With Bitcoin (BTC) trading at $113,580.00 and Ethereum (ETH) holding at $4,071.88 as of October 26,2025, crypto traders are navigating a market defined by both opportunity and risk. Yet, in this high-stakes environment, Twitter remains a double-edged sword: it’s a vital source of real-time information but also a hotspot for fake crypto stock signals designed to exploit unsuspecting investors. The proliferation of scams on “Crypto Twitter” is more than just noise, it’s a persistent threat that can undermine your trading strategy and portfolio integrity.

Why Fake Crypto Stock Signals Are Surging Amid Market Volatility

The rapid swings in the crypto market, like BTC’s recent climb above $113,000, draw in both ambitious traders and opportunistic scammers. As volatility increases, so does the volume of misleading trading signals on social platforms. Scammers know that traders crave quick insights and actionable tips; they exploit this by flooding Twitter with fraudulent accounts that mimic reputable influencers or organizations.

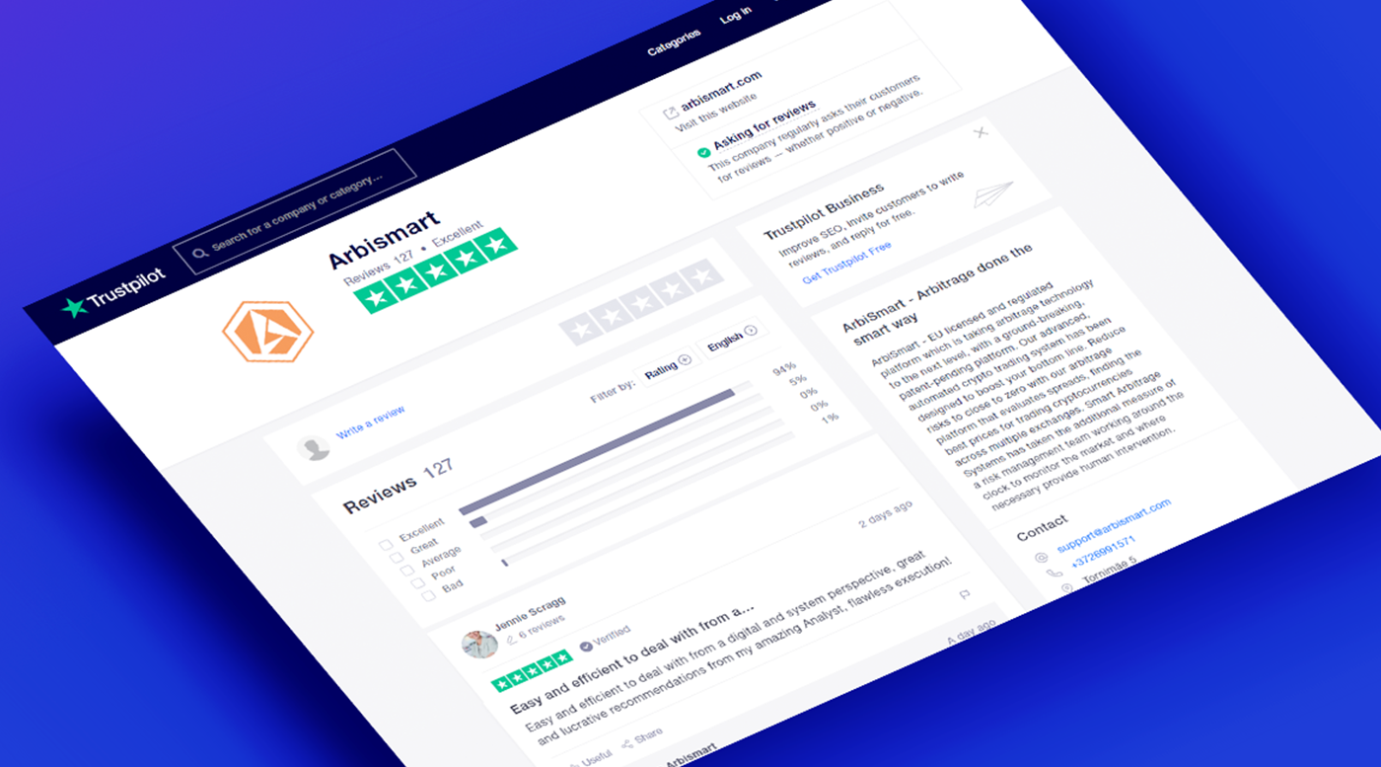

According to Binance’s report on Crypto Scams on Twitter, these bad actors copy the exact profile details and tweet history of trusted voices in the industry. They often comment under legitimate posts to promote scam links or pump-and-dump schemes, making it difficult for even experienced users to distinguish between authentic advice and deception.

Common Tactics Used in Crypto Stock Twitter Scams

- Impersonation of Reputable Accounts: Fraudsters create near-identical profiles to those of well-known analysts or companies, sometimes changing only one character in the username, to mislead followers.

- Manipulation of Verification Badges: Some scammers go as far as acquiring or faking verification badges, adding an extra layer of false credibility to their accounts.

- Mass Tagging and Unsolicited Messages: High-pressure tactics like tagging dozens (or hundreds) of users in tweets or sending direct messages about “exclusive” investment opportunities are common red flags.

- Fake Testimonials and Social Proof: Profiles often showcase fabricated success stories, with screenshots or testimonials, meant to lure victims by creating an illusion of widespread profitability.

The California Department of Financial Protection and Innovation maintains a Crypto Scam Tracker, which catalogs many such complaints involving fake signal groups and impersonators. This resource is invaluable for cross-referencing suspicious entities before engaging with them.

How to Spot Fake Trading Signals Before You Lose Capital

The best defense against crypto stock Twitter scams is sharp skepticism coupled with practical verification steps. Here are some strategies every trader should deploy before acting on any signal:

- Scrutinize Account Authenticity: Look beyond badges, check for consistent posting history, engagement from credible users, and any subtle differences in usernames or branding elements.

- Avoid Urgency Traps: If a signal comes with phrases like “act now, ” “limited time, ” or promises outrageous returns within hours, treat it as highly suspect.

- Lack of Transparency Is a Red Flag: Legitimate signal providers will offer clear details about their strategy, historical performance (with verifiable records), and risk disclosures. Opaque operations are almost always hiding something.

- Cross-Reference With Trusted Sources: Never rely solely on one tweet or account for trading decisions. Check multiple reputable channels, including regulated exchanges’ announcements, for confirmation before executing trades.

If you’re unsure about an account or offer, resources like DappRadar’s guide on identifying token scams (8 Ways to Check If It’s a Token Scam) can help you vet projects more thoroughly outside social media hype cycles.

Protecting your capital in today’s crypto market, where Bitcoin stands at $113,580.00 and Ethereum at $4,071.88, means building habits that make you less vulnerable to fake crypto stock signals. While social media can amplify your reach and speed of information, it also multiplies the risk of being targeted by sophisticated scams. The following checklist will help you stay one step ahead of fraudsters who prey on the fast-moving nature of crypto trading.

Building a Personal Safety Protocol for Crypto Stock Trading

Every trader needs a personal protocol for vetting signals before taking action. Start with basic due diligence: search for the signal provider’s presence beyond Twitter. Do they have a verifiable track record on other platforms? Is there a clear homepage, whitepaper, or documented trading strategy? As DappRadar highlights, if you can’t find transparent information about a project or provider, it’s almost certainly a red flag (8 Ways to Check If It’s a Token Scam).

Another smart move is to use community resources like the Crypto Scam Tracker from California DFPI. This tool lets you search complaints by company name or scam type and can quickly reveal patterns of fraudulent activity associated with certain accounts or groups.

Don’t Trade Alone: Leverage Community Oversight

The decentralized ethos of crypto doesn’t mean you have to go it alone. Engage with reputable trading communities and forums where experienced traders share insights about suspicious accounts or trending scams. Often, collective knowledge surfaces new threats faster than any individual can spot them.

Trusted Crypto Communities for Safe Stock Discussions

-

r/CryptoCurrency (Reddit): The largest crypto-focused subreddit, r/CryptoCurrency is moderated for scams and misinformation, with active discussions on crypto stocks, trading strategies, and market trends.

-

CryptoCompare Forums: CryptoCompare offers a reputable forum for traders to discuss crypto assets, including stocks and tokens, with a strong focus on data transparency and scam prevention.

-

Bitcointalk: As one of the oldest and most respected crypto forums, Bitcointalk features dedicated sections for altcoins, trading, and scam warnings, making it a valuable resource for vetting crypto stock signals.

-

Stack Exchange – Bitcoin & Cryptocurrency: The Bitcoin Stack Exchange is a Q&A site where experienced users address technical and trading questions, including safe trading practices and scam avoidance.

-

Discord – The Trading Pit: The Trading Pit is a well-moderated Discord server with channels dedicated to crypto stocks, market analysis, and scam alerts, fostering a collaborative and secure environment.

What To Do If You’ve Been Targeted By Crypto Stock Twitter Scams

If you suspect you’ve interacted with a scam account or acted on fake trading signals, act quickly:

- Cease all communication with the suspicious account immediately.

- Do not send any funds or sensitive information.

- Report the account to Twitter using built-in reporting tools.

- Document all interactions, including screenshots and transaction records.

- Consult official resources, such as regulatory scam trackers or your exchange’s support team.

This swift response not only helps protect your own assets but also assists the broader community in identifying and shutting down fraudulent actors sooner.

Staying Ahead in an Unpredictable Market

The surge in Bitcoin price above $113,000 has brought renewed excitement, and fresh waves of misinformation, to Crypto Twitter. With scammers constantly refining their methods, vigilance must become second nature for anyone serious about long-term success in crypto stock trading. Remember that no legitimate opportunity will require urgent decisions based solely on social media posts. When in doubt, slow down and verify every claim through multiple trusted sources before risking your capital.