In 2025, the intersection of artificial intelligence and crypto payments is no longer a theoretical promise – it is rapidly becoming the new foundation for digital asset transactions. With Google’s announcement of the Agent Payments Protocol (AP2), supported by Coinbase and a coalition of payment giants, AI agents are now empowered to transact autonomously across both traditional and crypto rails. For traders, this signals a paradigm shift with profound implications for efficiency, security, and market structure.

Google’s AP2: The Blueprint for AI-Driven Crypto Payments

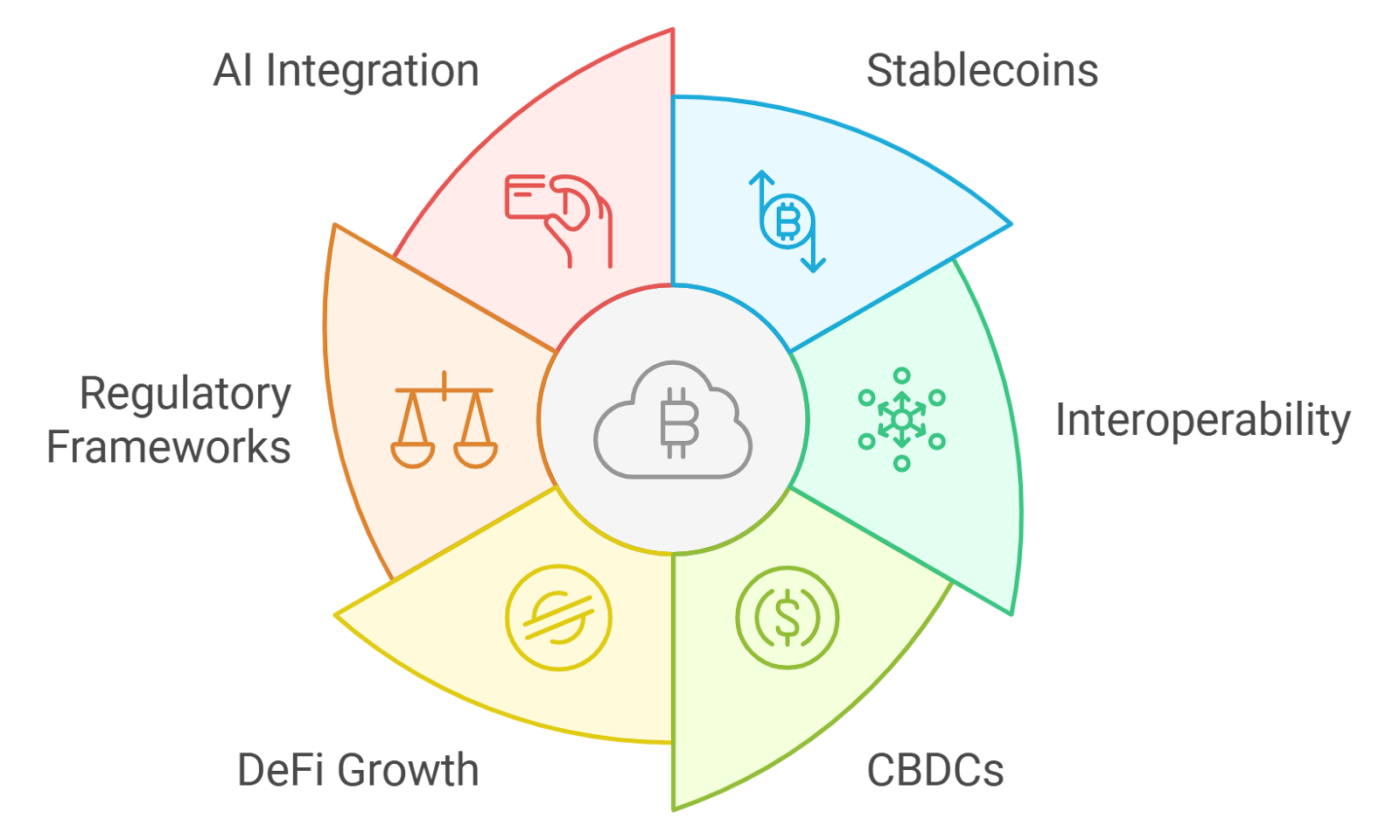

At the heart of this transformation is Agent Payments Protocol (AP2), an open standard designed by Google in collaboration with over 60 payment industry leaders. AP2 establishes a secure, interoperable framework allowing AI agents to authenticate users, initiate transactions, and interact seamlessly with both fiat and digital currencies. Notably, AP2 integrates stablecoin compatibility through its partnership with Coinbase, bridging the gap between legacy finance and next-generation crypto networks.

This protocol isn’t just about speed or automation; it’s about trust. By providing a “common language” for agentic payments, AP2 aims to make AI-driven transactions transparent, scalable, and resistant to fraud – all essential attributes as trading volumes surge and algorithmic actors become more prevalent. Learn more about AEON’s cryptographic approach here.

AEON and Multi-Chain Intelligence: The New Payment Stack

While AP2 lays the groundwork at the protocol level, innovative projects like AEON are pushing boundaries on execution. AEON introduces Payment Intent Identification (KYA), ensuring that every AI agent understands its transaction authority before acting. Its multi-chain intelligent routing analyzes real-time network fees and liquidity conditions, dynamically optimizing payment paths across chains – a game-changer for traders seeking best execution in volatile markets.

This means that whether you’re arbitraging on Ethereum layer-2s or executing cross-chain swaps via Solana or Avalanche bridges, AI-driven protocols will automatically seek out optimal routes based on current market data – all within milliseconds. The result? Lower costs, fewer failed transactions due to congestion or slippage, and more time for traders to focus on macro trends rather than operational friction.

Top 5 Ways AI Payments Are Reshaping Crypto Trading in 2025

-

Universal AI Agent Transactions via Agent Payments Protocol (AP2): Google’s AP2 establishes a global standard for AI-driven transactions, allowing AI agents to securely and autonomously execute crypto trades and payments across multiple platforms and payment systems. This interoperability streamlines trading operations and reduces friction for traders.

-

Autonomous Cross-Chain Payments with AEON Protocol: AEON enables AI agents to conduct seamless cross-chain transactions, leveraging intelligent routing to optimize for real-time fees and network conditions. Its Payment Intent Identification (KYA) ensures only authorized AI agents execute trades, enhancing both efficiency and security for crypto traders.

-

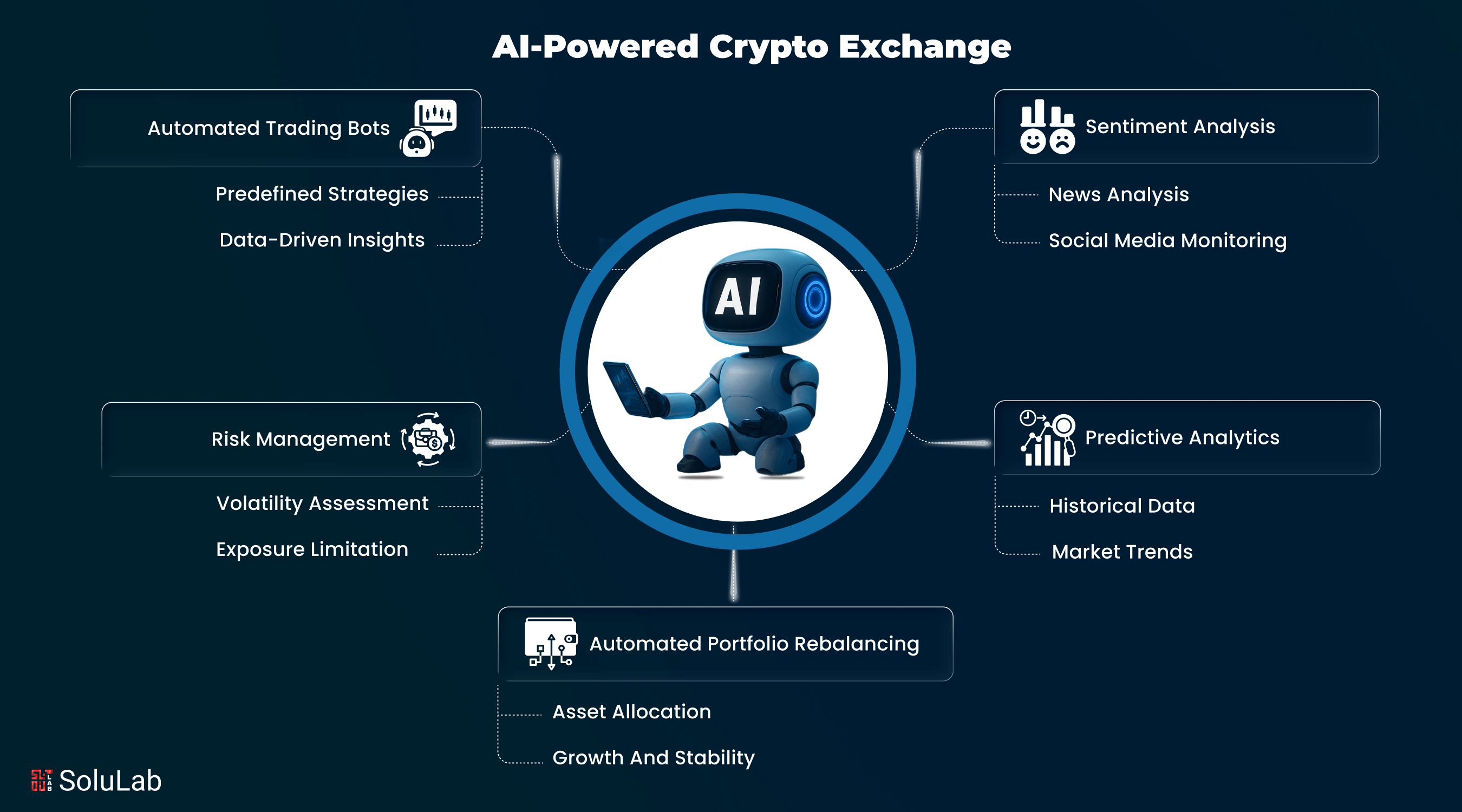

AI-Powered Trading Bots for Millisecond Execution: Advanced AI trading bots analyze massive datasets and execute trades in milliseconds, minimizing emotional bias and continuously refining strategies through machine learning. This results in more consistent, data-driven trading outcomes and improved risk management for active traders.

-

Predictive Analytics and Market Insights: AI algorithms deliver real-time predictive analytics, empowering traders to anticipate market trends and make informed decisions. These tools leverage vast historical and live data, giving traders a competitive edge in volatile crypto markets.

-

Enhanced Security and Fraud Detection: AI-driven payment protocols incorporate robust security layers, using machine learning to detect suspicious activity and prevent fraud. This fosters greater trust in crypto transactions and protects traders from emerging threats.

The Data Surge: Why Traders Are Embracing AI Crypto Payments

The numbers tell a compelling story. In just two years, market capitalization for AI-linked crypto tokens has ballooned from $2.7 billion in April 2023 to over $39 billion in 2025 (source). Adoption is not just institutional; nearly 37% of U. S. and UK respondents cite AI-powered digital payments as their primary driver for entering crypto markets today.

This trend coincides with the rise of autonomous trading bots leveraging machine learning to analyze order books, news sentiment, and even blockchain mempool data at unprecedented speeds. These bots aren’t just automating trades – they’re continuously refining strategies based on live feedback loops while minimizing human emotional bias. Traders who harness these tools gain an edge in both risk management and execution quality.

Security remains a central concern as AI agents take on greater responsibility in financial transactions. The integration of advanced anomaly detection and real-time fraud monitoring, powered by machine learning, means that suspicious activity can be flagged and blocked before it impacts traders. This is a step-change from legacy systems, where fraud detection often lags behind actual events. With protocols like AP2 and AEON, security is not just reactive but predictive, AI learns from each attempted exploit to strengthen defenses across the network.

Transparency is another critical advantage. By leveraging open standards and on-chain attestations, AI-driven payment protocols allow traders to audit transaction histories and validate agent authority in real time. This transparency builds trust in a market increasingly dominated by autonomous actors, where black-box algorithms once ruled unchecked.

“The future of trading will be shaped by agents that not only act faster than humans but also build trust through transparency and auditability. “

What Traders Should Watch: Opportunities and Risks in the AI Payment Era

For active traders, these developments bring both opportunity and new risk vectors. Automated arbitrage strategies can now operate 24/7 across fragmented liquidity pools, capturing spreads that would be impossible for manual traders to spot in time. However, as more market participants deploy similar AI tools, competition intensifies, alpha decays quickly when everyone has access to the same playbook.

Moreover, the growing reliance on agentic infrastructure introduces fresh systemic risks. A vulnerability or exploit in a widely adopted protocol like AP2 could ripple rapidly through interconnected markets. Traders must therefore prioritize operational due diligence: vetting which protocols their bots interact with, monitoring for emergent bugs or governance changes, and maintaining fallback procedures should an agent go rogue or a network outage occur.

Key Risks for Crypto Traders Using AI-Driven Payment Protocols

-

Autonomous Transaction Errors: AI agents, such as those enabled by Google’s Agent Payments Protocol (AP2) and AEON, can autonomously execute trades and payments. However, misconfigured algorithms or flawed payment intent identification (KYA) may result in unintended or unauthorized transactions, exposing traders to financial loss.

-

Smart Contract Vulnerabilities: AI-driven payment protocols rely on smart contracts for automation and execution. Exploits or bugs in these contracts—especially on multi-chain platforms like AEON—can be targeted by attackers, potentially leading to loss of funds or service disruptions.

-

Data Privacy Concerns: AI agents require access to sensitive trading and payment data to function effectively. Improper data handling or breaches could compromise user privacy and expose confidential financial information to malicious actors.

-

Interoperability Risks: Protocols like AP2 aim for cross-platform compatibility, but integration issues between different blockchains, payment systems, or AI platforms can result in transaction failures, delays, or inconsistencies.

-

Regulatory Uncertainty: The rapid evolution of AI-driven payments, especially with stablecoin integration via platforms like Coinbase, creates a landscape where regulatory frameworks may lag behind technology, exposing traders to compliance risks and potential legal challenges.

-

Overreliance on Automation: While AI-driven bots and agents can enhance efficiency, excessive dependence may reduce trader oversight, increasing vulnerability to market anomalies or unforeseen events that automated systems fail to detect or properly respond to.

The regulatory landscape is also evolving. As AI agents gain autonomy over funds movement, questions arise about accountability and compliance, who is responsible if an agent makes an unauthorized trade? Expect increased scrutiny from regulators as adoption scales; forward-thinking traders should stay informed about KYC/AML requirements embedded within these new standards.

Macro Perspective: The Next Phase of Crypto Market Structure

The convergence of AI and crypto payments is catalyzing unprecedented market efficiencies, but it’s also changing the very structure of digital asset markets. Liquidity is fragmenting across chains yet becoming more accessible thanks to intelligent routing; spreads are compressing as bots arbitrage away inefficiencies; retail users are gaining access to institutional-grade automation tools via user-friendly interfaces built atop AP2-compatible wallets.

The net effect? Markets are moving toward continuous price discovery with lower latency and tighter spreads, a boon for those who adapt quickly but a challenge for legacy strategies built around slower execution cycles.

Looking Ahead: How To Position Your Portfolio

If you’re trading crypto stocks or digital assets today, embracing AI-driven payment rails isn’t optional, it’s essential. Start by integrating bots that leverage AP2 or AEON standards for order routing and risk controls; monitor stablecoin flows facilitated by Google Coinbase crypto partnerships; track emerging regulations around agentic payments; and above all else, remain nimble as this technology reshapes market cycles at an accelerating pace.

Cycles matter, timing is everything, and those who understand both the macro trends and micro-level protocol shifts will be best positioned to thrive as we enter this new era of AI crypto payments.