High volatility is the lifeblood of crypto stock trading in 2024. If you want to thrive in this market, you need more than just nerves of steel, you need a plan built for speed and precision. The recent bull run, fueled by regulatory shakeups and relentless innovation, has sent names like Coinbase, MicroStrategy, and Riot Platforms on wild price swings. To win in this environment, you must adapt your strategy in real time and never let emotions dictate your next move.

1. Dynamic Position Sizing and Risk Management: Survive First, Then Thrive

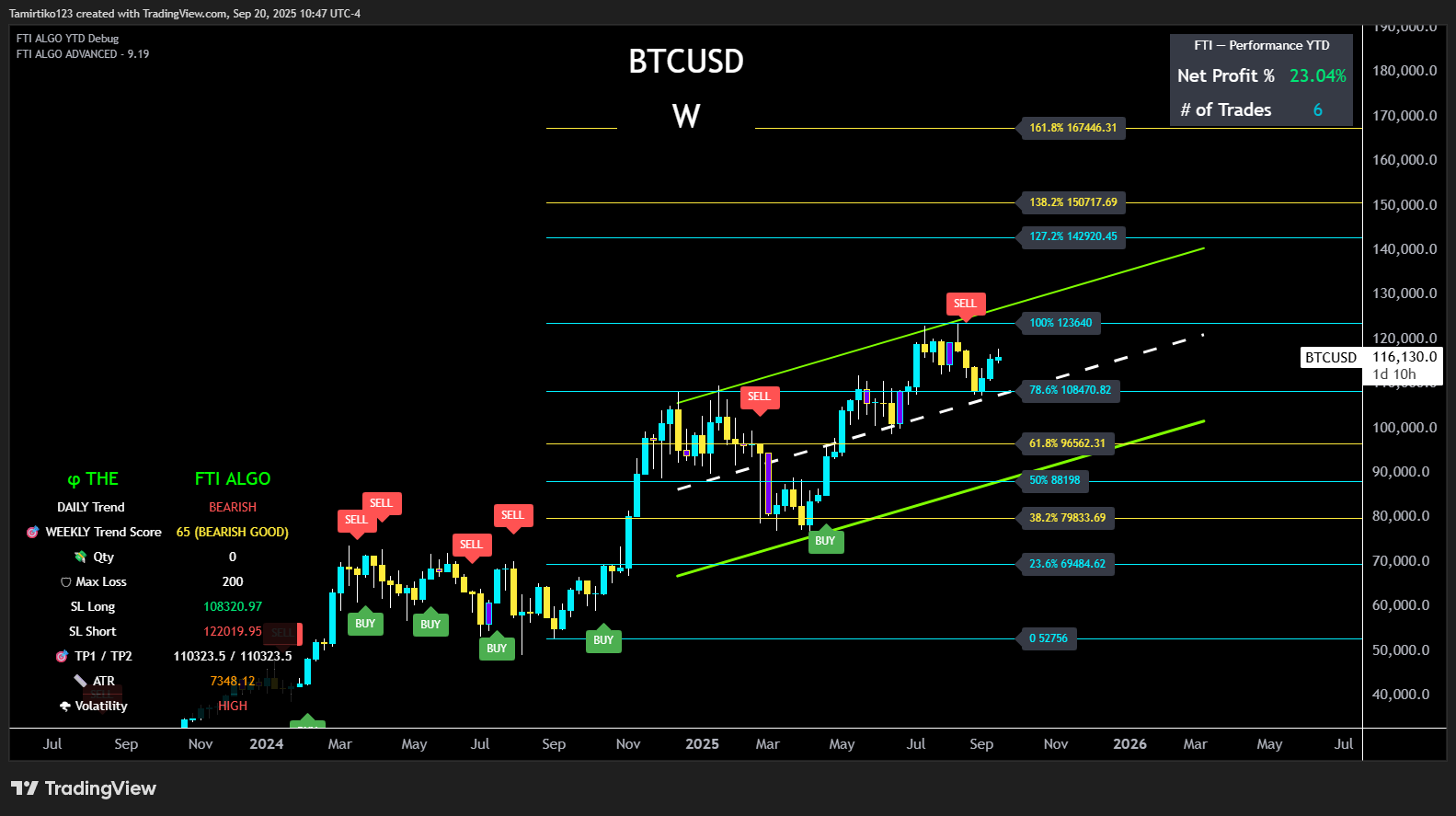

When volatility spikes, your number one job is to protect capital. That means dynamic position sizing: adjusting your trade sizes based on real-time volatility metrics like Average True Range (ATR) and Bollinger Bands. For example, if ATR expands after a major news event or regulatory announcement, shrink your position size to limit downside risk. This isn’t theory, it’s survival.

Stop-loss and take-profit orders must be tailored to current volatility levels, not set-and-forget numbers from a quiet market. If Coinbase ($COIN) whipsaws 8% in an hour, your stops need to breathe with the market or you’ll get chopped out by noise. Diversify across multiple crypto stocks so one rogue move doesn’t wipe out weeks of gains.

2. Dollar-Cost Averaging (DCA) During Dips: Turn Chaos Into Opportunity

Panic selling creates opportunity for disciplined traders. Dollar-cost averaging (DCA) means systematically buying fixed amounts of top-performing crypto stocks, think Coinbase, MicroStrategy, Riot Platforms, at regular intervals regardless of price action. When sharp corrections hit during this bull run, stick to your DCA plan instead of trying to time the bottom.

This approach isn’t just for passive investors; it’s a weapon against FOMO and fear-driven mistakes that plague traders during wild swings. By deploying capital steadily into quality names while others are dumping in panic, you build positions at attractive average prices and mitigate timing risk.

Top 5 Actionable Crypto Stock Trading Strategies for 2024

-

Dynamic Position Sizing and Risk Management: Adjust your trade sizes in real time using volatility metrics like ATR and Bollinger Bands. Set stop-loss and take-profit orders based on current volatility—not guesswork—to protect your capital during sudden price swings. This disciplined approach keeps you in the game when the market gets wild.

-

Dollar-Cost Averaging (DCA) During Dips: Systematically invest fixed amounts into top-performing crypto stocks—think Coinbase, MicroStrategy, or Riot Platforms—at regular intervals, especially during sharp corrections. This helps you sidestep the stress of market timing and smooths out your entry price over time.

-

Momentum Trading with Real-Time Indicators: Ride the strongest trends by using momentum indicators like RSI or MACD to spot powerful moves. Focus on high-volume crypto stocks showing sustained upward momentum during the bull run—get in early, ride the wave, and exit with confidence.

-

Volatility Breakout Strategies: Watch for price consolidations followed by volume surges. Enter trades when crypto stocks break out of established ranges, confirming moves with technical analysis and news catalysts. This strategy lets you catch explosive moves right as they happen.

-

Hedging with Crypto Derivatives: Protect your portfolio by using options or futures contracts on major crypto assets or ETFs. Hedging lets you lock in gains and defend against sudden downturns—without giving up your upside potential during the bull run.

3. Momentum Trading with Real-Time Indicators: Ride the Wave or Get Washed Out

The biggest moves happen fast, blink and you’ll miss them. Momentum trading is about catching these explosive trends as they unfold using indicators like RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence). Focus on high-volume crypto stocks that show sustained upward momentum during periods when Bitcoin maintains position above $100,000.

Your edge comes from acting quickly when technicals align with market sentiment. When RSI confirms strength on MicroStrategy as volume surges after a bullish ETF headline, don’t hesitate, ride that trend until indicators flash signs of exhaustion or reversal.

The Fast Lane Isn’t for Everyone, But It’s Where the Action Is

If you want outsized returns from crypto stock trading strategies in 2024, embrace these techniques with discipline and speed. The next section will dive into breakout strategies and hedging tactics that separate pros from amateurs when the market goes haywire.

4. Volatility Breakout Strategies: Exploit the Explosion

In a market where price can coil for hours and then erupt in minutes, volatility breakout strategies are your ticket to outsized gains. Start by scanning for periods of tight consolidation on names like Coinbase or Riot Platforms, these quiet zones often precede major breakouts. Watch for volume spikes and confirmation from technical analysis: when price bursts out of its range, enter decisively, but always confirm the move with real news catalysts or sector momentum.

This isn’t about guessing direction; it’s about waiting for the market to tip its hand and then reacting with speed. Set alerts on your trading platform for key resistance and support levels. When breakout volume aligns with bullish sentiment or breaking news, don’t hesitate, jump in with a tight stop-loss that adapts to current volatility metrics. If you get faked out, cut losses fast and move on; if you catch the real move, scale profits as volatility expands.

5. Hedging with Crypto Derivatives: Play Both Sides of the Chaos

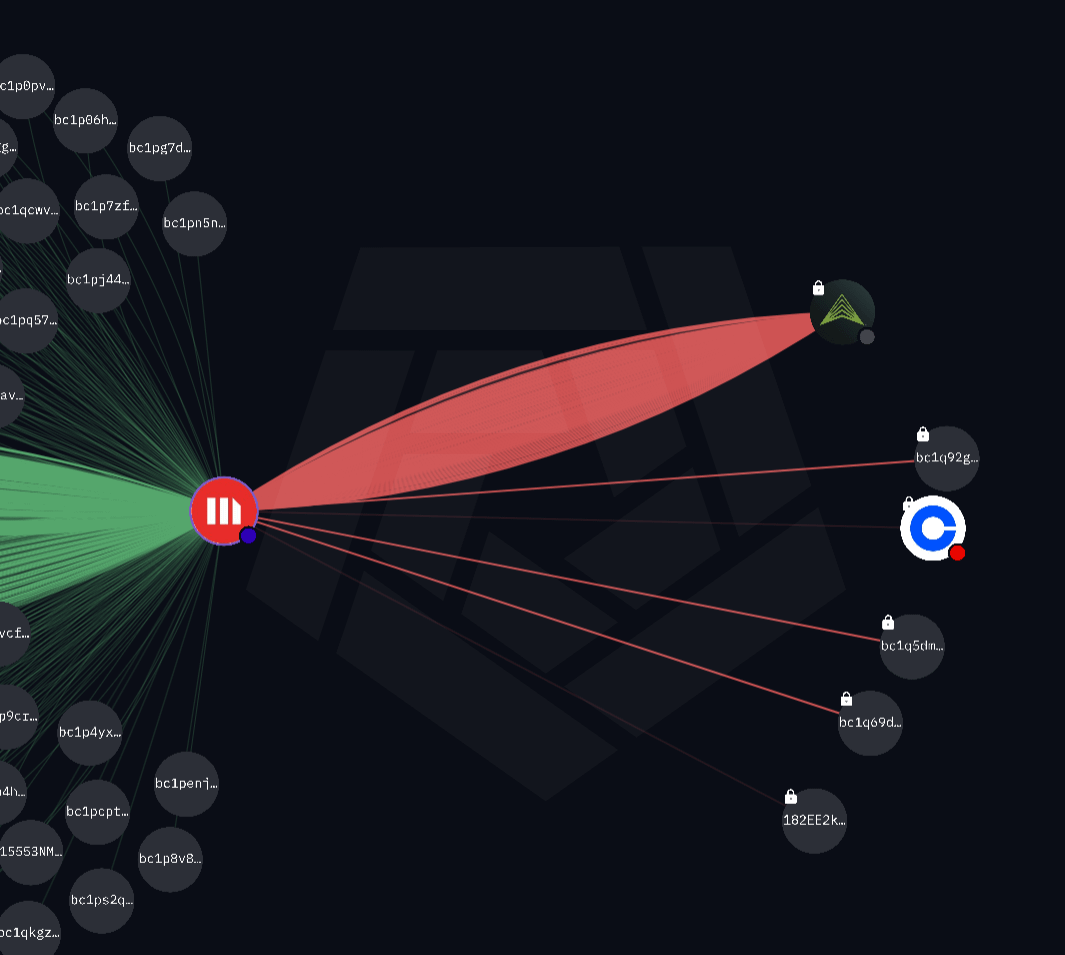

No matter how dialed-in your strategy is, there will be days when nothing goes your way. That’s where hedging with crypto derivatives comes in. Use options or futures contracts on major crypto assets or ETFs to protect your portfolio against sharp reversals while still keeping upside exposure.

This isn’t just insurance, it’s strategic offense and defense at once. For example, if you’re long MicroStrategy but see storm clouds forming over Bitcoin’s price action, buy put options or short futures to offset potential downside without liquidating your core holdings. This keeps you in the game when others are forced out by volatility whiplash.

Stay Agile, Adapt or Get Left Behind

The game changes fast in 2024’s crypto stock market. What worked last month might be obsolete today as new regulations drop, tech evolves, and sentiment flips on a dime. The traders who win are those who relentlessly review their edge, adapt their strategies, and never stop learning from both wins and losses.

If you want an edge over the masses chasing hype, focus on these five actionable strategies:

Top 5 Crypto Stock Trading Strategies for High Volatility

-

Dynamic Position Sizing and Risk Management: Adjust your trade sizes in real time using volatility metrics like Average True Range (ATR) and Bollinger Bands. Set stop-loss and take-profit orders based on current volatility, not fixed percentages, to limit downside during sudden price swings and lock in gains.

-

Dollar-Cost Averaging (DCA) During Dips: Systematically invest fixed amounts into top-performing crypto stocks such as Coinbase (COIN), MicroStrategy (MSTR), or Riot Platforms (RIOT) at regular intervals. Especially during sharp corrections, DCA helps you mitigate timing risk and build positions without chasing tops.

-

Momentum Trading with Real-Time Indicators: Ride strong price trends by using momentum indicators like Relative Strength Index (RSI) and MACD. Focus on high-volume crypto stocks showing sustained upward momentum during the bull run, and use these tools to time your entry and exit points for maximum impact.

-

Volatility Breakout Strategies: Scan for periods of price consolidation followed by significant volume spikes. Enter trades when crypto stocks break out of established ranges, confirming moves with technical analysis and news catalysts. This approach captures explosive moves during high-volatility markets.

-

Hedging with Crypto Derivatives: Protect your portfolio by using options or futures contracts on major crypto assets or ETFs, such as Bitcoin futures or ProShares Bitcoin Strategy ETF (BITO). Hedging helps offset losses during adverse swings while maintaining upside potential.

Combine ruthless risk management with tactical aggression, size up when opportunity knocks but never let one trade blow up your account. Use volatility as fuel for growth rather than letting it burn you out.

Final Thoughts: Mastering Volatility Is Your Competitive Edge

If you’re serious about dominating crypto stock trading during high-volatility cycles in 2024 and beyond, commit to these strategies now. Review them after every session; track what works in your journal; double down on discipline when markets turn manic. There’s no room for hesitation in this arena, only speed, precision, and relentless learning will separate winners from the rest.