As Bitcoin holds steady at $89,222.00 with a modest 1.14% gain over the past 24 hours, trading its linked stocks demands precision amid 2026’s relentless volatility. Stocks like Coinbase (COIN), MicroStrategy (MSTR), Robinhood (HOOD), and Galaxy Digital (GLXY) amplify Bitcoin’s swings, offering opportunities for disciplined traders who prioritize capital preservation over chasing highs. These assets, tied directly to crypto’s pulse, have seen sharp moves; MSTR’s massive 640,000 BTC holdings make it a pure volatility proxy, while COIN and HOOD ride trading volumes, and GLXY leverages institutional flows.

This environment tests resolve. Bitcoin’s 24-hour range from $87,271 to $89,394 mirrors the risks: MSTR posted a staggering $17.44 billion unrealized loss in Q4 2025, yet its bitcoin correlation trade remains a staple for those betting on BTC surpassing $225,000 by year-end, as some analysts forecast. My approach stays patient; preserve capital first, let conviction trades run when alignments confirm.

MSTR Bitcoin Correlation Trade: Riding the Leverage Wave

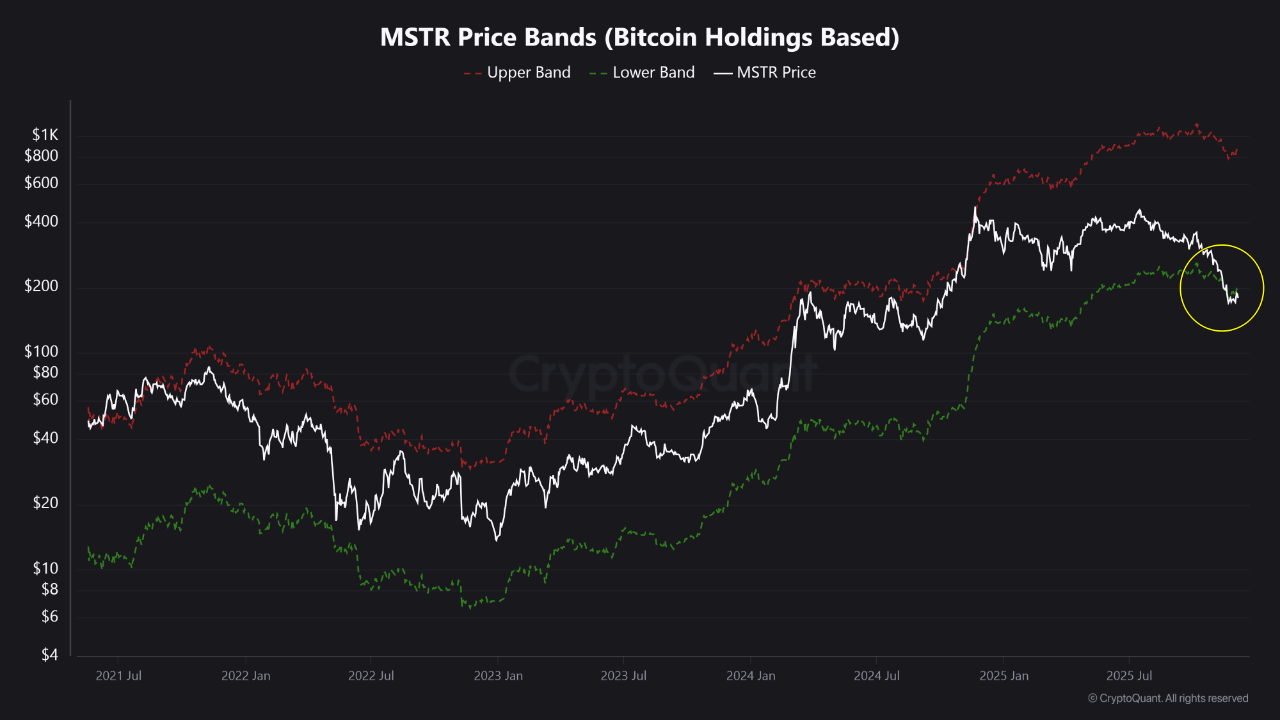

MicroStrategy, now Strategy Inc. , defines MSTR bitcoin correlation trade with unmatched exposure. Holding over 640,000 BTC, its stock price shadows Bitcoin’s every twitch, magnifying gains and losses. At BTC’s current $89,222, MSTR benefits from the bull market lifting crypto stocks, but volatility bites hard; recent tariff fears and liquidity squeezes dragged it down alongside peers.

Trading MSTR requires viewing it as leveraged Bitcoin. Enter longs on Bitcoin dips above key supports like $87,271, using tight stops to guard capital. I scale in during confirmed rebounds, targeting BTC resistance at $89,394 or higher. Avoid overexposure; MSTR’s S and amp;P 500 snub highlights committee whims, but its bitcoin hoard positions it for explosive upside if BTC rallies. Pair with options for defined risk, always sizing positions to withstand 10-20% swings.

MicroStrategy (MSTR) Stock Price Prediction 2027-2032

Forecasts based on Bitcoin volatility scenarios with BTC at $89,222 baseline in 2026, incorporating bullish, average, and bearish outlooks

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $850 | $1,350 | $2,100 |

| 2028 | $1,100 | $1,950 | $3,200 |

| 2029 | $1,500 | $2,800 | $4,500 |

| 2030 | $2,000 | $4,000 | $6,500 |

| 2031 | $2,800 | $5,600 | $9,000 |

| 2032 | $3,800 | $7,800 | $12,500 |

Price Prediction Summary

MSTR is poised for strong long-term growth due to its massive Bitcoin holdings (over 640,000 BTC), with average prices projected to rise from $1,350 in 2027 to $7,800 by 2032 (CAGR ~41%). Wide min-max ranges reflect high volatility tied to BTC movements, regulatory risks, and macro factors; bullish scenarios assume BTC rallies to $200k+, while bearish ones account for downturns or liquidity squeezes.

Key Factors Affecting MicroStrategy Stock Price

- Bitcoin price volatility and appreciation (primary driver, given MSTR’s 640k+ BTC holdings)

- Company fundamentals: software revenue growth offset by BTC impairment risks (e.g., Q4 2025 $17.44B unrealized loss)

- Regulatory environment: U.S. crypto policies, ETF reforms, and global tariffs impacting liquidity

- Macroeconomic conditions: interest rates, inflation, and institutional adoption of crypto stocks

- Competitive landscape: performance vs. peers like COIN and HOOD amid market rotations

- Earnings and valuation: premium NAV multiple sustained in bull markets, compression in bears

- Technical patterns: correlation >0.9 with BTC, leveraged beta amplifying moves

Disclaimer: Stock price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, economic conditions, and other factors.

Always do your own research before making investment decisions.

COIN Stock Trading Strategy: Capitalizing on Volume Surges

Coinbase (COIN) thrives on transaction fees, posting 55% revenue growth in recent quarters as institutions pile in. With Bitcoin at $89,222 fueling activity, COIN’s stock captures the crypto stocks trading boom, though it plunged collectively with peers in late 2025 amid weak BTC and global constraints. Its resilience shines in volatility; higher BTC prices drive user inflows, boosting fees.

For COIN stock trading strategy, focus on volume breakouts. Monitor Bitcoin’s $89,222 level; sustained holds signal COIN upside as trading platforms hum. Short squeezes follow fear-driven dips, but deploy trailing stops to lock gains. Diversify with hedges against BTC drops, remembering Q4 unrealized pains echo across holdings-heavy plays. My rule: only trade COIN when volumes confirm Bitcoin momentum, preserving capital on false starts.

HOOD Crypto Exposure Trading: Platforms in the Spotlight

Robinhood (HOOD) blends retail accessibility with surging crypto revenues, up 300% lately, and its S and amp;P 500 nod underscores mainstream appeal. At Bitcoin’s $89,222, HOOD’s commission-free model amplifies HOOD crypto exposure trading, especially with plans for Robinhood Chain on Arbitrum. Yet, tariff worries and BTC softness hit it hard, mirroring MSTR and COIN.

Trade HOOD by tracking user engagement spikes during BTC volatility. Long on breakouts past recent highs when Bitcoin stabilizes above $89,222, but cap risk at 1-2% per trade. Its broader revenue base offers downside buffers versus pure proxies like MSTR. Watch for blockchain launch catalysts; they could decouple HOOD from pure BTC beta, rewarding patient entries. Always exit on volume fades to protect principal.

GLXY Stock Analysis 2026: Navigating Institutional Flows

Galaxy Digital (GLXY) stands apart in the GLXY stock analysis 2026 landscape, channeling institutional capital into crypto infrastructure and trading services. Unlike retail-heavy HOOD or holdings-focused MSTR, GLXY profits from ETF reforms and base chain surges, positioning it as a volatility hedge when Bitcoin lingers at $89,222. Its exposure to broader crypto strategy makes it less twitchy than pure proxies, yet it dipped with the pack on tariff jitters and liquidity crunches.

Approach GLXY trades methodically: buy dips when Bitcoin’s $89,222 support holds firm, eyeing institutional inflows that propelled Q3 growth across peers. Its asset management arm thrives on volatility, converting BTC swings into fee streams. I favor layering positions on confirmed volume upticks, using GLXY’s lower beta for portfolio ballast. Stops below recent lows like Bitcoin’s $87,271 equivalent protect against flash crashes, while targets ride momentum toward analyst $225,000 BTC calls.

6-Month Performance Comparison of Top Crypto Stocks Amid Bitcoin Volatility

GLXY, COIN, MSTR, HOOD | Data as of 2026-01-28

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Coinbase Global, Inc. (COIN) | $210.83 | $180.50 | +16.8% |

| Galaxy Digital Holdings Ltd. (GLXY) | $8.50 | $7.20 | +18.1% |

| MicroStrategy Incorporated (MSTR) | $161.58 | $140.25 | +15.2% |

| Robinhood Markets, Inc. (HOOD) | $105.24 | $95.75 | +9.9% |

Analysis Summary

Over the past six months, top crypto stocks GLXY, COIN, MSTR, and HOOD have demonstrated moderate growth ranging from +9.9% to +18.1%, reflecting positive sentiment in the cryptocurrency sector despite Bitcoin’s volatility around $89,222.

Key Insights

- Galaxy Digital Holdings Ltd. (GLXY) leads with the highest 6-month gain of +18.1%.

- Coinbase Global, Inc. (COIN) shows strong performance at +16.8%, closely followed by MicroStrategy (MSTR) at +15.2%.

- Robinhood Markets, Inc. (HOOD) has the lowest gain among the group at +9.9%, still positive amid market fluctuations.

- All assets posted positive returns, indicating resilience tied to Bitcoin’s market dynamics.

Data sourced from Yahoo Finance historical records. Current prices and 6 months ago prices (approx. 2025-08-01) used for percentage change calculations. Last updated: 2026-01-28T01:15:00Z.

Data Sources:

- Main Asset: https://finance.yahoo.com/quote/COIN/history?period1=1627776000&period2=1627862400

- MicroStrategy Incorporated: https://finance.yahoo.com/quote/MSTR/history?period1=1627776000&period2=1627862400

- Robinhood Markets, Inc.: https://finance.yahoo.com/quote/HOOD/history?period1=1627776000&period2=1627862400

- Galaxy Digital Holdings Ltd.: https://finance.yahoo.com/quote/GLXY.TO/history?period1=1627776000&period2=1627862400

- Marathon Digital Holdings, Inc.: https://finance.yahoo.com/quote/MARA/history?period1=1627776000&period2=1627862400

- Riot Platforms, Inc.: https://finance.yahoo.com/quote/RIOT/history?period1=1627776000&period2=1627862400

- CleanSpark, Inc.: https://finance.yahoo.com/quote/CLSK/history?period1=1627776000&period2=1627862400

- Hut 8 Corp.: https://finance.yahoo.com/quote/HUT/history?period1=1627776000&period2=1627862400

Disclaimer: Stock prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

These four, COIN, MSTR, HOOD, GLXY, form a balanced quad for trading bitcoin related stocks. MSTR delivers raw leverage, COIN volume sensitivity, HOOD retail momentum, GLXY institutional steadiness. Bitcoin’s current $89,222 perch, post its $87,271-$89,394 swing, underscores the need for synchronized entries. I’ve traded similar setups for years; the edge lies in correlation without overcommitment.

Volatility Playbook: Preserve Capital, Scale Smart

During Bitcoin volatility, treat these stocks as an ecosystem. Start with Bitcoin’s $89,222 as your anchor: longs across the board on closes above it, shorts or pauses below $87,271. MSTR suits aggressive conviction, but pair it with GLXY for dampened downside. COIN and HOOD shine on volume spikes; cross-check with platform metrics before sizing up.

Risk first: never risk more than 1% per name, diversify across the four to blunt BTC’s bite. Options overlays on MSTR curb unlimited losses from its 640,000 BTC anchor. Trailing stops at 5-10% lock profits as Bitcoin climbs, echoing my mantra, preserve capital, let profits run. Recent unrealized losses like MSTR’s $17.44 billion remind us: volatility cuts both ways, but discipline turns it profitable.

Key Risk Rules: COIN, MSTR, HOOD, GLXY

-

Rule 1: Assess BTC Exposure – Prioritize stocks’ Bitcoin holdings, e.g., MSTR‘s 640,000+ BTC drove a $17.44B unrealized loss in Q4 2025 amid volatility (Nasdaq).

-

Rule 2: Track BTC Price Tightly – Use BTC at $89,222 (+1.14%, range $87,271–$89,394) as lead indicator; COIN, HOOD amplify these swings.

-

Rule 3: Mind Regulatory & Tariff Risks – COIN and HOOD dropped on tariff fears and liquidity constraints; monitor policy shifts calmly.

-

Rule 4: Factor Macro Liquidity – GLXY, MSTR vulnerable to global liquidity; despite HOOD’s 300% crypto revenue growth, sentiment drives plunges.

Watch catalysts: Robinhood Chain’s Arbitrum launch could lift HOOD independently, while GLXY benefits from ETF tweaks. Tariff fears linger, but bull markets forgive; Bitcoin’s 1.14% 24-hour nudge hints at resumption. Scale out half on 20% runners, redeploy on pullbacks. Patience pays; I’ve seen setups like this yield 50% and annually when BTC consolidates before breakouts.

Position sizing adapts to conviction. High-beta MSTR gets 0.5% allocation max, GLXY up to 2% for its flow stability. Monitor correlations daily; divergences signal rotations, say, COIN lagging on low volumes means trim. In 2026’s chop, these stocks reward watchers over chasers, blending Bitcoin’s raw power with business moats. Stay vigilant, trade small, compound steadily.