Bitcoin hovers at $89,509, mere inches from the $90,000 support that’s morphed into an accumulation battleground. Corporate heavyweights keep scooping up BTC here despite $1.1 billion ETF outflows, while tariff threats jolt crypto stocks like MSTR and COIN. With BTC’s 24-hour low scraping $88,598 and high touching $91,002, this level screams opportunity for traders eyeing bitcoin 90k support trading. MSTR sits at $163.11 after dipping to $158.77, its massive Bitcoin stash amplifying every twitch. COIN, at $216.95, mirrors the exchange frenzy, down from $223.77. Cross-market ripples from traditional equities underscore why coinbase stock bitcoin correlation and microstrategy mstr bitcoin holdings demand sharp focus.

Illiquid order books bolster this zone, as recent dips under $90K triggered 8% plunges in MSTR yet sparked after-hours rebounds when BTC clawed back. Institutional consolidation, cooling inflation signals, and MicroStrategy’s relentless hoarding to 673,783 BTC paint a resilient picture. Yet volatility lurks, with tariff shadows and ETF flows dictating the next leg.

Decoding the $90K Pivot for BTC ETF Plays

Spot Bitcoin ETFs like IBIT and GBTC front the charge here. Outflows haven’t crushed prices, hinting at corporate dip-buying divergence. My cross-disciplinary lens, blending crypto with equity flows, spots btc etf trading strategies thriving on this disconnect. Strategy one: Scale-In Long BTC ETFs at $90K Support. Accumulate IBIT or GBTC as BTC tests this accumulation zone amid outflows, targeting $95K rebound with stop-loss below $88K. Volumes in IBIT soared on recent pops above $90,000, validating entry timing.

Strategy four complements this: BTC ETF Pairs Trade vs. Outflows. Go long spot ETFs like ARKB, short GBTC on persistent redemptions, capitalizing on $90K corporate buying. This hedges flow noise while riding underlying strength, a tactic honed from traditional pairs trading in volatile sectors.

MSTR’s Leveraged Edge in the Support Squeeze

MSTR’s 252K and BTC holdings (part of its larger treasury) lever it 2-3x against pure BTC, fueling wild swings from $158.77 to $168.93. Post-8% tank on sub-$90K BTC, after-hours gains signal stabilization. Strategy two: Leveraged MSTR Long on Bitcoin Hold. Snap up shares or calls on BTC steadying above $90K, chasing correlation-fueled rallies. I’ve seen this playbook crush it when Bitcoin proxies like MSTR decouple briefly from broader equities, especially with Saylor’s unyielding accumulation defying sell-off warnings.

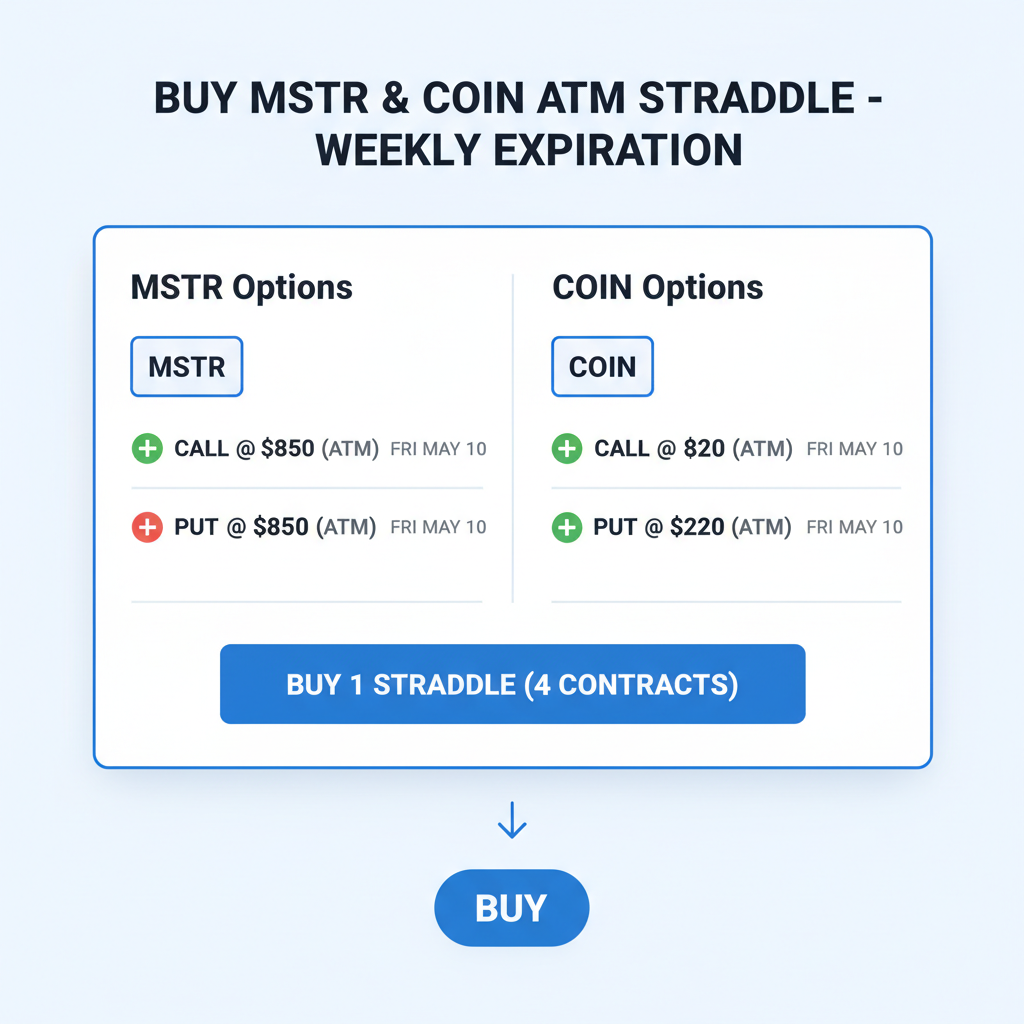

Options traders, take note of strategy five: Volatility Straddle on MSTR/COIN Options. Roll out at-the-money straddles expiring weekly around BTC’s $90K test, harvesting spikes from tariff jitters and support skirmishes. MSTR’s beta makes it a volatility magnet, blending crypto purity with stock leverage.

Bitcoin (BTC) Price Prediction 2027-2032

Long-term forecasts amid $90K support test, incorporating trading strategies for COIN, MSTR, and BTC ETFs, market cycles, and adoption trends

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $80,000 | $140,000 | $220,000 | +56% |

| 2028 | $130,000 | $240,000 | $380,000 | +71% |

| 2029 | $180,000 | $340,000 | $520,000 | +42% |

| 2030 | $250,000 | $480,000 | $720,000 | +41% |

| 2031 | $350,000 | $620,000 | $950,000 | +29% |

| 2032 | $450,000 | $800,000 | $1,200,000 | +29% |

Price Prediction Summary

From a 2026 baseline of ~$90K amid $90K support testing ($95K rebound potential vs $88K downside), Bitcoin is forecasted for strong long-term growth. Average prices could climb to $800K by 2032, fueled by halvings, institutional inflows, and adoption, with min/max reflecting bearish consolidation and bullish peaks.

Key Factors Affecting Bitcoin Price

- Bitcoin halving in 2028 boosting scarcity

- Institutional ETF inflows and outflows stabilization

- Corporate accumulation (e.g., MicroStrategy’s strategy)

- Regulatory clarity and global adoption trends

- Macroeconomic hedging against inflation

- Technological upgrades and Layer-2 scaling

- Historical 4-year market cycles with progressive highs

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

COIN’s Beta Play Amid Crypto Stocks Price Analysis

COIN thrives on transaction fever, its 1.5x BTC beta shining post-dips. From $215.81 lows, $216.95 holds as BTC probes support. Strategy three: COIN Momentum Reversal Trade. Jump long after BTC slips below $90K, entering near $220 support for $250 target. High trading volumes on Coinbase signal sentiment shifts, and with crypto stocks plunging on external shocks yet rebounding on BTC holds, this captures the elastic snapback. Pair it with ETF flows for confirmation; inflows could rocket COIN as exchange kingpin.

These five prioritized strategies – scale-in ETFs, MSTR longs, COIN reversals, ETF pairs, and volatility straddles – interlock around $90K, offering layered exposure. Corporate bids counter outflows, MSTR’s hoard anchors proxies, and COIN rides volume waves, all while technicals like Stochastic bottoms flash buy signals.

| Asset | Current Price | Key Level |

|---|---|---|

| BTC | $89,509 | $90K Support |

| MSTR | $163.11 | 252K and BTC Leverage |

| COIN | $216.95 | $220 Entry |

Layering these strategies demands vigilance on cross-market correlations, where tariff tremors from traditional equities bleed into crypto volatility. At BTC’s $89,509, MSTR’s $163.11 embeds leveraged conviction via its Bitcoin treasury, while COIN’s $216.95 captures exchange flows. I’ve traded similar pivots blending equity beta with crypto purity, spotting edges when Stochastic signals bottoms amid ETF divergence.

Risk-Adjusted Execution: Fine-Tuning the Five Strategies

Scale-in longs on IBIT or GBTC shine brightest when corporate accumulation counters outflows, a pattern echoing equity dip-buying in 2022 bear markets. Pair it with the ETF pairs trade, longing ARKB against GBTC shorts, to neutralize flow distortions at this $90K fulcrum. MSTR longs demand tighter stops given its amplification; enter calls only post-stabilization above $90,000, eyes on Saylor’s hoard defying forced-sell chatter. COIN reversals leverage its 1.5x beta, but volume spikes confirm entries near $220. The straddle? Pure volatility harvest, agnostic to direction yet feasting on support battles.

Cross-disciplinary insight: Traditional fixed-income yields cooling bolster BTC as digital gold, while equity rotations favor high-beta plays like these. Yet tariff escalations could drag crypto stocks harder, amplifying MSTR’s swings. Position sizing caps at 2% per strategy, diversified across the five for balanced crypto stocks price analysis 90k.

Picture BTC grinding higher from $89,509, dragging MSTR past $163.11 toward prior highs as ETF volumes swell. COIN could snap to $250 on rebound fever, with straddles printing on the volatility crush post-breakout. Outflows persist, but microstrategy mstr bitcoin holdings anchor the proxy rally. I’ve profited from such setups by anchoring on technicals while respecting macro crosswinds, turning $90K tests into multi-asset wins.

Forward Edges: Watching the Rebound Catalysts

Technicals align: MACD crossovers hint bottoms, Stochastic oversold at this $88,598 intraday scrape. Institutional bids, evident in illiquid depth, clash with retail ETF exits, birthing arbitrage. For MSTR bulls, Saylor’s strategy persists despite breaking-point whispers, its treasury a volatility fortress. COIN benefits from platform stickiness, correlation tightening as BTC holds. Execute the pairs trade if GBTC lags, scale ETFs on every $90K probe.

These plays interweave btc etf trading strategies with stock proxies, offering granularity amid the squeeze. Corporate resolve at $89,509 suggests the support morphs into launchpad, rewarding patient accumulation over panic. Tune risk to your edge, monitor flows hourly, and let correlations connect the opportunities.