Ready to make your small crypto stack work harder? Whether you’re starting with $50 or $500, smart traders know that maximizing gains isn’t about how much you start with, but how you manage your trades. In today’s fast-paced market, strategies like scalping, day trading, and swing trading are giving nimble investors the edge. The secret sauce: trade duration. Get it right, and even modest accounts can grow surprisingly fast.

Why Trade Duration Matters for Small Crypto Accounts

If you’re trading crypto with small amounts, every move counts. The duration of each trade can be the difference between compounding small wins or getting wiped out by a single bad bet. Short-term approaches like scalping and day trading let you react quickly to price swings while limiting exposure to sudden market reversals. Longer holds, think swing trades, can deliver bigger wins but come with increased risk from overnight volatility.

Let’s break down why trade duration is your best friend when capital is tight:

- Quick Exits Limit Losses: Shorter trades mean less time for the market to turn against you.

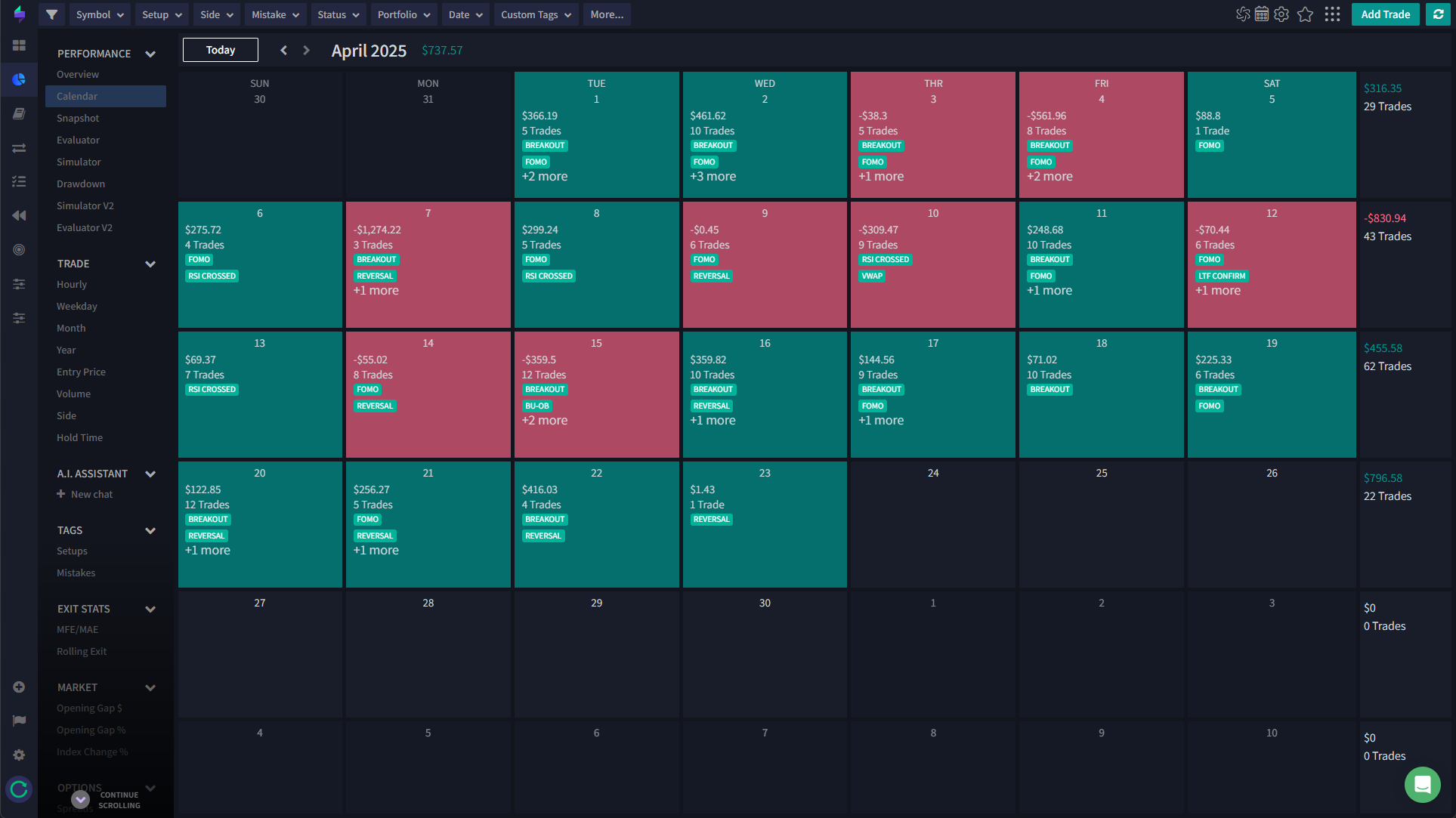

- Compounding Small Gains: Multiple small wins add up fast if you keep losses tight.

- Avoiding Overnight Surprises: Closing positions before the day ends sidesteps news-driven gaps.

This isn’t just theory, pro traders use these tactics daily. For more on short-term crypto strategies and risk control, check out this excellent primer from Bitstamp.

The Top Strategies for Small Account Crypto Trading

You don’t need a whale-sized bankroll to capture profits in crypto. Here’s how savvy traders are squeezing more out of every dollar by picking the right strategy for their situation:

Top Short-Term Crypto Trading Styles for Small Accounts

-

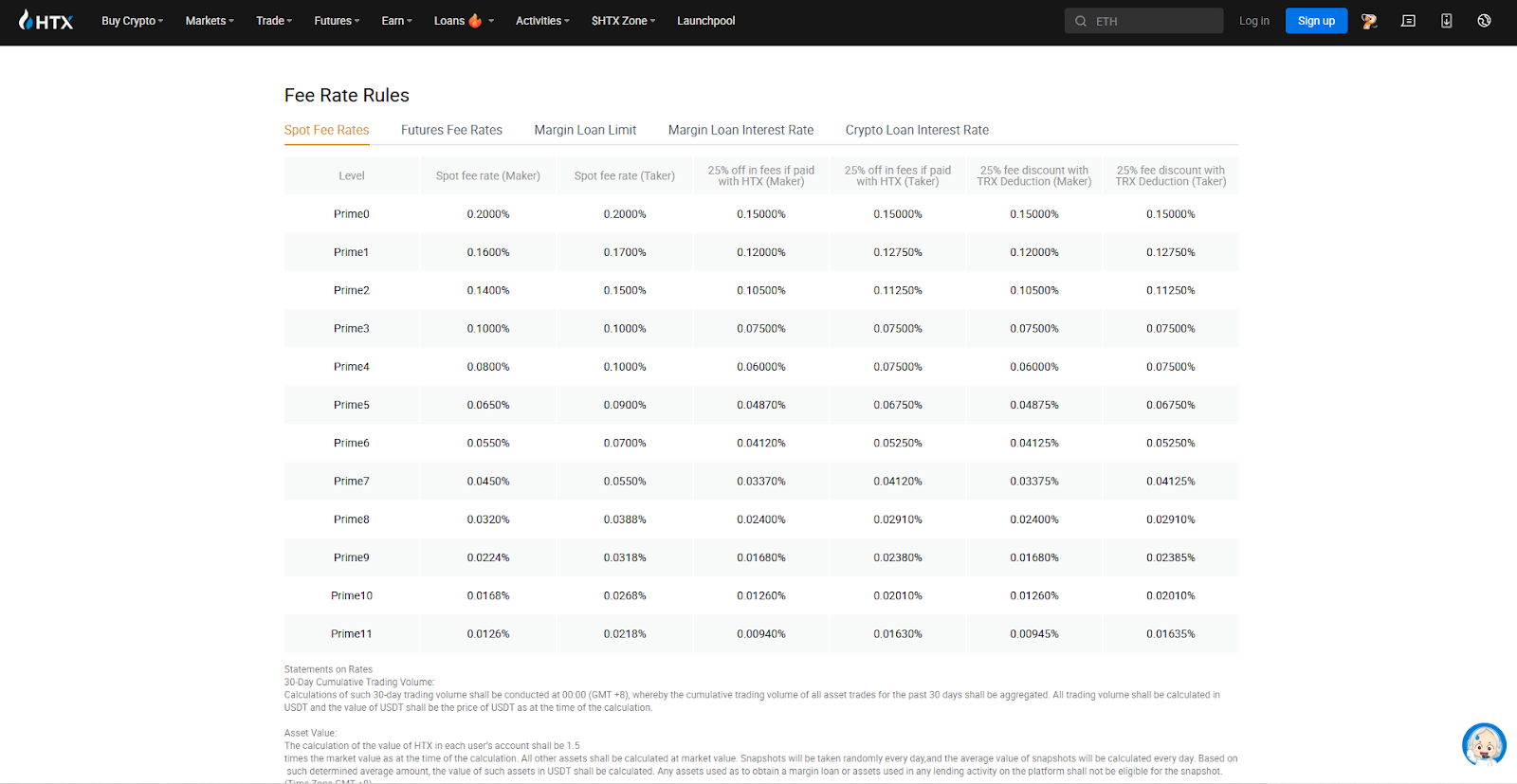

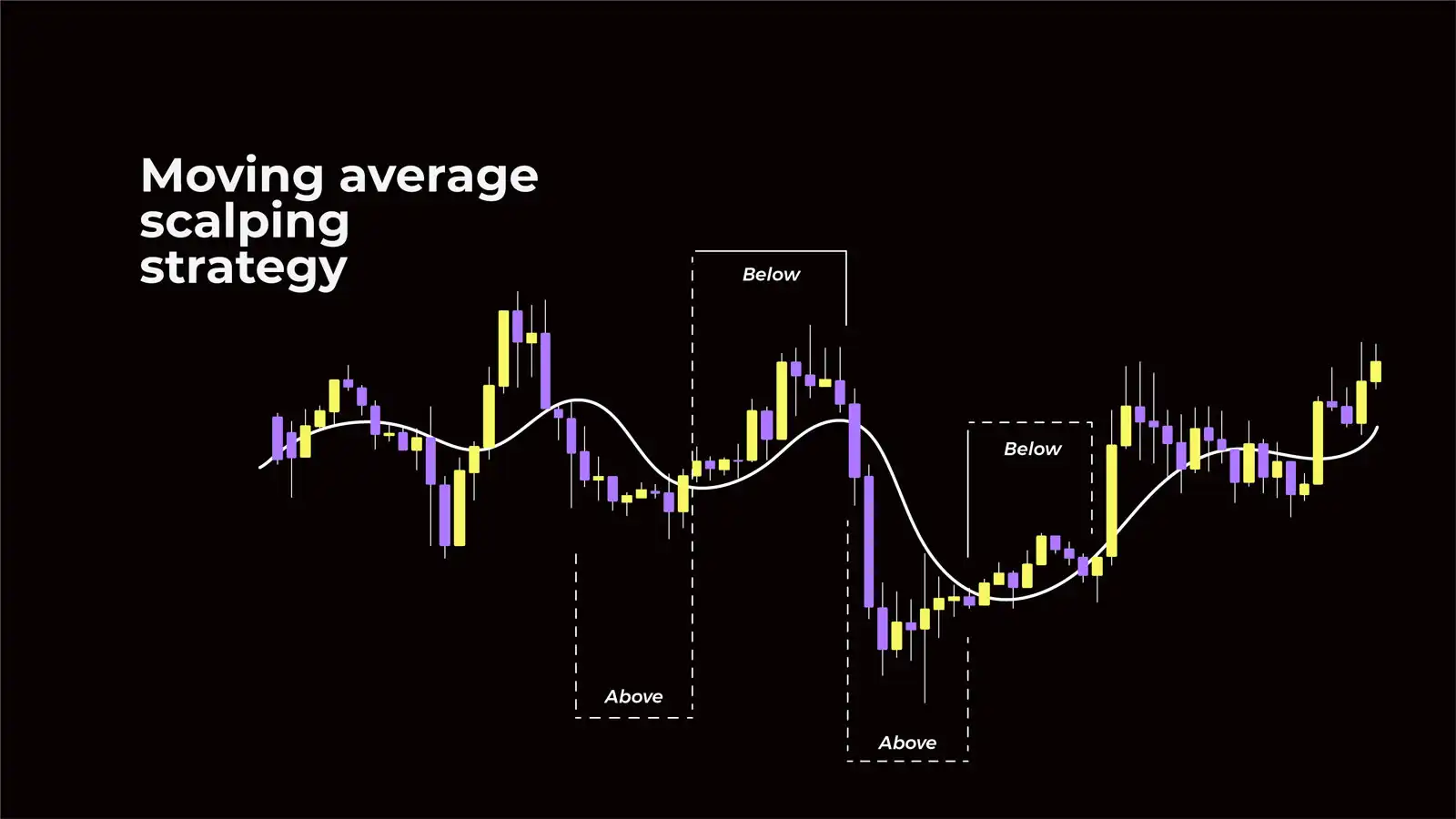

Scalping: This ultra-fast strategy involves making dozens or even hundreds of trades in a single day, each aiming for tiny profits from small price moves. Pros: Quick gains, lots of trading opportunities. Cons: High stress, requires constant attention, and transaction fees can eat into profits—especially with small accounts.

-

Day Trading: Day traders open and close positions within the same day, avoiding overnight risk. Pros: No exposure to overnight volatility, more time to analyze trades than scalping. Cons: Still requires significant time monitoring charts, and fees can add up if trading frequently with a small account.

-

Swing Trading: Swing traders hold positions for several days or weeks to capture larger price swings. Pros: Less time-intensive, lower trading fees, and easier to manage with a small account. Cons: Exposure to overnight and weekend market moves, may require patience during sideways markets.

Scalping is all about speed, executing dozens of micro-trades in minutes or hours. This style thrives on high liquidity pairs and low transaction fees. Just remember: fees can eat your lunch if you aren’t careful! Day trading offers a middle ground; positions last from 15 minutes up to several hours but are always closed before bedtime. If your schedule is packed or you can’t stare at charts all day, swing trading might suit you better, holding positions for days or weeks to catch bigger price waves.

The bottom line? Choose a strategy that matches both your lifestyle and appetite for risk. For a deep dive into building your own short-term plan, including technical tools and position sizing tips, see this guide from Morpher.

Pillars of Risk Management: Protecting Your Tiny Stack

No matter which style fits you best, nothing matters more than risk management. With smaller accounts, even one oversized loss can set you back weeks or months. Here’s how experienced traders keep their edge sharp:

Essential Risk Management Checklist for Small Crypto Traders

-

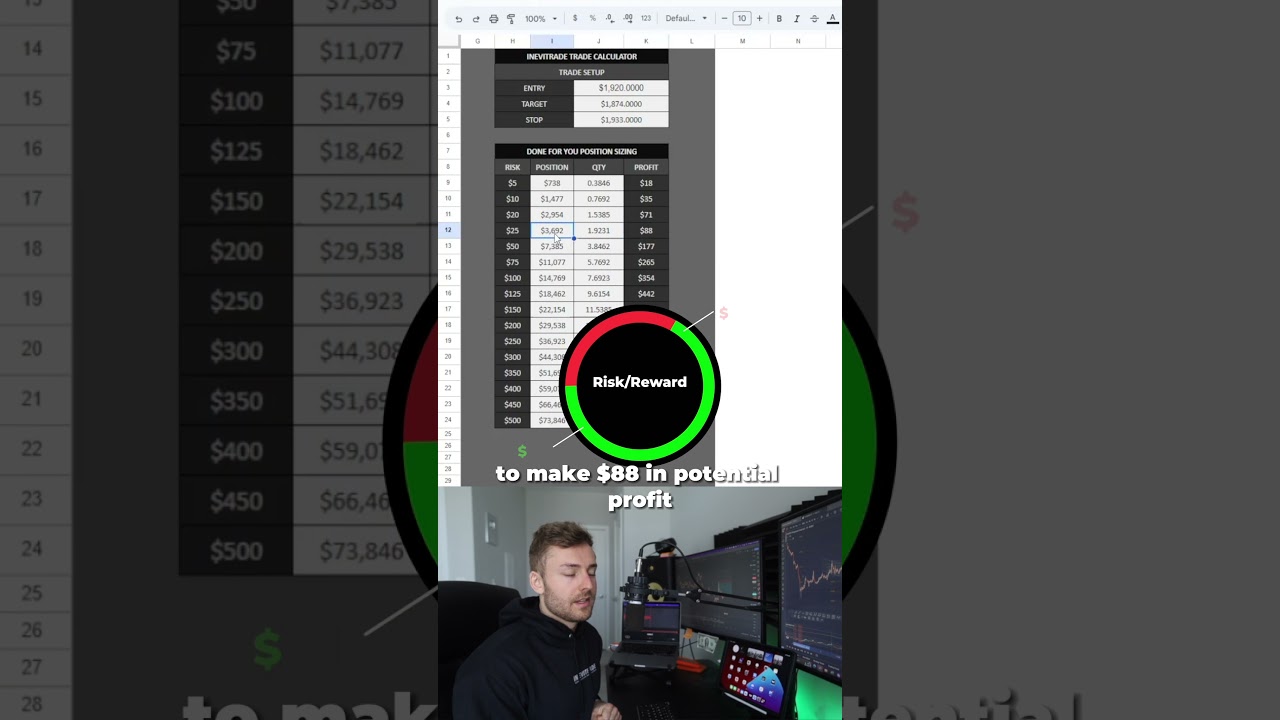

Never Risk More Than 1–2% of Your Account Per Trade: Position sizing is crucial—calculate your trade size so a single loss won’t wipe out your account. Tools like Bybit’s position calculator can help.

-

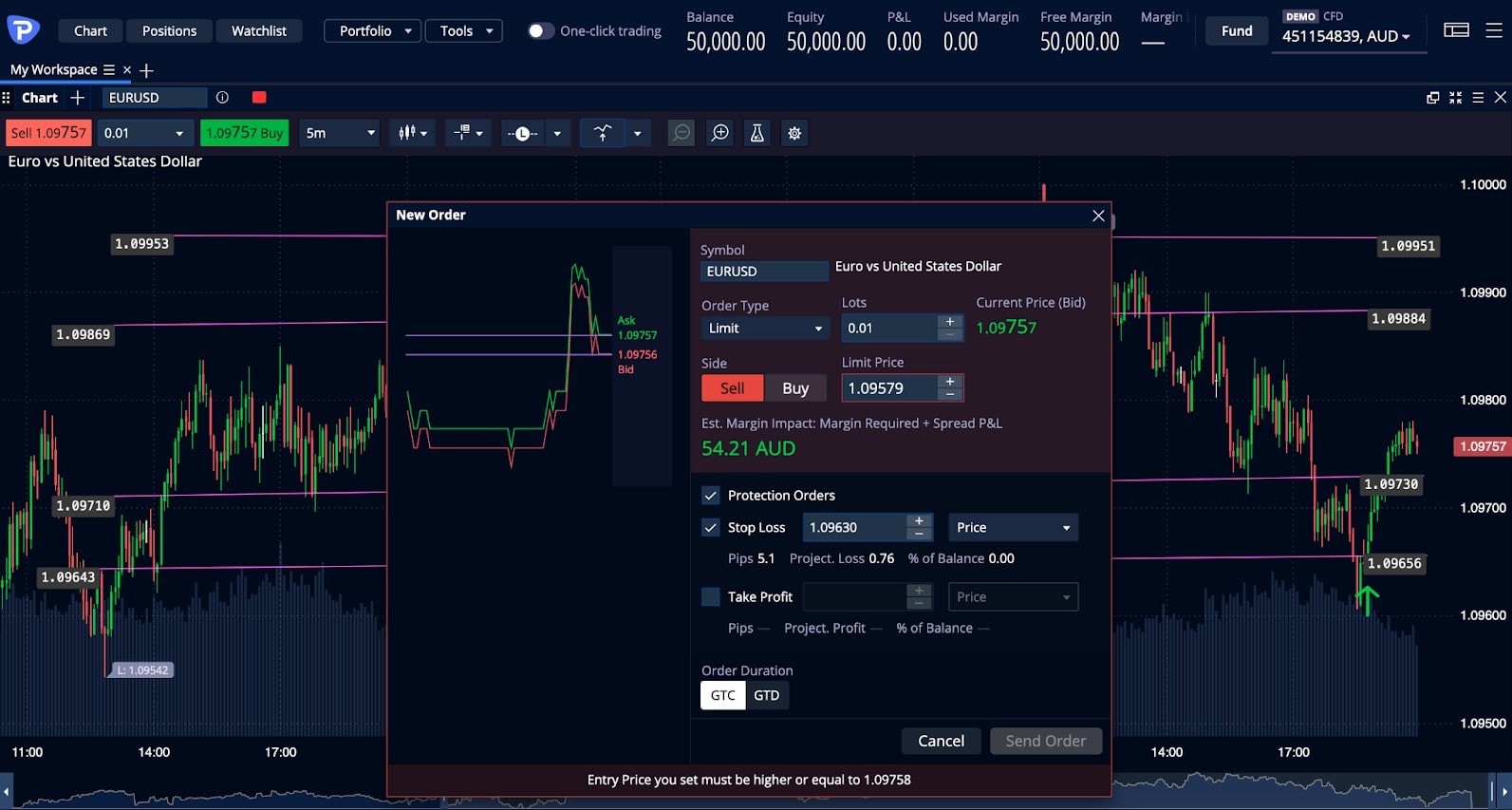

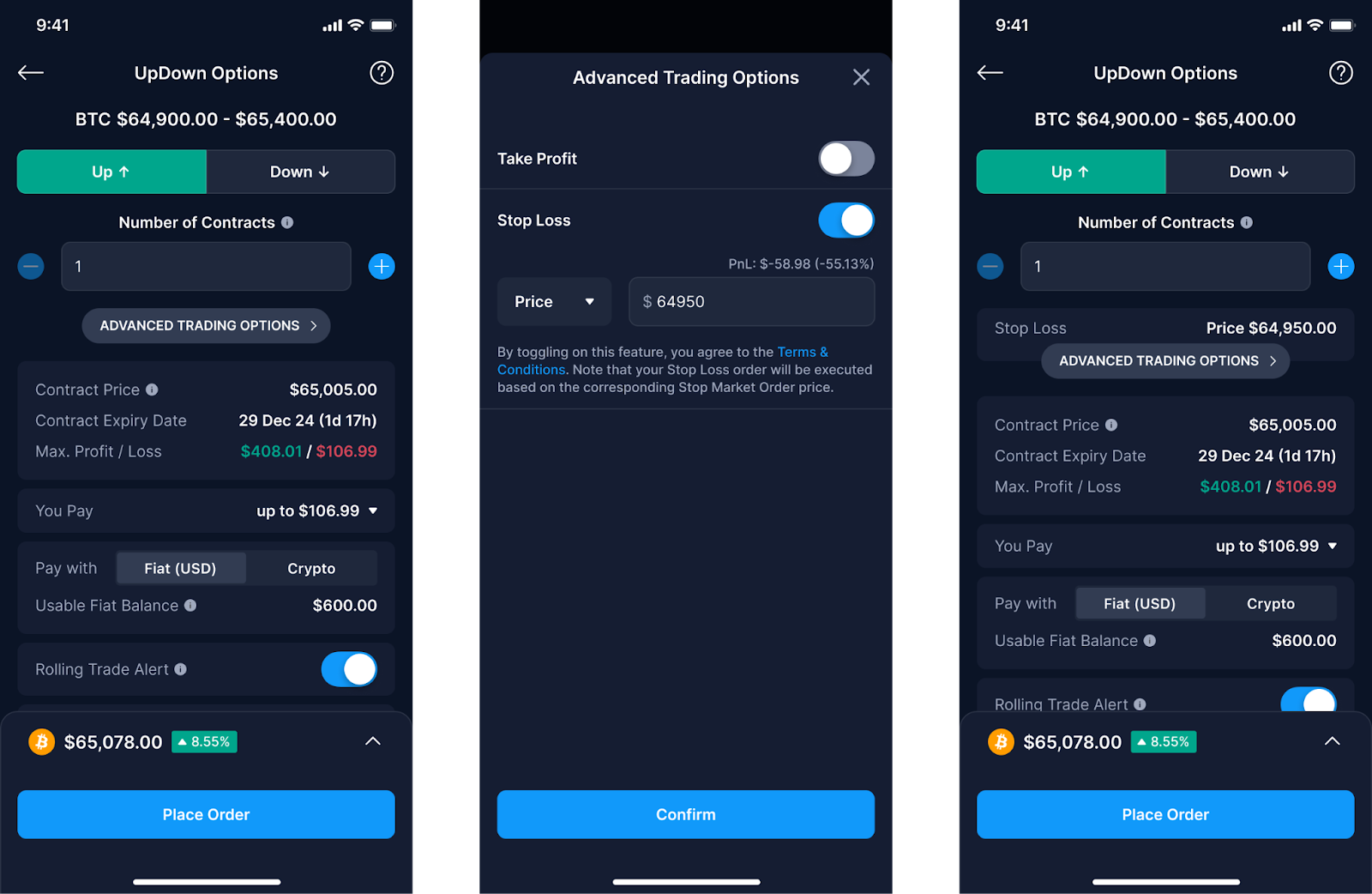

Use Take-Profit Orders to Lock in Gains: Secure profits automatically by setting take-profit targets. This is especially important for scalping and day trading. Most exchanges support this feature.

-

Avoid Overtrading and Stick to Your Plan: Emotional decisions and revenge trading can quickly drain a small account. Set clear rules and follow them, even after a loss or win.

-

Diversify, But Don’t Overextend: Spread your risk across a few carefully chosen cryptocurrencies, rather than putting all your funds in one asset. Stick to established coins like Bitcoin (BTC) and Ethereum (ETH) when starting out.

A golden rule? Never risk more than 1, 2% per trade, a tip echoed by pros everywhere and highlighted in this breakdown from OSL Crypto Exchange. Combine disciplined stop-losses with smart position sizing and an eagle eye on fees to keep your account growing steadily instead of swinging wildly.