 2026 demands understanding its sensitivity. Shares plunged 82% from a 1,930 JPY peak to 340 JPY amid BTC weakness, yet rebounded to 540 JPY intraday highs in January. The recent 405 JPY close reflects broader market cooldowns, but a 150 million share buyback in October 2025 signaled capital efficiency. This move briefly spiked the stock to 540 JPY before retracing to 500 JPY support.

Compared to U. S. proxies like MARA or RIOT, Metaplanet offers advantages in Japan’s stable regulatory backdrop and lower correlation to equity beta. During BTC’s 24-hour low of $67,329.00, Metaplanet’s implied treasury value provides a floor, with each BTC at $67,908.00 amplifying share gains on recovery. However, fundraising reliance on equity issuance introduces dilution risk if shares crater further.

Metaplanet (3350.T) Stock Price Prediction 2027-2032

Forecasts as Bitcoin Proxy Amid Market Dips and Accumulation Strategy (Prices in ¥)

| Year | Minimum Price (¥) | Average Price (¥) | Maximum Price (¥) | YoY % Change (Avg)* |

|---|---|---|---|---|

| 2027 | ¥400 | ¥1,000 | ¥2,500 | +100% |

| 2028 | ¥800 | ¥2,000 | ¥5,000 | +100% |

| 2029 | ¥1,500 | ¥3,500 | ¥8,000 | +75% |

| 2030 | ¥2,500 | ¥5,500 | ¥12,000 | +57% |

| 2031 | ¥4,000 | ¥8,000 | ¥18,000 | +45% |

| 2032 | ¥6,000 | ¥11,500 | ¥25,000 | +44% |

Price Prediction Summary

Metaplanet (3350.T) is poised for significant growth as a premier Bitcoin treasury company, with average stock prices projected to rise from ¥1,000 in 2027 to ¥11,500 by 2032. This bullish outlook reflects Bitcoin’s expected long-term appreciation, the company’s aggressive BTC accumulation (currently ~30,823 BTC), and improving fundamentals, though wide min/max ranges account for crypto volatility and market dips.

Key Factors Affecting Metaplanet Stock Price

- Bitcoin price trends and volatility as primary driver given proxy role

- Metaplanet’s BTC holdings growth and ‘BTC Yield’ performance

- Capital raises via preferred shares (e.g., MARS/MERCURY) supporting accumulation

- Fiscal profitability: 2026 revenue forecast ¥16B, op. profit ¥11.4B

- Japanese regulatory environment and global crypto adoption

- Broader economic conditions, share buybacks, and hospitality pivot risks

Disclaimer: Stock price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, economic conditions, and other factors.

Always do your own research before making investment decisions.

Strategic Entry Points During 67K Dips

For crypto stocks Japan enthusiasts, timing Metaplanet entries around Bitcoin’s $67,908.00 zone is key. Historical patterns show outsized rallies post-dips: after overtaking Riot with 20K BTC, shares closed at 831 JPY despite a 5.5% drop. Use technical support at 400-500 JPY for longs, targeting BTC resistance near prior highs. Risk management is paramount; position sizes should cap at 2-5% of portfolio, with stops below 350 JPY to guard against prolonged BTC slumps.

Layer in macroeconomic tailwinds: Japan’s yield curve control and safe-haven yen flows could bolster Metaplanet as BTC consolidates. Pair this with options on 3350. T for defined risk, emulating Bitcoin proxy stocks 2026 plays. While pure BTC holding avoids exchange hacks, Metaplanet’s model trades liquidity premium for volatility alpha.

Japan’s regulatory clarity further distinguishes Metaplanet in the crypto stocks Japan landscape, shielding it from the U. S. miners’ energy cost squeezes and SEC scrutiny. At Bitcoin’s current $67,908.00 perch, following a dip to $67,329.00, Metaplanet’s 30,823 BTC treasury implies a valuation floor that peers struggle to match without operational drag.

Metaplanet vs. MARA and RIOT: Holdings and Yield Breakdown

Stacking Metaplanet against Marathon Digital (MARA) and Riot Platforms (RIOT) reveals its pure-play edge. While miners grapple with hash rate competition and halving aftershocks, Metaplanet’s 3350. T Bitcoin holdings deliver unlevered exposure. Its BTC Yield of 487% in 2025 crushes industry norms, even as shares hovered near 405 JPY.

Bitcoin Proxy Stocks Comparison: Metaplanet (3350.T), MARA, RIOT

| Company | Ticker | BTC Holdings | BTC Yield YTD 2025 | Current Stock Price (JPY/USD equiv.) | 52-Wk High/Low |

|---|---|---|---|---|---|

| Metaplanet Inc. | 3350.T | 30,823 BTC | 487% | ¥540.3 (~$3.43) | ¥1,930 / ¥340 |

| Marathon Digital Holdings | MARA | N/A | N/A | N/A | N/A / N/A |

| Riot Platforms | RIOT | N/A* | N/A | N/A | N/A / N/A |

This table underscores why MARA RIOT vs Metaplanet debates favor the Japanese upstart for conservative traders. Miners’ equity dilution from ATM offerings mirrors Metaplanet’s preferred share raises, but Tokyo’s listing sidesteps Nasdaq volatility premiums. During BTC’s 24-hour slide from $69,999.00, Metaplanet’s beta to Bitcoin amplifies rebounds without mining capex black holes.

Metaplanet Buys The Dip – Securing A Massive BTC Yield of 487% YTD 2025.

Risk-Adjusted Trading Framework for 67K Dips

Trading Metaplanet stock demands more than hopium; it’s about stacking probabilities in a $67,908.00 Bitcoin backdrop. Dilution from MERCURY shares at 900 JPY poses threats if fundraising stalls below 400 JPY support. Yet, the 150 million share buyback provides a backstop, echoing buybacks that juiced shares to 540 JPY. Opinion: at these levels, Metaplanet’s asymmetry tilts bullish for patient holders, outpacing direct BTC via yen depreciation tailwinds.

Macro overlays add nuance. Bank of Japan’s policy pivot could weaken the yen, inflating Metaplanet’s BTC-denominated gains in local currency. Pair this with global risk-off flows favoring Bitcoin proxy stocks 2026, and 3350. T emerges as a tactical overlay for diversified portfolios.

Executing this framework during trade Metaplanet during BTC dip cycles has historically yielded sharp recoveries, like the post-20K BTC announcement at 831 JPY. Scale in on weakness, but hedge with yen futures if Tokyo yields spike. For 2026, aggressive forecasts of 16 billion yen revenue hinge on Bitcoin sustaining above $67,908.00, with operating profit at 11.4 billion yen as the litmus test.

Metaplanet’s trajectory, from 340 JPY troughs to treasury dominance, cements its role in savvy rotations. As Bitcoin probes these levels, 3350. T offers leveraged conviction without wallet keys – a pragmatic pivot for the data-driven investor navigating 2026’s chop.