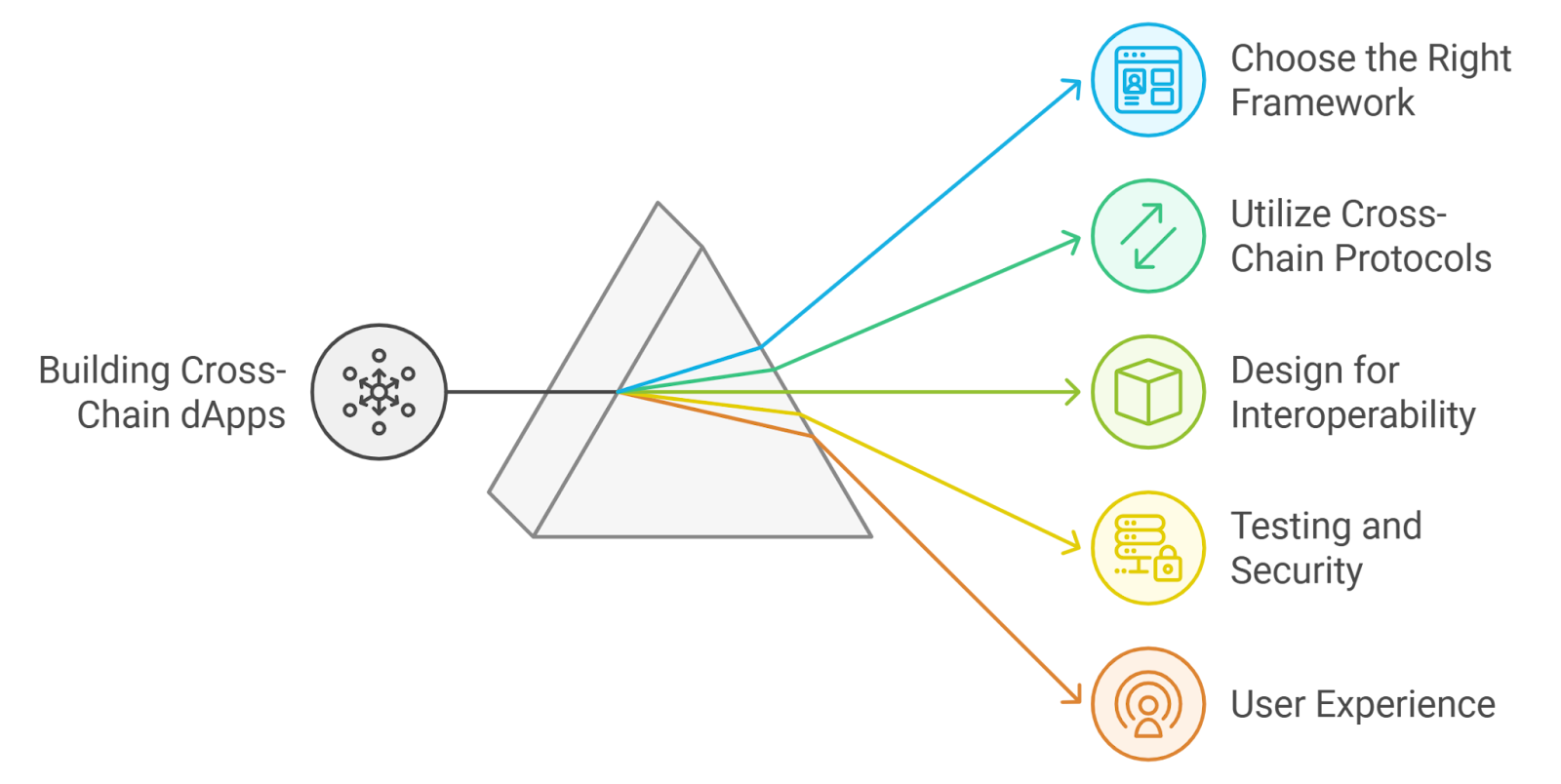

As of September 2025, crypto markets are being fundamentally reshaped by the rapid expansion of Layer 2 solutions and the proliferation of cross-chain crypto assets. These twin forces are not just technical upgrades – they are redefining liquidity flows, trading strategies, and the very architecture of decentralized finance.

Layer 2 Crypto Trading: Scaling Up Efficiency and Opportunity

The Layer 2 revolution is in full swing. Ethereum’s Layer 2 scaling has already doubled transaction capacity by mid-2025, with projections pointing to a staggering 10-20x increase before year’s end. This surge in throughput is not just a technical milestone; it’s a macro shift that directly impacts traders, investors, and protocols across the ecosystem. Lower fees and faster settlement times have made Ethereum-based DeFi protocols like Aave and Uniswap markedly more attractive for active trading. The days of $50 gas fees for simple swaps are gone – replaced by seamless, near-instant trades that rival centralized exchanges for speed and cost.

The numbers speak volumes. Bitcoin (BTC) is currently holding at $115,586, while Ethereum (ETH) trades at $4,472.87. Polygon (MATIC), Arbitrum (ARB), and Optimism (OP) – all core players in the Layer 2 landscape – are showing their own price dynamics amid this transition: MATIC at $0.251241, ARB at $0.493039, OP at $0.801665. These assets are not just tokens; they represent the infrastructure powering next-gen trading rails.

Cross-Chain Crypto Assets: Unlocking New Liquidity Horizons

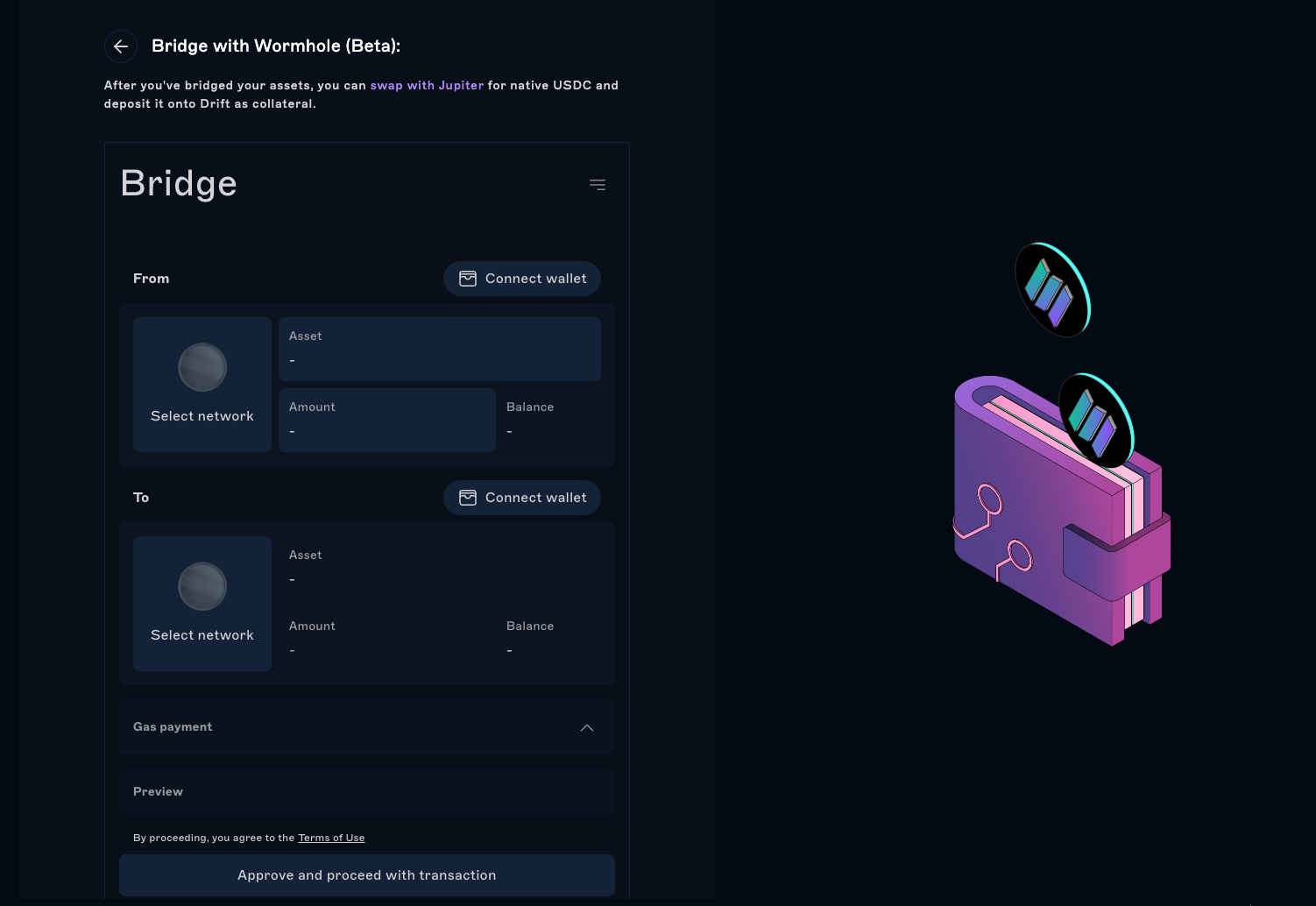

The maturation of cross-chain bridges is breaking down long-standing silos between blockchains. Traders now have access to aggregated liquidity across networks like Solana, Ethereum, Polygon, Base, Arbitrum, and more. This means better price discovery and tighter spreads – but also new risks to manage.

Top Cross-Chain Bridges on Solana & Supported Assets

-

Wormhole: One of the most widely used cross-chain bridges on Solana, Wormhole supports asset transfers between Solana, Ethereum, Polygon, BNB Chain, Avalanche, Arbitrum, Optimism, and Base. Supported assets include USDC, ETH, BTC (wrapped), SOL, and major ERC-20 tokens.

-

LayerZero: Recently integrated with Solana, LayerZero enables seamless transfers across Solana, Ethereum, Avalanche, Polygon, Arbitrum, BNB Chain, Optimism, and Base. Key assets transferred include USDC, ETH, SOL, and other leading tokens.

-

Circle CCTP (Cross-Chain Transfer Protocol): Circle’s CCTP allows native USDC transfers between Solana, Ethereum, Base, Noble, Arbitrum, Avalanche, Polygon, and Optimism, ensuring interoperability and liquidity for stablecoin traders.

-

Allbridge: A popular bridge for moving assets between Solana and blockchains like Ethereum, BSC, Polygon, Avalanche, and Fantom. Supported assets include USDT, USDC, SOL, and other major tokens.

-

Portal Bridge (by Wormhole): Portal is Wormhole’s dedicated token bridge, facilitating transfers of USDC, ETH, BTC (wrapped), and SOL between Solana and major EVM chains.

-

Base Bridge: Coinbase’s Base Layer 2 network has launched an open-source bridge to Solana, allowing transfers of key assets such as ETH, USDC, and SOL between Base and Solana.

Cross-chain interoperability is more than a buzzword; it’s an answer to liquidity fragmentation that plagued early DeFi markets. With projects like LayerZero integrating Solana into its cross-chain bridge network – now linking Solana with Ethereum, Avalanche, Polygon, Arbitrum, BNB Chain, Optimism and Base – traders have never had more options for asset movement or arbitrage plays.

This expansion isn’t without its trade-offs. Security remains a real concern: from 2021 to 2023 alone over $2.6 billion was lost to exploits targeting cross-chain bridges (source). Robust security frameworks will be essential as volume grows.

Base Blockchain Trading and The Multi-Chain Wallet Era

The introduction of Base – Coinbase’s Layer 2 solution built on Optimism’s OP Stack – marks another inflection point for both institutional and retail traders. With an open-source bridge to Solana now live (source), developers can build dApps that natively support cross-chain transfers between major ecosystems.

Bitcoin, Ethereum, and Polygon Price Prediction (2026-2031)

Forecasts reflect the impact of Layer 2 expansion, cross-chain adoption, and evolving market dynamics. Prices are based on current 2025 market data and projected trends. All prices in USD.

| Year | Asset | Minimum Price | Average Price | Maximum Price | % Change (Avg. YoY) | Market Scenario Insights |

|---|---|---|---|---|---|---|

| 2026 | BTC | $82,000 | $128,000 | $168,000 | +10.8% | Layer 2 and cross-chain growth continue, but global regulation introduces volatility. Bearish: macro tightening. Bullish: ETF inflows, adoption. |

| 2026 | ETH | $3,600 | $5,200 | $6,800 | +16.3% | ETH benefits most from Layer 2 scaling. Bearish: L2 competition. Bullish: DeFi/NFT resurgence, institutional use. |

| 2026 | MATIC | $0.18 | $0.32 | $0.48 | +27.4% | Polygon faces stiff L2 competition but remains vital for Ethereum scaling. Bearish: Bridge hacks. Bullish: Major dApp migration. |

| 2027 | BTC | $91,000 | $142,000 | $182,000 | +10.9% | ETF adoption and global digital asset frameworks mature. Bearish: Regulatory clampdowns. Bullish: Treasury adoption. |

| 2027 | ETH | $4,100 | $6,100 | $7,900 | +17.3% | ETH further integrates with high-throughput L2s. Bearish: Alt L1s gain ground. Bullish: CBDC integrations. |

| 2027 | MATIC | $0.22 | $0.38 | $0.57 | +18.8% | Polygon expands cross-chain utility. Bearish: L2 fee wars. Bullish: Enterprise partnerships. |

| 2028 | BTC | $104,000 | $156,000 | $200,000 | +9.9% | Store-of-value narrative strengthens. Bearish: Global recession. Bullish: Emerging market adoption. |

| 2028 | ETH | $4,800 | $6,800 | $9,000 | +11.5% | ETH’s DeFi TVL hits new highs. Bearish: Layer 2 fragmentation. Bullish: Real-world asset tokenization. |

| 2028 | MATIC | $0.25 | $0.43 | $0.62 | +13.2% | Polygon cements role in multi-chain DeFi. Bearish: Tech obsolescence. Bullish: zkEVM upgrades. |

| 2029 | BTC | $122,000 | $171,000 | $235,000 | +9.6% | Halving cycle impact fades, but adoption steady. Bearish: New safe-haven competitors. Bullish: Sovereign wealth allocations. |

| 2029 | ETH | $5,300 | $7,700 | $10,800 | +13.2% | ETH as global settlement layer. Bearish: L2/L1 consolidation. Bullish: Interbank settlements. |

| 2029 | MATIC | $0.29 | $0.49 | $0.71 | +14.0% | Polygon sustains cross-chain lead. Bearish: Regulatory hurdles. Bullish: Major CEX listing. |

| 2030 | BTC | $138,000 | $188,000 | $260,000 | +9.9% | Mainstream financial integration. Bearish: Taxation, compliance burdens. Bullish: Retail adoption spike. |

| 2030 | ETH | $5,900 | $8,400 | $12,600 | +9.1% | ETH becomes core in global DeFi. Bearish: L2 centralization risks. Bullish: Institutional DeFi. |

| 2030 | MATIC | $0.33 | $0.54 | $0.80 | +10.2% | Polygon evolves to support multi-chain dApps. Bearish: Market saturation. Bullish: LayerZero, Base integrations. |

| 2031 | BTC | $155,000 | $205,000 | $285,000 | +9.0% | BTC matures as digital gold. Bearish: Tech upgrades required. Bullish: Cross-border payments mainstream. |

| 2031 | ETH | $6,350 | $9,200 | $14,200 | +9.5% | ETH dominates Web3 infra. Bearish: Competition from new L1s. Bullish: AI/data integrations. |

| 2031 | MATIC | $0.37 | $0.60 | $0.90 | +11.1% | Polygon remains a leading L2. Bearish: L2 consolidation. Bullish: New zk scaling breakthroughs. |

Price Prediction Summary

Over 2026-2031, Bitcoin, Ethereum, and Polygon are projected to benefit from Layer 2 scaling and cross-chain interoperability, though volatility will persist due to regulatory and macroeconomic factors. BTC could reach an average of $205,000 by 2031, ETH $9,200, and MATIC $0.60, with bullish scenarios driven by institutional adoption and technology upgrades, and bearish scenarios by regulatory crackdowns or security breaches.

Key Factors Affecting Bitcoin Price

- Layer 2 scaling adoption and transaction cost reductions

- Cross-chain interoperability and bridge security

- Global regulatory frameworks and compliance trends

- Institutional and sovereign adoption of crypto assets

- Macro-economic cycles (inflation, recession, risk appetite)

- Security of DeFi and bridge protocols

- Competition from new Layer 1 and Layer 2 solutions

- Network upgrades (e.g., Ethereum sharding, Polygon zkEVM)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

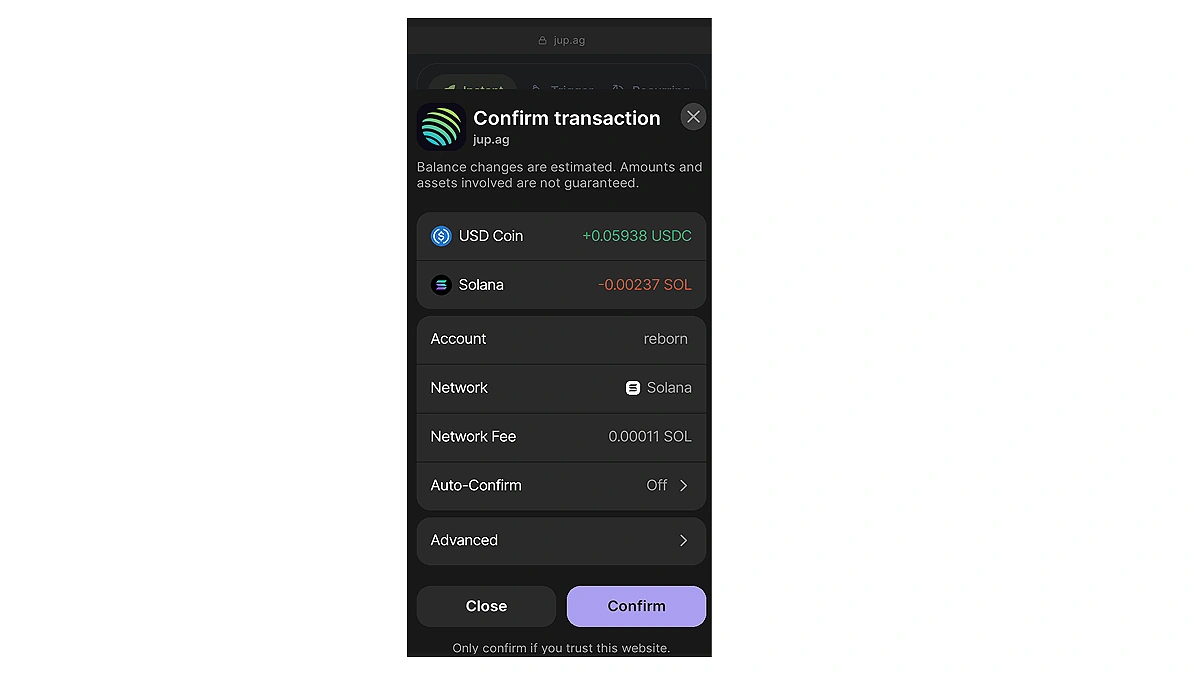

This multi-chain reality is manifesting in consumer products too: Phantom wallet users can now buy ether and USDC on Base within the app and swap tokens between Base, Ethereum, Solana and Polygon seamlessly (source). The result? Traders no longer need to worry about which chain their assets reside on, capital efficiency is maximized across protocols.

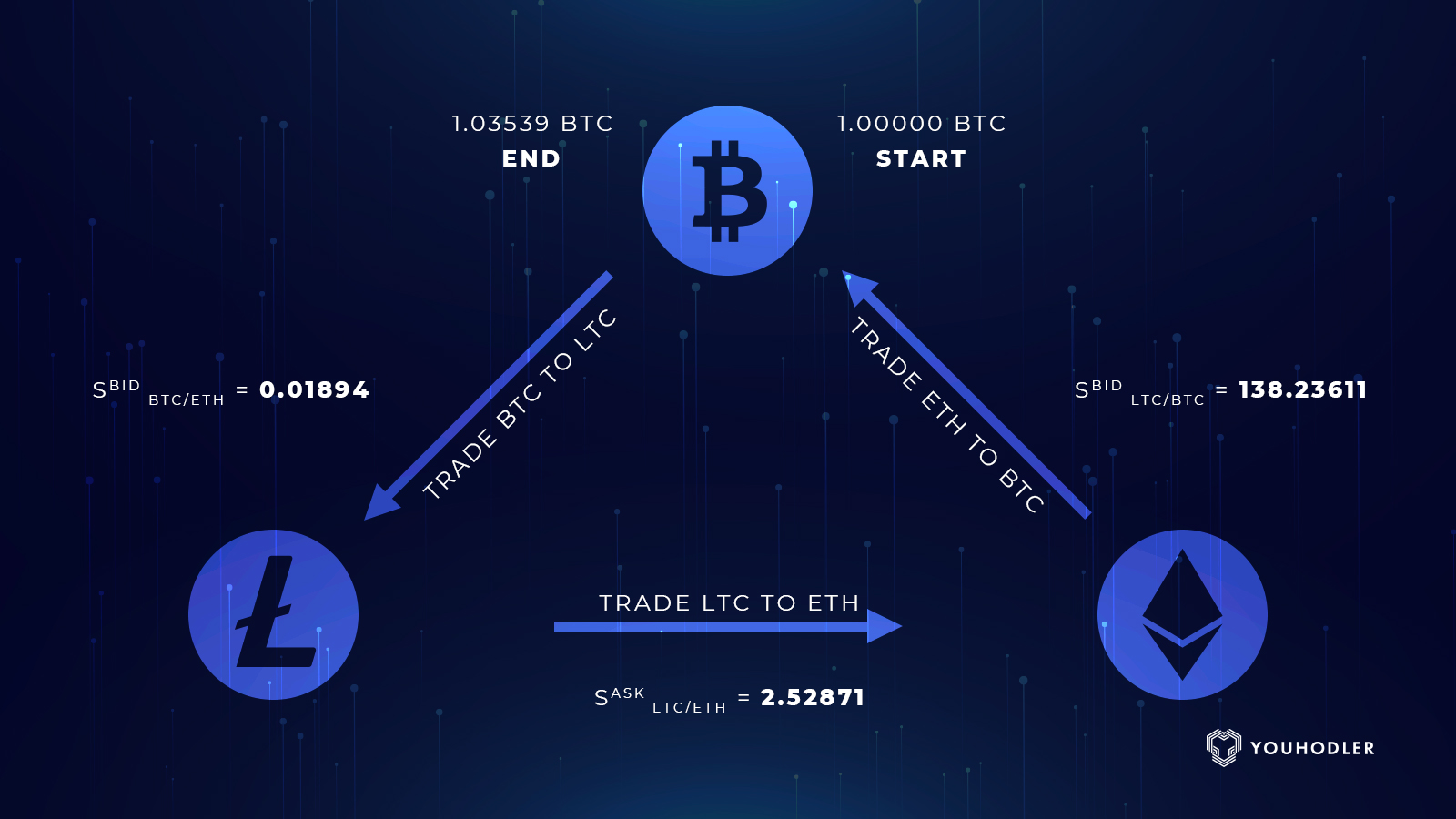

As the infrastructure matures, the lines between Layer 1 and Layer 2 blockchains are blurring. For traders, this means that arbitrage opportunities and liquidity mining strategies now span not just multiple protocols, but entirely different chains. The resulting capital flows are more dynamic than ever, with market makers leveraging bridges like Wormhole and LayerZero to move assets at scale and speed.

Polygon, Solana, and the Battle for Cross-Chain Dominance

Solana and Polygon are at the forefront of this cross-chain push. With Solana boasting 19 active Web3 bridges (source), its interoperability footprint is rapidly expanding. Polygon’s low-cost transactions and robust DeFi ecosystem make it a preferred route for cross-chain swaps. As these networks integrate with Ethereum Layer 2s like Base and Arbitrum, traders benefit from near-instant settlement across ecosystems that were once siloed.

This competitive landscape is fueling innovation in both DeFi protocols and wallet solutions. Tools like Phantom’s multi-chain wallet are emblematic of a new era where users expect seamless access to liquidity regardless of chain, an expectation that’s quickly becoming reality.

Key Opportunities (and Risks) in Layer 2 and Cross-Chain Trading

Top Trading Opportunities & Risks from Layer 2 and Cross-Chain Expansion

-

Enhanced Arbitrage Across Chains: Layer 2 solutions like Base and cross-chain bridges such as LayerZero enable traders to exploit price discrepancies between networks like Ethereum, Solana, and Polygon, increasing arbitrage opportunities and liquidity efficiency.

-

Access to Broader Asset Pools: Integration of cross-chain bridges (e.g., Circle CCTP, Phantom Wallet’s multi-chain swaps) allows traders to move assets like USDC and ETH seamlessly between chains, tapping into deeper liquidity and more diverse trading pairs.

-

Reduced Transaction Costs & Faster Settlement: Layer 2 protocols (such as Optimism and Arbitrum) have slashed transaction fees and improved speed, making high-frequency and DeFi trading more viable. For example, Ethereum (ETH) trades at $4,472.87 with lower fees than on Layer 1.

-

Security Risks from Bridge Exploits: Despite improved interoperability, cross-chain bridges remain prime targets for hackers. Over $2.6 billion was stolen in bridge attacks between 2021 and 2023, underscoring the importance of robust security for protocols like LayerZero and Solana’s canonical bridge.

-

Fragmented Liquidity and Slippage: While cross-chain solutions aggregate liquidity, differences in protocol standards and bridge reliability can still cause fragmented markets and unexpected slippage, especially during volatile periods for assets like Polygon (MATIC) at $0.251241 or Arbitrum (ARB) at $0.493039.

The macro impact is clear: as more liquidity becomes chain-agnostic, slippage decreases and price discovery improves across markets. However, as highlighted by recent exploits, risk management frameworks must evolve in tandem with technical progress. Traders need to stay vigilant, security audits for bridges and new dApps are now as critical as technical analysis when deploying capital.

Macro Takeaway: The rise of Layer 2 crypto trading platforms combined with robust cross-chain assets is creating a more interconnected, and competitive, market environment. Those who adapt early will find deeper liquidity pools, tighter spreads, and new arbitrage frontiers.

The numbers reinforce this trend: Bitcoin remains anchored above $115,000 at $115,586, while Ethereum’s $4,472.87 valuation reflects its central role in DeFi’s scaling narrative. Meanwhile MATIC ($0.251241), ARB ($0.493039), and OP ($0.801665) continue to serve as barometers for the health of their respective Layer 2 ecosystems.

Looking ahead to Q4 2025 and beyond, expect further convergence between leading blockchains as interoperability becomes table stakes for both protocols and products. The winners will be those who master not just speed or cost, but security and user experience in a truly multi-chain world.