Crypto stock traders, buckle up: 2024’s regulatory landscape is shifting at breakneck speed. With the US and UK finally syncing their approaches to stablecoins, we’re witnessing a market moment that could reshape trading strategies, liquidity flows, and price action for years to come. If you’re serious about crypto stock trading strategies, this is not the time to sit on your hands.

US-UK Crypto Deal: The Regulatory Shake-Up You Can’t Ignore

Let’s get right to it: In July 2025, the US passed the GENIUS Act, laying down strict federal rules for stablecoins. Every stablecoin must now be fully backed by liquid assets like US dollars or Treasury bills, with transparent monthly reserve disclosures. Meanwhile, in April 2025, the UK rolled out draft rules to bring exchanges and stablecoin issuers under robust oversight, directly aligning with Washington’s new standards (source).

This cross-Atlantic regulatory harmony is more than bureaucratic paperwork, it’s a game-changer for anyone trading crypto stocks like Coinbase Global Inc (COIN), which currently sits at $342.46. Forget the old days of regulatory arbitrage; now, big players and retail traders alike will have to adapt to a unified rulebook.

Stablecoin Regulations 2024: What Traders Need to Watch

The new regime targets fiat-backed stablecoins, the backbone of liquidity in both spot and derivatives markets. In 2024 alone, 80% of dollar-backed stablecoin flows happened outside the US. That’s about to change as global capital starts chasing regulated venues with clear rules (source).

Here’s why this matters for you:

- Tighter spreads: With improved transparency and reserve requirements, expect less risk premium on regulated stablecoins, translating into tighter bid-ask spreads on crypto stocks.

- Bigger institutional flows: Clearer regulations are magnets for institutional capital. Get ready for higher volumes and more volatility, both opportunities if you know how to play them.

- No more regulatory whiplash: Say goodbye to sudden delistings or exchange bans based on jurisdictional ambiguity. Aligned rules mean fewer black swan events triggered by policy surprises.

The Digital Securities Sandbox and Interoperability: New Tools for Aggressive Traders

The US-UK deal isn’t just about compliance, it’s about unlocking innovation. Both nations are launching a digital securities sandbox allowing firms to test blockchain-based capital markets solutions under coordinated oversight (source). For traders who thrive on speed and precision, this sandbox means new asset classes and products will hit regulated exchanges faster than ever before.

The push towards interoperability is equally critical. By harmonizing frameworks for payment stablecoins and tokenized securities, regulators aim to create seamless capital flows across borders, think instant settlements between London and New York desks without FX headaches or fragmented liquidity pools.

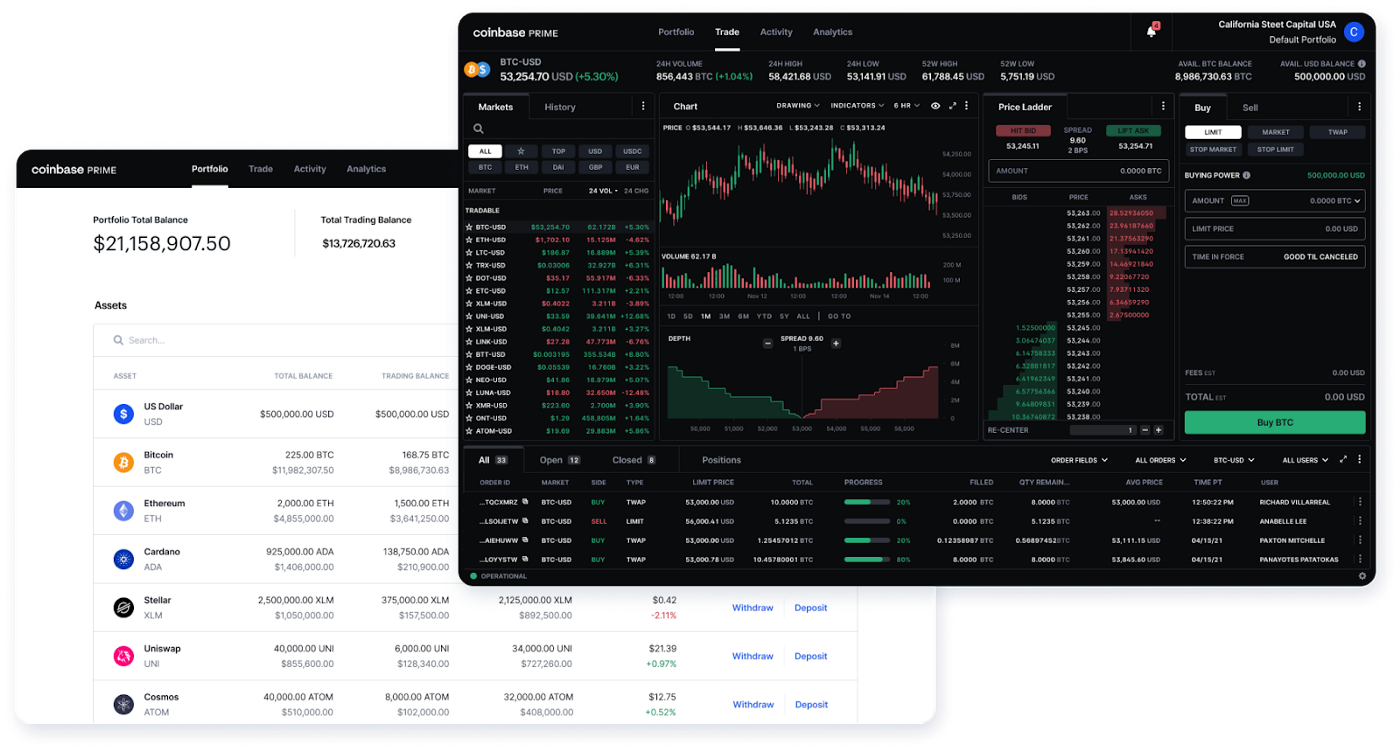

Price Action Spotlight: COIN at $342.46 Amid Regulatory Momentum

If you’re tracking Coinbase Global Inc (COIN), pay attention: At $342.46, COIN is positioned at the intersection of regulatory clarity and institutional adoption. As major exchanges benefit from harmonized frameworks, their revenues, and share prices, could see significant upside volatility as new capital floods in.

Coinbase Global Inc. (COIN) Price Prediction 2026-2031

Professional forecast post US-UK stablecoin regulatory alignment and GENIUS Act passage

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $285.00 | $360.00 | $420.00 | +5% | Regulatory clarity boosts institutional participation; volatility from global macro trends remains. |

| 2027 | $320.00 | $392.00 | $470.00 | +9% | Continued adoption of regulated stablecoins; earnings growth driven by higher trading volumes. |

| 2028 | $350.00 | $430.00 | $520.00 | +10% | Expansion into tokenized securities and new product lines; increased international user base. |

| 2029 | $375.00 | $460.00 | $570.00 | +7% | Stablecoin harmonization matures; COIN benefits from capital market innovations. |

| 2030 | $400.00 | $485.00 | $610.00 | +5% | Market consolidation; COIN’s regulatory leadership attracts institutional clients. |

| 2031 | $420.00 | $510.00 | $650.00 | +5% | Widespread adoption of digital assets; COIN leverages global partnerships and diversified revenue. |

Price Prediction Summary

Coinbase (COIN) is positioned for steady growth through 2031 as regulatory clarity in the US and UK drives mainstream adoption of stablecoins and digital assets. The average price is projected to grow from $360.00 in 2026 to $510.00 in 2031, reflecting both expanding market opportunities and persistent volatility. Bullish scenarios are supported by Coinbase’s leadership in regulated markets, while bearish risks include competitive pressures, regulatory setbacks, or crypto market downturns.

Key Factors Affecting Coinbase Global Inc. Stock Price

- US-UK regulatory harmonization reduces legal uncertainty and enables cross-border innovation.

- GENIUS Act and UK stablecoin rules attract institutional investors and boost market confidence.

- Coinbase’s diversified product suite and global expansion increase revenue streams.

- Potential for higher trading volumes and transaction fees as stablecoins become mainstream.

- Risks include regulatory delays, market volatility, competition from decentralized platforms, and macroeconomic shocks.

- Earnings growth, cost management, and valuation multiples will be key to sustaining upward price momentum.

Disclaimer: Stock price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, economic conditions, and other factors.

Always do your own research before making investment decisions.

But don’t just watch the headlines, watch the order book. The GENIUS Act and the UK’s parallel rules will force stablecoin issuers to show their cards every month. This level of transparency is unprecedented, and it means traders will have fewer surprises, more liquidity, and a tighter feedback loop between regulatory developments and price action. If you’re scalping or swing trading crypto stocks, you need to factor these regulatory catalysts into your setups.

Crypto Stock Trading Strategies: Adapting to the New Normal

So how do you capitalize on this new era? First, focus on stocks and tokens directly impacted by cross-Atlantic regulation. Exchanges like COIN are obvious winners, but keep an eye on payment networks and fintechs integrating regulated stablecoins for settlement. Second, volatility spikes around regulatory news are now tradeable events, use advanced indicators like implied volatility rank (IVR) and watch for volume surges post-announcement.

Top 5 Crypto Stock Trading Strategies for 2024 US-UK Stablecoin Rules

-

1. Focus on Regulated Crypto Exchanges Like Coinbase Global Inc (COIN)With the GENIUS Act and UK draft rules prioritizing regulatory compliance, trading stocks of regulated exchanges such as Coinbase Global Inc (COIN)—currently priced at $342.46—offers exposure to platforms likely to benefit from increased market legitimacy and institutional inflows.

-

2. Monitor Stablecoin Issuer Partnerships and DisclosuresUS and UK regulations now require stablecoin issuers to back coins with liquid assets and publish monthly reserve reports. Traders should track public disclosures from major issuers like Circle (USDC) and Tether (USDT) to anticipate shifts in market confidence and stock price movements for related companies.

-

3. Leverage Cross-Border Payment Stocks Poised for GrowthThe US-UK push for interoperable stablecoin frameworks boosts prospects for payment giants integrating stablecoins. Watch for developments from PayPal Holdings (PYPL) and Visa (V), both of which have launched crypto payment features and could see increased transaction volumes as regulations clarify.

-

4. Track Digital Securities Sandbox ParticipantsBoth governments are piloting a digital securities sandbox to test blockchain-based capital market solutions. Traders should follow publicly listed companies like London Stock Exchange Group (LSEG) and Nasdaq Inc. that are actively involved in these regulatory sandboxes, as early adoption could drive stock outperformance.

-

5. Prioritize Stocks with Transparent Regulatory StrategiesCompanies with proactive, public-facing regulatory strategies—such as Kraken (owned by Payward Inc.) and Robinhood Markets Inc (HOOD)—are better positioned to navigate evolving compliance demands. Look for firms with clear disclosures and ongoing engagement with US and UK regulators.

Third, don’t underestimate the ripple effect on DeFi protocols or tokenized securities platforms that list in both jurisdictions. With London and New York now reading from the same playbook, expect cross-listings and dual-market launches to accelerate. This opens up arbitrage windows for aggressive traders willing to move fast.

Risks and Opportunities: What Could Go Wrong (or Right)

Let’s be real: Regulatory harmonization doesn’t eliminate risk, it just changes its shape. On one hand, clearer rules mean fewer rug pulls and less chance of sudden delistings. On the other hand, if either side tightens capital controls or imposes stricter KYC/AML requirements mid-cycle, liquidity could dry up fast. Stay nimble; always have a plan B for your exits.

The upside? Global capital flows could surge into regulated venues as uncertainty fades. That means deeper order books and more sophisticated market participants, exactly what you want if your edge is speed and precision.

What’s Next for Crypto Regulatory News?

The US-UK deal is just the first domino. Expect other G7 nations to follow suit as stablecoins become integral to payment rails worldwide (source). Forward-thinking traders should monitor upcoming consultations in early 2025 as both governments fine-tune their frameworks.

If you’re serious about staying ahead in this market, set alerts for every major policy update out of Washington or London, and be ready to pivot your portfolio at a moment’s notice.

Speed, precision, relentless learning: That’s how you thrive in an environment where regulation moves as fast as innovation itself.