The crypto stock market is in a period of remarkable activity, with Bitcoin currently trading at $108,412 and Ethereum at $3,974.58. In this environment of heightened volatility, success hinges on more than just intuition or luck. A robust mechanical trading plan for crypto stocks is your blueprint for navigating the chaos with discipline and consistency. This guide breaks down the essential steps to build a systematic approach that can weather both bull runs and sharp corrections.

Why a Mechanical Trading Plan Matters in Today’s Crypto Stock Market

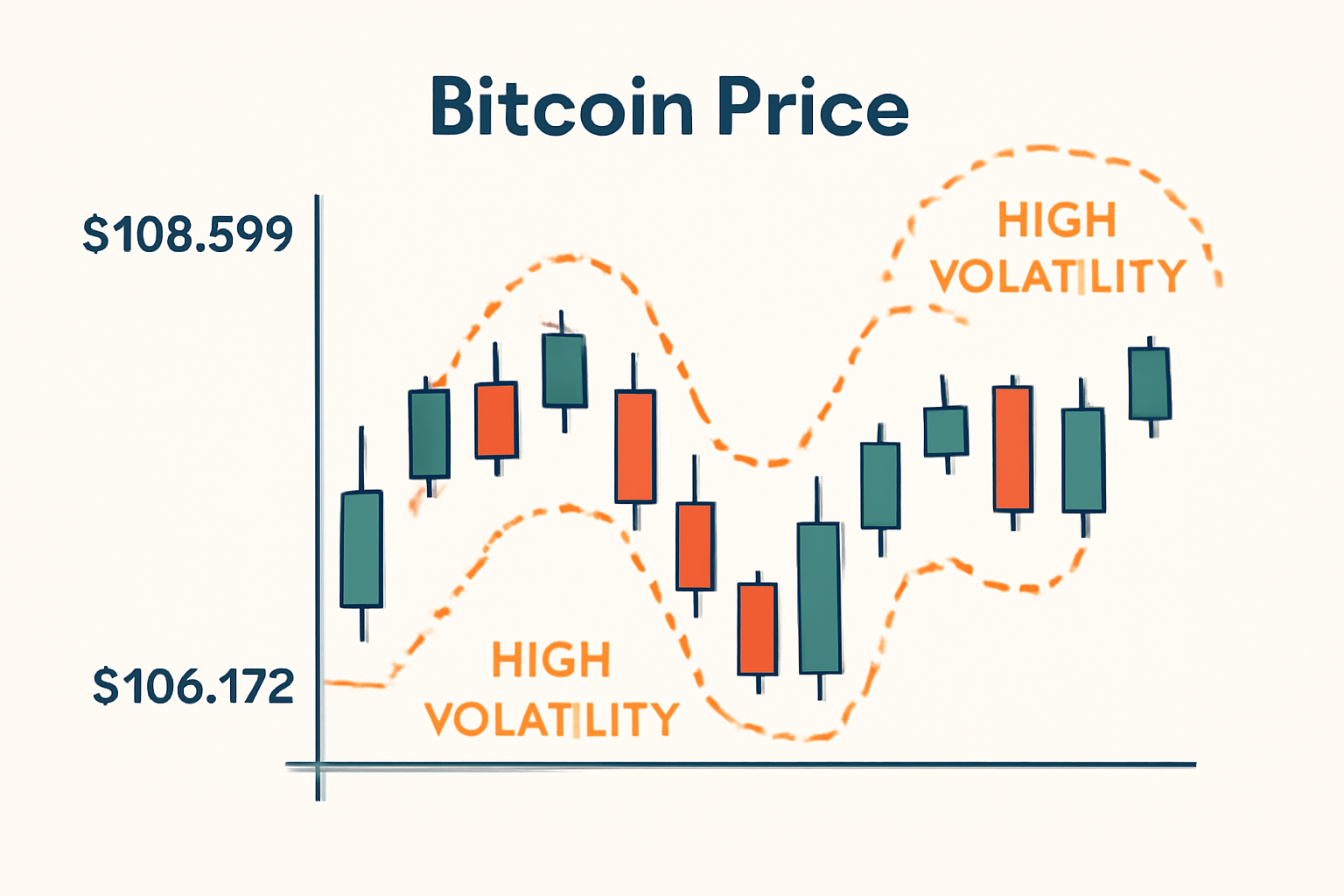

Unlike discretionary trading, a mechanical plan relies on predefined rules and objective criteria. This eliminates emotional decision-making, which is especially critical when Bitcoin swings over $1,400 in a single day, as we’ve seen in the current session. Mechanical trading rules foster consistency and can be backtested for reliability, offering traders a measurable edge in the unpredictable world of crypto stock trading.

“A mechanical strategy is about executing the same setup every day, relying on strict consistency and effective money management to become successful. “

Step 1: Define Clear Trading Objectives and Risk Parameters

Every systematic plan begins with clarity. Define what you want to achieve, whether it’s monthly percentage returns, capital preservation, or outperforming a benchmark like Bitcoin at $108,412. Next, set your risk tolerance per trade and for your overall portfolio. For example, you might cap losses at 1% of capital per trade or set a maximum daily drawdown limit. These parameters serve as guardrails that keep your trading aligned with your financial goals and psychological comfort zone.

Step 2: Select Crypto Stocks and Timeframes Based on Market Volatility

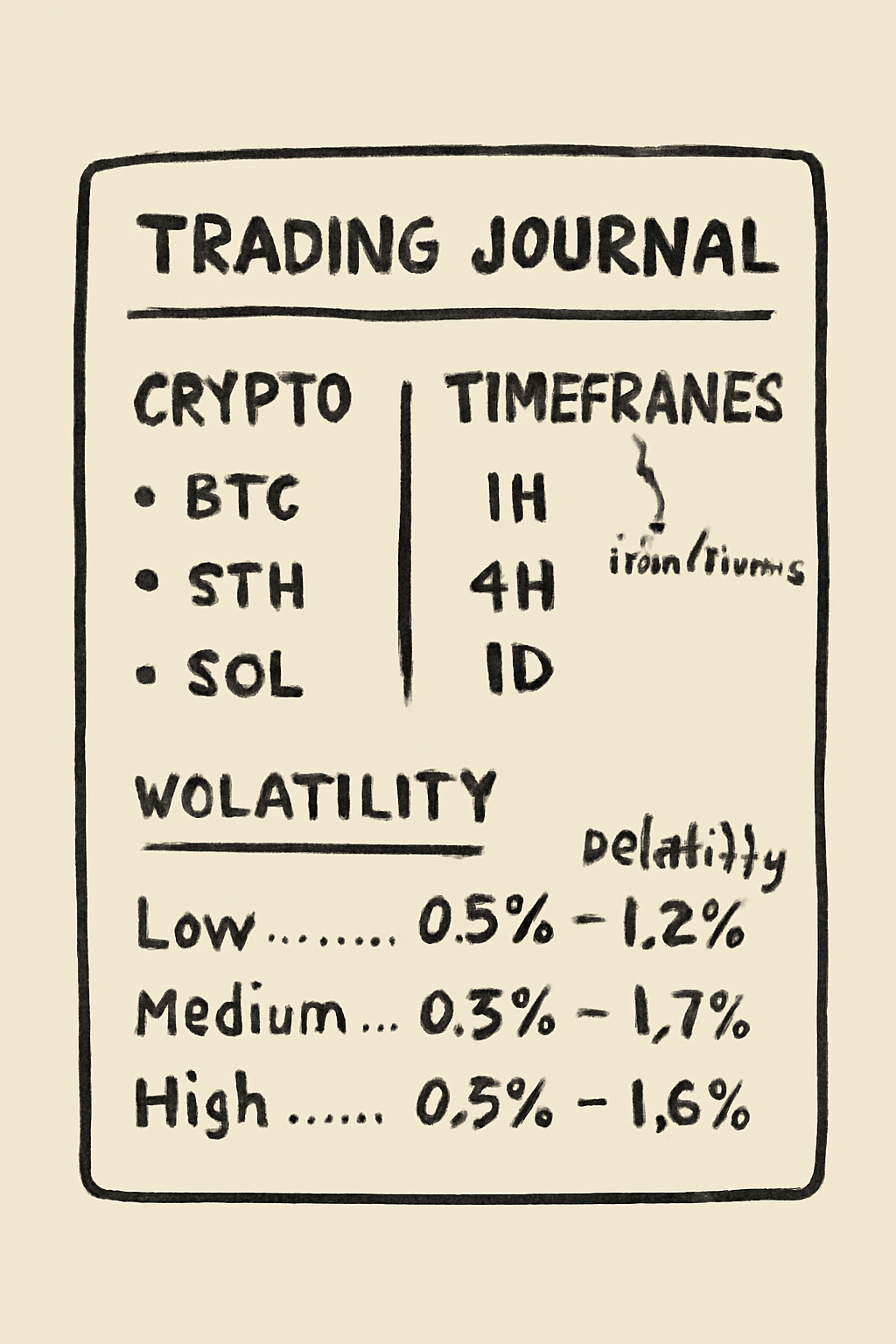

Not all crypto stocks respond the same way to market shocks. Choose your instruments carefully, for instance, high-beta tokens may offer outsized opportunities but also amplify risk when volatility spikes. With Bitcoin holding steady above $100,000 and Ethereum near $4,000, consider how these benchmarks influence correlated crypto stocks or tokenized equities.

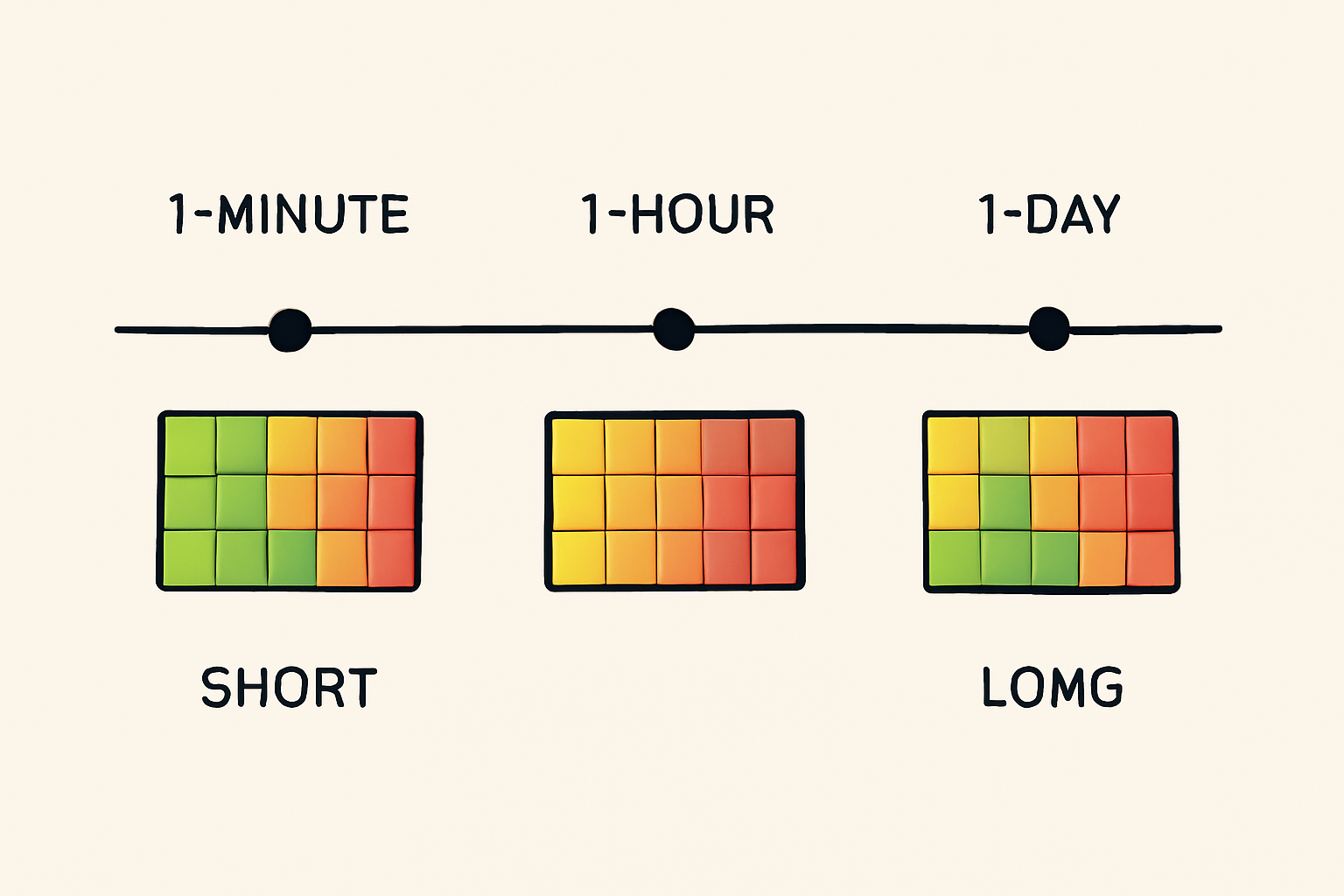

Your plan should specify which assets you’ll trade and the timeframes best suited to your strategy. Day traders might focus on 5-minute or 15-minute charts to capture intraday swings; swing traders could opt for 4-hour or daily setups to ride broader trends.

Step 3: Establish Precise Entry, Exit, and Position Sizing Rules

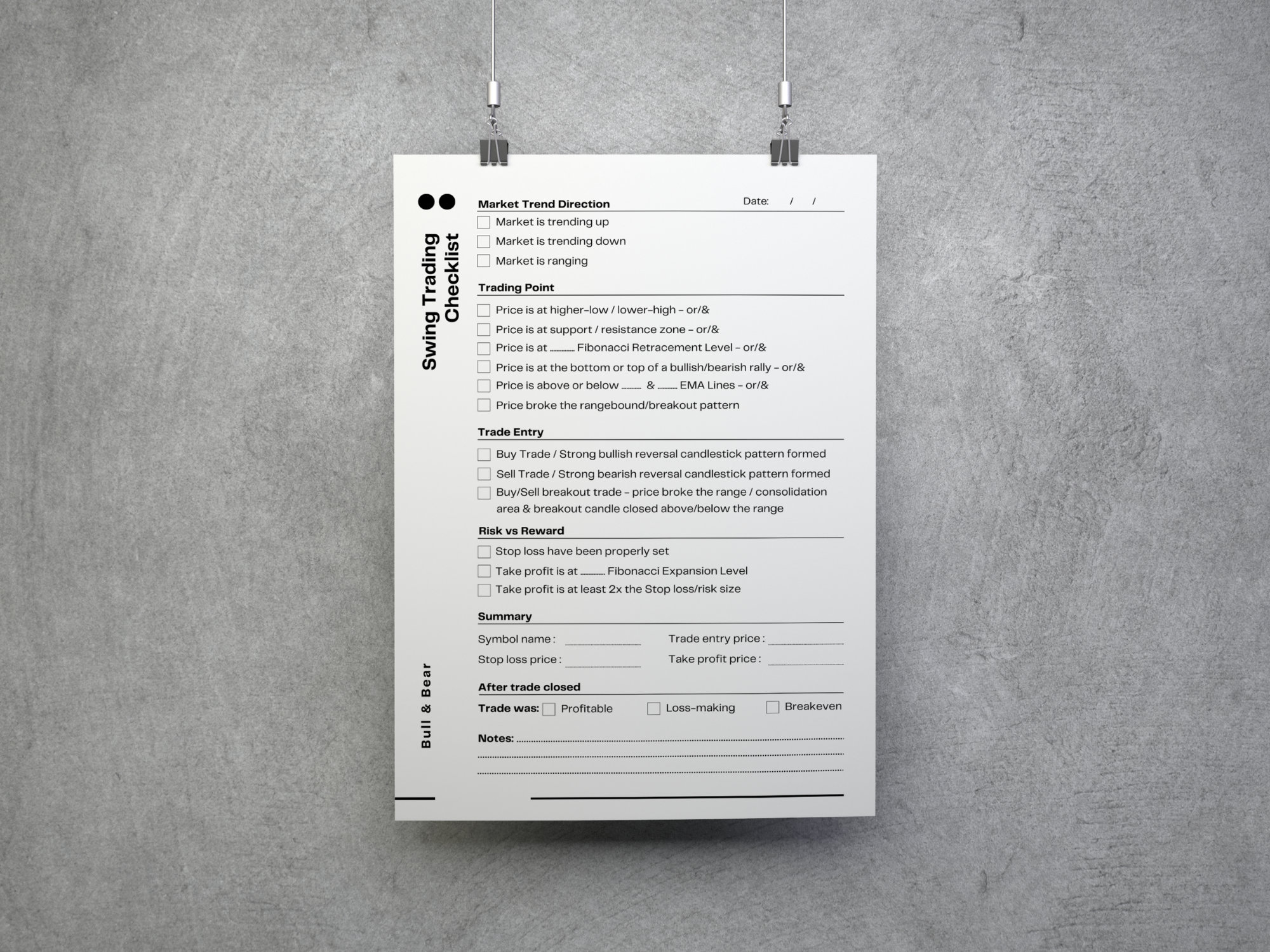

This is where your mechanical plan becomes actionable. Define exact criteria for entering trades (e. g. , price crossing above a moving average), exiting positions (e. g. , hitting a stop loss or profit target), and sizing each position relative to account size and risk tolerance.

For example:

- Entry: Buy when price closes above the 20-period EMA with volume above average.

- Exit: Sell if price drops below the EMA by 1% or if profit target of 5% is reached.

- Position Sizing: Risk no more than 1% of account equity per trade.

These rules must be unambiguous so they can be automated or consistently executed without hesitation.

Bitcoin (BTC) Price Prediction 2026-2031

Forecast based on current volatility, market cycles, and adoption trends (as of October 2025)

| Year | Minimum Price (Bearish) | Average Price | Maximum Price (Bullish) | Year-over-Year % Change (Avg) | Market Scenario Brief |

|---|---|---|---|---|---|

| 2026 | $94,000 | $120,000 | $148,000 | +11% | Post-halving consolidation; regulatory uncertainty persists |

| 2027 | $98,500 | $133,000 | $165,000 | +10.8% | Renewed institutional interest; wider adoption; volatility remains high |

| 2028 | $110,000 | $148,500 | $190,000 | +11.7% | Bullish sentiment with new tech upgrades; ETF expansion |

| 2029 | $123,500 | $162,000 | $215,000 | +9.1% | Macro headwinds; global regulatory clarity improves |

| 2030 | $135,000 | $178,000 | $240,000 | +9.9% | Mainstream adoption accelerates; increasing competition from altcoins |

| 2031 | $140,000 | $195,000 | $265,000 | +9.6% | Mature market phase; stable growth with institutional dominance |

Price Prediction Summary

Bitcoin is projected to continue its upward trajectory over the next six years, with average prices rising from $120,000 in 2026 to $195,000 in 2031. The price range widens each year, reflecting both bullish and bearish scenarios amid ongoing volatility, evolving regulations, and technological advancements. Year-over-year average growth is expected to hover around 10-12%, with periods of consolidation and potential corrections.

Key Factors Affecting Bitcoin Price

- Market cycles and Bitcoin halving events impacting supply dynamics

- Institutional and retail adoption trends

- Evolving global crypto regulations and taxation policies

- Technological upgrades (e.g., scalability, security) and network development

- Competition from Ethereum and emerging altcoins

- Macroeconomic factors such as inflation, interest rates, and geopolitical tensions

- ETF approvals and traditional finance integration

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

With your entry, exit, and position sizing rules clearly defined, you now have the core mechanics of your strategy. However, true consistency in mechanical trading plan crypto execution comes from removing as much subjectivity as possible. This is where technology and automation can make a measurable difference in both performance and peace of mind.

Step 4: Implement Automated Tools for Signal Execution and Monitoring

Manual execution introduces human error and emotional bias, two of the biggest threats to systematic trading. Leverage automated platforms or trading bots that can scan for your specific setups, execute trades instantly when criteria are met, and manage stops or profit targets without hesitation. For example, if your plan dictates buying a crypto stock when Bitcoin breaks above $108,412, an automated system ensures no opportunity is missed due to hesitation or distraction.

Modern platforms offer robust backtesting features, real-time alerts, and integration with exchanges for seamless trade execution. Remember to monitor these systems regularly; automation should enhance vigilance, not replace it entirely.

Step 5: Continuously Backtest, Review, and Adjust the Plan Based on Performance

No mechanical trading plan is set-and-forget, especially in a market as dynamic as crypto stocks. With Bitcoin’s price action fluctuating between $106,172 and $108,599 in just 24 hours, yesterday’s optimal parameters might underperform tomorrow. Regularly backtest your strategy on historical data to assess its robustness across different market regimes. Use performance metrics like win rate, average risk/reward ratio, and maximum drawdown to identify strengths and weaknesses.

Schedule periodic reviews (weekly or monthly) to analyze live results versus backtests. If you notice consistent slippage or shifting volatility patterns, such as Ethereum’s recent moves near $3,974.58: adjust your rules accordingly. The goal is to stay systematic while remaining adaptive.

5 Key Steps to a Mechanical Crypto Trading Plan

-

Define Clear Trading Objectives and Risk ParametersEstablish your profit goals, risk tolerance, and maximum drawdown limits before trading. This ensures you operate with discipline in volatile markets like Bitcoin (BTC) at $108,412 and Ethereum (ETH) at $3,974.58.

-

Select Crypto Stocks and Timeframes Based on Market VolatilityChoose liquid, high-volume crypto stocks and set appropriate trading timeframes (e.g., 15-min, 1-hour, daily) to match your strategy and adapt to current volatility levels.

-

Establish Precise Entry, Exit, and Position Sizing RulesDefine mechanical criteria for trade entries and exits (e.g., moving average crossovers, RSI thresholds) and set position sizes using proven money management formulas.

-

Implement Automated Tools for Signal Execution and MonitoringLeverage reliable trading platforms like TradeStation, TradingView, or Binance for automated order execution, alerts, and real-time monitoring.

-

Continuously Backtest, Review, and Adjust the Plan Based on PerformanceUse historical data and backtesting tools (such as Cryptowatch or QuantConnect) to refine your strategy, ensuring it remains effective as market conditions evolve.

Bringing It All Together: A Repeatable Edge in Crypto Stock Trading

The current state of the crypto stock market, with Bitcoin firmly above $100K, rewards those who approach it with discipline rather than bravado. By following these five essential steps:

- Define clear objectives and risk limits

- Select assets and timeframes based on volatility

- Establish precise mechanical rules for every trade decision

- Automate signal execution wherever possible

- Continuously test and adapt based on real results

You create a framework that is repeatable regardless of market mood swings, and scalable as your capital grows or new opportunities arise.

If you’re ready to move beyond guesswork into true systematic trading, start by documenting each step above in detail. Treat your mechanical trading plan not as a static document but as a living guide, one that evolves alongside the fast-paced world of crypto stock trading.