In the ever-evolving crypto landscape, relying on a single trading style can leave even experienced investors exposed to volatility and missed opportunities. Instead, the most resilient portfolios blend long-term holding, swing trading, and core position strategies to generate consistent profits while controlling risk. This multi-layered approach leverages the strengths of each method, allowing you to weather market storms and seize upside when momentum shifts. Let’s explore how to combine these strategies for optimal results in 2025’s dynamic crypto environment.

Building Your Core: The Foundation of Crypto Portfolio Management

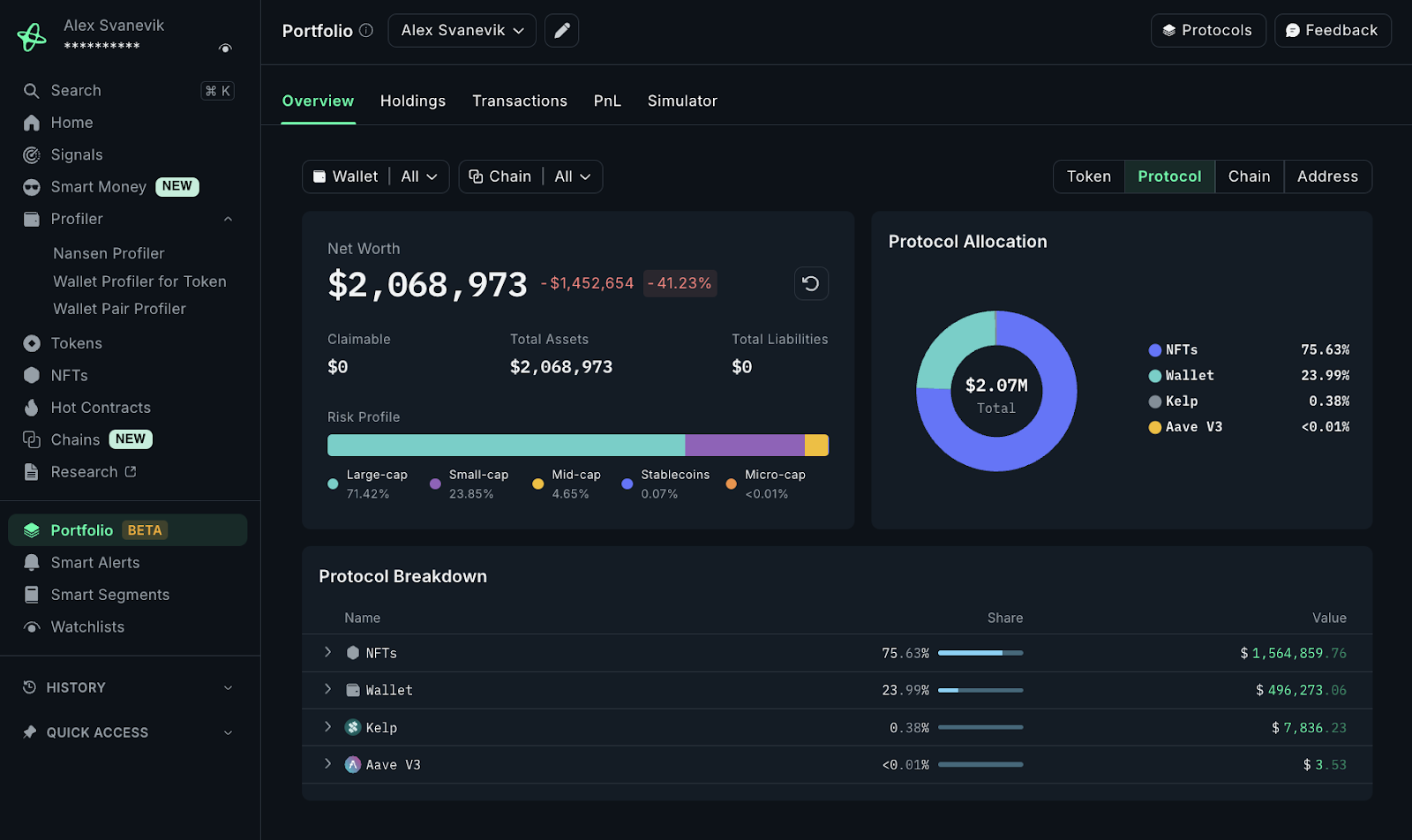

Your core position is the backbone of your crypto portfolio. Typically, this involves allocating 60-80% of your capital to assets with robust fundamentals – think Bitcoin (BTC) and Ethereum (ETH), which have proven resilience across multiple cycles. This core is designed for long-term holding, riding out short-term turbulence in pursuit of major market trends and compounding gains over time. The idea is simple: while markets may swing wildly week-to-week, well-chosen core assets often appreciate steadily as adoption grows.

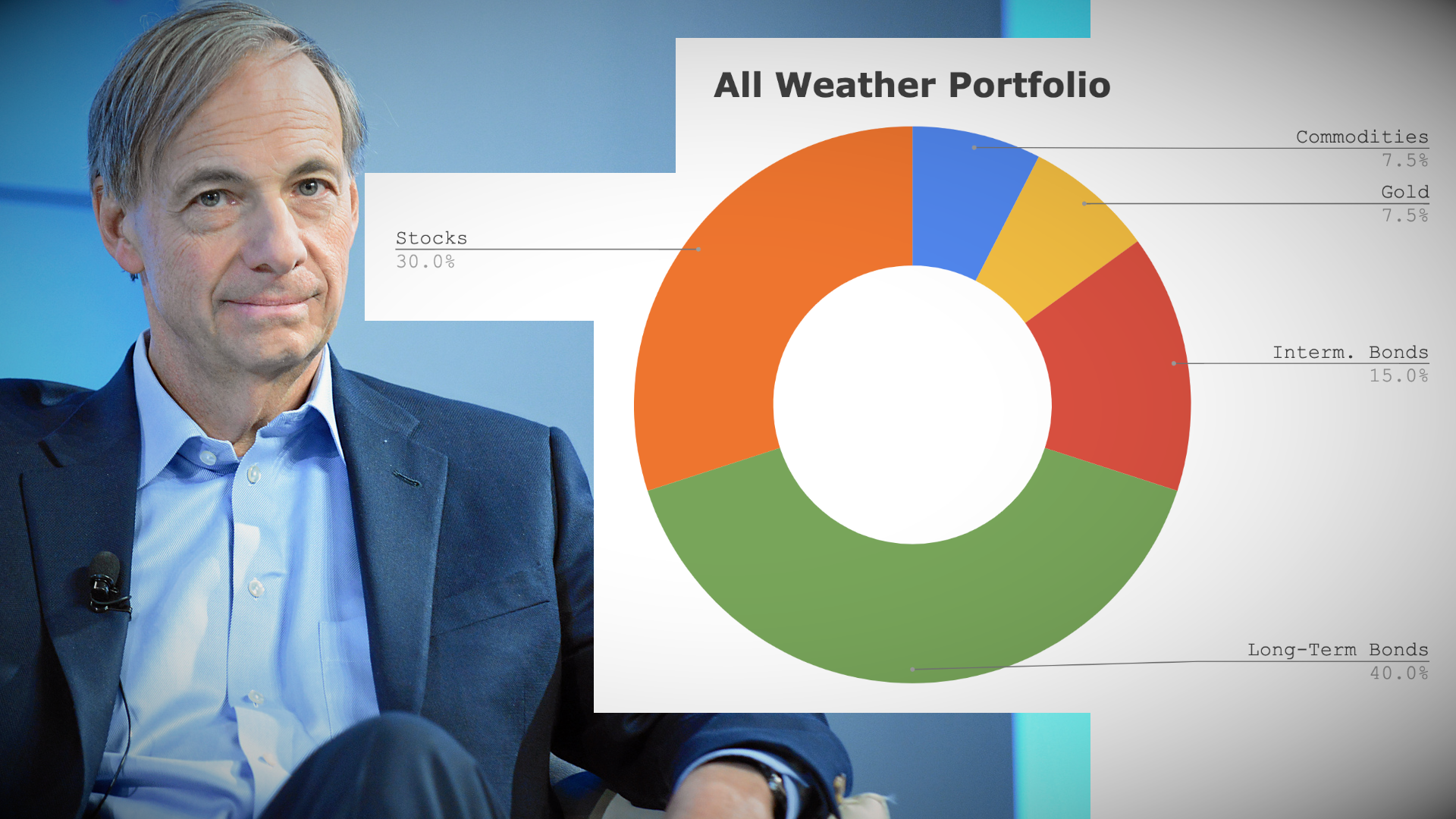

This approach mirrors the core-and-satellite model favored by professionals. Your core delivers stability and anchors your risk profile. Meanwhile, satellites (smaller positions) allow for more active trading and experimentation without jeopardizing your portfolio’s integrity.

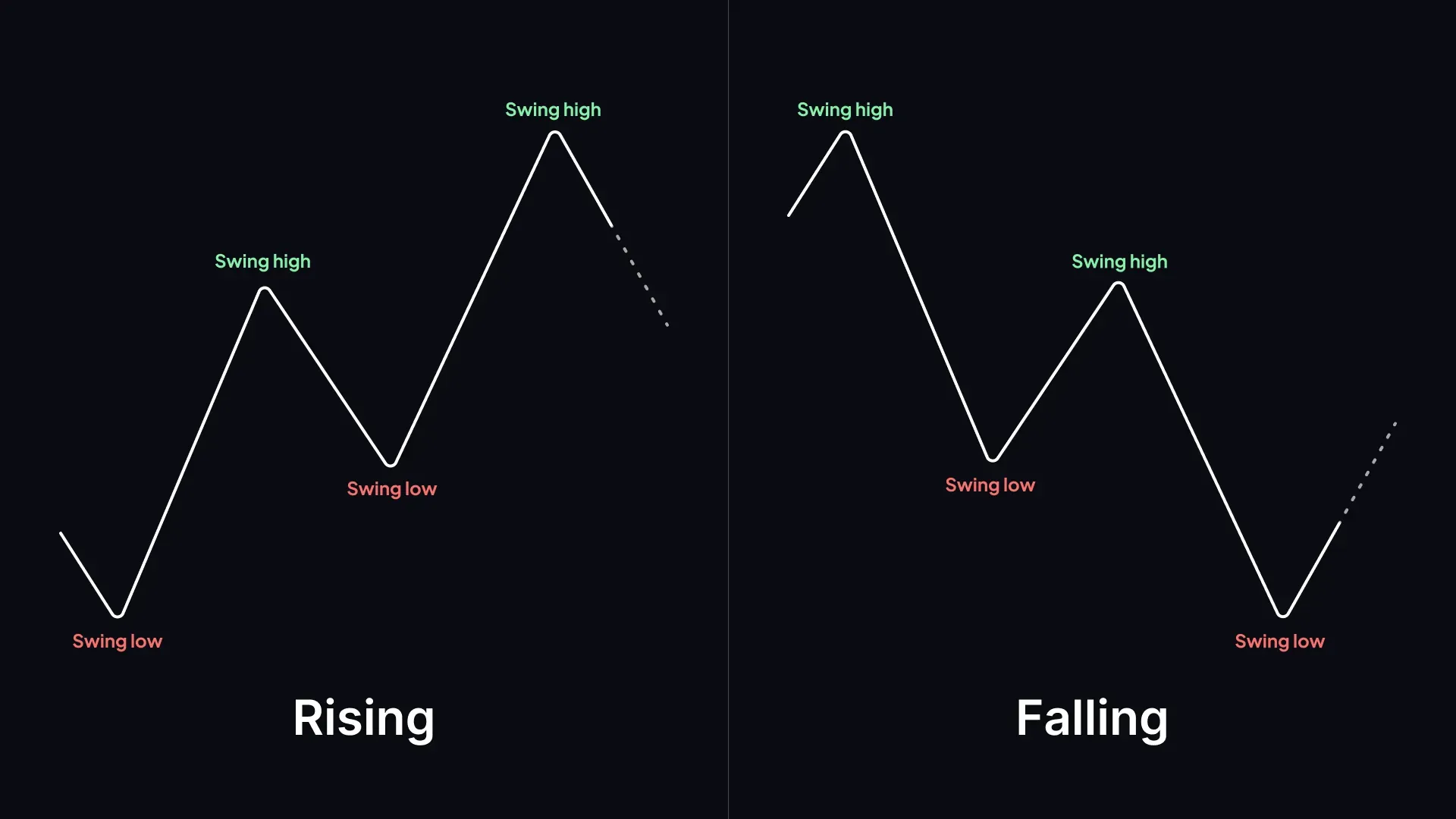

Swing Trading Strategies: Capturing Short- to Medium-Term Gains

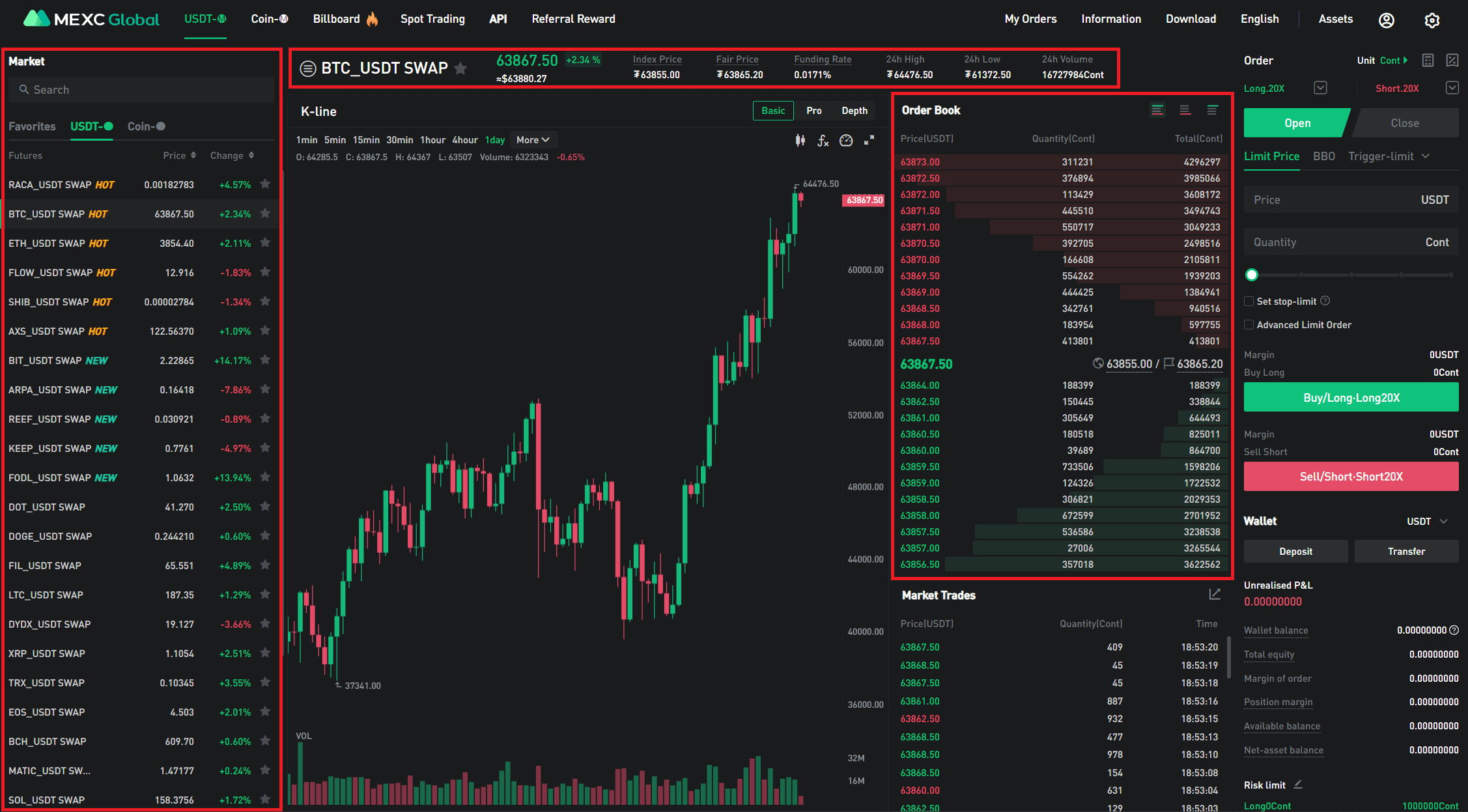

With a solid core in place, allocate 20-40% of your portfolio to swing trading strategies. Here, the goal is tactical: capitalize on short- or medium-term price movements using technical analysis tools like Moving Averages, RSI (Relative Strength Index), and Bollinger Bands. Swing trades typically last several days to weeks – long enough to catch meaningful moves but nimble enough to avoid getting stuck during reversals.

This hybrid approach lets you participate in breakouts or retracements without overcommitting capital or emotional energy. For example, if Ethereum consolidates after a sharp move upward, a swing trade might target a bounce from support or fade an overbought rally based on RSI signals (see more on key indicators here). Importantly, profits from successful swing trades can be recycled into your core holdings or used as dry powder for future setups.

Trading Around Your Core Position: Active Alpha Without Compromising Stability

Trading around a core position means making short-term trades – buying dips or selling rips – while keeping your main investment untouched. For instance, if BTC is your anchor asset, you might sell small portions during local rallies above resistance and buy back on sharp pullbacks without touching the majority of your holdings. This technique helps you extract additional value from volatility without losing exposure to potential long-term appreciation.

The key here is discipline: avoid letting short-term trades erode your conviction or destabilize your allocation strategy. As outlined by Quantified Strategies (read their guide here), this method works best when you set clear rules for trimming profits and redeploying capital back into your core as conditions shift.

Key Benefits of Combining Crypto Investment Strategies

-

Balanced Risk and Reward: By blending long-term holding with swing trading and active core management, you can reduce portfolio volatility while still capturing short-term opportunities for profit.

-

Consistent Profit Potential: Trading around a core position allows you to lock in gains during market swings without sacrificing your long-term upside, leading to more reliable, steady returns.

-

Improved Risk Management: Utilizing stop-loss orders, position sizing, and diversification across multiple cryptocurrencies helps protect your capital from major losses.

-

Adaptability to Market Conditions: Regularly monitoring and adjusting your strategies enables you to respond quickly to market trends and news, staying ahead in the fast-moving crypto space.

-

Maximized Growth from Core Assets: Holding established coins like Bitcoin (BTC) and Ethereum (ETH) as your core position lets you benefit from long-term appreciation while using a portion of your portfolio for active trading.

The Critical Role of Risk Management in Combined Strategies

No matter how sophisticated your approach becomes, risk management remains paramount. Use stop-loss orders strategically – for example, placing stops just below breakout levels for longs or above resistance for shorts during swing trades (see stop-loss tactics here). Size each trade so that no single loss exceeds 1-2% of total portfolio value; this ensures that even a string of bad trades won’t cripple long-term performance.

Diversification also plays a crucial role in smoothing returns. Allocate across different sectors – smart contract platforms like Ethereum, emerging L1s like Solana, infrastructure projects such as Chainlink – so that setbacks in one area don’t drag down overall results (learn more about diversification here). Finally, maintain regular reviews to adapt positions as markets shift; flexibility is an underrated edge in today’s fast-paced environment.

Another layer to consider involves leveraging passive yield strategies alongside active trading. While not a substitute for disciplined risk management, staking and yield farming can generate steady income streams from assets that would otherwise sit idle in your portfolio. For example, staking Ethereum or participating in reputable DeFi protocols lets you earn rewards on your core positions, further compounding your returns over time. However, always vet platforms for security and sustainability before committing funds, as the risks in DeFi remain elevated compared to traditional exchanges.

Adapting Your Approach: Continuous Monitoring and Tactical Flexibility

The crypto market’s rapid evolution means yesterday’s winning strategy may not guarantee tomorrow’s success. Regularly assess both your core holdings and active trades against current market conditions, macro trends, and regulatory developments. Setting up alerts for key price levels or news catalysts can help you respond proactively rather than reactively. Many advanced traders use demo accounts to test new swing trading setups or rebalancing models before risking real capital, a prudent step as volatility spikes or narratives shift.

Rebalancing is another essential practice: as certain assets outperform or underperform, your allocation can drift away from its intended structure. Quarterly or semi-annual reviews ensure you maintain the desired balance between long-term holds and tactical trades. This discipline helps lock in gains from successful swing trades while preventing emotional decisions during drawdowns.

Practical Crypto Portfolio Management Tips

-

Establish a Core Position in Leading Cryptocurrencies: Allocate 60-80% of your portfolio to long-term holdings in major assets like Bitcoin (BTC) and Ethereum (ETH). This core position provides stability and is held through market fluctuations, following the core-and-satellite model.

-

Use Swing Trading for Short to Medium-Term Gains: Dedicate 20-40% of your portfolio to swing trading, targeting short to medium-term moves. Employ technical analysis tools like Moving Averages, RSI, and Bollinger Bands to identify optimal entry and exit points.

-

Trade Around Your Core Position: Execute short-term trades around your core holdings without reducing your main position. For example, actively trade price swings in BTC or ETH while maintaining your core allocation, aiming to profit from volatility.

-

Implement Robust Risk Management: Set stop-loss orders to limit potential losses, and use position sizing (risking 1-2% of your portfolio per trade) to prevent large drawdowns. Diversify across multiple cryptocurrencies and sectors, such as smart contract platforms (Ethereum), emerging ecosystems (Solana), and infrastructure projects (Chainlink).

-

Continuously Monitor and Adapt Strategies: Regularly review your portfolio and adjust strategies based on market trends and performance. Stay updated on news and developments, and consider using demo accounts to refine your trading methods without financial risk.

Common Pitfalls When Combining Crypto Strategies

While blending these methods can enhance returns and resilience, there are pitfalls to avoid:

- Overtrading: Frequent short-term trades around your core can rack up fees and erode profits if not managed carefully.

- Lack of Discipline: Straying from predefined allocation targets or risk limits often leads to suboptimal results, especially during emotional market swings.

- Poor Diversification: Concentrating too heavily on one sector or asset exposes you to outsized drawdowns if sentiment shifts suddenly.

A thoughtful plan with clear rules for each strategy, core holding, swing trading, and position management, can help you sidestep these traps while maximizing upside potential.

Putting It All Together: A Blueprint for Consistent Crypto Profits

Ultimately, the most effective crypto investors treat their portfolios like dynamic systems, not static bets. By anchoring capital in proven assets such as Bitcoin (BTC) and Ethereum (ETH), actively seeking alpha through disciplined swing trades, and tactically trading around core positions during periods of heightened volatility, you create multiple avenues for profit while protecting against catastrophic losses.

This holistic approach is especially crucial as we enter an era where Bitcoin maintains its position above $100,000, a psychological milestone that will attract both institutional flows and retail speculation. Staying vigilant about risk management practices like stop-loss orders (see more here) and strategic diversification (read about diversification here) ensures that gains are preserved even when markets turn choppy.

If you’re ready to move beyond single-style investing toward a more resilient framework for 2025 and beyond, start by defining your own allocation rules, and stick to them religiously. The combination of patience with your core holdings plus agility in tactical trades is what separates consistent winners from those who fall victim to crypto’s notorious volatility cycles.