Tokenized stock futures are redefining how investors access traditional equities, merging the liquidity and accessibility of crypto markets with the stability and familiarity of blue-chip stocks. Imagine trading Tesla or Apple around the clock, using USDT or USDC as margin, with no need to wait for Wall Street’s opening bell. This is the new reality for modern traders seeking flexibility and diversification in a 24/7 global market.

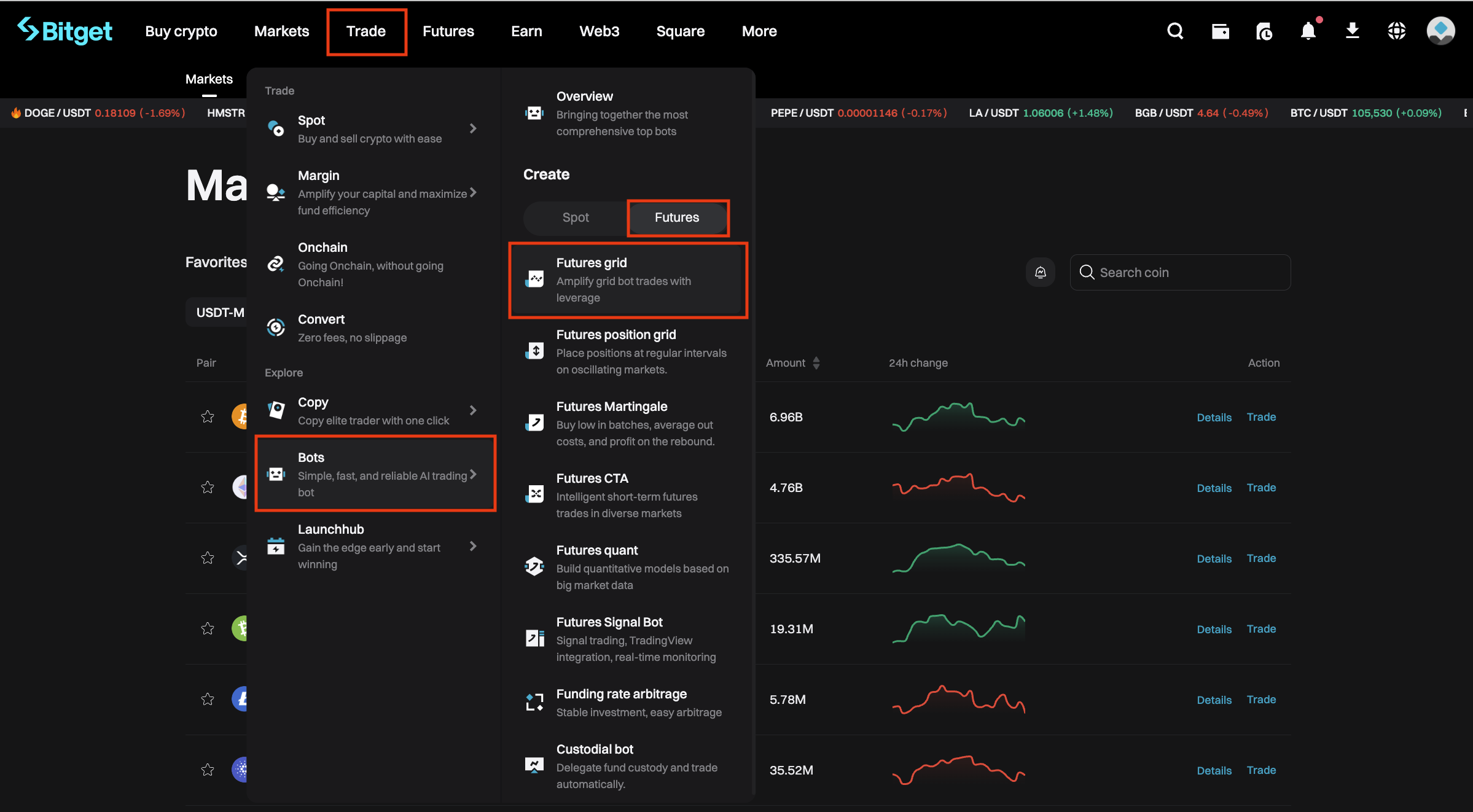

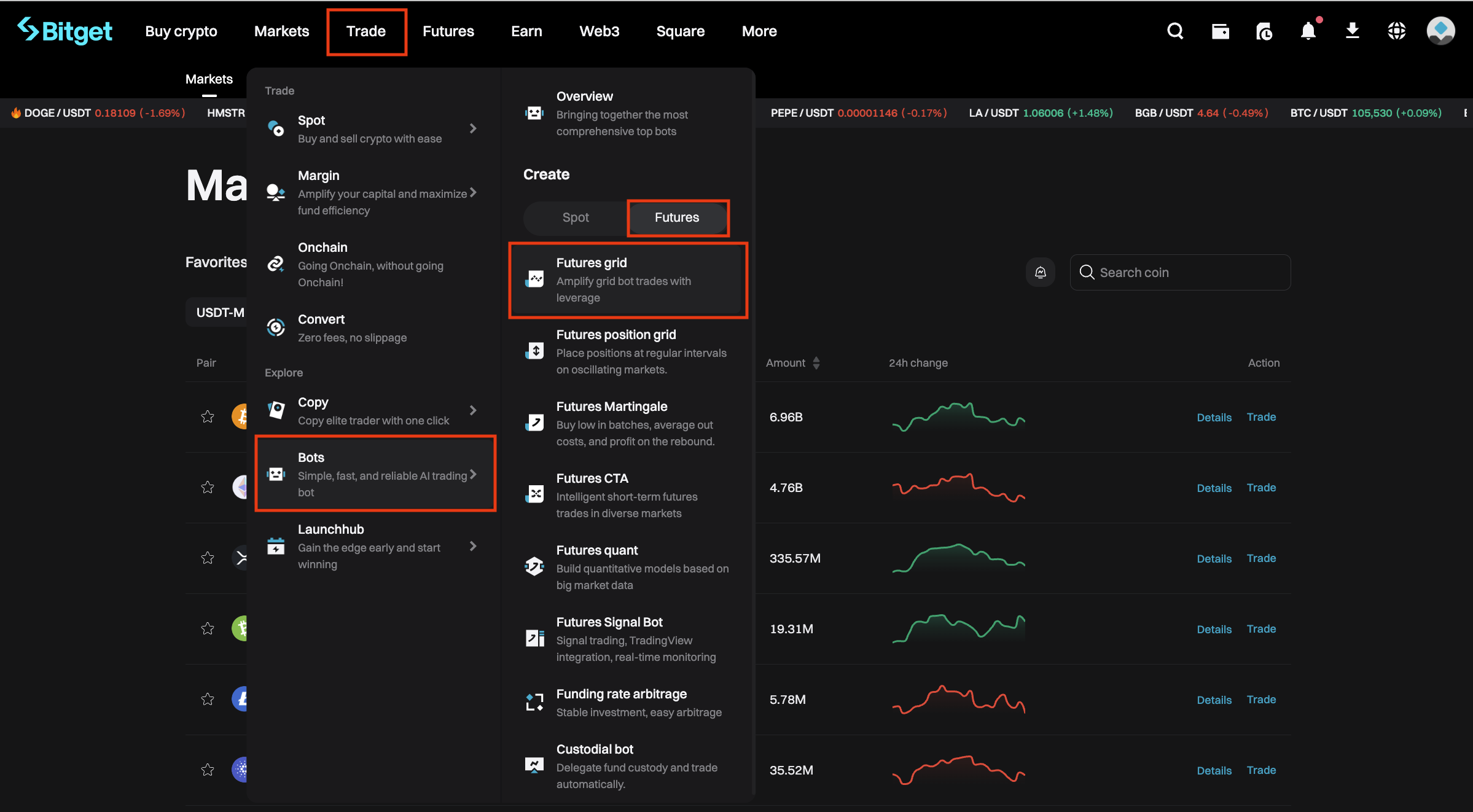

Bitget: The Powerhouse for Tokenized Stock Futures

Bitget stands out as a top-tier platform for trading tokenized stock futures. Its user-centric interface allows seamless deposits in USDT or USDC, which can be transferred directly to your spot account. From there, you gain access to perpetual contracts tracking major U. S. stocks like Tesla and Nvidia. Bitget’s RWA Index Perpetual Contracts mirror the mechanics of crypto perpetuals but use index values from multiple sources to ensure price stability. Flexible leverage (up to 10x) and competitive fees make it attractive for both retail traders and institutional participants looking to maximize capital efficiency.

What sets Bitget apart is its commitment to 24/7 access. Unlike legacy stock markets that close overnight or during holidays, Bitget’s tokenized assets are tradable at any hour. This continuous access enables traders to react instantly to global news – whether it’s an earnings surprise after hours or geopolitical events over the weekend.

Key Benefits of Trading Tokenized Stock Futures on Bitget

-

Bitget: Leading platform for trading tokenized stock futures with USDT or USDC margin, offering 24/7 access to major U.S. stocks like Tesla and Apple. Bitget provides flexible leverage options (up to 10x) and competitive fees, mirroring the convenience of crypto perpetuals while integrating real-world asset exposure.

-

No-KYC Trading & Wallet Integration: Many tokenized stock platforms—including Bitget Wallet and select decentralized exchanges (DEXs)—allow users to trade tokenized stocks without KYC requirements. This enhances privacy and enables self-custody of assets directly in crypto wallets, giving users more control over their investments.

-

24/7 Global Market Access & Risks: Tokenized stock futures enable round-the-clock trading, letting users react instantly to global events even outside traditional stock market hours. However, traders should be aware of risks such as liquidity limitations, regulatory uncertainty, and potential price discrepancies between tokenized assets and the underlying stocks.

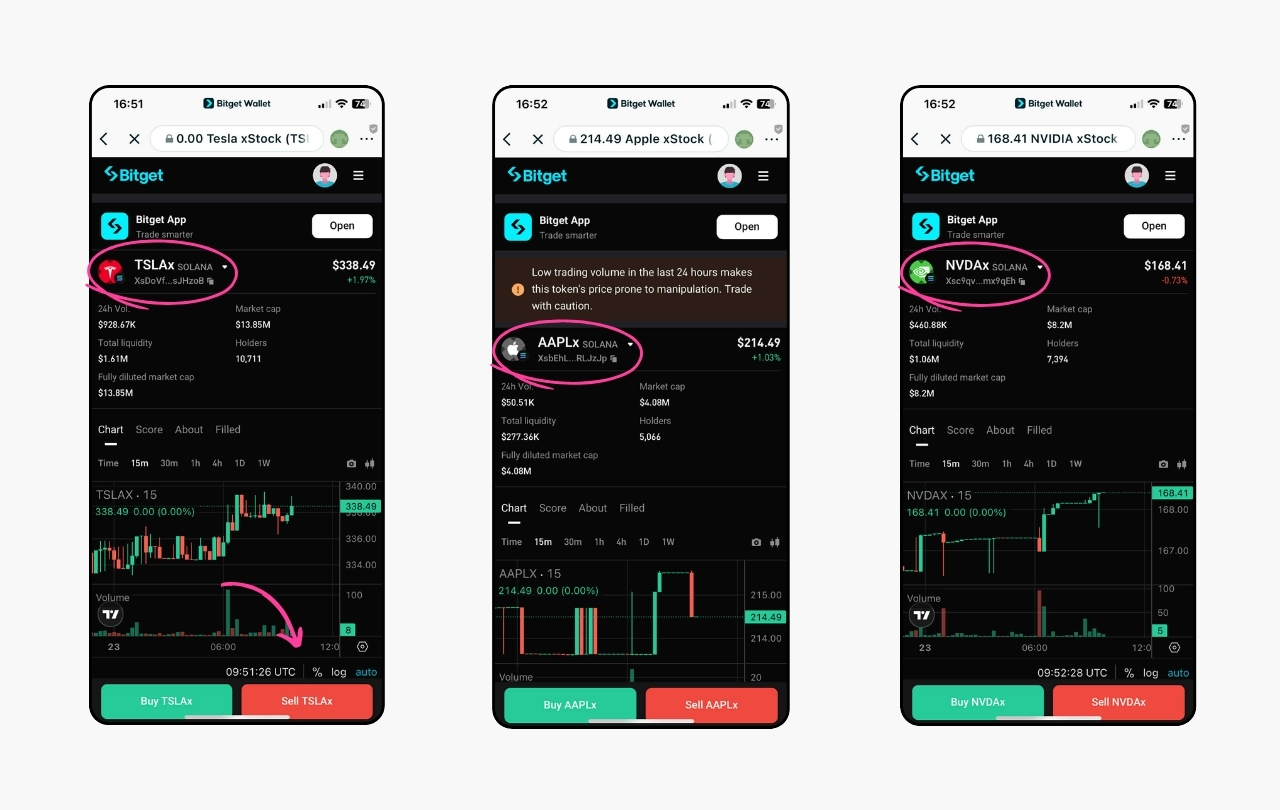

No-KYC Trading and Wallet Integration: Privacy Meets Flexibility

The rise of no-KYC tokenized stocks is a game-changer for privacy-focused traders. Platforms like Bitget Wallet and certain decentralized exchanges (DEXs) empower users to trade tokenized equities without cumbersome identity verification processes. This not only enhances privacy but also speeds up onboarding – especially valuable in fast-moving markets where every minute counts.

The ability to self-custody assets directly in your crypto wallet means you’re not reliant on centralized entities for security or withdrawals. For example, with Bitget Wallet, you simply download the app, fund your account with USDT or USDC, then navigate to the xStock section and select your preferred company tokens – all without submitting personal documents.

Learn more about xStocks on Bitget Wallet

24/7 Global Market Access and Core Risks

The appeal of 24/7 global market access cannot be overstated. Tokenized stock futures let you trade outside traditional hours – perfect for reacting instantly when macroeconomic data drops overnight or when U. S. -listed companies release earnings after Wall Street closes. This always-on environment is especially useful for global investors who want exposure without being limited by time zones.

However, this flexibility comes with new risks:

- Liquidity limitations: Not all tokenized stocks have deep order books at all hours; large trades may move prices unexpectedly.

- Regulatory uncertainty: Jurisdictions differ on how they treat these assets; platforms may restrict access based on your location.

- Price discrepancies: Since these tokens track underlying stocks via indices or synthetic mechanisms, their prices can temporarily diverge from real-world shares – especially during volatile events when traditional exchanges are closed.

For those seeking to capitalize on these opportunities, understanding the interplay between platform features, risk management, and trading strategies is essential. Bitget continues to lead with its robust infrastructure, offering both spot and perpetual futures contracts for tokenized stocks. Traders benefit from transparent fee structures and a responsive support team, key elements for navigating fast-paced markets where every second matters.

Yet, the true edge comes from the unique blend of no-KYC trading and wallet integration. By allowing users to trade directly from their wallets without identity checks, platforms like Bitget Wallet have lowered barriers to entry. This is particularly attractive for users in regions where financial privacy is paramount or where access to traditional brokerage accounts is limited. The option to self-custody your assets also reduces counterparty risk, a significant advantage given recent headlines about centralized exchange failures.

Strategy-wise, traders are employing several approaches tailored for this new asset class:

Top Strategies for Trading Tokenized Stock Futures

-

Bitget: Leading platform for trading tokenized stock futures with USDT or USDC margin, offering 24/7 access to major U.S. stocks like Tesla and Apple, and flexible leverage options with competitive fees. Bitget also supports Real-World Asset (RWA) Index Perpetual Contracts, providing traders with diversified exposure and robust risk management tools.

-

No-KYC Trading & Wallet Integration: Many tokenized stock platforms—including Bitget Wallet and some decentralized exchanges (DEXs)—allow users to trade tokenized stocks without KYC. This offers enhanced privacy and enables self-custody of assets directly in crypto wallets, combining the flexibility of DeFi with exposure to traditional equities.

-

24/7 Global Market Access & Risks: Tokenized stock futures enable round-the-clock trading outside traditional market hours, letting traders respond instantly to global news. However, users should be aware of risks such as liquidity limitations, regulatory uncertainty, and potential price discrepancies between tokenized assets and their underlying stocks.

- Arbitrage: By monitoring price differences between tokenized futures on Bitget and underlying stocks on legacy exchanges, savvy traders can profit from temporary inefficiencies, especially during off-market hours.

- Hedging: Investors with large equity holdings use tokenized stock futures as a hedge during periods when traditional markets are closed, protecting portfolios against overnight shocks.

- Leverage: With up to 10x leverage available on Bitget’s RWA Index Perpetuals, traders can amplify returns, but must manage margin carefully to avoid liquidation during volatile swings.

Navigating the Risks: What Every Trader Should Know

The ability to trade stocks with crypto around the clock is revolutionary, but not without pitfalls. Liquidity remains uneven across different tokens; while blue chips like Tesla or Apple often have tighter spreads and deeper books on Bitget, less popular equities may experience slippage or wide bid-ask gaps. Regulatory clarity also lags behind innovation; always check if your platform of choice complies with local rules before allocating significant capital.

If you’re considering diving into crypto stock futures strategies, start small and use demo accounts where possible, BTCC offers a virtual trading environment ideal for practice before risking real USDT or USDC.

Why Tokenized Stock Futures Are Here to Stay

The integration of real-world equities into the blockchain ecosystem isn’t just a fleeting trend, it’s a structural shift in global finance. Platforms like Bitget are bridging traditional and digital markets by offering seamless, borderless access to leading U. S. stocks through familiar crypto rails. The rise of no-KYC options and wallet-based custody further democratizes participation while empowering individuals with greater control over their assets.

If you’re ready to explore this frontier, prioritize platforms known for transparency and security, and never underestimate the value of continuous education as new products emerge. Whether you’re arbitraging after-hours price gaps or hedging equity exposure overnight, tokenized stock futures open new dimensions for active traders and long-term investors alike.