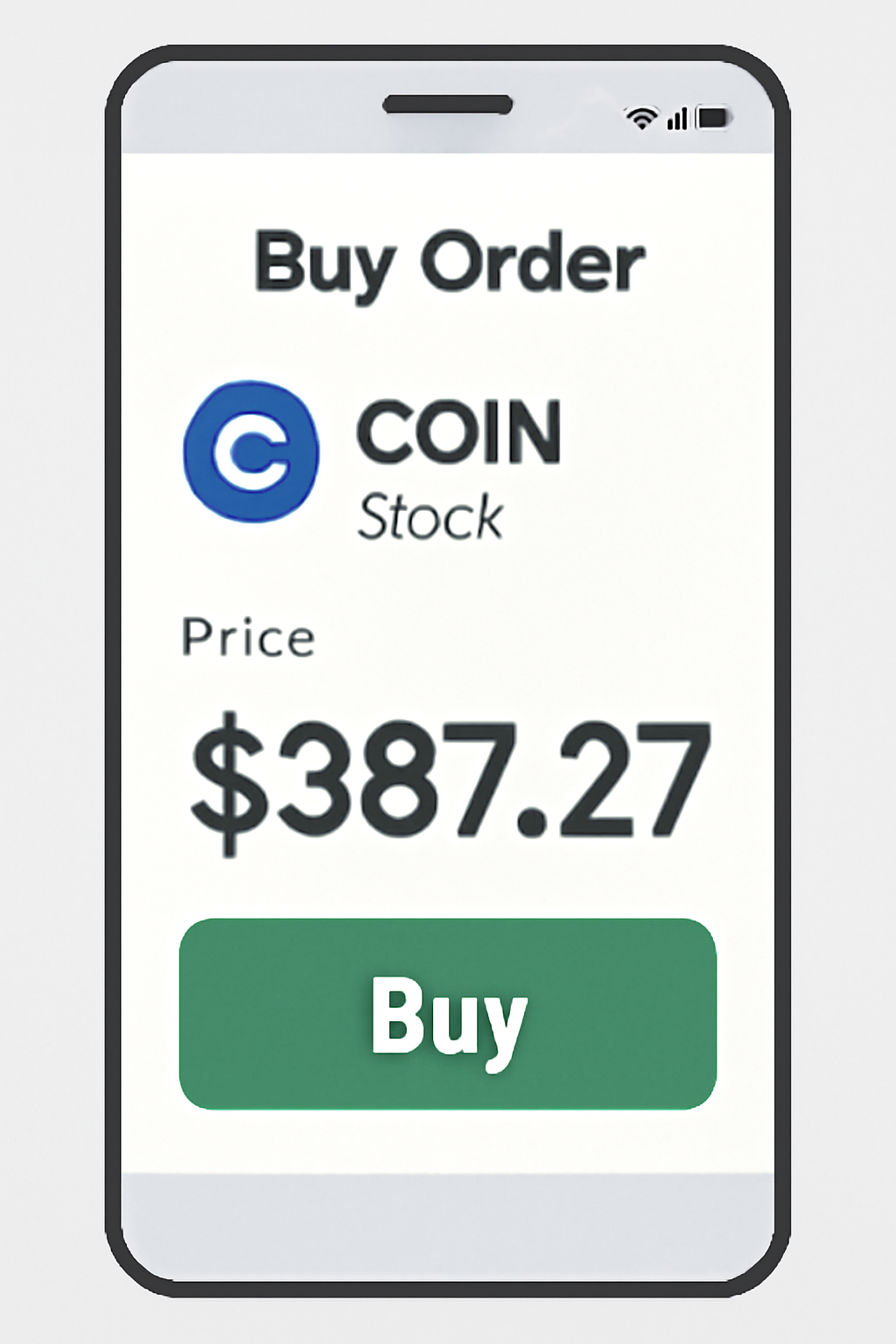

The line between traditional equities and digital assets is blurring, and 2024 is shaping up to be a pivotal year for investors looking to bridge both worlds. If you’re curious about how to trade crypto-backed stocks, you’re not alone. With market leaders like Coinbase Global Inc. (COIN) currently trading at $387.27 (24h change: and $11.44), and companies like MicroStrategy and Marathon Digital Holdings reshaping their business models around crypto, the opportunity to gain exposure to the crypto market without holding digital coins directly is more accessible than ever.

What Are Crypto-Backed Stocks?

Crypto-backed stocks are shares of publicly traded companies whose fortunes are tightly linked to the cryptocurrency sector. These companies might run major exchanges, mine Bitcoin, or hold substantial crypto reserves on their balance sheets. For example:

- Coinbase Global Inc. (COIN): The largest US-based crypto exchange, acting as a gateway for millions of investors and institutions.

- MicroStrategy Inc. (MSTR): Not just a software company anymore; it’s now the world’s largest corporate holder of Bitcoin, with over 214,000 BTC on its balance sheet.

- Marathon Digital Holdings Inc. (MARA): A pure play on Bitcoin mining, with aggressive expansion plans aiming for a hash rate of 50 exahashes per second by year-end.

This approach lets you participate in the crypto economy via regulated stock markets – an attractive route if you want crypto exposure but prefer the oversight and structure of equity investing.

How to Start Trading Crypto-Backed Stocks

Trading these stocks requires a slightly different mindset than direct crypto trading. Here’s how to get started:

1. Research Your Targets

Begin by identifying which companies truly have significant exposure to crypto. For instance, Coinbase (COIN) is not just an exchange – it also serves as a primary custodian for major Bitcoin and Ethereum ETFs, benefiting from custody fees and trading volumes (coinpedia.org). MicroStrategy’s share price is famously correlated with Bitcoin’s moves (btcc.com). Marathon Digital Holdings (MARA) offers leveraged exposure to Bitcoin mining profitability (btcc.com).

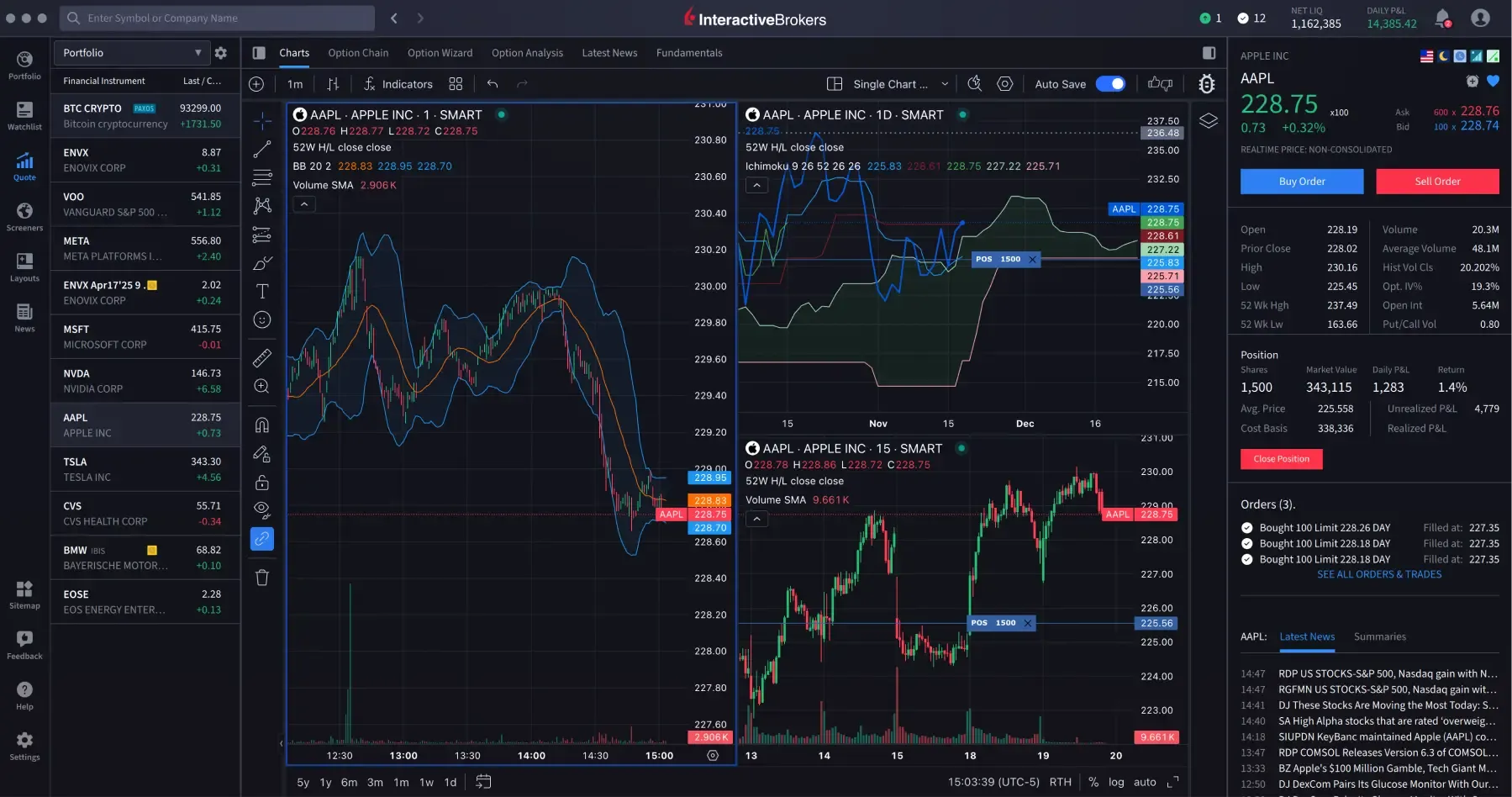

2. Choose a Brokerage Platform

You’ll need access to US stock markets – platforms like Interactive Brokers or Schwab are popular choices. Make sure your broker supports all the stocks you’re interested in and provides the research tools you need for ongoing analysis.

3. Open and Fund Your Account

After selecting your brokerage, complete their onboarding process (identity verification is standard), then fund your account using ACH transfer, wire, or even debit card in some cases.

Current Market Insights: COIN at $387.27 and What It Means for You

Coinbase Global Inc. (COIN) currently trades at $387.27, reflecting not only its core business performance but also broader sentiment around institutional adoption of cryptocurrencies. As a primary custodian for several major ETFs, Coinbase stands to benefit from both increased trading activity and institutional flows into spot Bitcoin products. This makes COIN a bellwether for crypto-backed equities in general.

Risk Management and Volatility: What Every Beginner Should Know

The volatility of the cryptocurrency market often spills over into crypto-backed stocks. Even though you’re buying equities on regulated exchanges, the underlying business models can be highly sensitive to digital asset price swings and regulatory news cycles. Diversification is key; don’t put all your eggs in one basket, and consider setting stop-loss orders to cap potential downside risk.

Coinbase Global Inc. (COIN) Stock Price Prediction 2026-2031

Forecast based on current fundamentals, crypto market trends, and evolving regulatory landscape. All prices in USD.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $260.00 | $410.00 | $520.00 | +5.9% | Crypto adoption steady, earnings growth driven by ETF custody and rising trading volumes |

| 2027 | $280.00 | $435.00 | $560.00 | +6.1% | Regulatory clarity boosts institutional inflows; volatility persists with Bitcoin price cycles |

| 2028 | $305.00 | $460.00 | $600.00 | +5.7% | New crypto products and global expansion drive revenue; competition increases pressure |

| 2029 | $330.00 | $485.00 | $645.00 | +5.4% | Broader digital asset adoption; potential for higher transaction revenue but more regulatory scrutiny |

| 2030 | $355.00 | $510.00 | $690.00 | +5.2% | Integration with traditional finance accelerates; macroeconomic headwinds may limit upside |

| 2031 | $380.00 | $535.00 | $735.00 | +4.9% | Continued growth in crypto ETF markets; COIN seen as market infrastructure leader |

Price Prediction Summary

COIN is positioned for steady growth as the leading crypto exchange and ETF custodian. While volatility remains due to crypto market cycles, increasing institutional adoption, product innovation, and regulatory clarity are likely to support higher valuations. The minimum and maximum ranges reflect both adverse and bullish crypto scenarios. Average annual price growth is projected at 5-6%, with potential for outperformance if digital asset adoption accelerates.

Key Factors Affecting Coinbase Global Inc. Stock Price

- Crypto market cycles and Bitcoin/Ethereum price trends

- Coinbase’s role as ETF custodian and exchange leader

- Regulatory developments in the US and globally

- Earnings growth from new products and higher trading volumes

- Competition from new entrants and traditional finance

- Macro environment and investor risk appetite

Disclaimer: Stock price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, economic conditions, and other factors.

Always do your own research before making investment decisions.

A well-balanced approach can help mitigate risk while positioning your portfolio to benefit from both bull runs in digital assets and growth in the underlying businesses of these innovative companies.

Another crucial point for beginners: liquidity and timing matter. Crypto-backed stocks, while traded on major exchanges, can experience sharp price swings during periods of crypto market turbulence. For example, when Bitcoin or Ethereum prices spike or crash, companies like Coinbase (COIN), MicroStrategy (MSTR), and Marathon Digital Holdings (MARA) often see amplified moves. This correlation can be both a risk and an opportunity, depending on your trading strategy and risk tolerance.

Smart Strategies for Trading Crypto-Backed Stocks in 2024

Top Trading Tips for Beginner Crypto Stock Investors

-

Start with Well-Known Crypto-Backed Stocks: Focus on established companies like Coinbase Global Inc. (COIN), MicroStrategy Inc. (MSTR), and Marathon Digital Holdings Inc. (MARA). These firms have significant exposure to the crypto sector and are widely tracked by investors.

-

Research Company Fundamentals: Before investing, analyze each company’s financial health, crypto exposure, and business model. For example, MicroStrategy holds over 214,000 Bitcoins, directly tying its stock performance to Bitcoin price movements.

-

Use a Trusted Brokerage Platform: Choose established brokers such as Interactive Brokers or Charles Schwab that offer access to U.S. stock markets and crypto-related equities. Ensure the platform provides robust security and user-friendly trading tools.

-

Diversify Your Portfolio: Don’t put all your funds into a single crypto-backed stock. Spread your investments across multiple companies and sectors to reduce risk and exposure to volatility.

-

Set Clear Entry and Exit Strategies: Decide in advance when to buy or sell based on your risk tolerance and investment goals. Use limit orders and stop-loss orders to automate your trades and protect against sudden market swings.

-

Monitor Both Crypto and Stock Markets: Stay updated on cryptocurrency price movements and stock market trends. For instance, Coinbase (COIN) recently traded at $387.27 with a 24h change of +$11.44 (+0.0304%), showing how closely these stocks track the crypto sector.

-

Stay Informed About Regulatory Changes: Crypto-backed stocks are sensitive to regulatory developments. Follow news from agencies like the SEC and monitor global policy updates that could impact the crypto industry.

-

Invest Only What You Can Afford to Lose: The crypto sector is highly volatile. Start small and use discretionary funds, as prices can fluctuate rapidly and unpredictably.

Stay on top of news cycles. Regulatory developments, ETF approvals, or security breaches can cause rapid shifts in sentiment. Tools like news alerts and watchlists can help you react quickly.

Understand the difference between direct crypto exposure and equity exposure. While crypto-backed stocks offer a bridge to the digital asset world, their prices are influenced by both company fundamentals and crypto market sentiment. For example, COIN at $387.27 is not just a reflection of Bitcoin’s price, but also Coinbase’s earnings, user growth, and regulatory positioning.

Use technical analysis in tandem with fundamental research. Chart patterns, moving averages, and volume trends can provide entry and exit signals. But always pair these with an understanding of the company’s latest quarterly results or strategic announcements.

Building Your Portfolio: Diversification and Position Sizing

Don’t fall into the trap of over-concentrating in a single crypto stock. While it’s tempting to go all-in on a high-flyer like MicroStrategy, a more resilient approach involves spreading your risk across several names and sectors. Consider adding crypto-adjacent companies, such as payment processors or fintechs with blockchain initiatives, alongside pure plays like miners and exchanges. This broader exposure can help smooth out volatility and position you for multiple trends within the digital asset ecosystem.

Continuous Learning: Resources for the Modern Crypto Stock Trader

The landscape is evolving at breakneck speed. To keep your edge, leverage educational resources, webinars, and community discussions. Platforms like IG and Management. Org offer step-by-step guides for beginners (see IG’s beginner guide). For a deeper dive, video courses like VirtualBacon’s “Crypto Investing for Beginners 2024” can provide hands-on tips for navigating both crypto and equity markets.

Above all, start small and scale up as your confidence grows. With COIN priced at $387.27, fractional shares can be a great way to dip your toe in without overcommitting capital. Remember, the best traders are those who adapt, learn, and stay disciplined in the face of volatility.

Connecting markets, connecting opportunities.: Marissa Chow