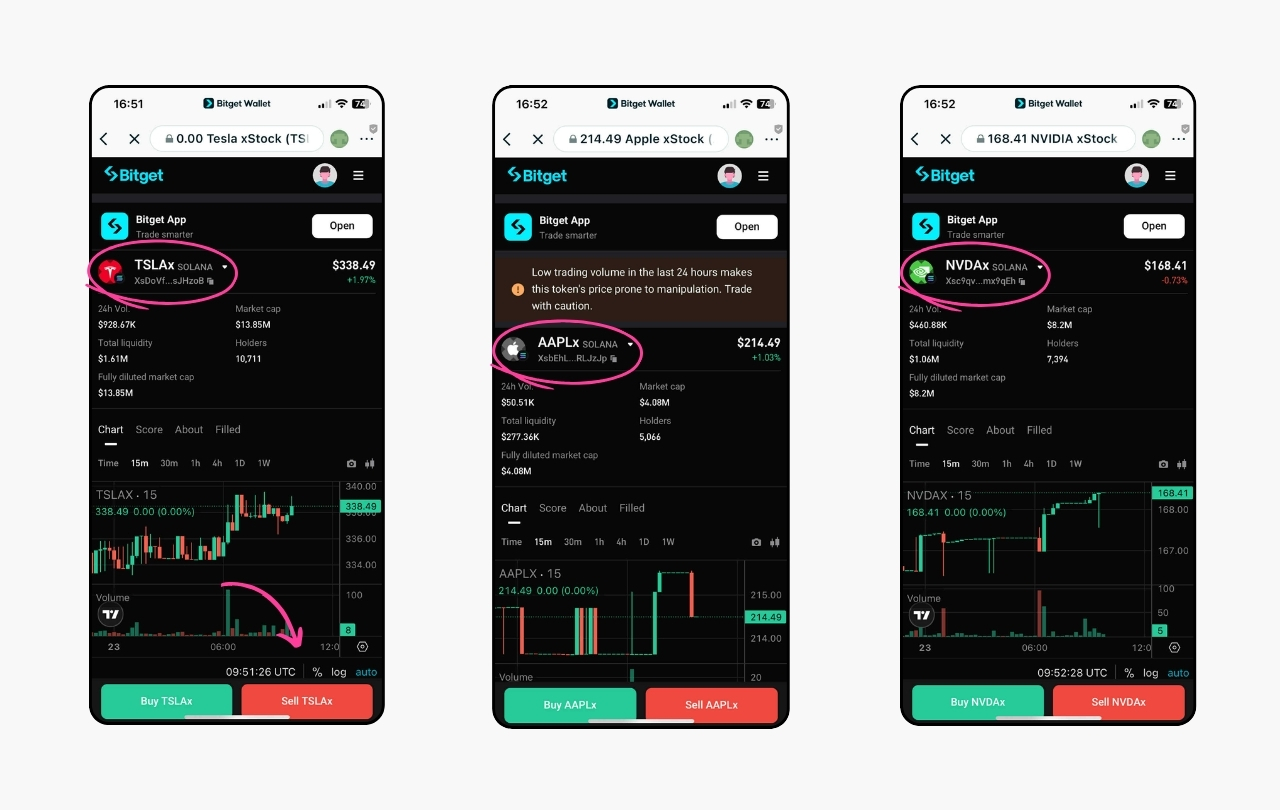

Tokenized stocks have rapidly transformed the landscape for crypto investors, blurring the lines between traditional equities and blockchain-based assets. By enabling 24/7 trading, tokenized stocks unlock new strategies and risks that demand a pragmatic approach. As of October 17,2025, major tokenized stocks such as Tesla Inc (TSLA) at $428.75, Apple Inc (AAPL) at $247.45, and Amazon. com Inc. (AMZN) at $214.47 are actively traded around the clock, but their prices can diverge from traditional market hours due to unique liquidity and demand factors.

How Tokenized Stocks Enable 24/7 Trading

Unlike conventional equities, which are bound by stock exchange hours, tokenized stocks exist on blockchain platforms that never sleep. This perpetual market access empowers investors with flexibility but also requires a disciplined trading strategy to manage volatility outside of Wall Street’s regular session. For an in-depth look at how tokenized stocks enable round-the-clock trading and fractional ownership, see this guide.

Top Strategies for Trading Tokenized Stocks 24/7

Top Strategies for Trading Tokenized Stocks 24/7

-

Automated Trading with Bots: Utilize algorithmic trading bots to capitalize on price movements during off-market hours. Bots can execute trades based on predefined strategies, ensuring you never miss opportunities in the 24/7 tokenized stock market.

-

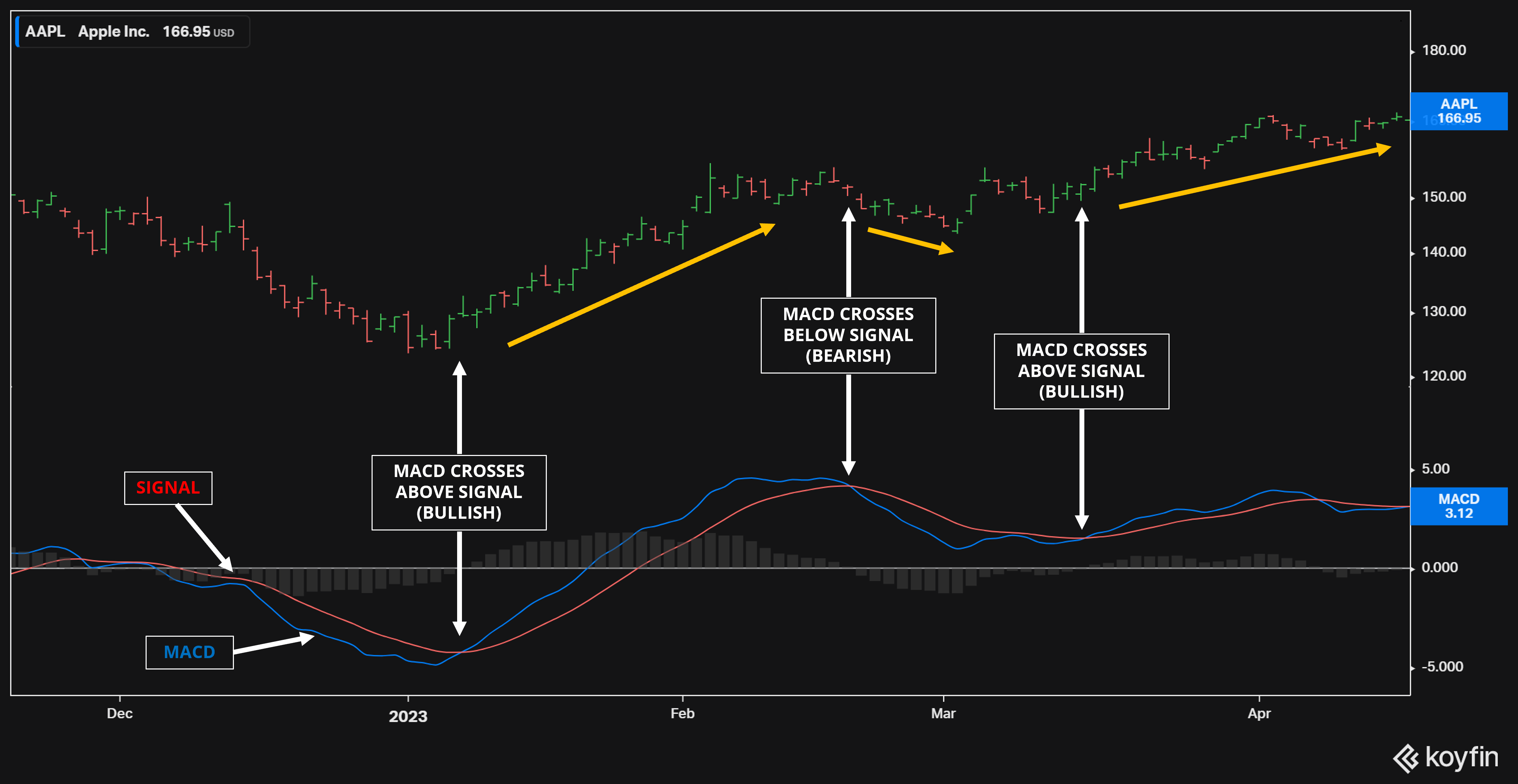

Technical Analysis for Volatile Periods: Apply technical indicators like RSI, MACD, and moving averages to identify optimal entry and exit points during high-volatility periods—often occurring outside traditional stock exchange hours.

-

Diversification Across Multiple Tokenized Equities: Spread investments across different tokenized stocks and sectors to mitigate risks associated with single-asset exposure in a continuously open market.

Success in the always-on world of tokenized equities depends on leveraging tools and tactics designed for continuous markets:

- Automated Trading with Bots: Algorithmic bots are essential for capitalizing on price swings during off-market hours when manual attention is impractical. These bots execute trades based on pre-set criteria, ensuring you never miss opportunities as global news or crypto sentiment moves prices overnight.

- Technical Analysis for Volatile Periods: High volatility often strikes when traditional exchanges are closed. Applying indicators like RSI, MACD, and moving averages can help spot actionable trends or reversals during these windows, crucial for timing entries and exits effectively.

- Diversification Across Multiple Tokenized Equities: With the ability to access US tech giants like TSLA ($428.75), AAPL ($247.45), AMZN ($214.47), GOOGL ($251.46), and MSFT ($511.61) alongside international equities, spreading your holdings across sectors helps buffer against single-asset shocks in an always-open market.

The Biggest Risks Facing Crypto Investors in Tokenized Equities

The promise of non-stop access comes with significant challenges unique to this emerging asset class:

- Liquidity Gaps During Off-Peak Hours: While markets are technically open all day, real trading activity can be thin during certain periods, especially late-night or holiday hours, leading to wider spreads and potential slippage when executing large orders.

- Regulatory Uncertainty: The legal status of tokenized stocks is evolving quickly; sudden regulatory changes or platform restrictions can result in delistings or loss of access to certain assets without warning.

- Counterparty and Smart Contract Risks: Trusting third-party platforms means exposure to technical failures or hacks that could compromise your holdings, especially if smart contracts are not thoroughly audited or platforms lack robust security measures.

The Best Platforms for Tokenized Stock Trading Right Now

Top 3 Platforms for 24/7 Tokenized Stock Trading

-

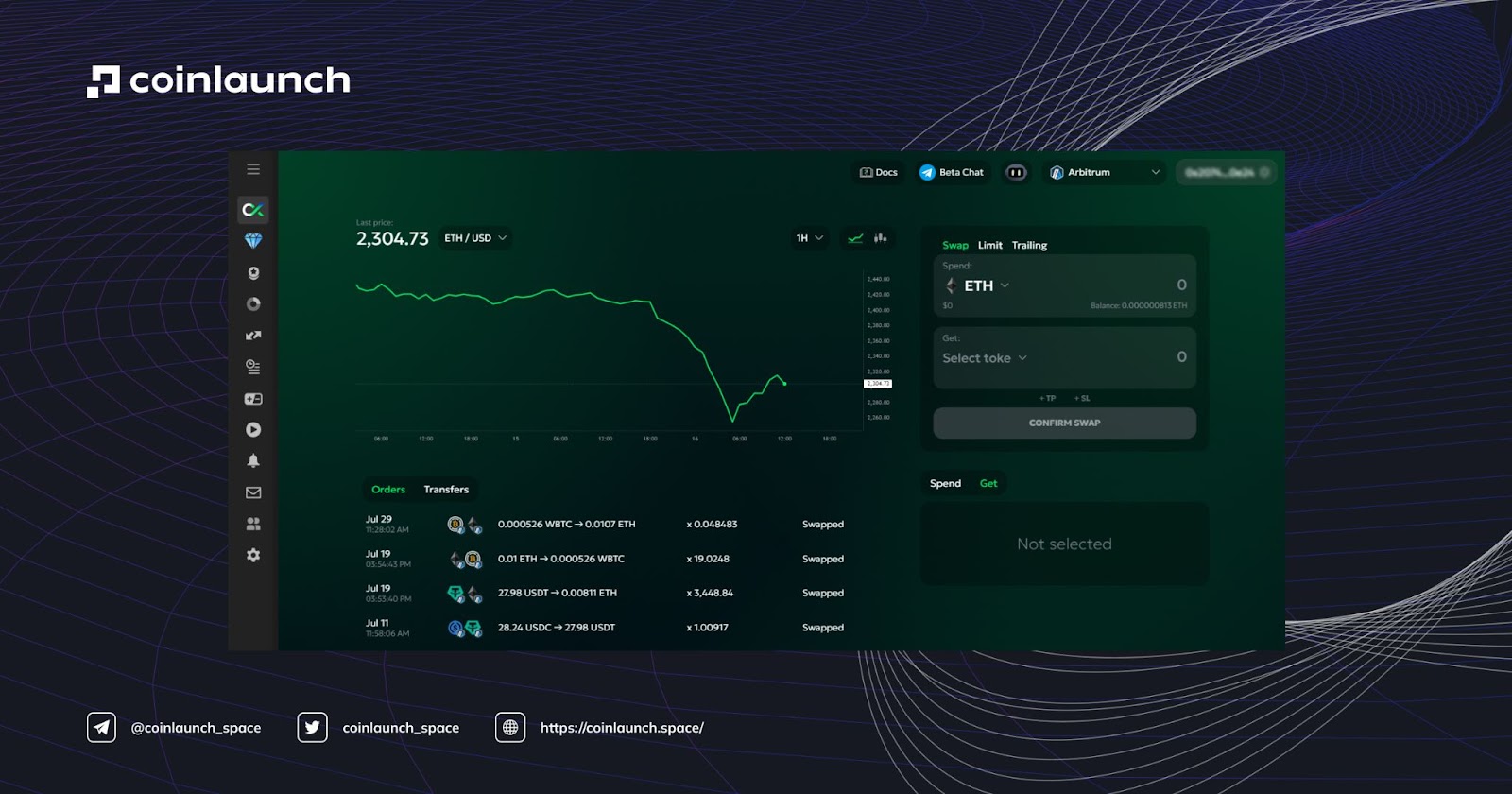

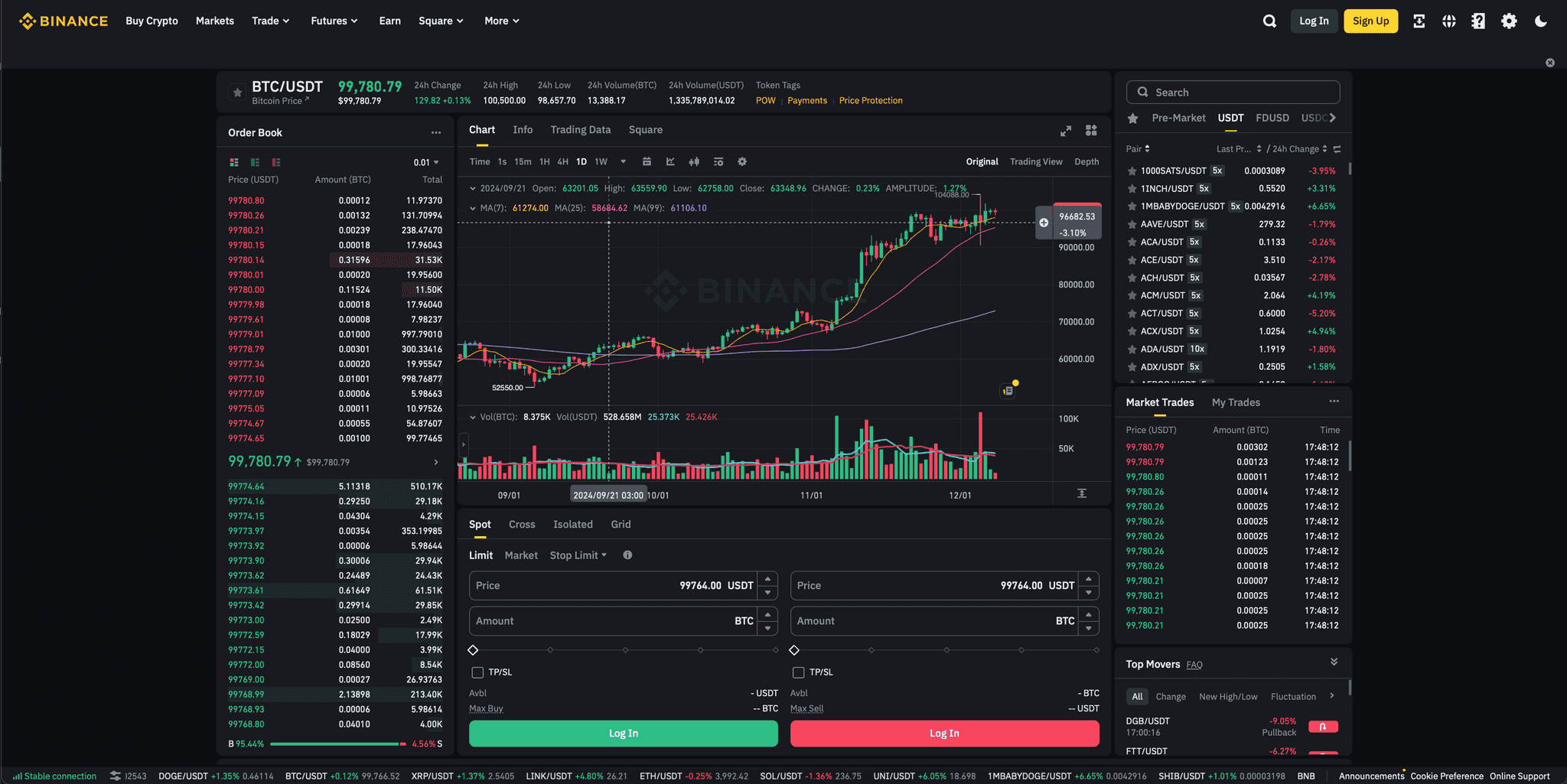

Binance (Binance Stock Tokens): Binance offers a selection of popular tokenized stocks with robust liquidity and 24/7 trading support. These tokens track real-world equities, enabling investors to trade outside traditional market hours. Note: Availability may vary by jurisdiction due to regulatory requirements.

-

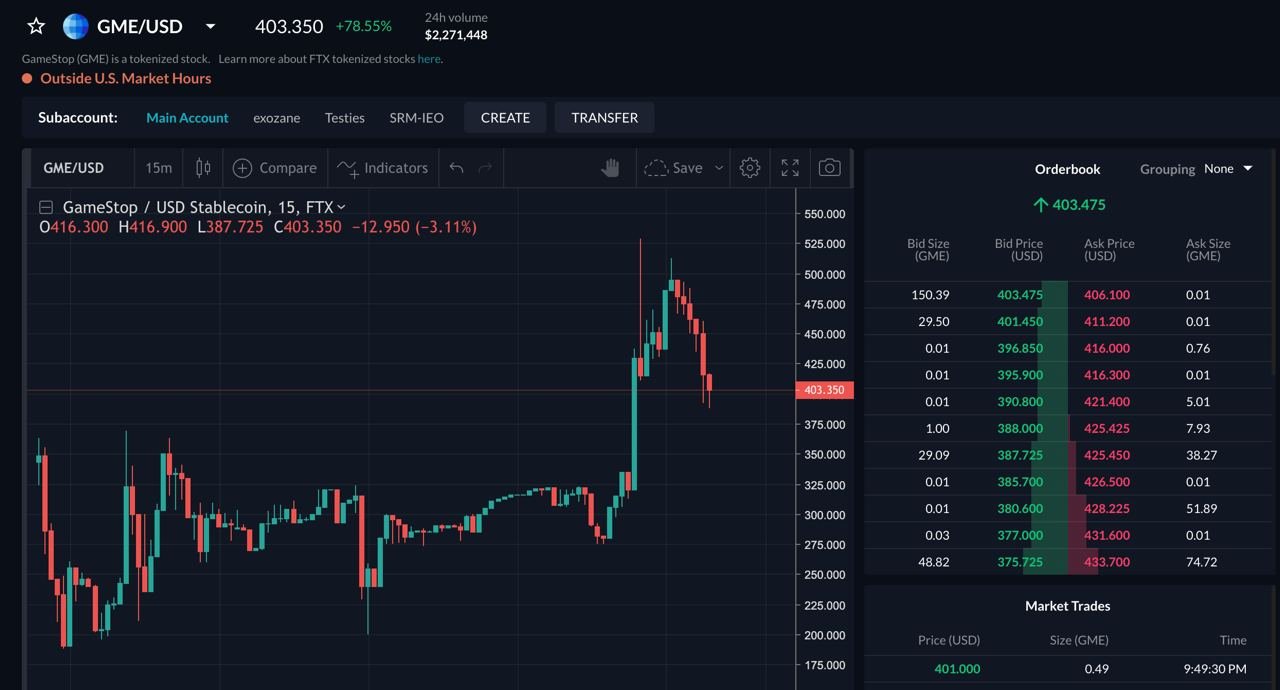

FTX (FTX Stocks): FTX provides a wide range of tokenized equities, featuring advanced trading tools and deep order books for active traders. Note: Always check the current operational status of FTX Stocks due to significant changes post-2023 events.

-

Bittrex Global: Bittrex Global features regulated tokenized stock trading with robust compliance measures. The platform offers a variety of US and international equities in tokenized form, ensuring security and accessibility for global investors.

Navigating this new frontier requires choosing the right venue for liquidity, compliance, and asset selection:

- Binance (Binance Stock Tokens): Offers popular US-listed tokens with strong liquidity pools but availability may vary by jurisdiction.

- FTX (FTX Stocks): Known for deep order books and advanced tools; however, investors must verify current operational status due to recent restructuring events post-2023.

- Bittrex Global: Features regulated access to US and international equities with compliance controls designed to protect both retail traders and institutions alike.

This trio sets the benchmark for accessing leading names like Tesla ($428.75), Apple ($247.45), Amazon ($214.47), Alphabet ($251.46), and Microsoft ($511.61) around the clock, with each platform offering a unique blend of features suited to different risk profiles.

Choosing the right strategy and platform is only half the equation. Smart crypto investors must also adapt their risk management frameworks to this new 24/7 paradigm. Automated bots can be fine-tuned to halt trading during periods of extreme illiquidity, while technical analysis tools should be recalibrated for the unique volatility patterns found in after-hours tokenized equities. Diversification isn’t just a buzzword here, it’s an operational necessity when sudden liquidity gaps or regulatory moves can impact single assets overnight.

Real-world price action underscores these dynamics. For example, Tesla Inc (TSLA) at $428.75 and Apple Inc (AAPL) at $247.45 can swing sharply outside of traditional US market hours, driven by global macro headlines or crypto sentiment shifts. These divergences are both an opportunity for arbitrage and a risk if you’re caught on the wrong side of thin liquidity.

Best Practices for Tokenized Stock Trading in 2025

- Set strict stop-losses: Automated protection is essential in a market that never sleeps.

- Monitor platform health: Stay updated on operational status, especially with platforms like FTX that have undergone recent restructuring.

- Avoid overexposure: Use position sizing and diversify across sectors to reduce tail risk from single-asset events.

The regulatory environment remains fluid. Jurisdictions may clamp down or open up overnight, impacting your ability to trade or withdraw assets. That’s why it’s critical to stay informed and use platforms with robust compliance controls like Bittrex Global, or those with proven liquidity such as Binance Stock Tokens.

For those serious about integrating tokenized stocks into their portfolio, continuous learning is non-negotiable. Follow real-time news feeds, join trading communities, and track platform updates rigorously. Consider reading more on how tokenized stocks are reshaping global equity access via blockchain wallets in this detailed analysis: Tokenized Stocks: Enabling 24/7 Global Equity Trading.

What’s Next for Crypto Investors?

The convergence of blockchain and equities is accelerating, but so are the complexities. As we watch real-time prices like Amazon. com Inc (AMZN) at $214.47, Alphabet Inc (GOOGL) at $251.46, and Microsoft Corporation (MSFT) at $511.61, it’s clear that tokenized stocks are not a passing trend, they’re an evolving asset class demanding advanced strategies and constant vigilance.

If you’re ready to move beyond traditional hours and embrace round-the-clock equity exposure, focus on automation, technical precision during volatile periods, and broad diversification across top-performing names via trusted platforms like Binance Stock Tokens, FTX Stocks, or Bittrex Global.

This is not a market for passive participants, but for those willing to adapt, overcome challenges, and profit from volatility wherever it appears on the clock face.