In the rapidly evolving crypto landscape of 2025, savvy traders are capitalizing on price gaps between decentralized exchanges (DEXs) and centralized exchanges (CEXs). As DEXs now account for over 20% of total spot trading volume, these price discrepancies have become more frequent and lucrative. But navigating this new terrain requires more than just a sharp eye for opportunity, it demands the right set of tools, strategies, and risk management practices.

How DEX vs CEX Price Gaps Create Arbitrage Opportunities

To understand why arbitrage is thriving in 2025, let’s look at how these platforms set prices. CEXs rely on traditional order books, matching buy and sell orders in real time. This system tends to offer deep liquidity and tight spreads. DEXs, on the other hand, use automated market makers (AMMs), which determine prices based on the ratio of assets in liquidity pools. When a large trade happens or liquidity is thin, prices can swing dramatically, creating those all-important gaps.

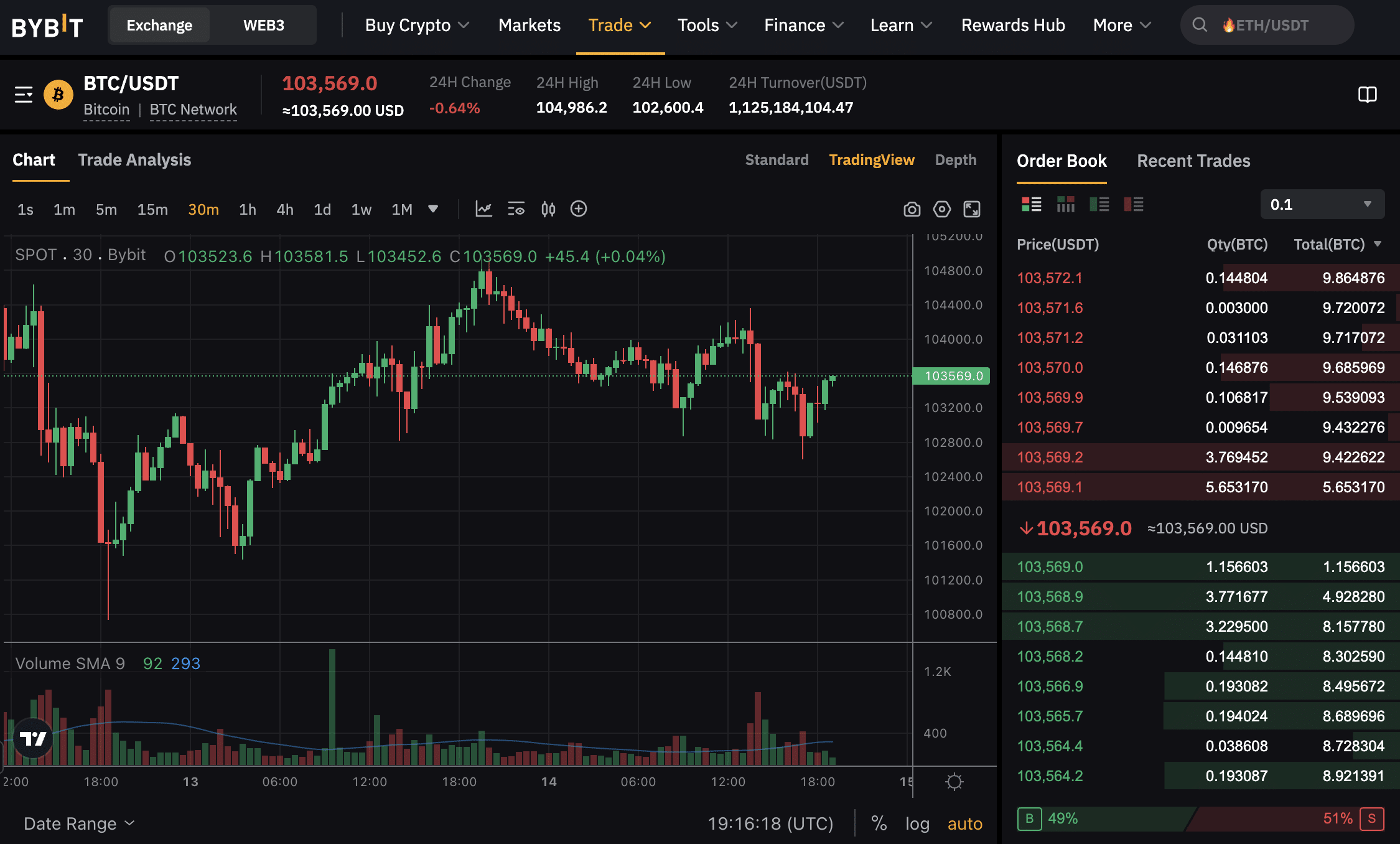

A striking example occurred with the $WIF token: it was trading at $2.7 on a DEX while simultaneously surging to $42 on a CEX due to low liquidity. Such moments are goldmines for arbitrageurs who can move fast enough to bridge the gap.

The Essential Toolkit for Crypto Arbitrage in 2025

The days of manually scanning exchanges are long gone. Today’s successful arbitrageurs depend on sophisticated technology designed for speed and precision:

Essential Tools, Strategies & Pitfalls for Crypto Arbitrage in 2025

-

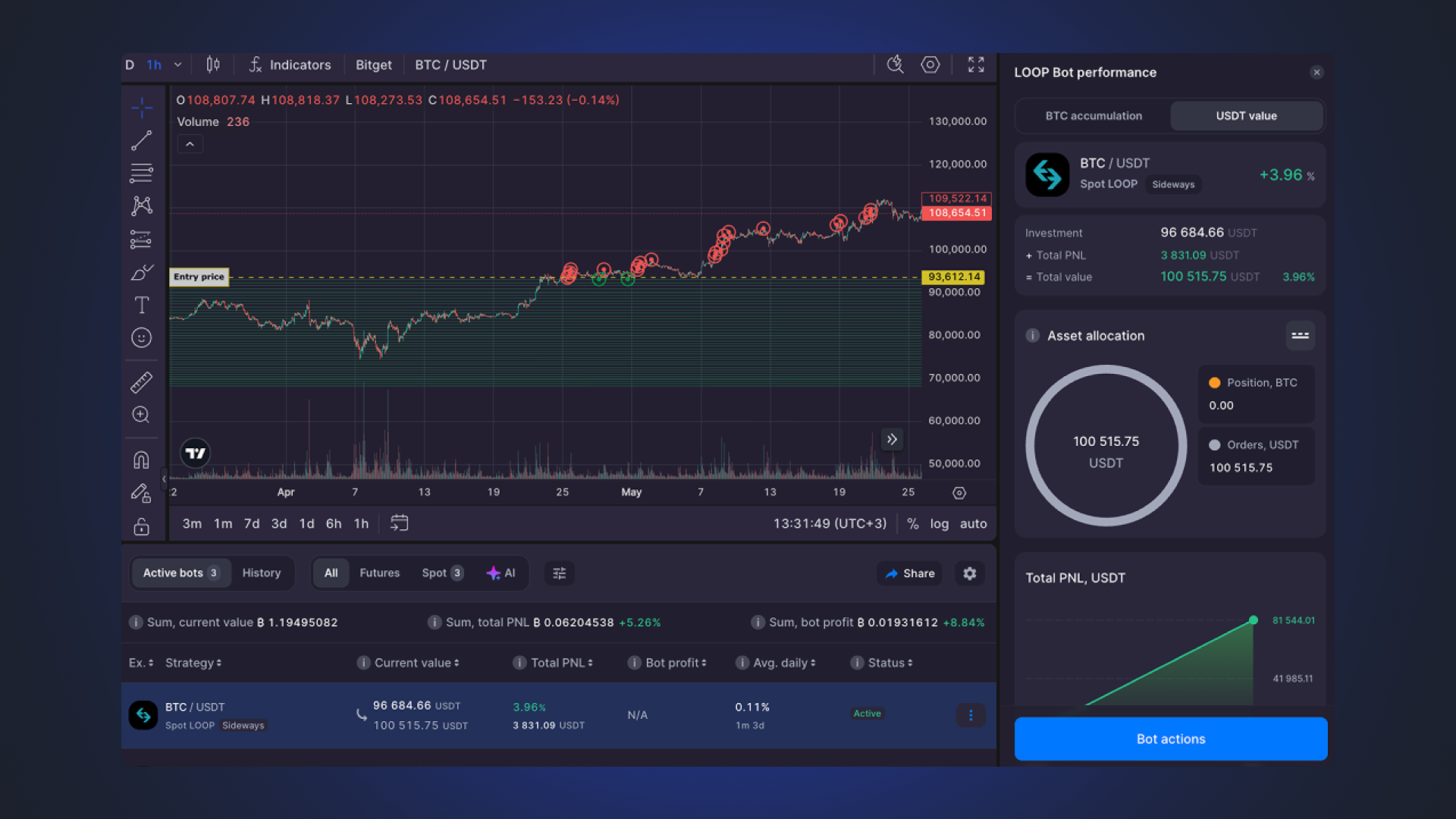

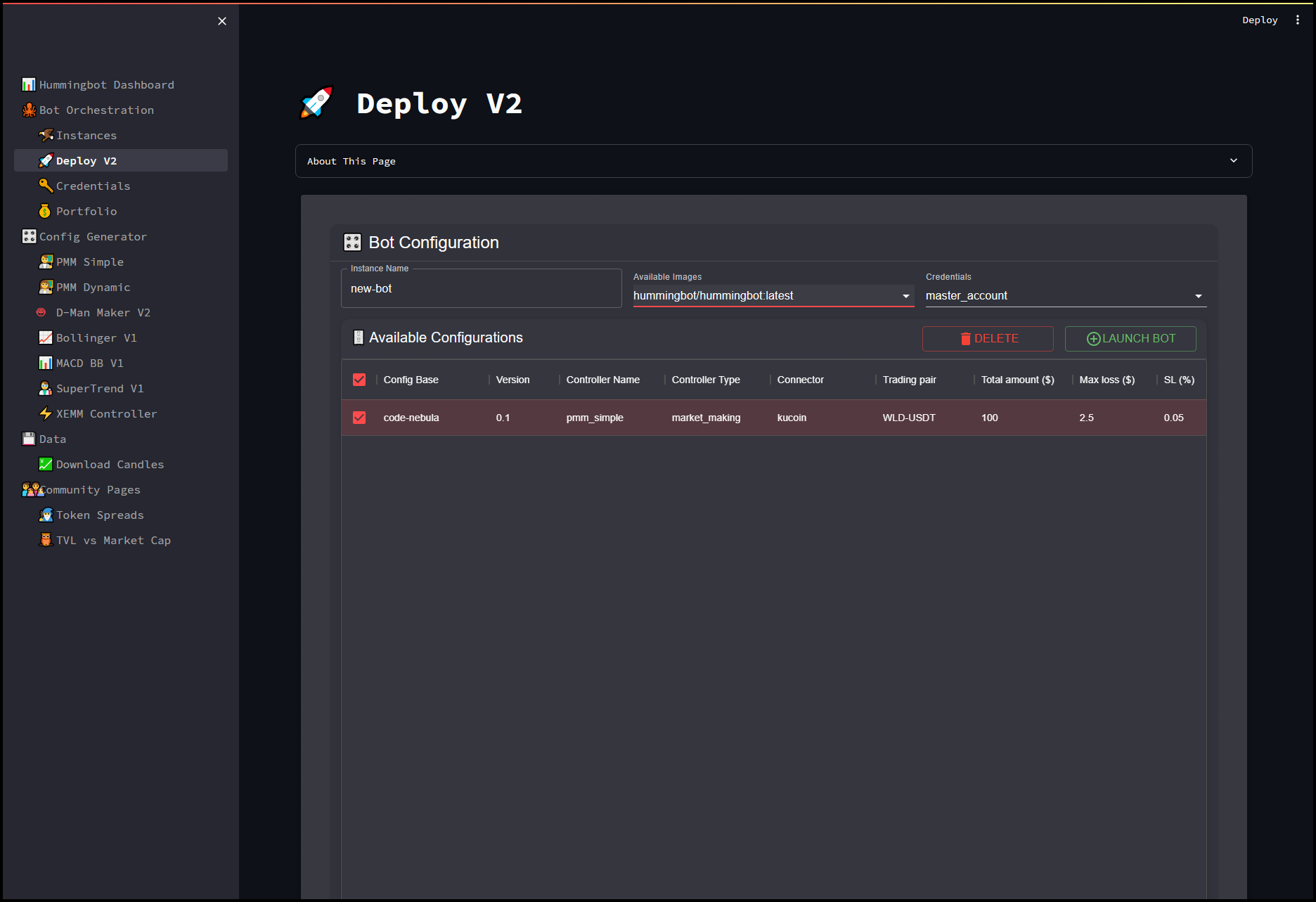

Automated Arbitrage Bots with Multi-Exchange Integration: Leverage advanced bots like Hummingbot and Cryptohopper to automatically scan and execute trades across both DEXs and CEXs. These platforms support integrations with major exchanges, enabling real-time, high-frequency arbitrage that outpaces manual trading.

-

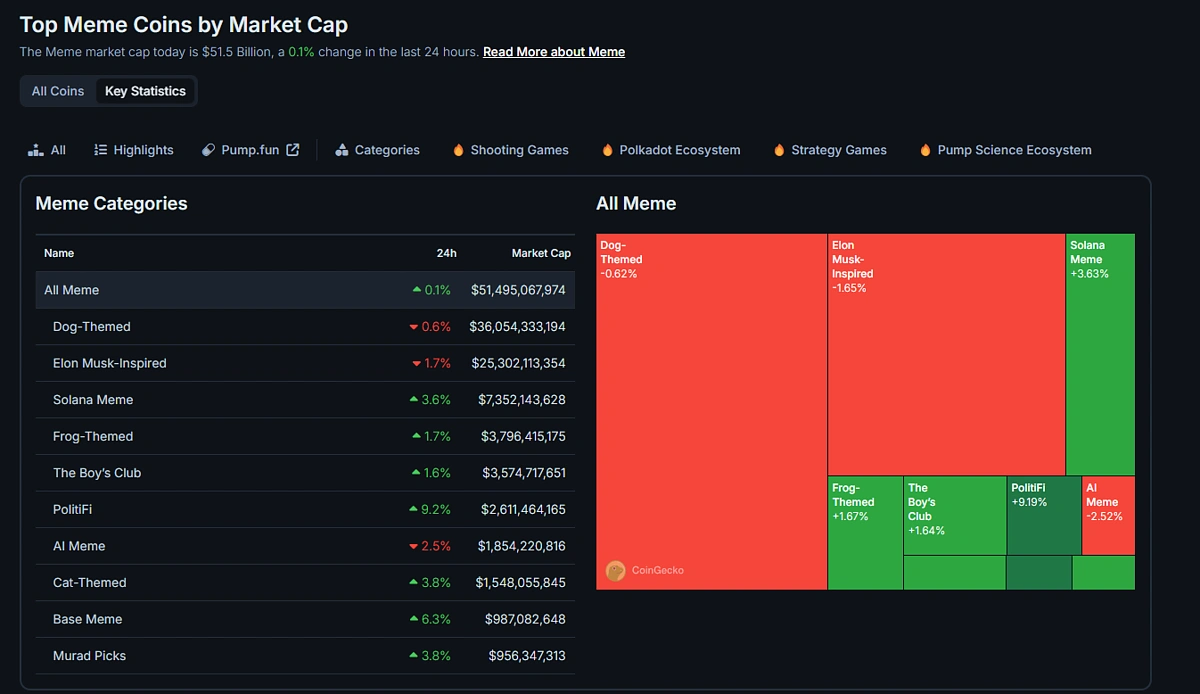

Real-Time Cross-Chain Price Monitoring Platforms: Use platforms such as ArbitrageScanner and CoinGecko to track price discrepancies for the same asset across multiple blockchains and exchanges. These tools provide instant alerts and visualizations, helping traders spot and act on profitable gaps.

-

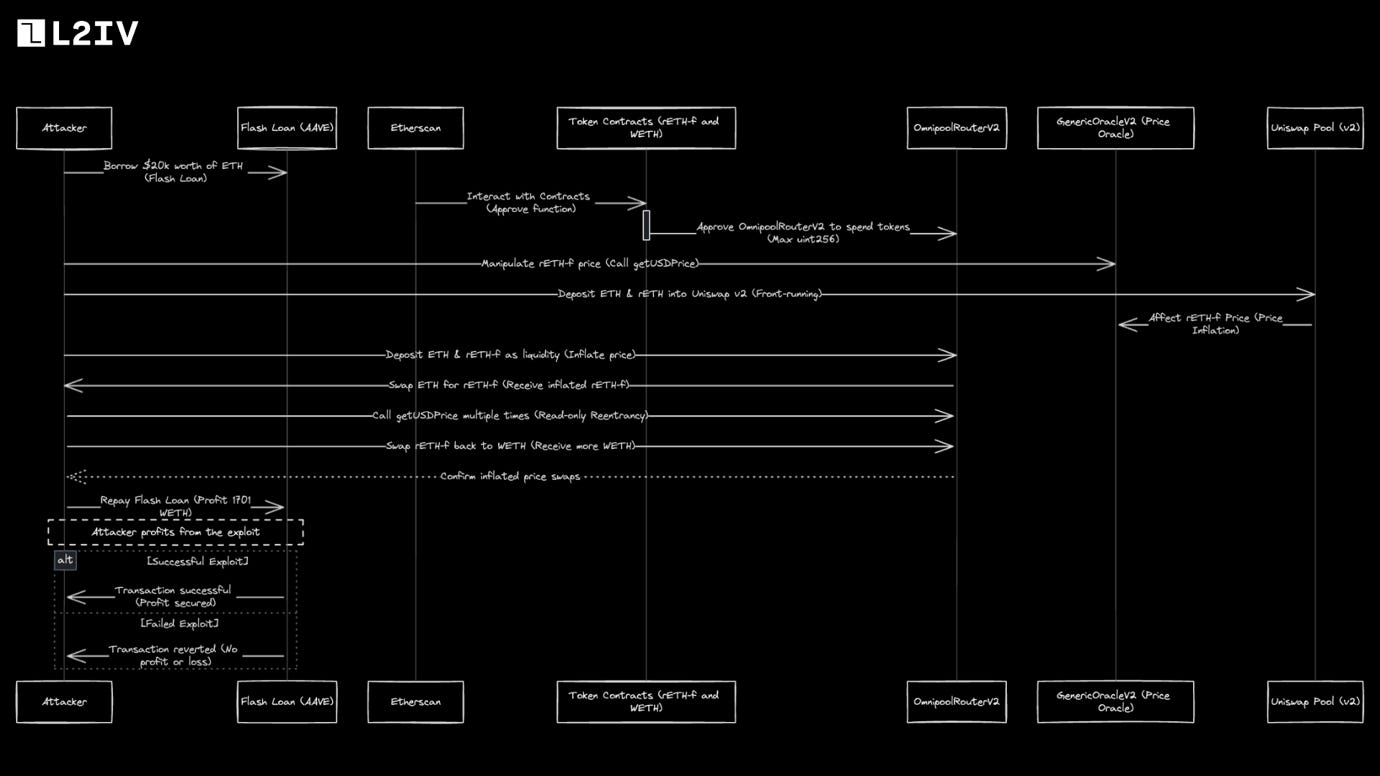

Utilizing Flash Loans for Zero-Capital Arbitrage: Platforms like Aave and Uniswap allow traders to borrow large sums instantly via flash loans, execute arbitrage trades, and repay—all within a single transaction. This enables profit opportunities without upfront capital, but requires technical skill and smart contract interaction.

-

Neglecting Transaction Fees and Slippage in Profit Calculations: Overlooking network fees (especially on congested blockchains) and slippage can quickly turn a seemingly profitable trade into a loss. Always factor in all costs before executing arbitrage strategies.

-

Overlooking Smart Contract and Bridge Security Risks: DEXs and cross-chain bridges are vulnerable to hacks and smart contract bugs. Not assessing these risks can lead to significant losses, even if the price gap is attractive.

-

Failing to Account for Withdrawal and Deposit Delays on CEXs: Asset transfers between exchanges can be delayed due to network congestion or CEX processing times. These delays may cause you to miss the arbitrage window, resulting in lost profits.

Automated Arbitrage Bots with Multi-Exchange Integration are at the core of modern strategies. These bots connect directly to both CEXs and DEXs via APIs, continuously scanning for profitable price gaps across dozens of platforms. By executing trades in milliseconds, they remove human latency from the equation, a critical edge when profits can vanish in seconds.

Real-Time Cross-Chain Price Monitoring Platforms have also become indispensable. As many tokens now exist on multiple blockchains (think Ethereum, Solana, BNB Chain), price differences can emerge not just between exchanges but between chains themselves. These platforms aggregate data across networks so traders can spot where an asset is undervalued or overpriced, for instance, buying a token where it’s cheapest and bridging it to sell where it commands a premium.

Utilizing Flash Loans for Zero-Capital Arbitrage is another game-changer unique to DeFi in 2025. Flash loans let traders borrow large sums instantly without collateral as long as they repay within one transaction block. This means you can exploit an arbitrage opportunity without fronting your own capital, but timing is everything; if any step fails or if prices shift mid-execution, the entire transaction reverts.

Pitfalls That Can Sabotage Your Crypto Arbitrage Profits

While technology has made arbitrage more accessible than ever before, several common mistakes continue to trip up even experienced traders:

Common Pitfalls for Crypto Arbitrage Traders in 2025

-

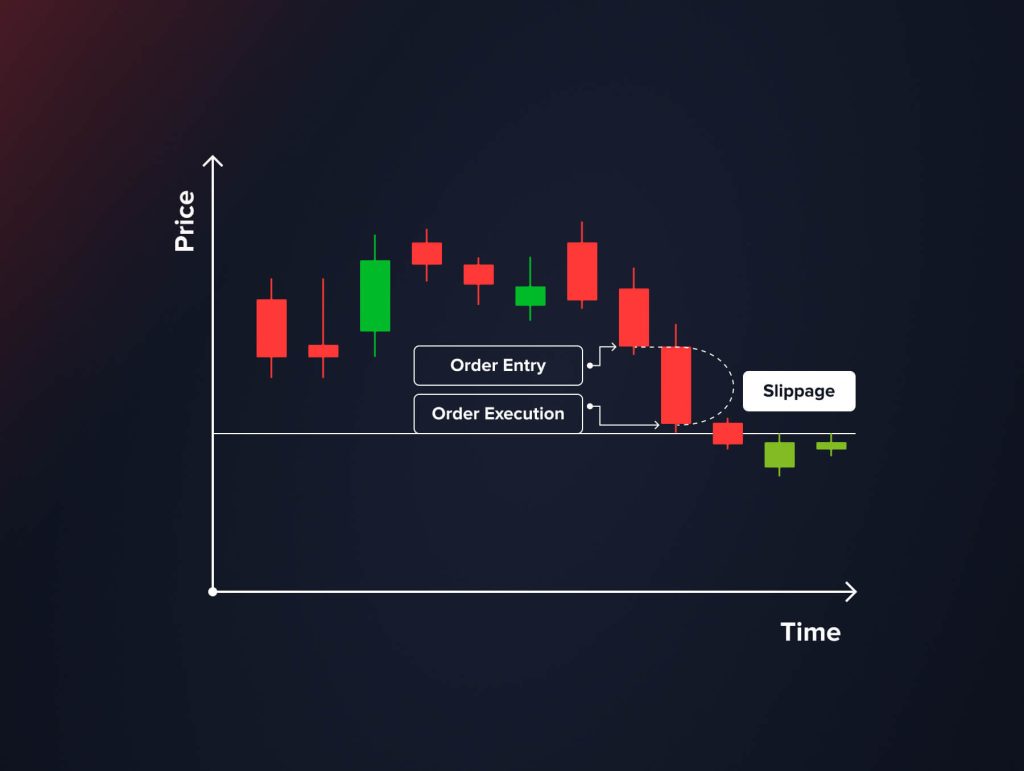

Neglecting Transaction Fees and Slippage in Profit Calculations: Many traders overlook the impact of network fees (especially on congested blockchains) and slippage when executing arbitrage trades between DEXs and CEXs. These costs can quickly erode or even eliminate potential profits, particularly during periods of high volatility or low liquidity. Always factor in all associated costs before executing a trade.

-

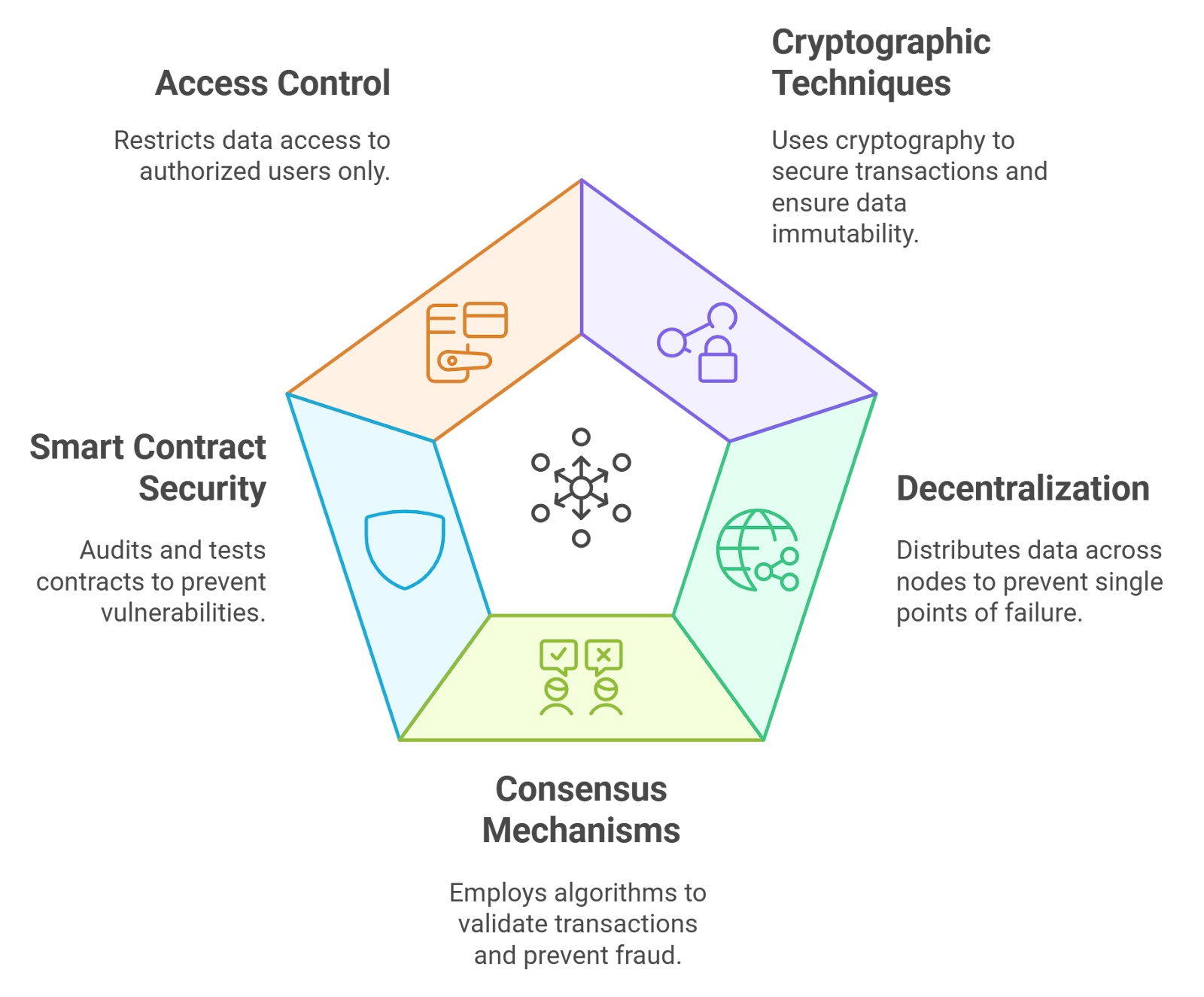

Overlooking Smart Contract and Bridge Security Risks: Arbitrage strategies often require interacting with smart contracts and cross-chain bridges on DEXs. In 2025, security vulnerabilities—including bugs and exploits—remain a top threat, with several high-profile hacks targeting DeFi protocols and bridges. Traders must conduct due diligence and use platforms with robust security audits to mitigate these risks.

-

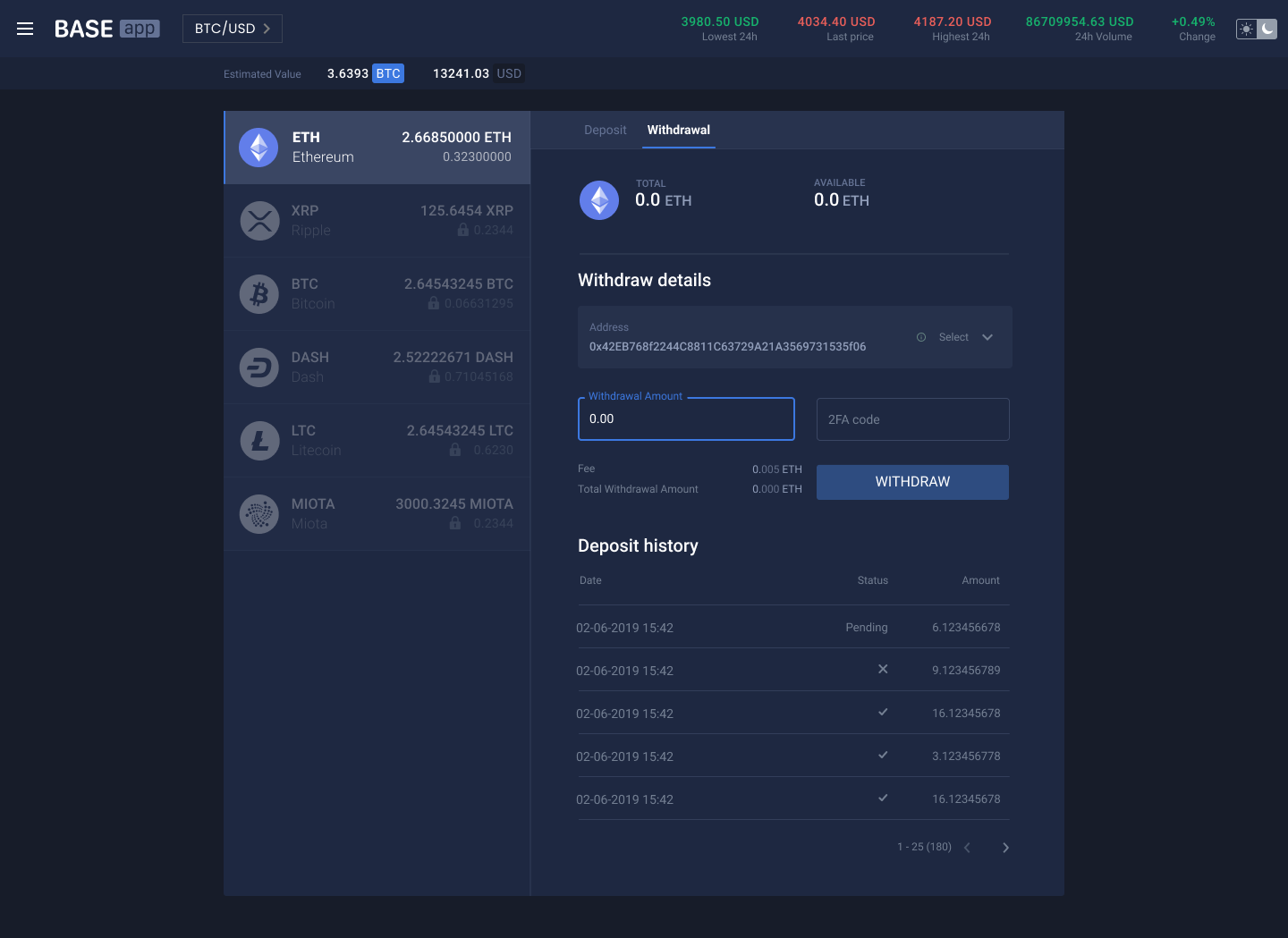

Failing to Account for Withdrawal and Deposit Delays on CEXs: Centralized exchanges (CEXs) can experience withdrawal and deposit delays due to network congestion, compliance checks, or maintenance. These delays may cause traders to miss fleeting arbitrage opportunities as price gaps close before funds arrive. Always check current withdrawal times and plan accordingly.

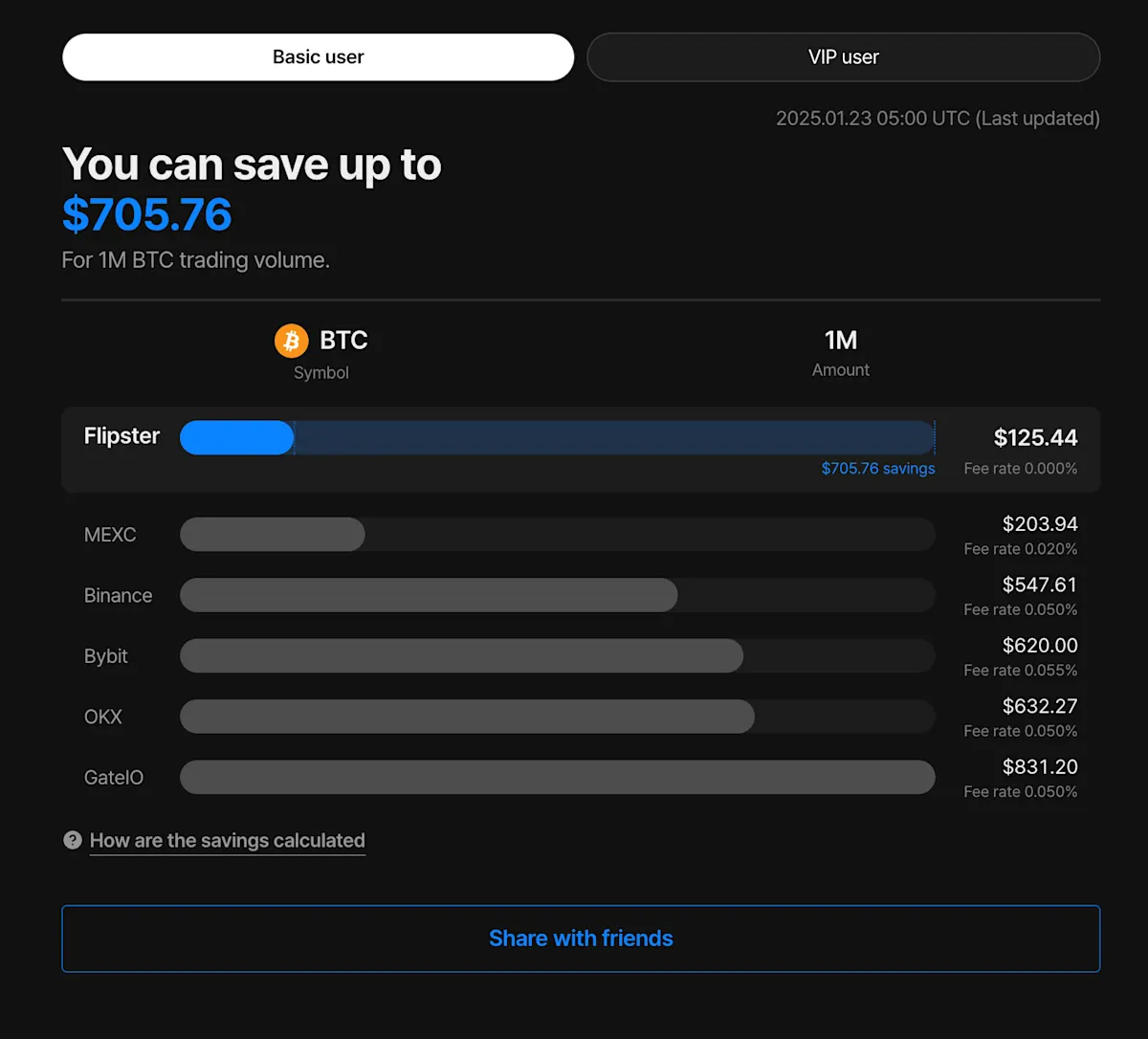

Neglecting Transaction Fees and Slippage in Profit Calculations is one of the most frequent errors. On congested blockchains or during high volatility periods, fees can spike unexpectedly, sometimes erasing your entire profit margin. Slippage (the difference between expected and actual trade execution price) is another silent killer, especially on low-liquidity DEX pairs.

Overlooking Smart Contract and Bridge Security Risks poses serious dangers as well. While DEXs offer transparency through open-source code, bugs or exploits can drain liquidity pools overnight. Cross-chain bridges, essential for moving assets between networks, remain prime targets for hackers due to their complexity.

Failing to Account for Withdrawal and Deposit Delays on CEXs, meanwhile, can mean missing out altogether as price gaps close before your funds arrive where needed. In fast-moving markets like those seen after major news events or hacks (such as with $GALA), delays of even a few minutes can turn sure wins into losses.

To succeed in this environment, traders must approach arbitrage with a blend of technical savvy and risk awareness. Let’s break down how to practically apply the most important tools and strategies, while steering clear of costly missteps.

Mastering the 2025 Arbitrage Toolkit

Modern automated arbitrage bots with multi-exchange integration are no longer just about speed, they’re about adaptability. The best bots in 2025 not only connect to dozens of CEXs and DEXs, but also factor in live network congestion and adjust routes accordingly. For example, if Ethereum gas fees spike during a meme coin frenzy, a well-programmed bot can reroute trades through a cheaper L2 or alternative chain, maximizing net profit.

Real-time cross-chain price monitoring platforms have also leveled up. Instead of simply showing static price differences, they now offer predictive analytics, alerting you when an arbitrage window is likely to close based on historical liquidity movements and on-chain activity. Imagine getting an alert that $WIF is trading at $2.7 on one chain and $42 on another before the rest of the market catches on. That’s the edge these platforms provide.

Utilizing flash loans for zero-capital arbitrage has become more accessible as DeFi protocols mature. However, success here hinges on precise execution: every step, from borrowing to swapping to repaying, must occur within a single transaction block. If you’re new to this strategy, start small and use testnets before risking real capital. Remember: if any leg fails or prices shift mid-transaction, the entire process reverts and you pay only gas fees, but repeated failures can still add up quickly.

The Most Common Pitfalls (and How to Avoid Them)

Even with cutting-edge tools at your disposal, certain pitfalls can wipe out gains or even lead to losses:

- Neglecting Transaction Fees and Slippage: Always calculate your true net profit after accounting for all network fees (which can be unpredictable) and expected slippage. Many seasoned traders use fee simulators built into modern arbitrage dashboards.

- Overlooking Smart Contract and Bridge Security Risks: Before using any DEX or bridge for large transactions, check recent audits and community reports for vulnerabilities. Follow trusted security researchers on Twitter for real-time alerts about exploits or bugs.

- Failing to Account for Withdrawal/Deposit Delays on CEXs: When moving funds between exchanges, especially during high volatility events, factor in wait times that could close your arbitrage window. Some traders maintain balances across multiple platforms to reduce transfer friction.

Bringing It All Together: Profiting from Price Gaps in 2025

The rise of hybrid exchanges, like Binance Alpha 2.0, has further blurred lines between DEXs and CEXs by enabling direct access to decentralized assets through centralized interfaces (read more here). This innovation increases speed but doesn’t eliminate risks; always verify withdrawal times and double-check security credentials before executing large trades.

Your edge as an arbitrageur in 2025 comes down to:

- Picking the right automated tools (bots and monitoring platforms)

- Understanding risks unique to each platform (fees, slippage, security)

- Treating every trade as an opportunity, but also as a potential lesson

Which crypto arbitrage approach do you prefer in 2025?

With DEXs now capturing over 20% of spot trading volume and new tools making arbitrage between CEXs and DEXs more accessible, do you favor hands-on manual strategies or automated bots to capitalize on price gaps?

If you’re ready to dive deeper into crypto arbitrage strategy, or want real-time insights from fellow traders, check out our recommended resources below:

Top Tools, Strategies, and Pitfalls for DEX/CEX Arbitrage in 2025

-

Automated Arbitrage Bots with Multi-Exchange Integration: Platforms like Hummingbot and Cryptohopper enable traders to automate arbitrage across both DEXs and CEXs. These bots connect to multiple exchanges, monitor price gaps in real time, and execute trades rapidly to capitalize on fleeting opportunities.

-

Utilizing Flash Loans for Zero-Capital Arbitrage: Protocols like Aave and Balancer offer flash loans, enabling traders to borrow large amounts of capital instantly and execute arbitrage trades without upfront funds. This advanced strategy requires precise execution and deep understanding of smart contracts.

-

Neglecting Transaction Fees and Slippage in Profit Calculations: A common pitfall is ignoring network fees (especially on busy blockchains like Ethereum) and slippage when calculating potential profits. High fees or unexpected price movement can quickly turn a seemingly profitable arbitrage into a loss.

-

Overlooking Smart Contract and Bridge Security Risks: DEXs and cross-chain bridges are vulnerable to exploits and bugs. Failing to assess the security of smart contracts or the reliability of bridges can result in significant losses from hacks or stuck funds. Always research platforms like DeFiLlama Hacks for recent incidents.

-

Failing to Account for Withdrawal and Deposit Delays on CEXs: Arbitrage profits can evaporate if funds are stuck due to slow withdrawals or deposit holds on centralized exchanges. Always factor in potential delays when executing cross-platform trades, especially during periods of network congestion or exchange maintenance.

The bottom line? Arbitrage isn’t just about spotting price gaps, it’s about acting faster than everyone else while managing risk like a pro. With today’s toolkit and awareness of common pitfalls, anyone can compete, but only those who prepare will thrive as DEX/CEX dynamics continue evolving throughout 2025.