Crypto stock trading bots have rapidly evolved from niche tools to essential components of modern portfolio management. With the crypto market operating 24/7 and Bitcoin (BTC) currently priced at $107,012.00 as of October 2025, automation is no longer a luxury but a necessity for serious traders. Automated portfolio management harnesses the power of algorithms and artificial intelligence, enabling investors to execute trades, rebalance portfolios, and manage risk with minimal manual intervention.

Why Automated Portfolio Management Is Crucial in 2025

The relentless pace of crypto price movements can overwhelm even the most disciplined investors. In the past 24 hours alone, Bitcoin gained 1.69%, Ethereum rose 2.67% to $3,876.51, and BNB increased by 2.78% to $1,096.74. These swings highlight the need for tools that can respond instantly to market changes. Automated portfolio management via trading bots ensures you never miss an opportunity or get caught off guard by sudden volatility.

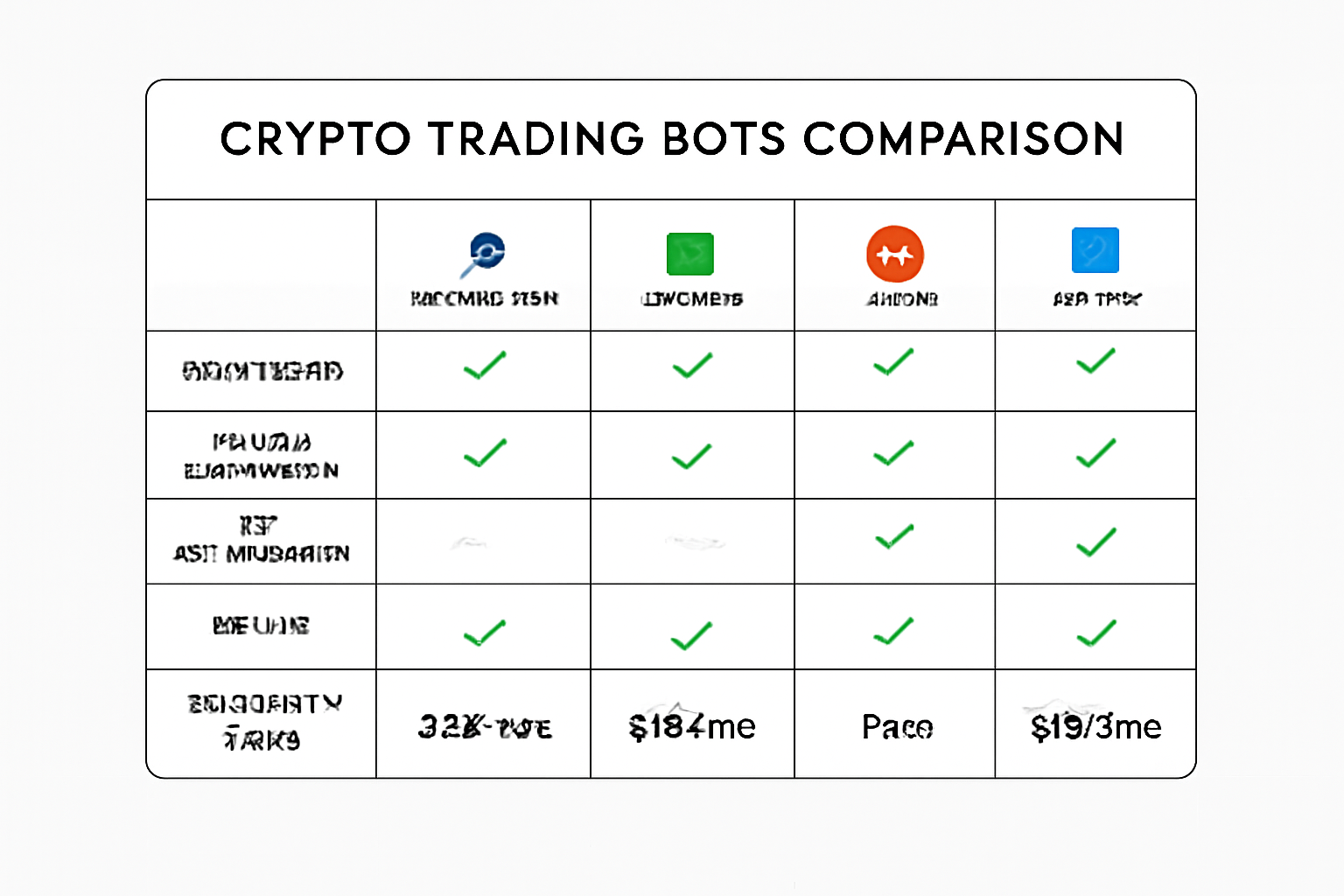

According to recent expert reviews, the best crypto trading bots for 2025 include names like Cryptohopper, 3Commas, and Pionex. These platforms offer customizable strategies, AI-driven decision-making, and seamless integration with major exchanges. For investors seeking to maximize returns while minimizing emotional bias, automation is the logical next step.

How Do Crypto Stock Trading Bots Work?

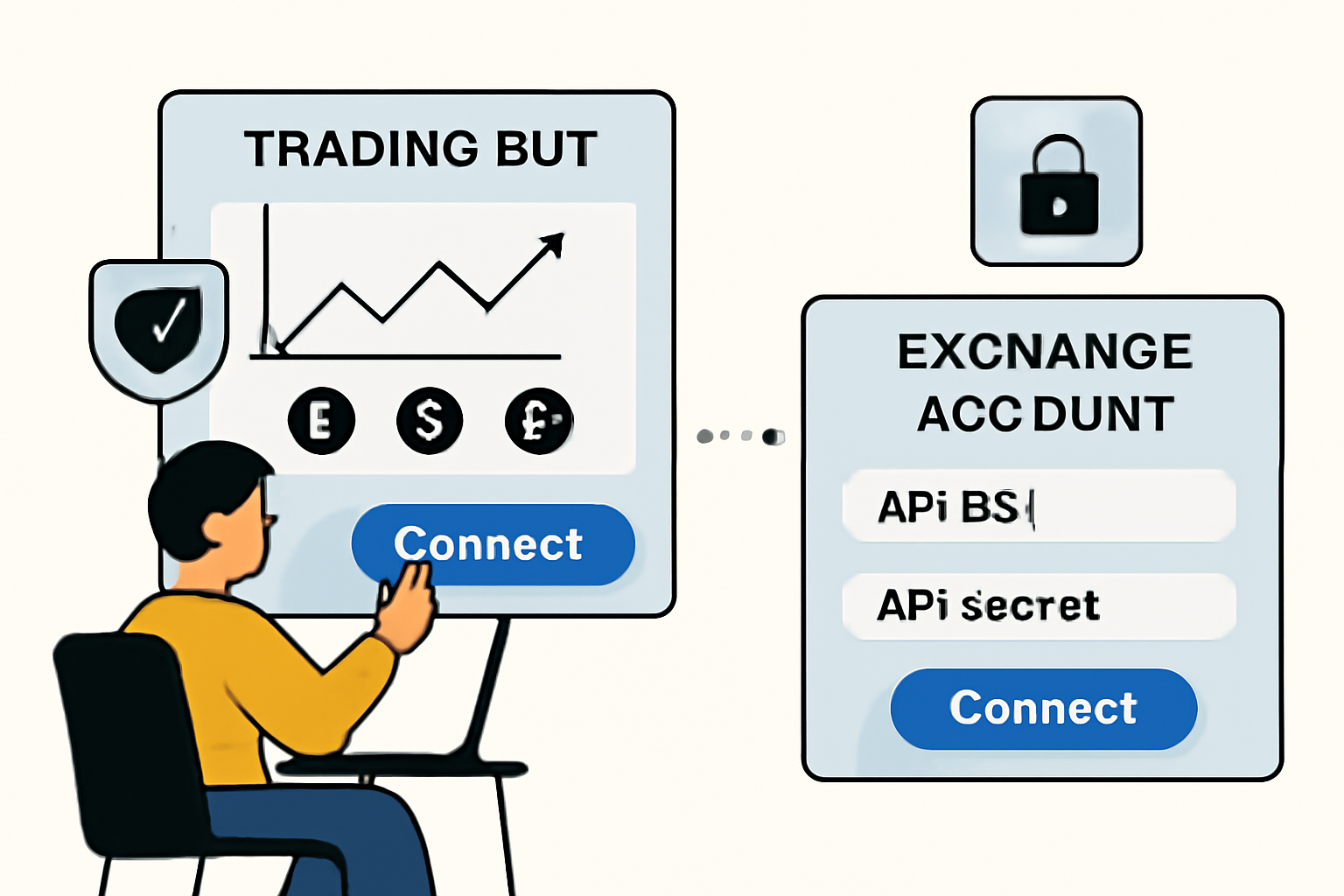

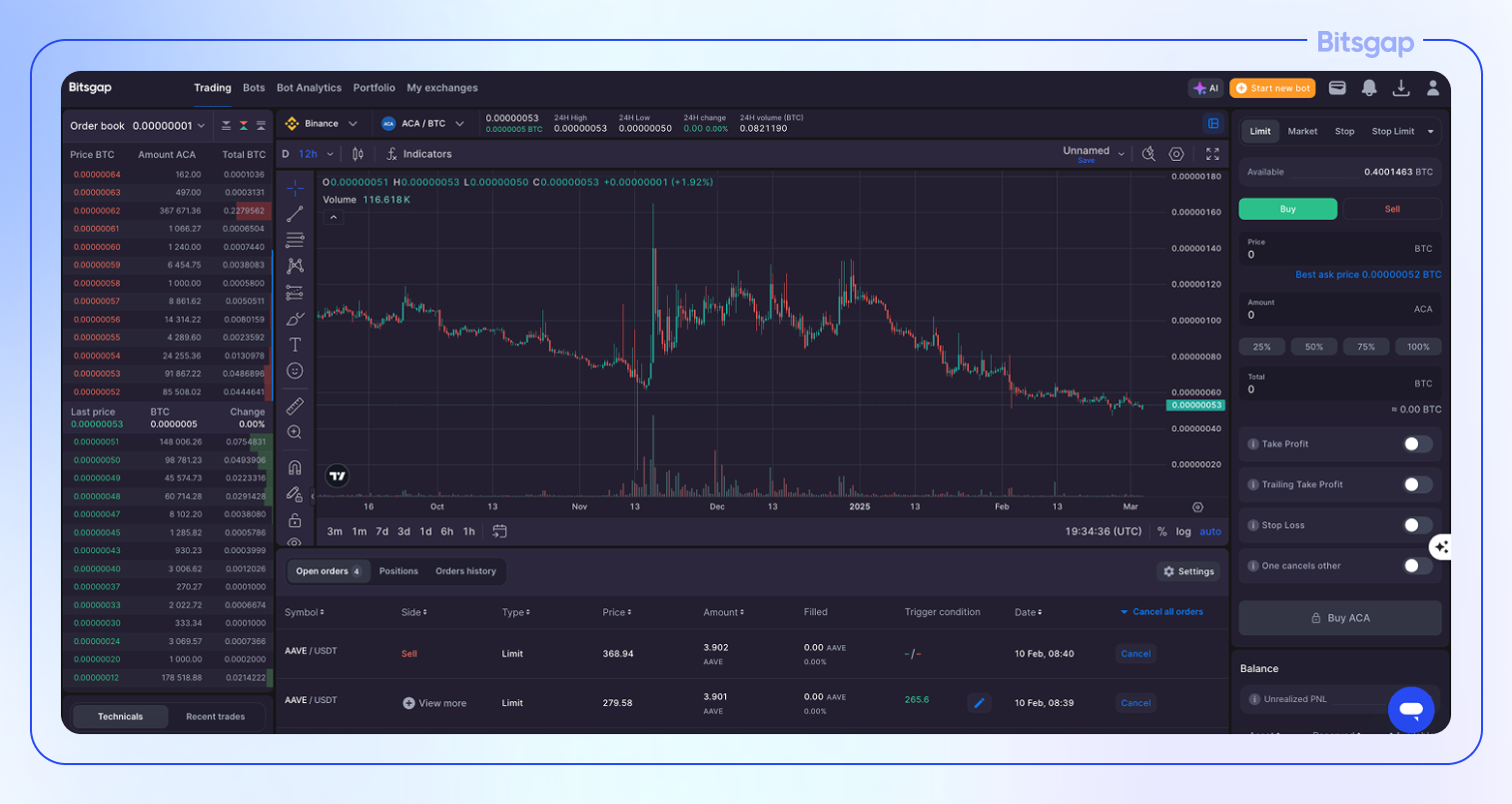

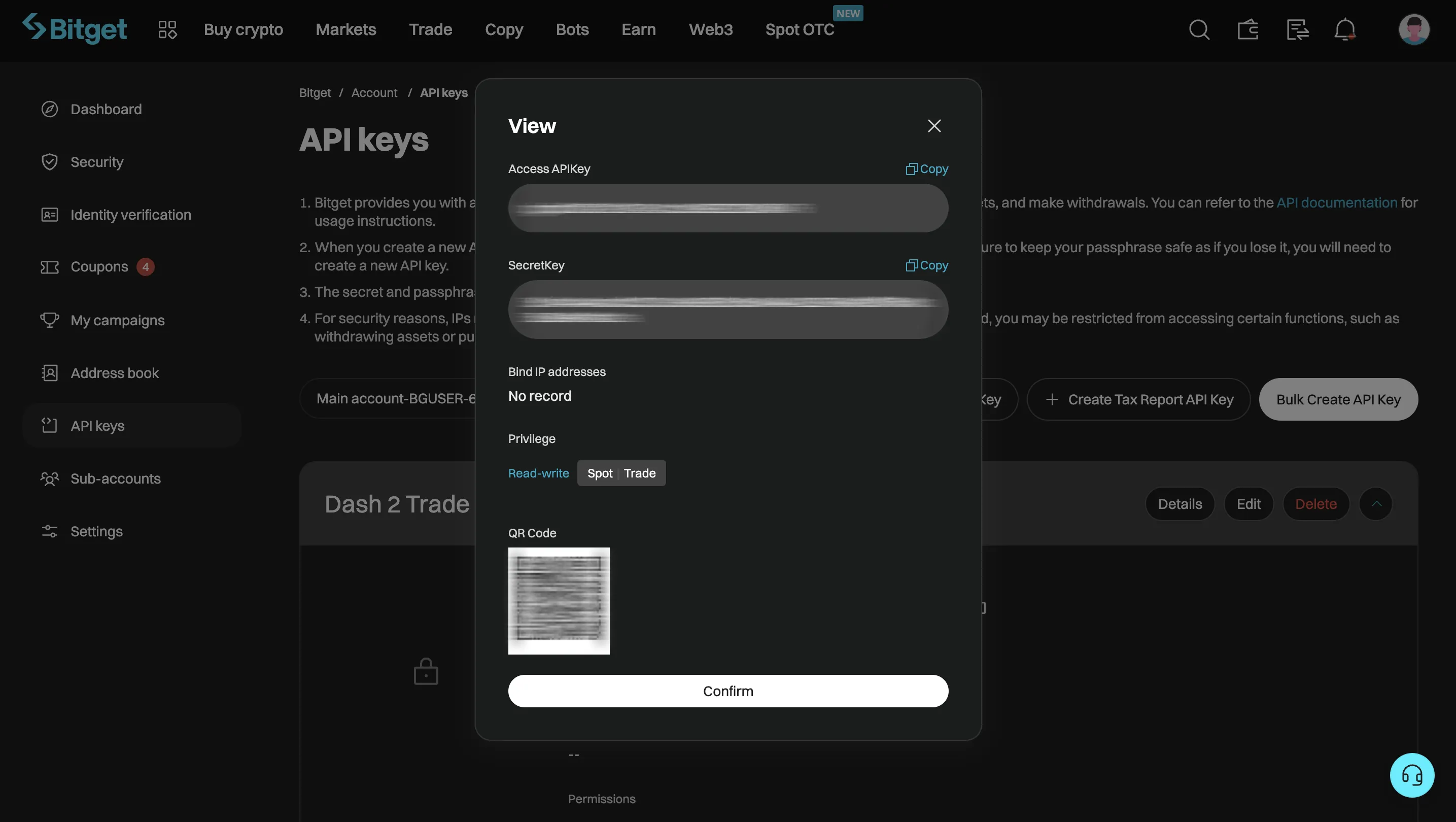

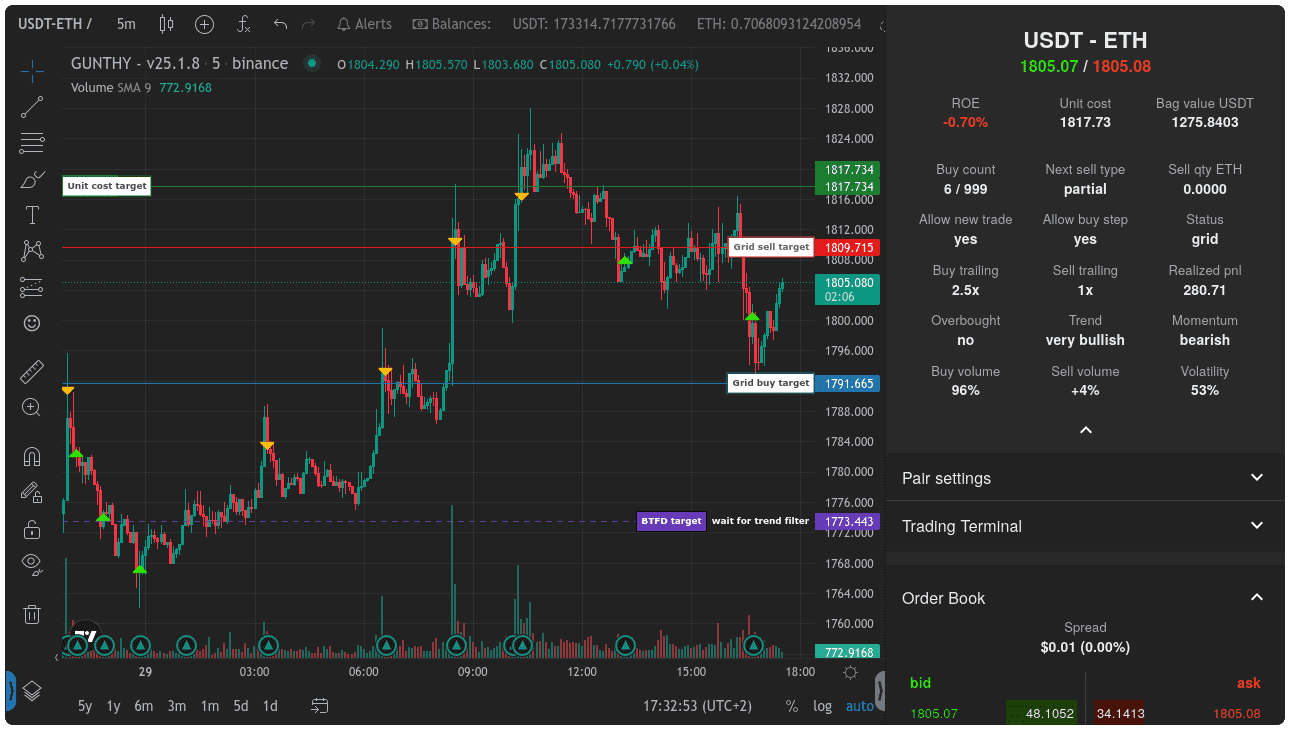

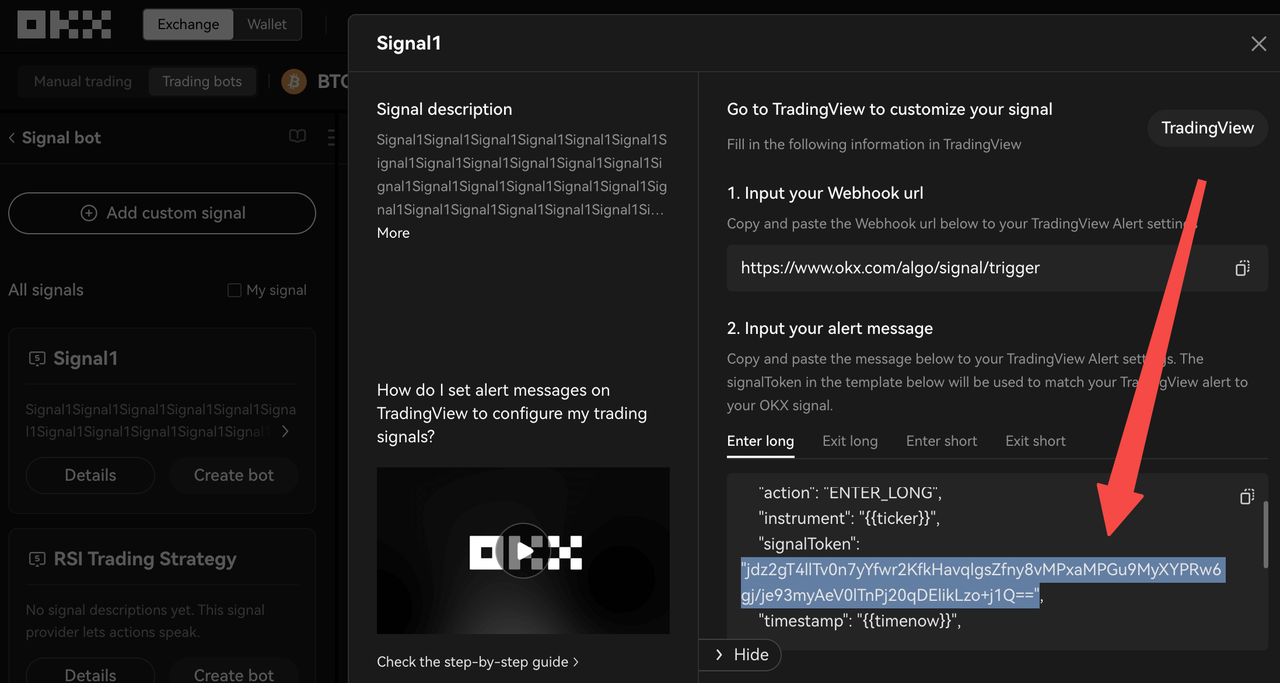

At their core, crypto stock trading bots are software programs that interact with exchanges through APIs. They monitor market data, analyze trends, and execute trades based on pre-set parameters or AI-driven models. The most advanced bots in 2025 leverage machine learning to adapt strategies in real time, responding to both macroeconomic shifts and micro-level price action.

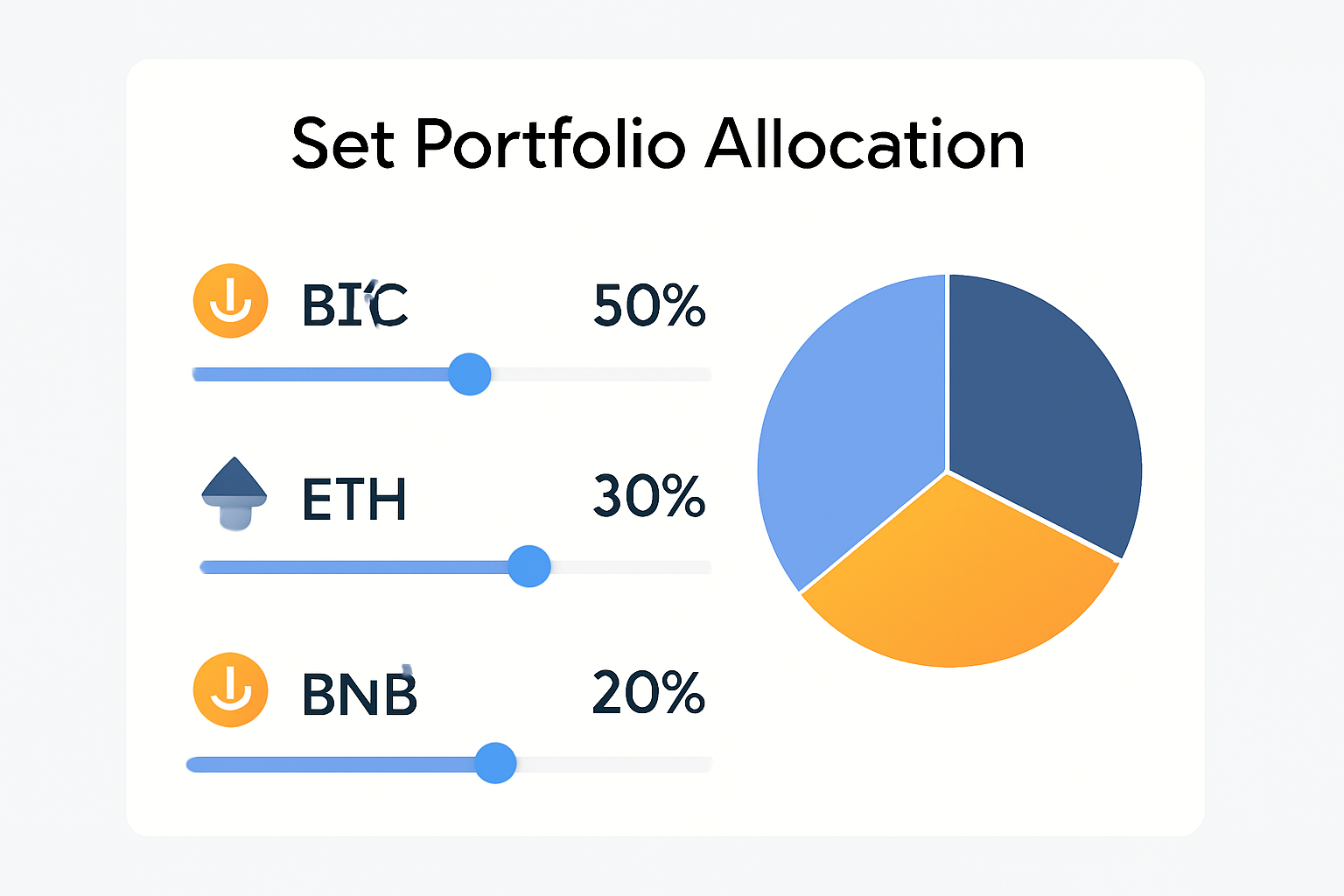

For example, a bot might automatically rebalance your portfolio if Bitcoin’s share exceeds a target threshold due to its climb above $107,000. Others implement dollar-cost averaging, arbitrage between exchanges, or deploy sophisticated technical analysis indicators. The key advantage is consistency: bots follow rules without hesitation, fatigue, or emotion.

Top Features to Look for in Crypto Trading Bots

Choosing the right trading bot can be daunting given the crowded landscape. Here are the features that set the best platforms apart:

- User-Friendly Interface: Even advanced bots like Cryptohopper and 3Commas offer dashboards that cater to both beginners and pros.

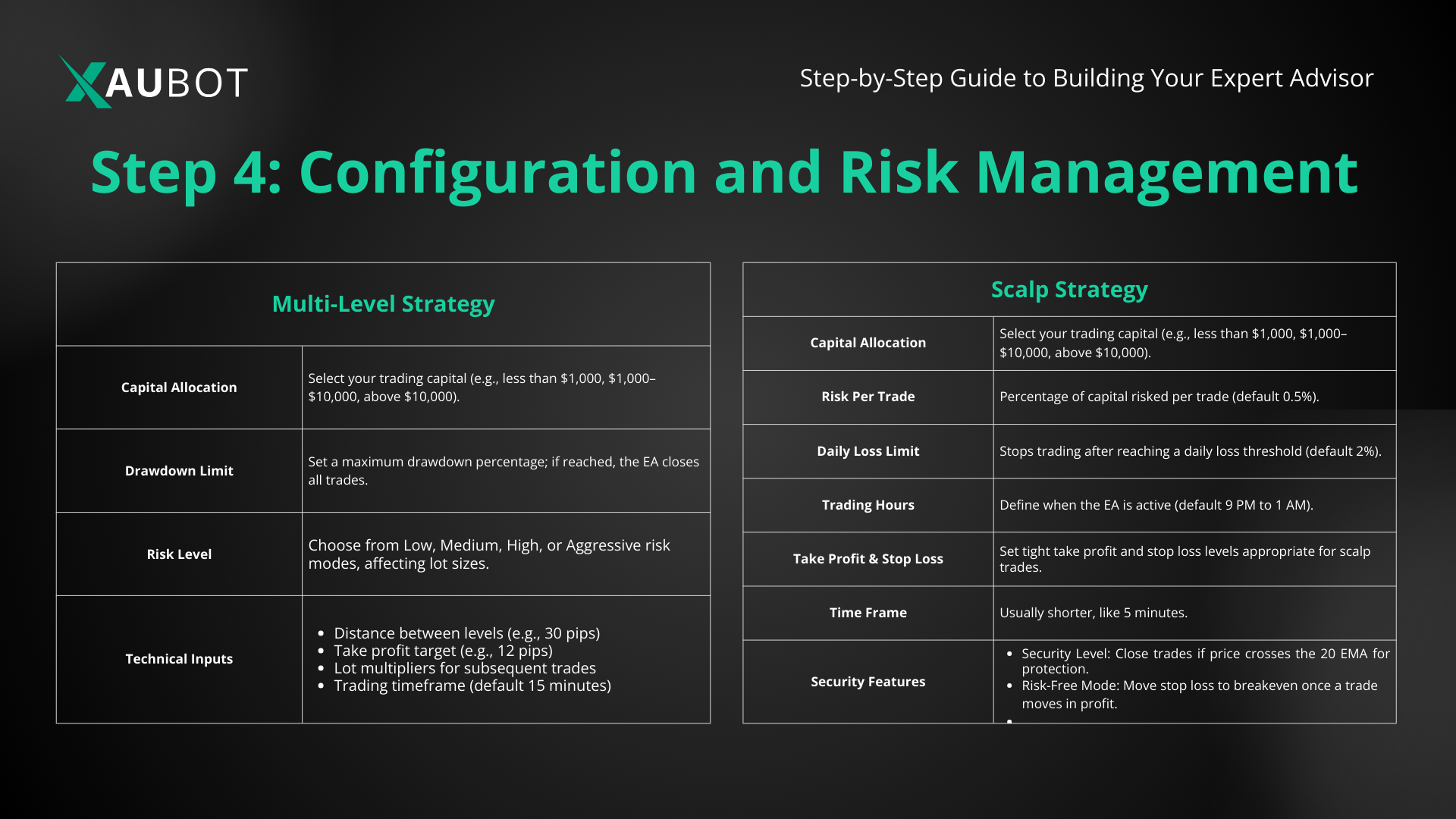

- Customizable Strategies: The ability to tweak trading logic or import community strategies is essential for adapting to market conditions.

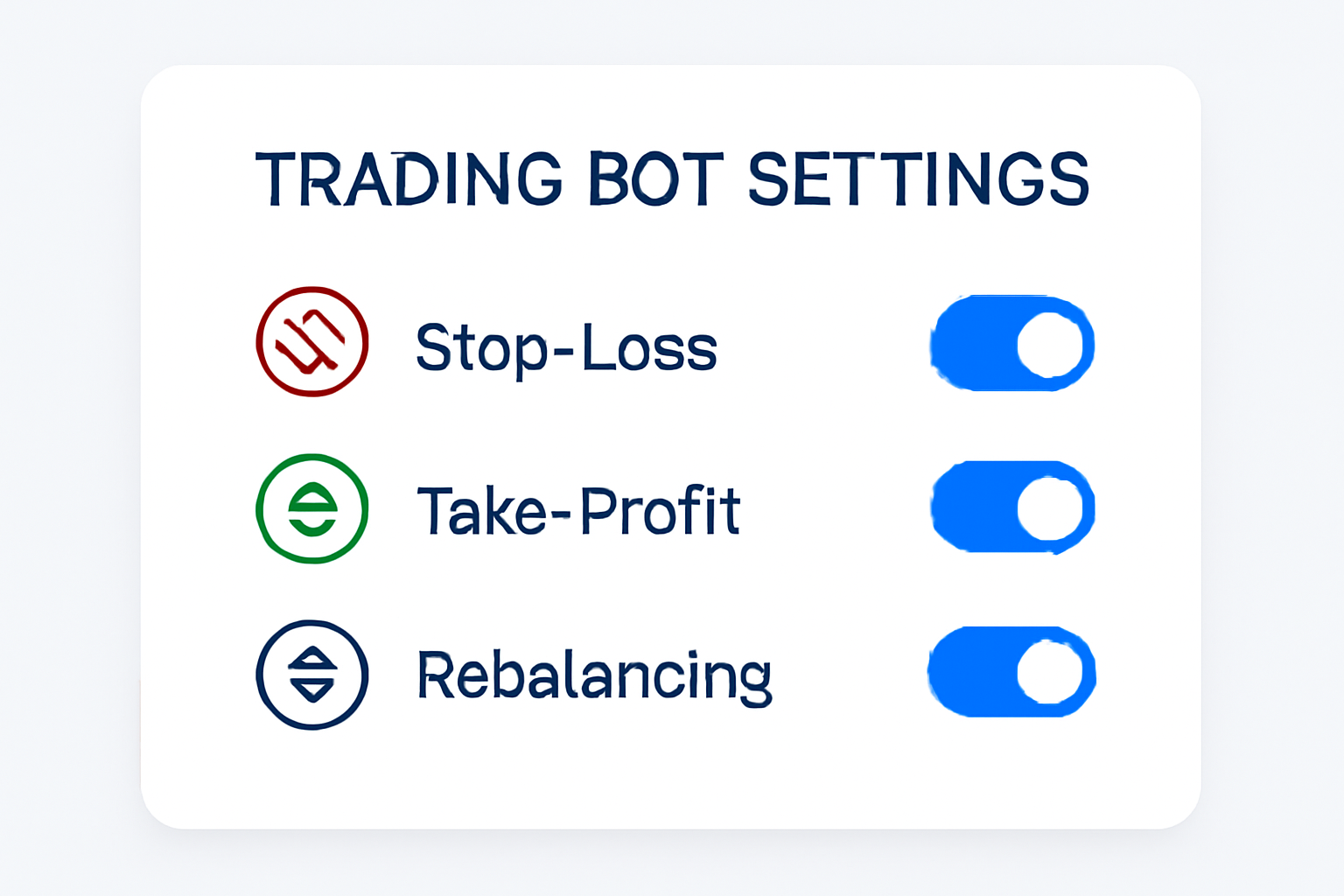

- Risk Management Tools: Look for bots with stop-loss, take-profit, and trailing stop features to safeguard capital.

- Backtesting and Analytics: Leading bots provide historical performance data so you can optimize strategies before risking real funds.

- Security and Reliability: Cloud-based bots with robust encryption and two-factor authentication minimize operational risks.

For a deeper dive into automated rebalancing and AI-powered agents, check out this comprehensive guide.

Market Performance and Bot-Driven Strategies

With Bitcoin maintaining its position above $107,000 and altcoins like Ethereum and BNB also posting solid gains, automated strategies are proving invaluable. Bots can dynamically adjust allocations to capitalize on trending assets or hedge against downturns. For instance, if Cardano (ADA) surges beyond its current price of $0.634151, a well-configured bot can rebalance your holdings to lock in profits or reduce exposure as needed.

Comprehensive Cryptocurrency Price Prediction Table (2026-2031)

Professional forecast for BTC, ETH, BNB, ADA, and DOGE based on October 2025 market conditions and adoption trends. Includes bullish and bearish scenarios for each year.

| Year | Asset | Minimum Price | Average Price | Maximum Price | Estimated % Change (Avg.) | Market Scenario Insights |

|---|---|---|---|---|---|---|

| 2026 | BTC | $85,000 | $120,000 | $150,000 | +12% | Potential consolidation after recent highs; halving effect still present |

| 2026 | ETH | $3,000 | $4,600 | $6,200 | +19% | ETH 2.0 upgrades and L2 adoption drive value; regulatory clarity possible |

| 2026 | BNB | $850 | $1,250 | $1,650 | +14% | BNB Chain ecosystem and exchange dominance remain strong |

| 2026 | ADA | $0.50 | $0.80 | $1.10 | +13% | Smart contract adoption grows, but faces tough competition |

| 2026 | DOGE | $0.13 | $0.22 | $0.32 | +14% | Speculative interest and meme culture sustain volatility |

| 2027 | BTC | $92,000 | $135,000 | $180,000 | +13% | Institutional adoption increases; macro headwinds possible |

| 2027 | ETH | $3,400 | $5,300 | $7,800 | +15% | DeFi and NFT use cases mature; scaling solutions drive growth |

| 2027 | BNB | $950 | $1,400 | $1,950 | +12% | Further exchange integrations; regulatory developments watched |

| 2027 | ADA | $0.60 | $0.95$1.40<\/tddclass=\"pricell\"\>+19%<\/tddclass=\"pricell\"\>Cardano ecosystem expansion; competition with ETH\/SOL<\/tddclass=\"pricell\"\>\/ As we move further into 2025, the integration of AI and machine learning into crypto stock trading bots is expected to accelerate. This means not only faster execution but also smarter strategy adaptation based on evolving market data. Staying competitive in today’s crypto stock market means leveraging every advantage, and automated trading bots are at the forefront of this evolution. With Bitcoin (BTC) at $107,012.00 and Ethereum (ETH) at $3,876.51, the stakes for optimizing portfolio management have never been higher. Automated bots empower traders to execute sophisticated strategies such as momentum trading, mean reversion, and sector rotation with precision, 24 hours a day.

Best Practices for Using Trading Bots in 2025While automation can dramatically enhance your results, it’s crucial to approach bot deployment with discipline and oversight. Here are actionable best practices to maximize your success: Best Practices for Configuring & Monitoring Crypto Trading Bots in 2025

Continuous monitoring is key, even the most advanced bots require periodic review to ensure they’re aligned with your risk tolerance and market conditions. Regularly update your strategy parameters as volatility shifts or as your investment goals evolve. It’s also wise to start with a demo or paper trading mode before committing real capital. Most leading bots like 3Commas and Cryptohopper offer robust backtesting environments, letting you fine-tune your approach using historical data. This reduces the risk of unexpected losses from strategy misconfigurations or market anomalies. Risks and Limitations of AutomationNo system is infallible. Even top-rated crypto stock trading bots can encounter technical glitches, exchange outages, or sudden black swan events that disrupt normal operations. It’s important to diversify across multiple strategies and avoid over-reliance on a single platform. Security remains paramount, always enable two-factor authentication and use API keys with restricted permissions. Never store large sums on exchanges unless absolutely necessary for liquidity. Finally, remember that past performance is not predictive of future results. The crypto market’s 24/7 nature means conditions can shift rapidly, so maintain a flexible mindset and be prepared to intervene manually if needed.

The Future of Crypto Stock Trading AutomationThe next wave of innovation is already underway: AI-powered bots capable of learning from vast datasets and adjusting strategies in real time. By 2026, expect even tighter integration with DeFi protocols, on-chain analytics, and cross-exchange arbitrage. These advances will further level the playing field between institutional players and retail investors. If you’re new to this landscape or want to refine your approach, our step-by-step guide for beginners offers a practical foundation for entering the world of crypto stock trading automation. Ultimately, the best crypto trading bots are those that fit your unique risk profile, investment goals, and technical expertise. In a market where Bitcoin holds firm above $107,000 and altcoins like ADA and DOGE continue to show momentum ($0.634151 and $0.187385, respectively), automation is not just about saving time, it’s about building a resilient, adaptive portfolio that can thrive in any market environment. Related Stories |