So you want to dip your toes into the world of crypto futures trading with less than $100? You’re not alone. In fact, a rising tide of traders are starting small, learning the ropes without risking a fortune. With exchanges like Coinbase and Kraken now offering regulated futures contracts, it’s never been easier for beginners to get started – even on a shoestring budget.

Let’s be real: $100 won’t make you a crypto whale overnight. But it’s the ideal amount to build skills, test strategies, and avoid those gut-wrenching losses that can come from overextending yourself early on. As one Redditor put it: “Staying around $100-500 while you’re learning means your gains won’t be huge – but your losses also won’t be a kick in the teeth. ” That’s the smart way to start.

Why Start Small? The Power of Scaling Up

The thrill of high-leverage trading is real – but so is the risk. Starting with less than $100 forces you to think strategically about every move. You’ll learn to manage risk, size positions carefully, and focus on process over profit. These are habits that will serve you well as your portfolio grows.

Plus, thanks to margin and leverage in futures markets, even $100 can control a much larger position. For example, on Coinbase Advanced or Kraken Futures, putting down $100 as initial margin can give you exposure to contracts worth several times that amount. This magnifies both potential gains and losses – so discipline is critical.

Setting Up for Success: Tools and Platforms for 2025

The crypto landscape in late 2025 is buzzing with opportunity for low-capital traders:

- Regulated Futures Access: Kraken’s acquisition of Small Exchange means more US traders can access regulated crypto derivatives safely.

- Coinbase Futures: With National Futures Association approval, Coinbase now offers federally regulated futures products – making compliance (and peace of mind) easier for beginners.

- User-Friendly Interfaces: Both platforms offer streamlined dashboards perfect for tracking trades and managing risk without information overload.

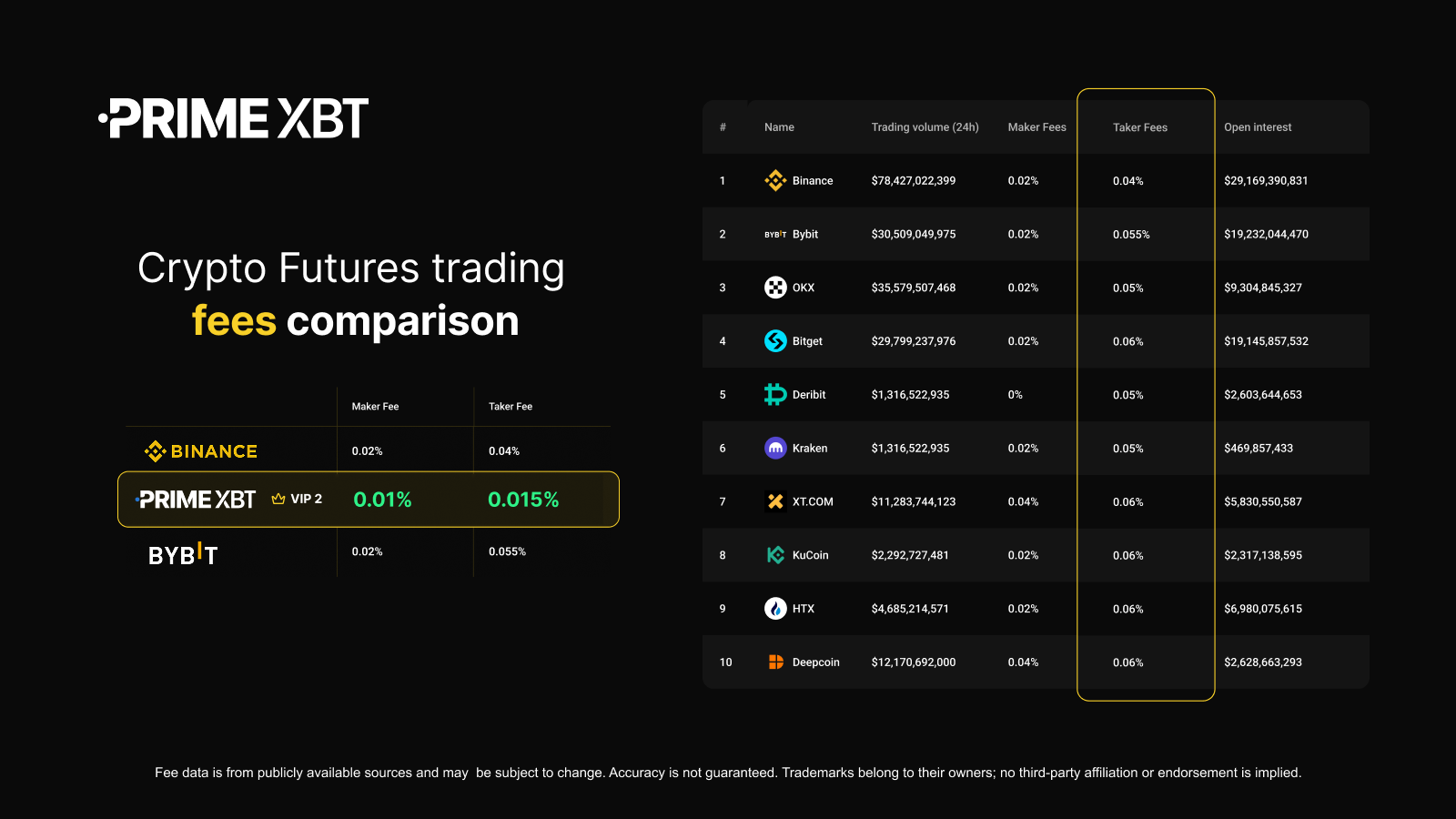

No matter where you trade, make sure your exchange offers robust security features (like two-factor authentication), transparent fee structures, and educational resources tailored for new futures traders.

Your Step-by-Step Guide: Building Your First Crypto Futures Portfolio

This isn’t about YOLO-ing into meme coins or swinging for the fences on every trade. Instead, let’s walk through practical steps that maximize learning while minimizing downside:

- Choose Your Exchange: Pick a platform that supports small minimum deposits (like Coinbase or Kraken) and offers regulated crypto futures products.

- KYC and Security Setup: Complete identity verification and enable security features before depositing funds.

- Select Liquid Contracts: Focus on highly traded assets like Bitcoin or Ethereum futures – these have lower spreads and more predictable price action than obscure altcoins.

- Diversify Across Contracts: Even with just $100, consider splitting your margin across two contracts (for example: half in BTC/USDT perpetuals, half in ETH/USDT).

- Tight Risk Management: Never risk more than 1-2% of your capital per trade; use stop-loss orders religiously!

This approach helps you survive losing streaks while giving your winners room to run. Remember: consistency trumps luck every time.

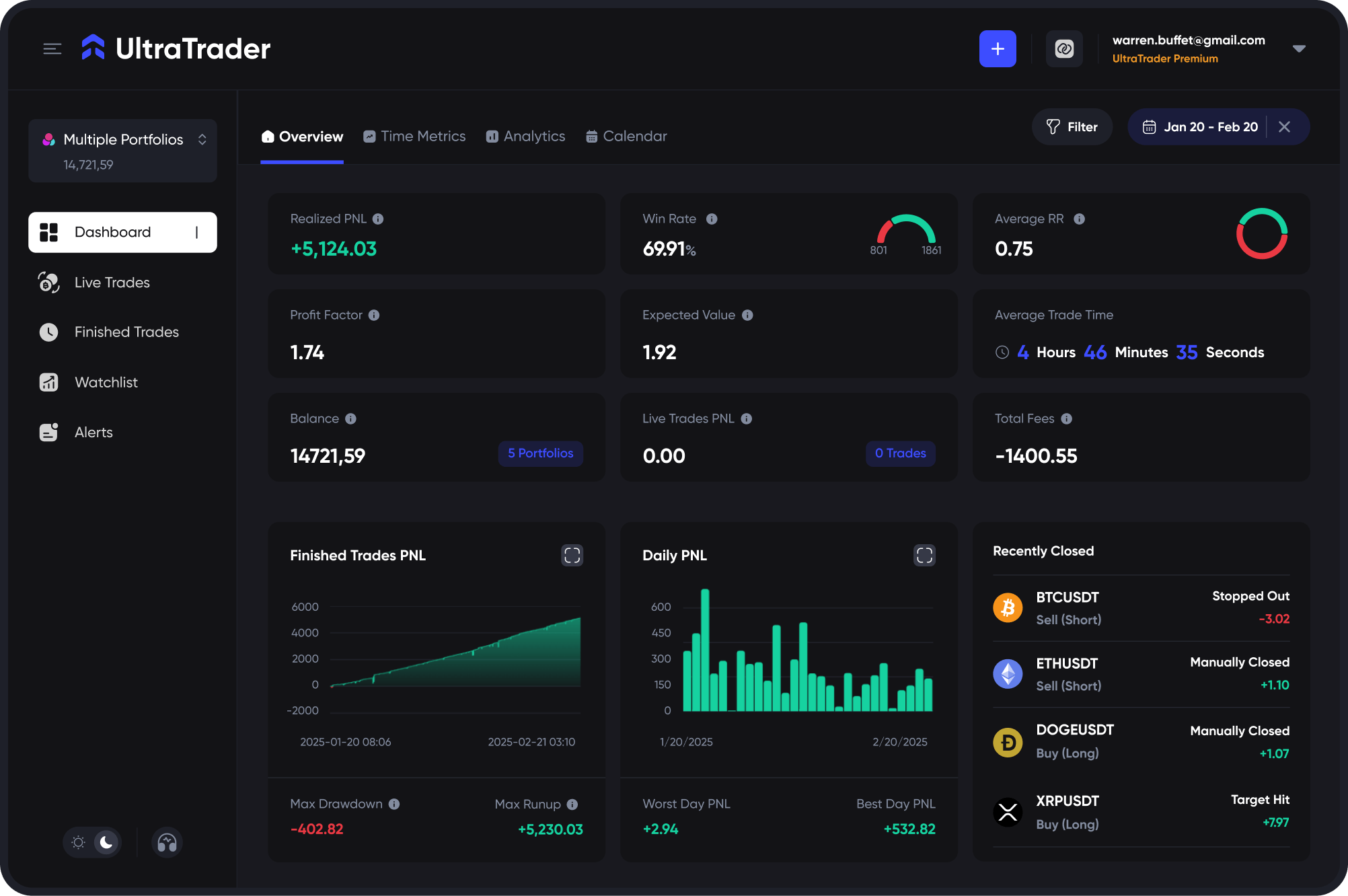

Once you’ve set up your portfolio and placed your first trades, the real challenge begins: managing emotions and sticking to your plan. Crypto futures are notorious for their wild swings. Even with a small account, you’ll feel the adrenaline when prices move fast. The key is to avoid panic selling or revenge trading after a loss. Instead, journal your trades, review your strategy regularly, and treat every mistake as a lesson, this is what separates hobbyists from pros.

Maximizing Growth: Compounding Small Gains

Don’t underestimate what compounding can do for a $100 portfolio. While it’s tempting to chase moonshots, focus on stacking small, consistent wins. Aiming for 1-3% returns per trade may not sound exciting, but over time these add up, especially if you reinvest profits and let winners ride. Remember: “Slow is smooth, smooth is fast. ”

Smart Habits for Managing a Small Crypto Futures Portfolio

-

Set Strict Risk Limits: Only risk 1-2% of your $100 capital per trade to avoid large losses. This is a widely recommended rule among traders on platforms like Binance and Coinbase Advanced.

-

Keep a Trading Journal: Track every trade, including entry/exit points and reasons for your decisions. Tools like TradingView make it easy to review your strategy and learn from mistakes.

-

Stick to Major Coins: Focus on established cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) for futures trading, as they offer higher liquidity and more predictable price movements.

-

Practice Patience and Consistency: Avoid emotional trading and stick to your strategy, even if gains are small. Consistent habits build long-term success, as echoed by experienced traders on Reddit.

Here are some habits that help scale up from micro to meaningful:

- Keep Position Sizes Tiny: Never go all-in, even if you’re feeling lucky.

- Review Your Trades Weekly: Spot patterns in wins and losses.

- Set Realistic Daily/Weekly Goals: Focus on process goals (like following your rules) instead of dollar targets.

- Avoid Overtrading: Quality over quantity, don’t force trades when setups aren’t there.

Risk Management: Protecting Your Capital Is Everything

If there’s one golden rule in low capital crypto futures trading, it’s this: Your #1 job is to protect your capital. Losing even $10 from $100 stings far more than it does in a bigger account. Here’s how seasoned traders keep losses tight:

- Always use stop-losses, even if you’re sure about the trade direction.

- Avoid doubling down on losers. Cut losses quickly and move on.

- Take profits incrementally. Don’t get greedy, secure gains as they come.

- Stick to your risk percentage per trade, no matter what.

This discipline will keep you in the game long enough to catch those big trend days that can make all the difference.

Scaling Up: When, and How, to Add More Funds

If you’ve been trading consistently for several weeks or months without blowing up your account, and better yet, if you’re growing it, consider gradually adding more capital. But don’t rush! Many traders jump from $100 to $1,000 too quickly and lose discipline. Instead:

- Add small amounts (say $25-$50) only after hitting clear performance milestones (like three consecutive winning weeks).

- Treat each new deposit with the same caution as your original stake.

- Revisit your risk management rules as your account grows, bigger numbers can tempt bigger mistakes!

The goal isn’t just to make money; it’s to build habits that last when real stakes are on the line.

The Trading Crypto Stock community is full of stories where discipline beat luck. One trader shared how they turned their initial $100 into over $1,000 in under six months, not by going all-in or chasing hype coins but by treating every dollar like gold and never risking more than 1% per trade. Their biggest advice? “Don’t compare yourself to others, focus on steady progress. ”

Final Thoughts: Your First $100 Is Just the Beginning

The journey of building a crypto futures portfolio with less than $100 isn’t about instant riches, it’s about learning market structure, developing emotional control, and mastering risk management while the stakes are still low. If you can thrive with micro-capital, scaling up later will feel natural, and far less stressful!

If you’re ready to take action today: choose your platform wisely, keep security tight, start small with liquid contracts like BTC or ETH futures, and make every trade count toward building skills, not just profits. The best traders aren’t those who start big, they’re the ones who start smart.