Trading crypto stocks on decentralized exchanges (DEXs) in 2025 is no longer a futuristic concept – it’s the new reality for traders seeking borderless access, 24/7 liquidity, and complete control over their assets. With tokenized equities like Apple, Tesla, and major ETFs now available on-chain through platforms such as Kraken, Bybit, and Solana’s DeFi ecosystem, investors can tap into traditional markets without ever leaving the blockchain world. But how do you actually get started? Let’s break down the essential steps to trade crypto stocks on DEXs, leveraging the latest tools and strategies for this rapidly evolving landscape.

Why Trade Crypto Stocks on Decentralized Exchanges?

The allure of DEXs lies in their transparency, autonomy, and non-custodial nature. Unlike centralized platforms that hold your funds and personal data, DEXs enable you to trade directly from your own wallet. Smart contracts execute trades automatically and transparently, ensuring you always retain full custody of your assets. In 2025, this has become especially relevant as regulatory scrutiny tightens around centralized exchanges while decentralized protocols innovate at breakneck speed.

Tokenized stocks represent shares of real-world companies issued as blockchain tokens. These digital assets are backed 1: 1 by underlying equities or synthetic derivatives and can be traded globally regardless of traditional market hours. As of November 2025, even giants like Robinhood have launched commission-free tokenized equities for EU users – a sign that mainstream adoption is here.

Step-by-Step: Setting Up for Crypto Stock Trading on a DEX

Step 1: Choose Your Platform

The first decision is which decentralized exchange supports the crypto stocks you want to trade. Leading options in 2025 include:

- Solana DeFi Ecosystem: Known for its lightning-fast transactions and low fees.

- Kraken and Bybit: Now offer tokenized stocks with seamless integration into DeFi wallets.

- Robinhood (EU): Commission-free trading of over 200 US stocks and ETFs via tokenization.

Each platform varies in terms of available assets, user interface, network fees, and regional restrictions. It’s wise to review current listings and liquidity before committing funds.

Step 2: Set Up Your Wallet

You’ll need a compatible non-custodial wallet that supports the blockchain network hosting your chosen DEX. Popular choices include Phantom (for Solana), MetaMask (for EVM chains), or Ledger hardware wallets for added security. Always back up your seed phrase securely; losing it means losing access to your assets permanently.

Navigating Tokenized Stocks: What Makes Them Unique?

The mechanics of trading tokenized stocks differ from both traditional equities and pure cryptocurrencies. Here’s what sets them apart in the decentralized world:

- Fractional Ownership: Buy micro-shares with minimal capital – perfect for diversifying across many companies without large upfront costs.

- No Market Closures: Trade Apple or S and P500 tokens at midnight or during weekends; global liquidity never sleeps on-chain.

- KYC-Light Access: Many DEXs require only wallet connection rather than invasive identity checks (though some regulated platforms may differ).

- Synthetic vs Asset-Backed: Some tokens are directly backed by real shares held by custodians; others use synthetic derivatives to replicate price action. Always check disclosure details before trading.

The Role of Smart Contracts and Security

Your trades are executed by smart contracts – bits of code that automate market orders transparently without human intervention. This reduces counterparty risk but places security responsibility squarely on the user; double-check contract addresses and beware phishing attempts masquerading as legitimate exchanges.

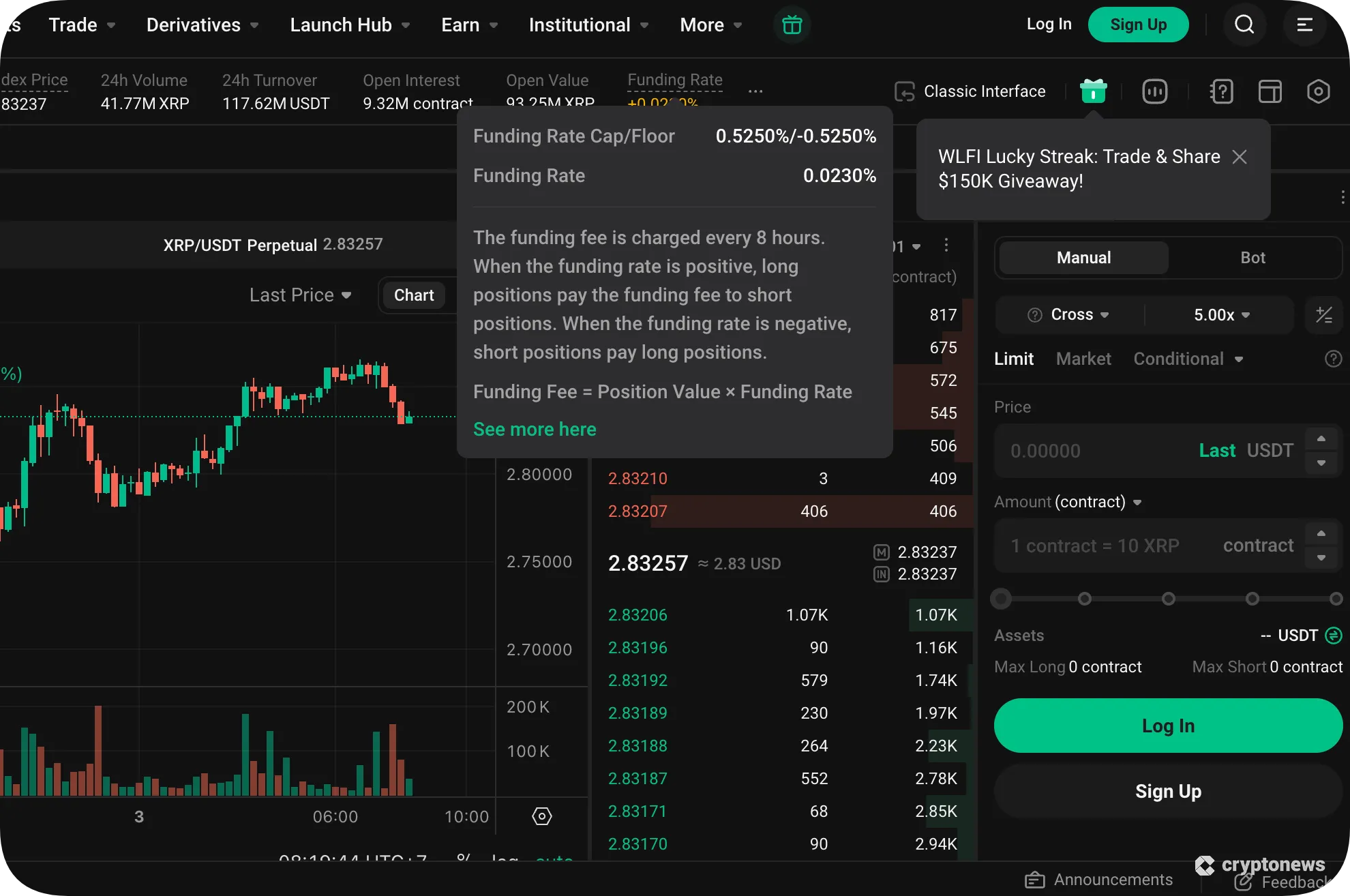

Once your wallet is funded and connected, you’re ready to explore the trading interface of your chosen DEX. Most decentralized exchanges in 2025 offer intuitive dashboards with real-time charts, order books, and simple swap functions. Still, it’s crucial to understand the nuances of placing trades in a non-custodial environment.

Executing Your First Trade: Practical Steps

Step 3: Find Your Market Pair

Navigate to the tokenized stock section on your DEX and search for the desired equity token, such as AAPL or TSLA. You’ll typically see pairs like AAPL/USDC or TSLA/SOL. Review liquidity and slippage settings; thin order books can lead to unfavorable execution prices during volatile periods.

Step 4: Place Your Order

You can either swap instantly at market price or set up a limit order if supported by the protocol. Confirm all details before approving the transaction in your wallet. Once confirmed, smart contracts handle settlement automatically, no intermediaries involved.

Top Crypto Stock Trading Strategies for DEXs in 2025

-

Leverage Tokenized Stocks on Kraken, Bybit, and Solana DeFi: Take advantage of tokenized equities now tradable 24/7 on major DEXs. Trade fractional shares of leading U.S. stocks directly from your crypto wallet, combining traditional equity exposure with DeFi flexibility.

-

Utilize Smart Contracts for Automated Trading: Deploy smart contract-based trading bots on DEXs to automate buying and selling of tokenized stocks. This strategy leverages transparent, programmable logic for efficient execution and risk management.

-

Arbitrage Between Centralized and Decentralized Platforms: Exploit price differences for tokenized stocks listed on both centralized exchanges (like Kraken) and DEXs (such as Solana DeFi). Swift wallet-to-wallet transfers enable rapid, non-custodial arbitrage opportunities.

-

Participate in Robinhood EU Tokenized Equities: Access Robinhood’s commission-free tokenized U.S. stocks for EU users. Trade over 200 equities and ETFs on-chain, enjoying seamless integration with decentralized wallets and platforms.

-

Stake and Earn Yield on Tokenized Stock Pools: Provide liquidity to tokenized stock pools on DEXs like Solana DeFi and earn yield from trading fees. This approach combines passive income with exposure to both crypto and traditional equities.

Step 5: Monitor and Manage Positions

Your tokenized stocks will appear directly in your wallet alongside other digital assets. Track performance using integrated analytics or third-party portfolio trackers that now support equities-on-chain. Remember, you’re responsible for managing private keys and staying alert to new governance proposals or protocol upgrades that might affect your holdings.

Key Risks and Advanced Strategies

While trading crypto stocks on DEXs unlocks compelling opportunities, it also introduces unique risks:

- Smart Contract Vulnerabilities: Even audited protocols can harbor bugs. Only trade on reputable platforms with a strong track record.

- Regulatory Uncertainties: Jurisdictional rules are evolving fast, tokenized stocks may face sudden restrictions depending on where you live.

- Synthetic Asset Divergence: Synthetic tokens sometimes deviate from real-world prices during extreme volatility; monitor peg mechanisms closely.

- Liquidity Shocks: Flash crashes are possible during news events or low-volume periods; always use stop-losses if available.

If you’re comfortable with these risks, consider advanced tactics like providing liquidity to tokenized stock pools for yield, arbitraging price discrepancies between DEXs and centralized exchanges, or exploring cross-chain bridges to access more exotic assets.

The Future of Crypto Stock Platforms in 2025

The convergence of traditional equities and blockchain technology is rapidly transforming how we think about ownership, market access, and financial sovereignty. With platforms like Kraken, Bybit, Solana DeFi protocols, and Robinhood EU leading the charge, and Coinbase seeking SEC approval for blockchain-based stocks, the lines between Wall Street and Web3 continue to blur.

This trend isn’t just about convenience; it’s about empowering individuals globally. For investors in regions historically excluded from US equities or those seeking round-the-clock flexibility without custodial risk, DEX-traded crypto stocks are a game changer. The coming year will likely see deeper integration between legacy finance and DeFi rails, expect more asset classes, richer analytics tools, and enhanced security standards as adoption accelerates.

Checklist: Before You Trade Crypto Stocks on a DEX

The bottom line? With careful preparation, and a willingness to embrace new technology, you can harness decentralized exchanges to build a diversified portfolio spanning both digital assets and real-world equities. Stay curious, stay secure, and remember: connecting markets means connecting opportunities.